- Home

- »

- Sector Reports

- »

-

Breast Pump & Breastfeeding Accessories Industry Data Book

Database Overview

Grand View Research’s breast pump & breastfeeding accessories industry data book is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research. The following data points will be included in the final product offering in 3 reports and one sector report overview:

Breast Pump And Breastfeeding Accessories Industry Data Book Scope

Attribute

Details

Research Areas

- Breast Pumps Market

- Wearable Breast Pumps Market

- Breastfeeding Accessories Market

Number of Reports/Deliverables in the Bundle

- 3 Individual Reports - PDFs

- 3 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data book - Excel

Cumulative Country Coverage

50+ Countries

Cumulative Product Coverage

25+ Level 1 & 2 Products

Highlights of Datasets

- Product Revenue, by Countries

- Technology Revenue, by Countries

- Competitive Landscape

- Regulatory Guidelines, by Countries

- Reimbursement Structure, by Countries

Total Number of Tables (Excel) in the bundle

183

Total Number of Figures in the bundle

165

Breast Pump And Breastfeeding Accessories Industry Data Book Coverage Snapshot

Markets Covered

Breast Pump And Breastfeeding Accessories Industry

USD 4.06 billion in 2021

7.8% CAGR (2022-2030)

Breast Pump Market Size

USD 1.84 billion in 2021

8.3% CAGR (2022-2030)

Wearable Breast Pumps Market Size

USD 350 million in 2021

8.2% CAGR (2022-2030)

Breastfeeding Accessories Market Size

USD 2.2 billion in 2021

6.4% CAGR (2022-2030)

Breast Pump Market Analysis & Forecast

The global breast pump market generated over USD 1.84 billion in revenue in 2021 and is projected to expand at a CAGR of around 8.3% during the forecast period to reach USD 5.2 billion by 2030.

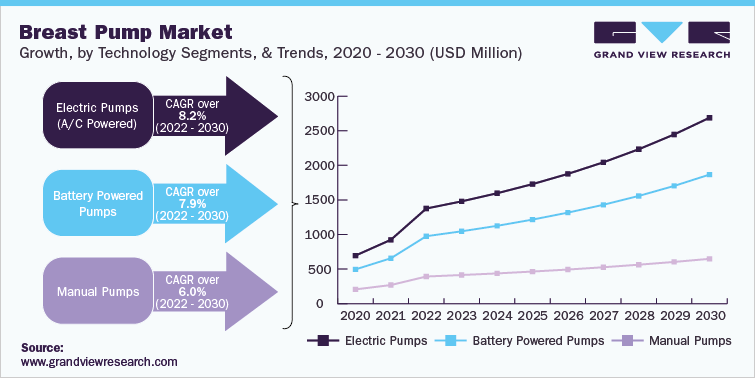

The global breast pump market is structurally strong giving scope for major global players to capitalize on the commercial opportunity. The addressable markets for both the breast pump and the breastfeeding accessories market are significantly large and it is expected that the developing markets with per capita income between USD 10-20K may drive the next phase of growth. While Medela, Spectra, and Pigeon dominate the market for breast pumps, Lansinoh and Philips enjoy strong brand power in the breastfeeding accessories market. The different technologies used in these devices is also well covered within the scope of this study. Key technologies segments and the takeaways are mentioned here in the following figure:

Various private & public companies provide insurance coverage for breast pumps. For instance, Medela offers insurance coverage for its breast pump products. Personal use standard electric breast pumps and manual breast pumps are covered under Medicaid insurance plans as per the Affordable Care Act. However, North Carolina Medicaid does not provide any insurance coverage for breast pumps, provided 15% discounts can be availed on all breast pumps.

In addition, the increasing number of milk banks in the U.S. is also anticipated to boost the demand for these devices. For instance, as per the article published by the Atlantic in 2017, the Human Milk Banking Association of North America (HMBANA) has doubled the number of milk banks that it had 5 years ago.

Wearable Breast Pumps Market Analysis & Forecast

The introduction of technologically advanced products such as Elvie wearable electric breast pump, Freemie Liberty wearable breast pump, and Willow Generation 3, are anticipated to drive the segment growth. This high-tech wearable device is connected with a mobile application that provides vital information such as milk volume, previous pumping session, and pumping time. It is best suited for women uncomfortable with cumbersome pumping devices. In addition, these pumps are preferred in working places without established designated spaces for expressing milk.

Factors such as Women’s employment rates directly impact this sector and is a high-impact rendering driver. Working women have a relatively high disposable income and less time to breastfeed their babies. and thus, are ideal customers for breast pumps and related accessories.

Women's Employment Rates, Worldwide

Country/region

2018 (%)

Developing countries

69.3

Emerging countries

45.6

Developed countries

52.4

Northern Africa

21.9

Sub-Saharan Africa

64.7

Latin America and the Caribbean

51.5

Breastmilk storage and feeding products are used to store breastmilk properly to ensure the safety and quality of expressed milk. A major aspect driving the segment is the increase in the number of working women. This is because maternity breaks are short and new mothers return to work soon after giving birth, thus driving the need for breastfeeding supplies. For instance, as per the latest statistics by World Bank and International Labor Organization, 46% of women globally are employed, and this number is expected to rise in the future. Thus, with an increase in the female employment rate, the breastmilk storage and feeding segment is expected to dominate the market over the forecast period.

Breastfeeding Accessories Market Analysis & Forecast

An increasing number of milk banks around the globe is predicted to propel market growth further. Due to the high demand for breast milk storage, the number of milk banks is increasing. Milk banks are beneficial for mothers and are considered a progressive initiative. If the mother is infected and there is a risk of disease transmission, the mother is unable to lactate, or the baby is orphaned, milk banks can offer major advantages. Thus, an increase in the number of milk banks may increase the use of breastfeeding accessories, thereby driving the market over the forecast period. We have studied the number of milk banks across regions and countries, as an important factor for market estimation. The following table represents the number of milk banks operational currently in the region:

Operational Milk Banks, By Region

Region/Country

Number of Milk Banks

Year

Source

North America

33

2021

Human Milk Bank Association of North America

U.S.

29

2021

Human Milk Bank Association of North America

Canada

4

2020

Canadian Pediatric Society

Europe

280

2021

European Milk Bank Association

UK

15

2021

European Milk Bank Association

Germany

31

2021

European Milk Bank Association

Competitive Landscape

Various market players, such as Medela LLC, Laura & Co., Newell Brands, and Ameda, & universities, including Washington University & Fudan University, are raising awareness among women about breastfeeding accessories and their benefits by arranging campaigns and providing informative magazines. In addition, social media platforms, such as YouTube, Facebook, and Instagram, have enabled individuals to access information about breast pumps and related accessories.

This section in the final deliverables also highlights various initiatives taken by the key companies in the recent past that strongly impacts this market space. The below figure represents the various strategic developments initiated by these market participants:

The market players are focused on research and development activities to develop technologically advanced products to gain a competitive edge. For instance, in September 2020, Willow raised funding of around USD 55 million in its Series C funding round from the investors NEA, Meritech Capital Partners, and others for the development of innovative wearable breast pumps. In addition, strategies such as marketing and promotions are widely used by companies operating in this market to increase awareness about the benefits of breastfeeding, educate, encourage and support nursing mothers, and also to increase the availability and outreach of their component offerings.

Key Drivers

- Next-generation smart pumps with blue tooth compatibility

- New sales channel mix of brick-and-mortar retail & specialty stores, and online retailing through e-Commerce

- Enhance brand exposure with women during early stages of pregnancy

- Strong brand loyalty through engagement with healthcare professionals and partnership with medical facilities

- Increasing awareness of wearable breast [pumps amongst working women

- Boost product development capabilities and drive innovation through increased R&D spend

- Target new customers through ongoing product innovation and premiumization

- Launch of products that may meet the needs of individual regions

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified