Polycarbonate Capacity Additions In Import Reliant Markets Is Crucial For Maintaining Trade Balance

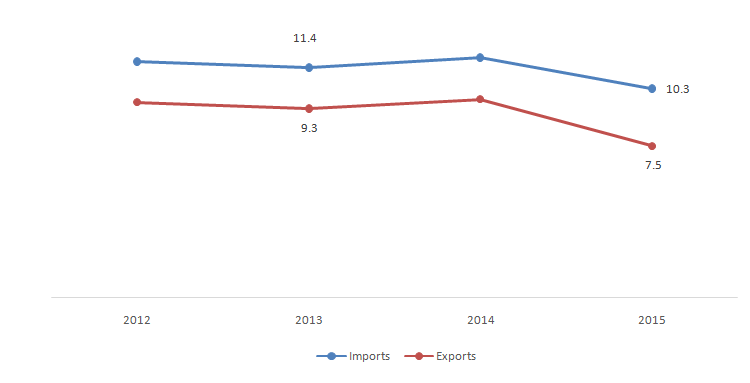

Polycarbonate is one of the widely traded resins with its import value estimated at USD 10.34 billion in 2015. Comparatively, its global export value was only USD 7.50 billion during the same period. This denotes a trade deficit scenario further indicating that production capabilities are concentrated in very few regions.

China is a major consumer of polycarbonate resins which are locally processed for usage in automotive, electrical & electronics, consumer goods and construction applications. To meet the burgeoning demand, the country is heavily reliant on imports. China accounted for 38.4% of the overall import value in 2015.

However, recent trends suggest that global polycarbonate trade witnessed a significant decline. From 2014 to 2015, imports and exports decreased by 12.8% and 23.4% respectively. This is primarily due to recent capacity additions in China. The U.S. being the largest exporter, has China as its second-ranking export destination of PC resins. In relation to the trends, it can be noted that sufficient domestic supply in China had an impact on the global trade landscape.

Import & export trends, 2012-2015, (USD Billion)

With continuously increasing transportation costs, suppliers are looking to establish production capabilities nearer to the locations of their customers. This would not only bring down the supply chain costs but will also provide the impetus for end-users to have a stable supply of materials, therefore, enabling a reduction in operational costs.

Therefore, there lies an opportunity for resin manufacturers and processors in expanding their production bases to locations with low domestic supply. This will enable the suppliers to establish a stable customer base, efficiency supply chain management, and price their products competitive to other entities.

In-depth report on global polycarbonate market by Grand View Research:

In-depth report on global polycarbonate market by Grand View Research:

https://www.grandviewresearch.com/industry-analysis/polycarbonate-market