Database Overview

Grand View Research’s heating equipment industry database is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Heating Equipment Industry Data Book Scope

|

Attribute |

Details |

|

Areas of Research |

|

|

Number of Reports/Presentations in the buddle |

1 Sector Outlook Report + 5 Summary Presentations for Individual Areas of Research + 1 Statistic ebook |

|

Cumulative Coverage of Countries |

50+ Countries |

|

Cumulative Coverage of Products |

10+ Products |

|

Highlights of Datasets |

|

Heating Equipment Industry Data Book Coverage Snapshot

|

Markets Covered |

|

|

Heating Equipment Industry USD 119.7 billion in 2022 |

|

|

Heat Pump Market Size USD 81.6 billion in 2022 9.3% CAGR (2023-2030) |

Unitary Heaters Market Size USD 2.2 billion in 2022 3.9% CAGR (2023-2030) |

|

Warm Air Furnace Market Size USD 8.4 billion in 2022 3.2% CAGR (2023-2030) |

Space Heating Boilers Market Size USD 27.4 billion in 2022 3.4% CAGR (2023-2030) |

Heating Equipment Sector Outlook

The economic value generated by the heating equipment industry was estimated at approximately USD 119.7 billion in 2022. Government initiatives for improving energy efficiency across industries coupled with technological innovations are also expected to drive the market. Growing spending in the construction sector is also anticipated to contribute to product demand over the coming years. Initiatives, such as the Leadership in Energy and Environmental Design (LEED) in the U.S., are also expected to benefit the industry growth.

Heating equipment plays a vital role in the processing and manufacture of ferrous & non-ferrous metals, mining, oil & gas, and the automotive industry. The demand for heating equipment solutions that lower operational costs and improve energy savings is anticipated to increase as energy consumption in the industrial and residential sectors rises.

Global energy consumption has increased dramatically due to the expanding population and rapid industrialization. Large quantities of processed heat are utilized by many industrial production processes and methods, which typically results in high energy expenditures for organizations.

Share of Major Heating Equipment Countries, by Product

|

Total, 2022 |

Heat Pump, 2022 |

Space Heating Boilers, 2022 |

Warm Air Furnace, 2022 |

||||

|

USD Billion |

119.7 |

USD Billion |

81.6 |

USD Billion |

27.4 |

USD Billion |

8.4 |

|

China |

25% |

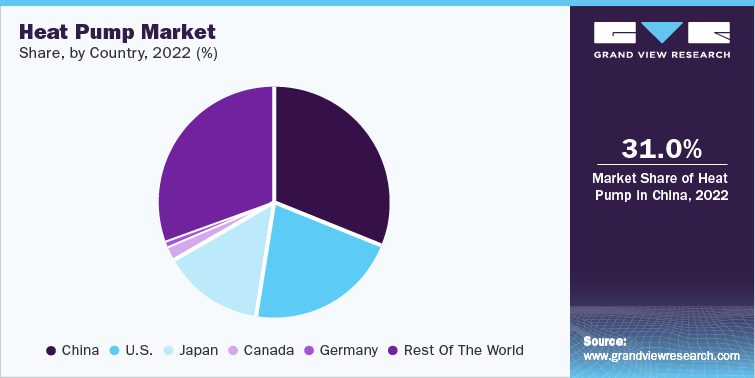

China |

31% |

China |

10% |

U.S. |

49% |

|

U.S. |

20% |

U.S. |

21% |

U.S. |

9% |

China |

9% |

|

Japan |

11% |

Japan |

14% |

Germany |

8% |

Japan |

5% |

|

Germany |

3% |

Canada |

2% |

Japan |

5% |

Canada |

4% |

|

Canada |

2% |

Germany |

1% |

Canada |

1% |

Germany |

4% |

|

Rest of the World |

38% |

Rest of the World |

30% |

Rest of the World |

66% |

Rest of the World |

29% |

The preference for energy-saving products in the industrial and residential sectors is also anticipated to rise due to government restrictions. Additionally, energy-efficient solutions significantly reduce operational costs to a more significant extent. The International Energy Agency estimates that greater energy efficiency in buildings, industrial processes, and transportation networks could reduce global energy consumption by one-third and help reduce greenhouse gas emissions by 2050.

Growing consumption of fossil fuels such as coal, oil, and natural gas to meet heating requirements has a detrimental impact on the environment. The demand for energy-efficient goods and solutions is anticipated to increase with growing awareness of climate change and greenhouse gas emissions. The type of equipment used and its capacity influence the price of installing a heating system. High Heating Seasonal Performance Factor (HSPF) and SEER ratings are typically associated with more expensive heat pumps. The energy-efficient models help save on energy bills and operational costs, but they require higher initial investments. Above mentioned, factors will positively impact the market growth.

Heat Pump Market Analysis & Forecast

Favorable government policies for energy-efficient solutions and lowering carbon footprint are anticipated to boost market growth over the forecast period. Many governments are providing subsidies or incentives, and tax credits & rebates for the installation of heat pumps are expected to further fuel the demand for energy-efficient heat pumps, thereby benefitting the growth. Various government has provided personal tax credits and direct incentives on product installation, which encourage the installation of heat pumps. Improving energy efficiency across multiple industries is one of the significant objectives of governments worldwide. The rising need for renewable energy sources, along with extensive government support in the form of subsidies, incentives, and other monetary benefits, is projected to fuel the market growth over the forecast period.

Heat pump products are used in commercial facilities like office buildings, hotels, schools, houses of worship, and historic buildings. Their variable refrigerant flow heat pump systems enable them to simultaneously offer cooling zones and heating to other zones in a facility. These products can also help achieve carbon neutrality and provide improved comfort and efficiency, which is likely to drive market growth over the forecast period.

Unitary Heaters Market Analysis & Forecast

Unitary heaters are commonly utilized in the commercial sector to address the space heating needs of small complexes or rooms. Unitary heaters have a low starting cost and an easy installation procedure. These reasons are expected to fuel market growth in the coming years. For instance, Warren Technologies provides unitary electric heaters in various sizes, shapes, and configurations that can be field mounted in any brand of air conditioning system.

Rising demand for low-noise operations, increasing integration of electric heaters with solar panels, growing use of sensors to adjust the temperature automatically, and elevated efficiency at lower costs are the major factors driving the demand for unitary heaters in the coming years. For instance, electric unitary heaters are available for installing various types of high-efficiency equipment, including split, packaging, central DX, heat pump, and PTAC systems. Unitary heaters are ideal for commercial & recreational constructions, industrial plants, and special-purpose structures. Furthermore, electric heaters are designed for even heat distribution and low installation and maintenance expenses.

Warm Air Furnace Market Analysis & Forecast

Warm air furnaces are intended to supply hot air via a duct system. In practice, commercial furnaces are the gas or propane heating parts of bundled roof-top units that are utilized in small to medium-sized business buildings. As condensing technology allows for energy savings from warm air furnaces, condensing furnaces extract additional heat by condensing the water vapor in the gases and achieve 90% or greater efficiency levels. These aforementioned factors are projected to increase the warm air furnace demand in the forecasted years.

Demand for commercial warm air furnaces in the U.S. is expected to increase over the coming years due to rising in refurbishing and renovations in the commercial sector. Also, the presence of a stringent regulatory framework in the country is expected to drive market growth over the forecast period. The global market is highly competitive, and major companies focus on minimizing the overall product cost by leveraging the significant price of technology and the high installation cost.

Space Heating Boilers Market Analysis & Forecast

Space heating boilers heat water and transmit hot water or steam for various applications. Steam is delivered to steam radiators via pipes; hot water can heat air via a coil. Water heating, power generation, cooking, central heating, and sanitation are among the applications of boilers. Space heating boilers use combustible fuel to heat water, converting the liquid water into steam, which is then dispersed to heat a building or other structure. These aforementioned factors are expected to drive the demand for space heating boilers in the coming years.

Space heating boilers are gaining wide preference as they require less maintenance, do not give off any harmful emissions, and are affordable. Increasing demand for upgraded heating systems that meet the required regulatory standards is expected to gain traction over the next seven years, which in turn is expected to drive the industry growth over the forecast period. Furthermore, the replacement of existing space heating boilers with energy-saving solutions is expected to be one of the major factors influencing the development of the market in China. Surging space heating requirements in the U.S. are projected to propel the demand for energy-efficient heating solutions, thereby increasing the demand for certified space heating boilers heating equipment in the country.

Competitive Insights

Major players in the heating equipment market include Lennox International, Inc.; Daikin Industries, Ltd.; Johnson Controls, Inc.; Robert Bosch GmbH; Carrier; Mitsubishi Electric Corporation; Danfoss; LG Electronics, Inc.; and Johnson Controls, Inc. The manufacturers of Heating Equipment adopt several strategies, including merger & acquisition, partnership & joint ventures, new product developments, distributor agreements, new online channels, and geographical expansions, to augment their market presence and cater to the ever-changing consumer requirements.

Strategies adopted by the companies usually include product portfolio expansion, collection network expansion, and geographic network expansion.

-

In March 2022, Fujitsu introduced the Halcyon split-system heat pump line, which achieves up to 27.2 SEER. With external ambient temperatures as low as -5°F, the heat pump's heating mode is operational, delivering 75% or more of the system's rated capacity. The device provides 100% heating capacity down to 20°F.

-

In February 2023, Hitachi introduced the Yutaki M R32 monobloc air-to-water heat pump. Even in subzero temperatures, the 4-ton and 3-ton systems have 140°F heating capacity

-

In January 2023, Johnson Controls acquired Hybrid Energy AS. Hybrid Energy's innovative technology will provide customers with fresh, cost-effective solutions while tackling decarbonization and sustainability efforts in Europe and beyond.

-

In June 2020, Canada's premier plumbing and HVAC/R distributor joined forces with GE Appliances, a Haier subsidiary. Wolseley will supply Haier's line of ductless and heat pump solutions throughout Ontario and Atlantic Canada.

-

In December 2022, Daikin Comfort Technologies North America Inc. acquired Venstar Inc., an energy & controls management systems provider whose indoor comfort products and technology are used in light commercial & residential applications across Canada, Mexico, and the U.S.