- Home

- »

- Sector Reports

- »

-

Adhesive Tapes Industry Trends, Overview (Data Book, 2030)

![Adhesive Tapes Industry Trends, Overview (Data Book, 2030)]()

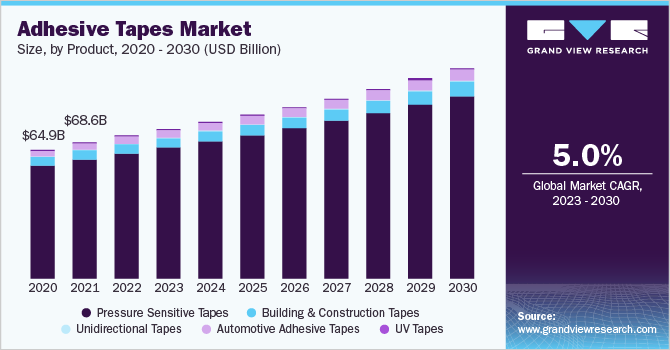

Adhesive Tapes Industry Data Book - Pressure Sensitive Adhesive Tapes, Building & Construction Tapes, Unidirectional Tapes, Automotive Adhesive Tapes and UV Tapes Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jul, 2023

- Report ID: sector-report-00190

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s adhesive tapes sector data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with an agricultural statistics e-book.

Adhesive Tapes Industry Data Book Scope

Attribute

Details

Research Areas

- Pressure Sensitive Adhesive Tapes Market

- Building & Construction Tapes Market

- Unidirectional Tapes Market

- Automotive Adhesive Tapes Market

- UV Tapes Market

Number of Reports/Presentations in the Bundle

1 Sectoral Outlook Report + 5 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

10+ Countries

Cumulative Coverage of Products

10+ Products

Highlights of Datasets

- Import/Export Data, by Countries

- Demand/Consumption, by Countries

- Competitive Analysis

- Adhesive Tapes, By Product

Adhesive Tapes Industry Data Book Coverage Snapshot

Markets Covered

Adhesive Tapes Industry

USD 72.20 billion in 2022

5.0% CAGR (2023-2030)

Pressure Sensitive Adhesive Tapes Market Size

USD 63.37 billion in 2022

4.0% CAGR (2023-2030)

Building & Construction Tapes Market Size

USD 4.64 billion in 2022

5.0% CAGR (2023-2030)

Unidirectional Tapes Market Size

USD 236.3 million in 2022

16.0% CAGR (2023-2030)

Automotive Adhesive Tapes Market Size

USD 3.43 billion in 2022

5.0% CAGR (2023-2030)

UV Tapes Market Market Size

USD 514.0 million in 2022

9.0% CAGR (2023-2030)

Adhesive Tapes Sector Outlook

The economic value generated by the adhesive tapes industry was estimated at approximately USD 72.20 billion in 2022. This economic output is an amalgamation of businesses that are involved in the manufacturing of adhesive tapes, distribution & supply, and various products of adhesive tapes.

The rising application of adhesive tapes in industries such as construction, automotive, aerospace, electrical, and sports propels the global demand for adhesive tapes. Furthermore, increasing penetration of health care and hospitality industries in major developing countries such as India, China, Mexico, and Brazil is expected to boost demand for adhesive tapes over the forecast period.

Adhesive tapes are versatile and inexpensive, and they can be used for a variety of applications such as joining, masking, sealing, splicing, bundling, and surface protection. Adhesive tapes have grown in popularity since they do not require any machinery or specific tools to apply. They are light and compact and come in rolls that may be unwound as needed. Adhesive tape, unlike traditional mechanical fasteners such as screws and bolts, avoids the need to pierce or punch the substrate, causing stress on a surface. The aforementioned factors are expected to propel the adhesive tapes market.

Pressure Sensitive Adhesive Tapes Market Analysis And Forecast

Pressure-sensitive adhesive tapes are tapes that stick to the surfaces with the application of pressure even when deprived of any solvent or heat for activation. They have pressure-sensitive adhesive applied on carriers/backing materials. Some of these tapes are accompanied by detachable release liners, which prevent the adhesive from the effects of the external environment until the liners are removed. Moreover, pressure-sensitive adhesive tapes add no significant weight to structures wherein they are used. These tapes also act as barriers to moisture and help reduce the assembly time in the manufacturing process. These tapes also provide adhesion to difficult surfaces, such as glass.

Asia Pacific dominates the market for pressure-sensitive adhesive tapes owing to the increased manufacturing of automobiles and their components and electronic appliances in the region, along with the rising number of industrial and infrastructural development projects being carried out in different countries of Asia Pacific. Besides, the ever-increasing export numbers of commodities from China, India, South Korea, and Japan also contribute to the demand for pressure-sensitive adhesive tapes for packaging applications. This is expected to fuel the growth of the PSA tapes market in Asia Pacific in the coming years.

Building & Construction Tapes Market Analysis And Forecast

Building & construction tapes Building & construction tapes market is anticipated to be driven by the expansion of the construction industry in developing regions including China, India, Indonesia, and others, which will consequently propel the demand for construction materials including tapes over the forecast period. In addition, a growing preference for lightweight construction materials is anticipated to further fuel the market growth.

The construction industry in Europe is expected to benefit from the recovery of residential and commercial construction sectors. The growth of the building and construction industry in the region has directly translated into a growing demand for construction materials such as tapes. The market is also expected to witness growth over the forecast period on account of the rise in residential constructions, spurred by the growing immigrant population in the region.

The production of advanced technology sealing tapes by companies such as 3M is expected to result in increased demand for adhesive tapes over the forecast period. The market is also expected to be driven by the introduction of advanced technology products by companies such as Shurtape and Nitto Denko. In addition, emphasis on improving the quality of a product by companies is expected to drive market growth over the forecast period.

Unidirectional Tapes Market Analysis And Forecast

Growing passenger traffic, especially in Asia Pacific and the Middle East & Africa, is expected to drive the demand and production of next-generation commercial aircraft. This may result in a high recovery in aircraft production, which experienced a slowdown in 2020, thus leading to a rise in the demand for adhesive tapes.

Passenger and freight traffic is likely to grow at an annual compounded rate of 4.8% and 4.2%, respectively over the period of 20 years from 2016 to 2036, thereby boosting aircraft production. In addition, the number of passengers flying per year has continued to ascend, fueled by affordable ticket prices, frequency of flights, and route availability. This is expected to have a positive impact on the demand for aircraft materials such as composites and tapes, thus driving the market in the coming years.

The thermoset UD tapes segment is also one of the most popular categories in the unidirectional tapes market that is likely to grow at a CAGR of 15.8% in terms of revenue from 2023 to 2030. Intrinsic flammability properties and robust performance offered by the tapes with thermoset resin are expected to represent it as one of the most suitable options for aerospace applications. The unidirectional tapes with thermoset resins induce excellent impact, creep, and fatigue resistance for use at extreme temperature conditions. In addition, the low weight coupled with superior mechanical strength offered by the aforementioned material is posing it one of the most suitable alternatives to conventional thermosets and metals.

Automotive Adhesive Tapes Market Analysis And Forecast

Increasing applications in seat heating elements, airbag wrapping & securing, steering wheel wrapping, and others are expected to support the market for adhesive tapes in vehicle interior applications. The use of adhesive tapes in exterior attachment applications in an automotive that include attachment of side molding, mirrors, car door still trim, emblems, and others.

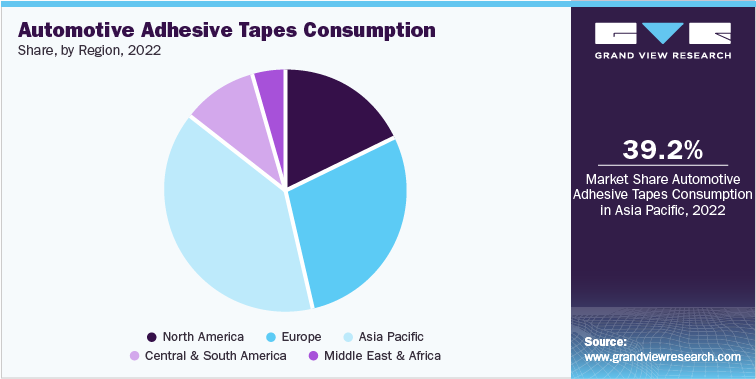

The automobile manufacturing industry in Asia Pacific is favorable for manufacturing operations owing to rising demand and the presence of prominent vehicle manufacturers. The presence of a robust manufacturing base in China and Japan coupled with the rapid growth of the automotive industry in India is likely to augment the demand shortly. National policies promoting the development of vehicles, fuel efficiency, and green policy are anticipated to impact future automotive trends. Thus, is likely to influence the automotive tapes market.

UV Tapes Market Analysis And Forecast

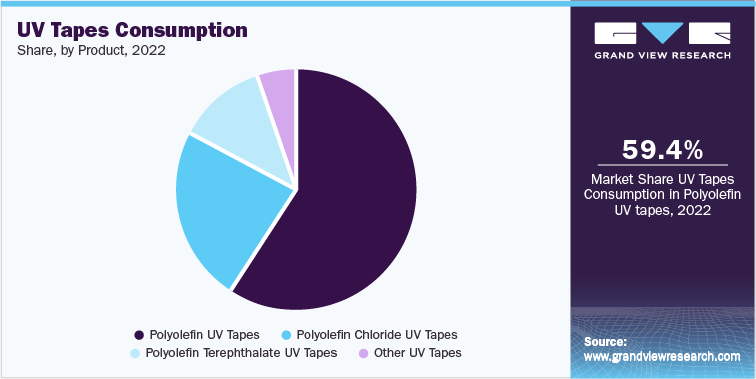

UV tapes are characterized by strong adhesion properties. By irradiation, these adhesive properties can be reduced, making the peeling off of tapes from semiconductors easy. These tapes are used to save cost and at the same time, improve the quality of the semiconductor processing. Besides, UV tapes are also used to protect the surface of the wafer of the semiconductor from damage.

Growing semiconductor and electronics industries are expected to augment demand for UV tapes over the forecast period. Rapid R&D has revealed numerous benefits of UV tapes over non-UV tapes in the past few years, which is expected to fuel growth over the forecast period. Polyolefin UV tapes had the highest penetration in the market in 2022. These tapes can perform under extreme heat and pressure conditions. Polyvinyl chloride UV tapes ranked second in terms of market penetration as these tapes can be easily recycled and since PVC is one of the widely manufactured compounds, they can be readily available in the market, reducing waiting periods.

Polyolefin UV tapes are known to exhibit strong adhesion properties, coupled with superior performance in extreme heat and pressure. Over the forecast period, growing demand for UV tapes in back grinding and wafer dicing applications is expected to drive the market for polyolefin (PO) UV tapes. Additionally, growing demand for small-sized electronic components such as chips and ICs is expected to drive the market over the forecast period. Besides, growing electronics industries in emerging markets such as China and India are also expected to drive the market.

Competitive Insights

The global adhesive tapes market is moderately competitive, with established players having significant experience, enabling them to devise better growth strategies as compared to other players. Companies such as Avery Dennison, 3M, Scapa, and Jostick Adhesive are integrated across the value chain, which enables them to have control over the raw material supply. These integrated companies can reduce the overall production cost through captive consumption, which leads to a higher profit margin.

Major players in the market are trying to increase their market share through production capacity expansion and mergers & acquisitions. The established companies in the market often operate an independent distribution network to increase their profits. Market players face severe competition from manufacturers in China since these manufacturers can offer their products at a relatively lower price owing to the lower manufacturing cost in the country. New entrants face the barrier of high initial setup costs, discouraging them from entering the market.

-

A majority of the companies in the market including 3M Company, DuPont de Nemours, Inc., Scapa Group plc, and others operate their business on a global level. Major market players are increasingly focusing on expanding their manufacturing capabilities in Asia to cater to the ascending demand in the region. The players are also focusing on increasing their market share through sustainable growth. They also emphasize active cost management via the efficient use of resources to achieve profitable growth in sales volume.

-

In June 2023, H.B. Fuller Co. completed two acquisitions, Adhezion Biomedical, a U.S. medical adhesives firm with customers present in over 40 countries, and another specialty adhesives company. The purchases will speed the company's product portfolio's evolution towards highly defined applications and increase the diversification of H.B. Fuller's Construction Adhesives (CA) business.

-

In April 2022, Arkema announced the acquisition of Polytec PT to help strengthen Arkema’s product portfolio for the electronics and batteries market. Furthermore, this acquisition will help the company to offer sustainably inclined products to its customers.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified