- Home

- »

- Sector Reports

- »

-

Adhesives Industry Growth, Overview, Data Book, 2023-2030

![Adhesives Industry Growth, Overview, Data Book, 2023-2030]()

Adhesives Industry Data Book - Packaging Adhesives, Construction Adhesives, Wood Adhesives, Medical Adhesives, Automotive Adhesives and Other Adhesives Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Oct, 2023

- Report ID: sector-report-00225

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s adhesives sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Adhesives Industry Data Book Scope

Attribute

Details

Areas of Research

- Packaging Adhesives Market

- Construction Adhesives Market

- Wood Adhesives Market

- Medical Adhesives Market

- Automotive Adhesives Market

- Other Adhesives Market

Number of Reports/Presentation Covered in the Bundle

1 Sector Outlook Report + 5 Summary Presentations for Individual Areas of Research + 1 Statistic eBook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Application

06 Application Categories

Highlights of Datasets

- Demand/Consumption, by Country

- Packaging Adhesives

- Construction Adhesives

- Wood Adhesives

- Medical Adhesives

- Automotive Adhesives

- Other Adhesives

- Competitive Landscape

Adhesives Industry Data Book Coverage Snapshot

Markets Covered

Adhesives Industry

19,905 Kilotons in 2022

5.2% CAGR (2023-2030)

Packaging Adhesives Market

4,806.5 Kilotons in 2022

5.8% CAGR (2023-2030)

Construction Adhesives Market

3,151.4 Kilotons in 2022

4.4% CAGR (2023-2030)

Wood Adhesives Market

2,538.3 Kilotons in 2022

4.5% CAGR (2023-2030)

Medical Adhesives Market

1,863.4 Kilotons in 2022

7.3% CAGR (2023-2030)

Automotive Adhesives Market

1,472.1 Kilotons in 2022

4.9% CAGR (2023-2030)

Other Adhesives Market

6,074.2 Kilotons in 2022

4.7% CAGR (2023-2030)

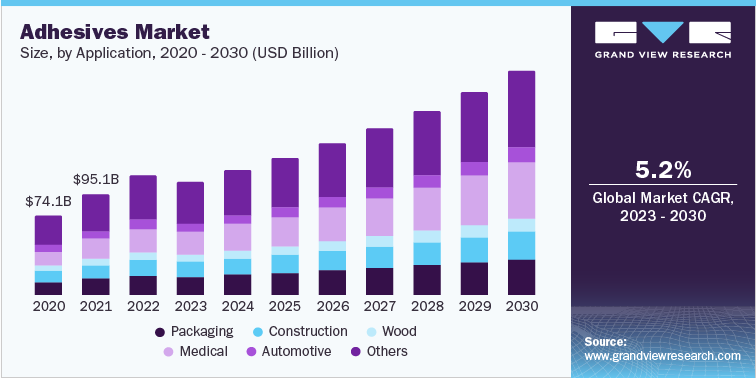

Adhesives Sector Outlook

The economic value generated by the adhesives industry was estimated at approximately USD 111.58 billion in 2022. This economic output is an amalgamation of basic adhesives categories namely, packaging adhesives, construction adhesives, wood adhesives, medical adhesives, automotive adhesives, and other adhesives.

The global adhesives market has witnessed remarkable growth in the recent past due to technological advancements, increasing demand from various industries, environmental concerns, and cost and performance benefits. The development of specialized adhesives, the focus on sustainability, and the adoption of adhesives in emerging sectors like electronics and healthcare are driving the expansion of the market. As industries continue to seek innovative and efficient bonding solutions, the adhesives market is expected to grow further in the coming years.

Adhesives play a crucial role in the automotive & transportation industry as they act as appropriate solutions for addressing the unique challenges faced by designers and manufacturers of automobiles. These challenges include the requirement for lightweight vehicles with increased design flexibility that offer improved performance and enhanced safety. Adhesives contribute to the aerodynamic improvements witnessed in modern vehicles. They enable the bonding of lightweight materials and eliminate the requirement for traditional fasteners. This reduces the drag of vehicles and improves their overall efficiency. The use of adhesives is highly significant in electric vehicles (EVs). Their lightweight allows for increased battery capacity and improved range. The advancing automotive production is anticipated to drive the demand for automotive adhesives over the forecast period.

Additionally, the medical industry relies on adhesives as their exceptional bonding properties and biocompatibility play a vital role in essential healthcare applications. Moreover, they play a critical role in drug delivery systems. Transdermal patches, for instance, rely on specialized adhesives to ensure proper adhesion to the skin and controlled release of medication. Adhesives used in drug delivery systems must have compatibility with various drug formulations, along with their ability to maintain adhesion strength over an extended period. The advancing medicine industry is further anticipated to drive the demand for medical adhesives over the forecast period.

Moreover, adhesives are used in furniture & woodworking applications for producing various types of boards and panels such as softwood plywood (SWPW), particle boards (PB), medium-density fiberboard (MDF), hardboard or fiberboard, hardwood plywood (HWPW), and oriented-strand board (OSB). Acrylic adhesives, EVA adhesives, polyurethane adhesives, and water-based or solvent-based adhesives are most widely used for developing furniture. These adhesives possess excellent water resistance and can be used in semi-dry rooms such as kitchens.

The primary applications of adhesives in the building & construction industry are in the installation of flooring materials. They allow secure bonding of tiles, vinyl, wooden floors, and carpets by enabling their strong connection that can withstand heavy foot traffic and resist moisture. The use of adhesives leads to the development of long-lasting flooring. They also find extensive use in the assembly and installation of building facades and curtain walls. Adhesives bond glass, metal panels, and composite materials. They provide structural integrity to buildings and enhance their visual appeal.

As the global building & construction industry continues to evolve majorly in China, Indonesia, and the U.S., adhesives play an increasingly vital role in meeting the surging demand for sustainable and energy-efficient buildings and construction materials.

The adhesives market is characterized by a high fragmentation, with numerous participants competing for market share. To strengthen their position in the industry, major players are actively pursuing mergers and acquisitions across the value chain. Additionally, these market leaders are investing in product innovation as a means to retain their market share on a global scale. For example, in December 2022, Arkema, under the brand Nuplaviva, unveiled a new line of disposable hygiene adhesive solutions that incorporate bio-based renewable materials.

Prominent market participants such as 3M and H.B. Fuller are characterized by a high degree of integration throughout the value chain. Some of the key manufacturers of adhesives operating in the market are Arkema Group, Henkel AG, Pidilite Industries Ltd. & Co. KGaA, Avery Denison Corporation, Sika AG, Huntsman, and Wacker Chemie AG, among others.

Packaging Adhesives Market Analysis And Forecast

Packaging adhesives accounted for a share of 16.5% in the industry in 2022. The global packaging industry relies increasingly on adhesives for a wide range of applications as they play a crucial role in ensuring the integrity, durability, and efficiency of products of this industry throughout the value chain. Adhesives are utilized in various stages, from raw material processing to end-product assembling, thereby resulting in the development of cost-effective and versatile paper & packaging products. The primary applications of adhesives in the packaging industry are for producing corrugated cardboard and boxes. Adhesives are used to securely bond different layers of corrugated boards to ensure their strength and stability. These adhesive formulations offer excellent bonding properties, enabling efficient assembly of packaging materials while maintaining resistance to humidity and temperature changes.

Case & carton in the application segment dominated the market with a revenue share of over 35% in 2022. Adhesives are widely used to seal cases and cartons, providing a secure closure that prevents tampering and protects the contents from dust, moisture, and other external elements. Adhesive tapes, such as pressure-sensitive tapes, are commonly used for this purpose. They offer quick and reliable sealing, saving time and effort compared to alternative methods like stapling or stitching.

The above-mentioned figure depicts the growth of the global packaging industry from 2019 to 2024. According to Invest India, the packaging industry has positioned as one of the fastest-growing industries after food and energy witnessing a CAGR of 2.8% from 2019 to 2024. Additionally, according to the Packaging Industry Association of India (PIAI), the packaging sector in India is witnessing growth at a CAGR of 22% to 25% with packaging consumption accounting for 8.6 kg per person per annum in 2020. Thus, the advancing packaging industry is anticipated to drive the demand for packaging adhesives over the forecast period.

Construction Adhesives Market Analysis And Forecast

Construction adhesives accounted for an industry share of 13.4% in 2022. Adhesives are widely used for structural bonding in construction projects. They offer high-strength bonds that can replace traditional mechanical fastening methods like welding, riveting, or screwing. Structural adhesives, such as epoxy, acrylic, or polyurethane-based adhesives, provide excellent adhesion to a variety of substrates, including metals, plastics, composites, and concrete. They are used to bond materials like panels, beams, and trusses, enhancing the overall strength and stability of structures.

The commercial sector in the application segment dominated the market with a revenue share of over 34% in 2022. Construction adhesives are extensively used for installing interior finishes in commercial buildings. They provide a strong bond between materials like wall panels, ceiling tiles, and acoustic panels, ensuring a secure and long-lasting installation. Adhesives designed for interior finishes offer benefits such as soundproofing, fire resistance, and moisture resistance, contributing to a comfortable and safe environment.

Moreover, adhesives are crucial in the installation of heating, ventilation, and air conditioning (HVAC) systems in commercial buildings. They are used to bond air ducts, insulation materials, and HVAC components, ensuring airtight seals and preventing air leakage. HVAC adhesives offer high-temperature resistance, flexibility, and compatibility with various substrates, contributing to the efficiency and performance of the system.

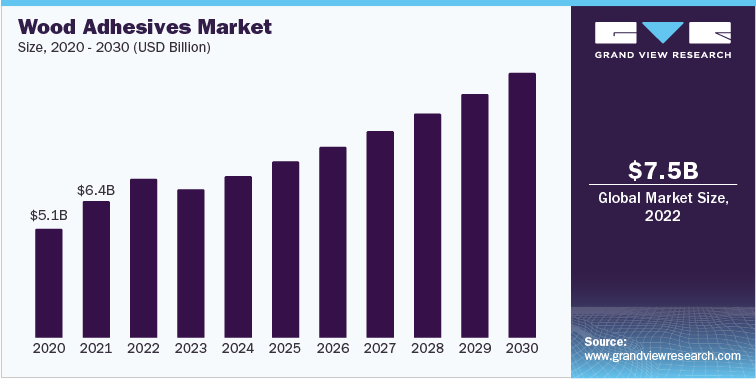

Wood Adhesives Market Analysis And Forecast

Wood adhesives accounted for an industry share of 6.7% in 2022. Wood adhesives are essential components in the woodworking industry, playing a crucial role in joining and bonding wood materials together. These specialized adhesives offer a range of properties that ensure strong and durable bonds, allowing for the construction of furniture, cabinets, flooring, and various wooden structures. Some of the commonly used wood adhesives include PVA (Polyvinyl Acetate) adhesives, Urea-Formaldehyde adhesives, Phenol-Formaldehyde adhesives, Melamine-Formaldehyde adhesives, Epoxy adhesives, and Cyanoacrylate adhesives among others.

Furniture in the application segment dominated the market with a revenue share of over 46% in 2022. Wood adhesive is a crucial component in the construction and assembly of furniture. It serves as the binding agent that ensures the durability and stability of the finished piece. Wood adhesive finds its application in various aspects of furniture making, such as joint assembly, edge banding, laminating, veneering, frame and structural assembly, as well as repair and restoration. By securely bonding different wooden components together, wood adhesive creates strong joints, covers exposed edges, laminates layers for added strength, attaches veneer for a seamless finish, reinforces frames and structural connections, and restores damaged furniture.

Medical Adhesives Market Analysis And Forecast

Medical adhesives accounted for a share of 19.3% in the industry in 2022. Medical adhesives are a vital component in modern healthcare, serving a range of crucial applications. These specialized adhesives play a pivotal role in wound closure, surgical procedures, tissue engineering, and medical device assembly. When used for wound closure, medical adhesives provide a secure and reliable alternative to traditional sutures or staples, promoting faster healing and reducing scarring. In surgical procedures, these adhesives help seal tissues, control bleeding, and support the healing process. In tissue engineering, medical adhesives facilitate the attachment of cells and biomaterials to scaffolds, aiding in the growth and regeneration of functional tissues. Additionally, medical adhesives are instrumental in dental applications, bonding restorations, and preventing secondary decay. Furthermore, they ensure the assembly and integrity of medical devices. With ongoing advancements, medical adhesives continue to evolve, offering improved biocompatibility, flexibility, and strength, making them necessary in the field of healthcare.

Internal medical application emerged as the fastest-growing segment and is expected to witness a CAGR of 12.3% over the forecast period. Medical adhesives find extensive use in internal medical applications, where they play a crucial role in various procedures and treatments. These specialized adhesives are designed to adhere to internal tissues and organs, providing secure and reliable bonding in a range of medical scenarios.

One key application of medical adhesives in internal medicine is in the field of surgical procedures. Surgeons use these adhesives to seal tissues, control bleeding, and support wound closure. In cases where traditional sutures or staples may not be suitable, medical adhesives offer an alternative method for closing incisions, reducing the risk of infection, and promoting faster healing. These adhesives provide a strong bond that holds tissues together, allowing the body's natural healing processes to take place. The advancing healthcare industry is anticipated to drive the demand for medical adhesives over the forecast period.

Automotive Adhesives Market Analysis And Forecast

Automotive adhesives accounted for a share of 7.0% in the industry in 2022. Automotive adhesives are a vital component in the manufacturing and assembly processes of vehicles. These specialized adhesives play a crucial role in providing strong and durable bonds between different components, contributing to the structural integrity and overall performance of automobiles.

One of the key applications of automotive adhesives is in the bonding of body panels. Traditionally, welding was the primary method used to join metal panels in car bodies. However, adhesives have become increasingly popular as they offer several advantages. Automotive adhesives provide a more uniform distribution of stress across the joint, reducing the likelihood of fatigue and improving the overall strength of the structure. Additionally, adhesives help to seal joints, preventing the ingress of moisture and reducing the risk of corrosion. This leads to improved durability and longevity of the vehicle.

Passenger cars in the application segment dominated the market with a revenue share of over 61% in 2022. One important application of automotive adhesives in passenger cars is in the bonding of body panels. Adhesives are used to securely join metal panels, such as the hood, doors, roof, and trunk, providing a strong and durable bond. This bonding method offers several advantages over traditional welding, including improved structural integrity, reduced weight, enhanced corrosion resistance, and improved aesthetics. Automotive adhesives ensure that the body panels remain firmly attached, even under the stresses and vibrations experienced during vehicle operation.

Interior applications of automotive adhesives in passenger cars are also crucial. Adhesives are used to bond various interior components, such as trim panels, headliners, carpets, and dashboard elements. These adhesives provide a strong and reliable bond, ensuring that the interior components remain securely in place, even when subjected to constant vibrations and movement. Additionally, adhesives help to reduce noise, vibration, and harshness (NVH) levels in the cabin, contributing to a more comfortable and quiet driving experience. Thus, the increasing demand for lightweight and durable passenger cars is anticipated to drive the demand for automotive adhesives over the forecast period.

Other Adhesives Market Analysis And Forecast

Other adhesives accounted for an industry share of over 37% in 2022. Adhesives play a crucial role in various industries, including electronics, footwear, consumer goods, and do-it-yourself (DIY) projects. Adhesives are extensively used in the electronics industry for bonding and encapsulating electronic components. They provide reliable and durable connections between various parts, such as circuit boards, chips, and connectors. Adhesives used in electronics offer excellent electrical insulation, ensuring proper functioning and preventing short circuits. They also protect against moisture, dust, and other environmental factors, enhancing the longevity and reliability of electronic devices.

Additionally, in the footwear industry, adhesives are essential for bonding various materials together. They are used to attach soles to uppers, securing them firmly and providing a strong bond. Adhesives used in footwear need to be flexible, durable, and resistant to heat, moisture, and chemicals. They also play a role in attaching linings, insoles, and other components, ensuring the overall integrity and longevity of the footwear. Moreover, adhesives are a go-to tool for many DIYs. They are used in a wide range of DIY projects, including home repairs, crafting, and model making. Adhesives offer convenience and versatility, allowing individuals to bond different materials together without the need for specialized equipment or skills. Whether it's repairing broken objects, creating artistic projects, or assembling models, adhesives provide a quick and effective solution. DIY adhesives come in various forms, such as tapes, glues, and epoxy, catering to different project requirements.

Water-based adhesives in the technology segment dominated the market with a revenue share of over 41% in 2022. It is a versatile and environmentally friendly approach to bonding and joining materials. These adhesives are formulated using water as the main solvent, replacing traditional solvent-based adhesives that contain harmful chemicals. These adhesives consist of a polymer or resin dispersed in water, along with other additives to enhance performance. They can be classified into different types, such as emulsion adhesives, dispersion adhesives, and aqueous adhesive solutions.

Water-based adhesives have significantly lower VOC content compared to solvent-based alternatives. This makes them safer to use, reducing the risk of harmful emissions and promoting healthier working environments. Additionally, they provide excellent adhesion to a wide range of substrates. They offer good wetting properties, allowing for optimal contact and bonding strength. All these factors are anticipated to contribute to the increasing demand for water-based adhesive technology over the forecast period.

Competitive Insights

The adhesives market is a highly competitive and dynamic industry that offers a wide range of adhesive solutions for various applications. To gain a competitive edge in this market, companies need to stay abreast of industry trends, customer demands, and technological advancements. Companies involved in the manufacturing of adhesives, such as Henkel, 3M, and H.B. Fuller, procure raw materials from chemical manufacturers. Owing to this, a moderate level of integration exists in the value chain. The operations of some of the major chemical companies such as Dow are forward integrated, as they are capable of producing raw materials and processed adhesive products. Key manufacturers in the market include Henkel AG & Co. KGaA, Sika AG, Dow, Arkema, H.B. Fuller Company, Pidilite Industries Ltd. & Co. KGaA, Avery Denison Corporation, Huntsman, and Wacker Chemie AG.

Companies are coming up with new product launches to strengthen their position in the market. In Feb 2023, 3M announced the launch of its new medical adhesive 3M Medical Tape 4578, which can stick to the skin for up to 28 days. Additionally, in December 2021, Sika opened its new manufacturing plant and technology center for manufacturing high-quality adhesives in Pune, India. This initiative was taken to meet the increasing demand for adhesives in India. Furthermore, in May 2023, Arkema announced the acquisition of Polytec PT, a manufacturer of adhesives for the electronics industry. This acquisition will enable the company to further strengthen its product portfolio in the electronic adhesives market.

Company Financial Performance, for Adhesives Business Portfolio, 2022 (USD Billion)

Company

Contact Details

Revenue

DOW

2211 H.H. Dow Way

Midland, 48674, U.S.

Tel: +1 (989) 636-1000

Performance Materials & Coatings: USD 10.8 Billion

3M

2501 Hudson Road,

Maplewood, 55144, U.S.

Tel: +1 888-364-3577

Industrial Adhesives & Tapes: USD 2.3 Billion

Arkema

420 rue d'Estienne d'Orves,

92705 Colombes Cedex France

Tel: 33 (0)1 49 00 80 80

Adhesive Solutions: USD 3.1 Billion

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified