- Home

- »

- Sector Reports

- »

-

Female Infertility Industry Trends & Growth Data Book, 2030

Database Overview

Grand View Research’s female infertility industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research along with a digital healthcare statistics e-book.

Female Infertility Industry Data Book Scope

Attributes

Details

Areas of Research

- In Vitro Fertilization (IVF) Market

- Artificial Insemination Market

Number of Reports/Presentations in the Bundle

- 2 Individual Reports - PDFs

- 2 Individual Reports - Excel

- 1 Data book - Excel

Country Coverage

25+ Countries

Cumulative Coverage of Products

30+ Companies and respective product benchmarking

Highlights of Datasets

- Therapeutic Areas Revenue, by Countries

- End-use Revenue, by Countries

- Competitive Landscape

- Regulatory and Reimbursement Guidelines, by Countries

Total Number of Tables (Excel) in the Bundle

300+

Total Number of Figures in the Bundle

200+

Female Infertility Industry Data Book Coverage Snapshot

Markets Covered

Female Infertility Industry

USD 25.7 billion in 2022

5.97% CAGR (2023-2030)

In Vitro Fertilization (IVF) Market Size

USD 23.6 billion in 2022

5.72% CAGR (2023-2030)

Artificial Insemination Market Size

USD 2.1 billion in 2022

8.6% CAGR (2023-2030)

Female Infertility Sector Outlook

The global female infertility market size was valued at USD 25.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.97% from 2023 to 2030.

Factors that can be attributed to the market growth are an increase in the incidence of infertility, emerging trends of late family planning, and the development of advanced technologies. The average age at which women and men get married and have their first child has increased. This trend is now prominent as an increasing number of individuals are aspiring for higher education and are career oriented.

The average age of women having their first child has increased to 26. According to the British Health Minister, children should be educated about their fertility age while providing them with sex education. This trend has increased the number of women seeking IVF treatment. Moreover, many women freeze their eggs to have a child later in life and focus on their careers. In Sweden, the average age of women having their first child was 29 and the average age of becoming a father was 31.5. With the increase in age, fertility declines and there are high chances of abnormalities and other fertility-related problems.

Key Regional Trend

Europe dominated the market due to large number of procedures, presence of well-equipped fertility clinics or centers, supportive reimbursement & regulatory scenario, and sufficient numbers of donors and egg & sperm banks

In-Vitro Fertilization (IVF) Market Analysis And Forecast

The global In-Vitro Fertilization (IVF) market size was valued at USD 23.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.72% from 2023 to 2030. This can be attributed to higher success rates and the introduction of advanced technologies, such as Percutaneous Epidydimal Sperm Aspiration and Testicular Sperm Extraction (PESA & TESE), three-parent IVF, mini-IVF, and others. Moreover, an increase in government funding for IVF is expected to boost segment growth over the forecast period. For instance, in May 2022, in Australia, under NSW Government 2022-23 budget, women in New South Wales opting for IVF will be provided with a USD 2,000 cash rebate to reduce the costs of the treatment for patients.

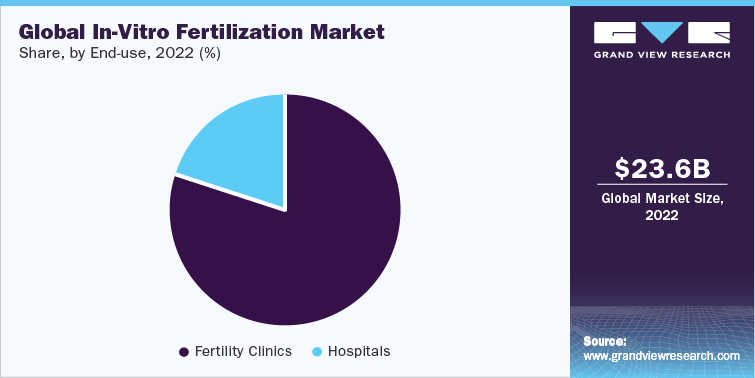

Fertility clinics and hospitals are key end-use segments analyzed in this study. Fertility clinics accounted for the maximum share of the market in 2022 and will continue to dominate the market during the forecast period, being the most preferred setting for physicians and surgeons. Licensed fertility clinics offer counseling to couples facing problems in conceiving. Based on the severity of their problems, doctors and specialists plan their IVF treatment. The IVF treatments offered by hospitals are generally more expensive than fertility clinics. IVF treatments require highly skilled physicians and staff. Hence, employing dedicated staff for IVF in hospitals is a less preferable approach.

Artificial Insemination Market Analysis And Forecast

The global artificial insemination market is valued at USD 2.1 billion as of 2022 and is expected to expand at a CAGR of 8.58% for the forecast period 2023-2030. This can be majorly attributed to the demand for minor fertility treatments and lower costs of treatment compared to IVF. Intrauterine insemination is the preferable treatment among all types of artificial insemination procedures. The intrauterine mode of insemination involves placing the sperm sample directly in the uterus and yields higher pregnancy rates. It is a non-invasive technique and is preferred by most of the infertile couples.

The market’s growth is driven by the lower cost of treatment, which is more suitable for minor fertility conditions and same-sex couples or single women. As per Human Fertilization and Embryology Authority (HFEA), the success rate of artificial insemination per cycle ranges from 15.8% for women under 35 to 11% for women aged 35 to 39, and 4.7% for women aged 40 to 42. Over the first six cycles, more than half of the women who had IUI reported pregnancy.

IUI is preferred over other methods as it is noninvasive, affordable, can be easily performed, there are minimum risks involved, and is easy to train. The pregnancy rate by IUI is higher than that by other modes of insemination.

Competitive Insights

Development of innovative products and their commercialization, mergers, and geographical expansions are key strategies undertaken by market players. The market is technologically driven and requires a fairly large investment to introduce effective techniques and procedures. In addition, stringent government protocols related to fertility treatments in certain areas are expected to limit the entry of new players.

Key Drivers

-

Increasing incidence rate of male and female infertility

-

Late initiation of family

-

Rising repro tourism

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified