- Home

- »

- Sector Reports

- »

-

Food Processing Equipment Industry Data Book, 2023-2030

![Food Processing Equipment Industry Data Book, 2023-2030]()

Food Processing Equipment Industry Data Book - Hot Food Processing Equipment, Bakery Processing Equipment and Meat Processing Equipment Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Feb, 2023

- Report ID: sector-report-00165

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s food processing equipment industry data book is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Food Processing Equipment Industry Data Book Scope

Attribute

Details

Areas of Research

- Seafood Processing Equipment Market

- Hot Food Processing Equipment Market

- Bakery Processing Equipment Market

- Grain Processing Equipment Market

- Meat Processing Equipment Market

- Brewery Equipment Market

- Dairy Processing Equipment Market

- Pet Food Processing Equipment Market

- Food Sterilization Equipment Market

Number of Reports/Presentations Covered in the bundle

1 Sector Outlook Report + 9 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Products

10+ Products

Highlights of Datasets

- Per Capita Food Consumption Data, by Countries

- Food Processing Industry, by Region

- Processed Food Consumption Statistics, by Country

- Competitive Analysis

- Food Processing Equipment , by Mode of Operation

- Food Processing Equipment , by Type

- Food Processing Equipment , by Application

Food Processing Equipment Industry Data Book Coverage Snapshot

Markets Covered

Food Processing Equipment Industry

USD 44,842.6 million in 2020

Seafood Processing Equipment Market Size

USD 1,957.5 million in 2017

3.2% CAGR (2018-2025)

Hot Food Processing Equipment Market Size

USD 20,824.8 million in 2021

6.3% CAGR (2022-2030)

Bakery Processing Equipment Market Size

USD 12,920.9 million in 2020

5.8% CAGR (2021-2028)

Grain Processing Equipment Market Size

USD 4,170.4 million in 2018

5.0% CAGR (2019-2025)

Meat Processing Equipment Market Size

USD 10,283.9 million in 2022

4.9% CAGR (2023-2030)

Brewery Equipment Market Size

USD 16,519.9 million in 2022

5.9% CAGR (2023-2030)

Dairy Processing Equipment Market Size

USD 10,414.9 million in 2019

6.0% CAGR (2020-2025)

Pet Food Processing Equipment Market Size

USD 4,622.1 million in 2019

4.5% CAGR (2020-2027)

Food Sterilization Equipment Market Size

USD 646.0 million in 2018

6.1% CAGR (2019-2025)

Food Processing Equipment Industry Outlook

The economic value generated by the food processing equipment industry was estimated at approximately USD 44,842.6 million in 2020. The global food processing equipment market growth is expected to be significantly driven by the growing demand for processed food products. Rising population, increasing disposable income, shift in the consumer shopping behavior is likely to demand for more processed food products during projected timeframe.

A rapid increase in population growth and expansion of manufacturing industries across the world are anticipated to boost the consumption for processed food products and food processing equipment market over the forecast period. In the U.S., around 23% of adults eat fast food meals approximately three or more times a week, according to the Fast-Food Statistics 2021 report. Rising expenditure on processed food & beverages and rapid industrialization is expected to increase demand for food processing equipment over the forecast period.

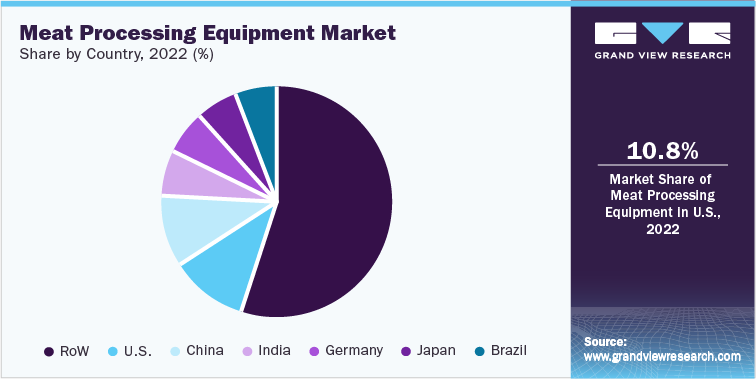

Share of Major Food Processing Equipment Countries, by Type

Food Processing Equipment Market, 2020

Hot Food Processing Equipment Market, 2021

Bakery Processing Equipment Market, 2020

Meat Processing Equipment Market, 2022

USD Million

44,842.6

USD Million

20,824.8

USD Million

12,920.9

USD Million

10,283.9

U.S.

11%

U.S.

12%

U.S.

10%

U.S.

