Impact Of Inflation On Supply Chains And How It Can Reinforce Itself

In a market framework, prices for products and services are constantly changing. Some prices climb, and some decline. Inflation is defined as a general increase in the prices of goods and services, as opposed to any individual objects. The consumer price index (CPI) serves as a key indicator of inflation. It is measured by the pace at which prices vary across the entire U.S. economy for items such as fruits and vegetables, haircuts, and concert tickets. For instance, as per the U.S. BLS December 2023 estimates, the CPI for food, juices, and drinks increased by 18.6%, motor vehicle repairs rose by 12.7%, and hospitals and related services increased by 6.3%. On the other hand, inflation rates fluctuated a lot in the energy sector due to its high volatility. It is estimated that inflation is still on a bullish momentum. However, it is projected to slowly return to normal rates in 2024.

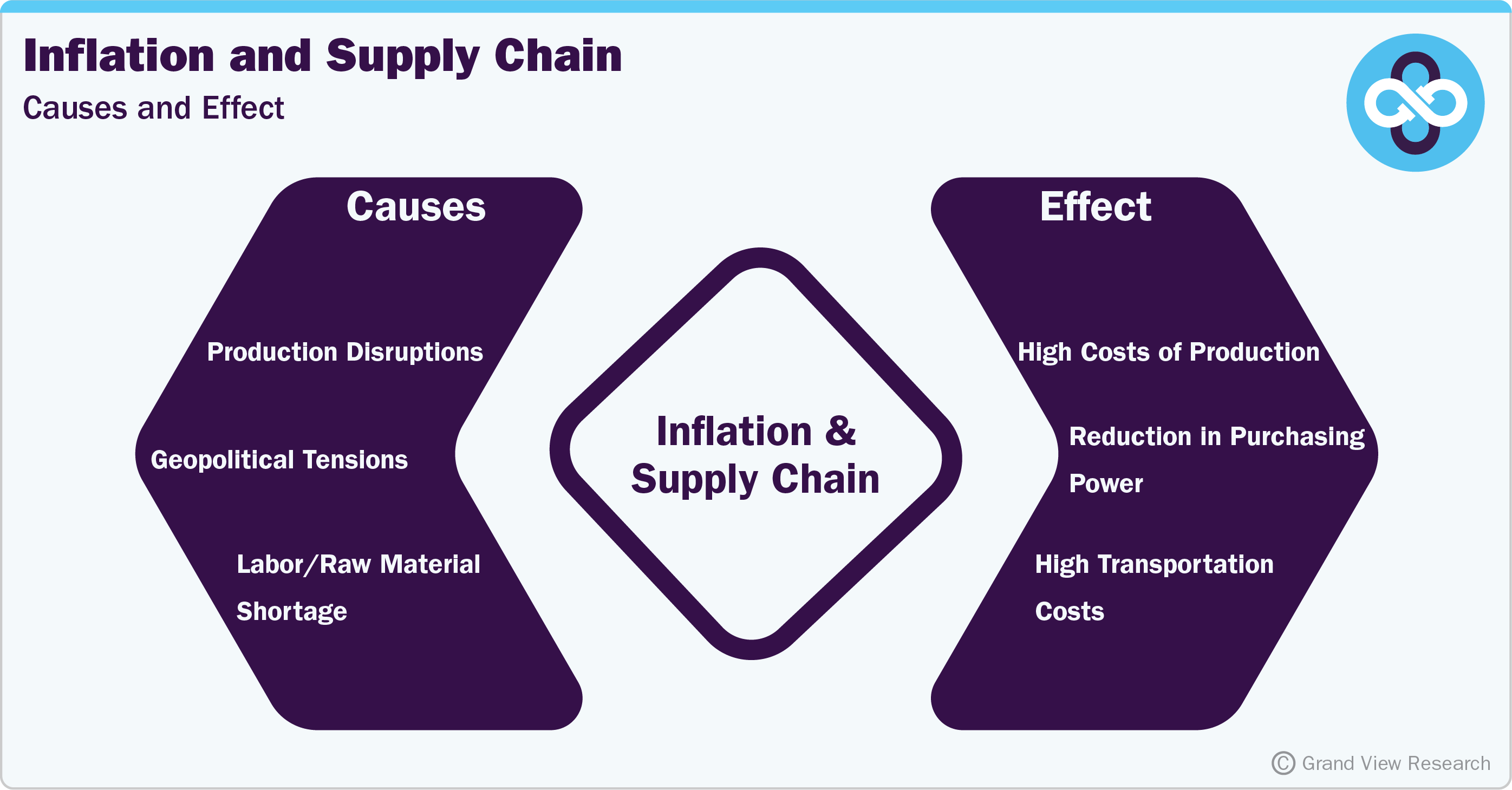

In the supply chain network, limited access to raw materials and labor is one of the major factors that can cause inflation. Other factors that give rise to inflation in the supply chain include – production disruptions, geopolitical tensions, or any events causing shortages. Companies in procurement that prioritize low costs over building resilience face challenges absorbing inflation.

Inflation within the supply chain can instigate a chain reaction in prices, leading to an increase in supply chain costs. This, in turn, can cause further inflation and ultimately result in escalated prices. Procurement gets more complicated during inflationary situations. Inflation, at present, is putting pressure on manufacturing expenses, raw materials, wages, energy, and transportation. Inflation, or the increased costs, when passed on to consumers or end users, generally leads to a reduction in the demand, which, in turn, causes producers to decrease their production. As a result, more detailed, thorough, and focused planning is required by all the stakeholders (such as – Warehousing and Logistics, Sales and Marketing teams) in the supply chain – Sales and Operating Processes (SOP).

Inflation directly impacts the supply chain. In the shipping industry, inflation further worsens import containers and labor availability. In logistics, fuel prices play a very important role. Inflation further escalates transportation and freight costs, which negatively impacts the businesses in the supply chain. Inflation also leads to capacity constraints, longer lead times, delayed orders, and persistent problems with shipping containers. For instance, as of January 2024, inflation resulting from attacks in the Red Sea is increasing pressure on freight and transportation costs, leading to delays in the delivery of goods. In January 2024, the shipping rates from Asia to North America's East Coast routes spiked up 55%. The rates reached USD 3,900 per 40-foot container. Industry experts also project that inflation in 2024 will cause import prices to rise in H1 2024 and shipping durations to increase, in addition to restricting the availability of intermediate supplies and consumer products.

Inflation within supply chains has the potential to become self-reinforcing. For instance, to avoid stock unit shortages or production setbacks, procurement managers may change their inventory management strategy by ordering items with more lead time, which leads to an increase in inventory storage costs. Labor training costs and productivity gaps owing to worker shortages can be costly for companies dependent on supply chains. In addition, high costs for transportation – such as diesel fuels, industrial equipment, and trucks can further impair supply chains.

Companies and procurement executives are constantly trying to mitigate the effects of inflation on their supply chain. Firms are trying to achieve this by identifying the risks connected with crucial suppliers and stress-testing the supply chain in various inflation-related scenarios to ensure its resilience. Companies in the procurement space are focusing more on supply chain management to reduce inflationary impacts in the face of variable pricing and availability. They are also shifting their inventory management strategy from just-in-time to just-in-case delivery of components and raw materials. Organizations are also expanding production facilities in countries such as Vietnam and India as part of the "China plus one" strategy to mitigate political volatility. For instance, companies such as General Motors and Intel are adding production plants in the U.S. region as part of their nearshoring strategy.

Effects of inflation on the supply chain

High costs of production

Inflation, coupled with tight global supply networks, is leading to higher raw materials and other production costs. In 2023, supply chain interruptions resulted in shortages, which drove up costs, causing more disruption. Inflation also hampers procurement since purchasers have to search other places for the commodities they want at a price they can manage. The additional expenses are frequently passed on to the ultimate client, lowering demand.

Reduction in purchasing power

Uncontrolled inflation within the supply chain reduces both consumers' and enterprises' buying power. For instance, in November 2023, the consumer price index increased by 3.1% from November 2022. However, compared to October 2023, CPI has decreased slightly in November 2023. This is primarily attributed to the decreasing gasoline prices (dropped by 6% in November 2023) and an overall softening of pricing pressure throughout the U.S. economy. According to industry experts, inflation is likely to drop considerably in 2024 due to continued disinflationary pressure in the economy.

High transportation costs

Inflation is also resulting in higher transportation costs. In 2023, shipping prices have increased throughout the world, making it harder for companies in the supply chain to sustain profit margins. In 2024, rising gasoline prices had the most significant impact on transportation expenses. In March 2024, challenges on major trade routes, refinery closures, and recovering demand continue to push global gasoline prices higher, making prediction difficult in the run-up to the United States presidential elections, when inflation will be a big issue. In some of the world's most crucial markets, the two predominant utilized fuels are increasing faster than crude oil. There was a significant increase in the U.S. gasoline futures in March 2024. At the same time, in Europe, diesel prices have already increased by more than 10%.

In 2023, inflation and port congestion in supply chains also resulted in higher transportation costs. According to Freightos 2024 data, the freight rates have increased by 173% between Asia and Northern Europe routes. The rates have almost tripled between Asia and the Mediterranean. Surcharges ranging from USD 500 to 2,700 per container have been introduced by shipping companies/shippers as a result of Red Sea disruptions and regional problems.

A few other impacts of inflation include – a crunch in resource availability and increased prices passed on to end users.

Some mitigation strategies suggested by Pipeline

-

Providing in-depth analysis of economic trends and forecasts, to help clients anticipate future price changes.

-

Offering valuable insights into consumer behavior to allow clients to adapt their products and services accordingly.

-

Conducting competitive analysis, thereby enabling clients to identify and exploit market opportunities.

-

Providing investment advice, and guiding clients to invest in assets that can hedge against inflation.

-

Facilitating strategic planning, helping clients make informed decisions to minimize the impact of inflation on their businesses.