11%

China

10%

China

12%

China

11%

China

10%

Germany

7%

India

7%

India

6%

India

6%

UK

6%

Germany

6%

Germany

6%

Germany

6%

India

6%

Japan

5%

Japan

6%

Japan

6%

Italy

6%

France

5%

Brazil

6%

Brazil

6%

Rest of the World

54%

Rest of the World

54%

Rest of the World

54%

Rest of the World

55%

Source: Grand View Research

The rapid industrialization in the emerging economies is anticipated to augment the global food processing equipment market growth. For instance, according to the India Brand Equity Foundation, Ministry of Commerce and Industry, Indian food processing industry is growing at a lucrative rate and expected to reach USD 535 billion by 2025-26. The growth is driven by the rising organized food retail sector.

Hot Food Processing Equipment Market Analysis And Forecast

Hot food processing equipment market is experiencing robust growth rate over the forecast period owing to the rising demand for fast food and packaged food products across the world. Key players are increasingly investing in research and development activities and launch innovative products which is also expected to fuel the demand for the equipment in the global market. For instance, in September 2021, JBT Corporation launched new bulk high-pressure pasteurization technology; the FlexiBulk.

The COVID-19 pandemic led to a significant change in consumer behavior, shifting away from restaurants, fast food service, coffee shops, and bars, towards at home food consumption, necessitating significant modifications food supply chains operations. This has fueled the demand for processed foods and led the food manufacturers to adopt new food processing equipment technology to meet the shifting demand.

Bakery Processing Equipment Market Analysis And Forecast:

The global bakery processing equipment market growth is significantly augmented by the rising consumption of baked goods and cakes across the world. The rising consumer disposable income and expansion of bakery and coffee shops to various geographical locations is driving the accessibility and consumption of bakery products. For instance, in February 2023, Paris Baguette announced opening of new bakery café in Montvale, U.S. and continues to focus on geographic expansion. This is also reflected in the rising demand for the bakery equipment and channel the market growth over the forecast period.

Globally, consumption of bread is rapidly increasing with the inclusion of bread as staple food and as a standard diet in many countries. According to the American Bakery Association, sales of baked goods increased by 62% with the advent of the pandemic in U.S. High fiber content, nutritional ingredients such as seeds and cereals, suitable for snacking, were the factors that propelled the consumption of bread. The rising demand for baked goods is likely to drive the bakery equipment market growth over the forecast period.

Meat Processing Equipment Market Analysis And Forecast:

Global meat processing equipment market is driven by the rising investments and technological development in machinery. The growth in the expansion of the fast-food outlets across the world such as KFC, McDonald’s, Taco Bell, and Domino’s is surging the demand for new and for replacement meat processing equipment. This is expected to drive the growth of market over the forecast period. For instance, in February 2022, KFC introduced new Next Generation store concept store in Bereq, U.S. Along with this store, the company reached total of 55 new store openings in 2022.

Moreover, rising meat consumption and new introduction of stringent regulation pertaining to the storage, process, and cooking of meat are likely to drive the demand for new efficient and sustainable equipment. According to the Food and Agriculture Organization of the United Nations, global meat consumption has been increasing at faster rate than rate of population growth since 1961. The rising consumption of meat and meat products is expected to drive the demand for meat processing equipment over the forecast period.

Competitive Insights

Major players in the food processing equipment market include GEA Group AG, BAADER Group,Bühler AG, Alfa Laval, Krones AG, Marel, JBT Corporation, The Middleby Corporation, Arenco AB, Baker Perkins Limited, etc. The industry participants focus on research & development activities to develop new technologies for energy-effective and sustainable food processing equipment. Along with R&D, key players also focuses on various strategies to expand the business and gain a competitive edge over their peers. Strategies adopted by the companies usually include joint ventures, partnerships, mergers & acquisitions, product innovation, distribution agreements, and geographic expansion.

From the growing demand for organic food products and transparency from consumers to rising need for automation and artificial intelligence, the food processing equipment sector is experiencing fundamental shift. Key players are continuously engaging in manufacturing new equipment with introduction of new cutting edge technologies such as process automation, control units, etc.

-

In November 2022, Marel and Tyson Ventures joined hands to invest in Soft Robotics Inc., which designs and manufactures automated solutions. Soft Robotics Inc. received USD 3 million Marel as an investment which are used for expansion of robotic picking solutions.

-

In September 2022, JBT Corporation completed the acquisition of Bevcorp, a leading provider of equipment for beverage processing. JBT Corporation acquired Bevcorp for USD 290 million.

-

In November 2021, KKR, a leading investment firm acquired Bettcher Industries from MPE Partners. The investment in Bettcher is the continuation of KKR’s commitment in industrial sector.

-

In June 2019, GEA Group AG introduced new meat processing machine with high performance equipment for improving quality of poultry and meat products. This new equipment, the MultiJector, is an automated brine injection system.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified