The Impact of Geopolitical Factors and Trade Risks on Global Supply Chain

In 2024, geopolitical risks are expected to significantly impact supply chains across the globe. Various factors, such as political instability, trade disputes, and regional conflicts, will lead to disruptions in the flow of goods and services. This may result in increased costs, longer lead times, and decreased overall efficiency for businesses. Firms operating in the sourcing and procurement sectors especially will be impacted negatively as conflicts further increase supply chain bottlenecks. During military standoffs between nations, the interdependence of supply chain networks is at risk of being compromised. As a result of political uncertainty, procurement strategies can abruptly change, in turn affecting the flow of goods.

Geopolitical tensions undermine traditional trade channels, with far-reaching consequences for global supply chains and procurement executives. The smooth flow of goods and materials can be disrupted in strategic waterways and transit corridors during times of geopolitical tension. Trade routes may be shut down, delayed, or subjected to increased security procedures, disrupting the flow of goods between countries. Heightening geopolitical tensions may also lead to the introduction of tariffs and trade barriers between contending nations.

Some of the major geopolitical risks in 2024 include the Israel – Hamas conflict, Houthi missile attacks on ships in the Red Sea, Russian-NATO tensions, climate risk, energy security, cyberattacks, U.S. – China tensions, and upcoming elections across major nations in 2024. The escalating tensions between major powers, such as the United States and China, are leading to potential trade wars or even military conflicts. The impacts of climate change could exacerbate resource scarcity and create new political and economic challenges, particularly in vulnerable areas. Energy and climate change continue to exist as politically sensitive and controversial topics with global progress on the climate transition which is particularly deficient. However, following the Russian-Ukraine war, the global energy price shock should prompt decarbonization efforts.

After Russia's invasion of Ukraine in 2022, there has been an increase in concern about trade resilience and national security. Procurement executives are increasingly pursuing reshoring, near-shoring, and friend-shoring programs globally. In the aftermath of this major event, oil and gas prices went sky-high, and a major artery of trade was cut off, resulting in a widespread energy crisis across Europe. Recent years have seen an increase in trade restrictions. There has been a reduction in euro-area exports to Russia following the conflict. At the same time, flows to Russia’s neighbors have increased due to the reordering of supply chains. The European Central Bank in 2023 reported that geopolitical distance plays a key role in the supply chain. For instance, a 10% increase in geopolitical distance decreases bilateral trade flows by 2 – 3%.

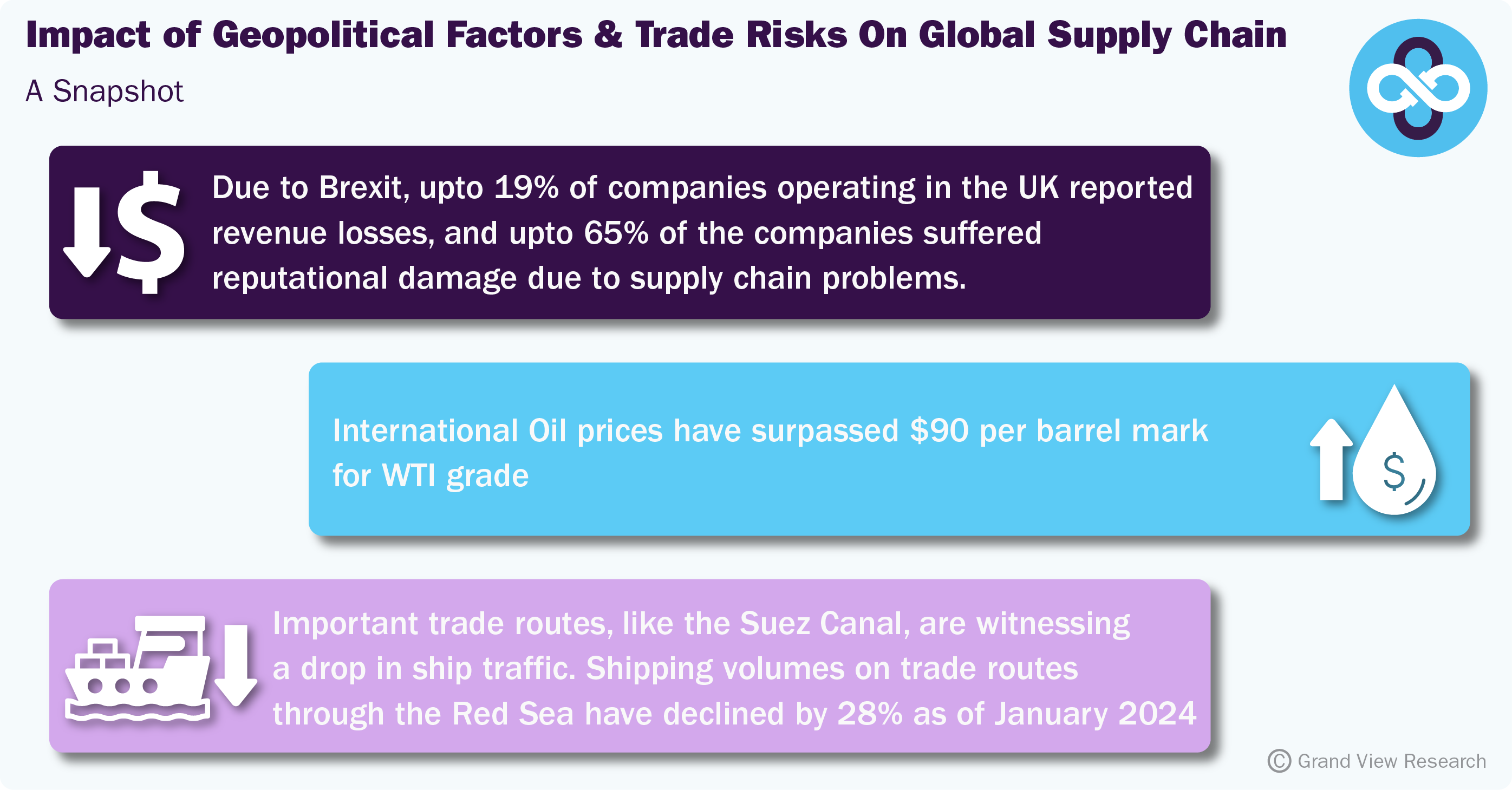

In 2023, Brexit is still regarded as a source of concern by numerous organizations in the supply chain. Companies operating across EU and U.K. borders still face higher costs due to uncertainty at the border, including administration, logistics, customs, financing, and IT adjustments. New drivers are desperately needed for the supply chain, but the barriers prohibiting mainland European workers from moving to the U.K. for work are hindering the growth of the workforce. By the end of 2022, Brexit was considered the largest supply chain disruptor by 83% of U.K. businesses, surpassing even the Russian-Ukraine conflict, COVID-19, and energy costs. As per Bloomberg estimates, firms lost revenues by 15 – 19% as a result of supply chain problems, and almost 60 – 65% of companies suffered reputational damage due to the late arrival of goods. [The Bloomberg estimates consisted of 303 procurement managers at organizations having 1,000+ employees with annual revenues of more than USD 60 million].

Impact of the Israel – Hamas Conflict across supply chain and trade

The conflict has caused remarkable challenges affecting vital industries such as pharmaceuticals, energy, technology, logistics, agriculture, and commodities. The Middle East is a crucial hub for energy production and transportation on a global scale. The conflict has significantly impacted the maritime shipping industry in 2023 and 2024. The potential escalation of the current hostilities in Israel beyond its national borders gives rise to significant apprehensions for two critical maritime chokepoints - the Suez Canal and the Strait of Hormuz.

The Suez Canal, which is used by many companies for transporting goods and container ships/vessels, is an important route in the supply chain that connects Europe and Asia through the Middle East region. Shipping companies are either temporarily suspending their activities or diverting their routes (either across the Red Sea or the Cape of Good Hope) to ensure smooth and safe operations as a result of this conflict. The tensions have given rise to significant security concerns in the supply chain network, including supply chain assets such as warehouses, transit routes, and storage facilities that have been targeted for security breaches. There has been a significant increase in petroleum prices, which is causing supply chain networks to become more complex. For instance, following the war, international oil prices have reached more than USD 90 per barrel for WTI grade. These increases are being passed on to end-users in the industry and are contributing to longer transportation timelines.

In the global logistics industry, UPS has halted flights, while DHL and FedEx have chosen to continue their services. To minimize service disruptions amidst the rising violence in the region, FedEx is using third-party carriers. The microchip manufacturing and oil markets are experiencing significant disturbances. This is because, along with Taiwan, Israel is one of the key regions for advanced chips used extensively by Intel, Nvidia, and Apple.

Due to the current political climate, companies are reconsidering their sourcing strategies. Locations that were previously good suppliers/sources of raw materials may now be considered potentially unsafe owing to wartime conflicts. As a result, businesses are aiming to find other suppliers and diversify their sourcing methods.

Impact of the Houthi missile attacks on ships in the Red Sea across supply chain and trade

There has been a significant diversion of international trade in the Red Sea because of continuous missile & drone attacks, and hijackings targeting vessels. In 2023 and 2024, it is now common for ships to avoid Egypt's Suez Canal, which accounts for approximately 12% of all shipping traffic in the world. This is also the shortest route from Europe to Asia. This has resulted in more prolonged travels, which incur more expenditures, higher energy prices, and higher insurance premiums for companies in the supply chain network. Several major global shipping and oil firms - notably Maersk and British Petroleum - have suspended shipments and halted operations in the region. This happened in the wake of Yemen's Houthi group attacks on cargo ships in Bab al Mandeb Strait at the southern end of the Red Sea. Maersk has halted its ships until further notice due to disrupted trade routes on waterways as of January 2024.

Procurement officials and companies delivering products have more inventory locked up in transportation and require even more containers in case they become scarce. In 2024, according to Container xChange, the manufacturers that produce those ubiquitous metal freight boxes are already operating at full capacity. Ships have been delayed in getting to ports as far as Halifax, and Nova Scotia. Shipping costs have, thus, increased in 2024 for shippers in Asia and North America. For instance, in January 2024, as per the Freightos estimates, the cost of shipping containers has more than quadrupled from China to the Mediterranean Sea from November 2023. At the same time, shipping volumes owing to attacks on the Red Sea have dropped by 28% as of January 2024.

End-use companies are rushing to adjust. Volvo and Tesla have announced manufacturing/operation suspensions at European facilities, citing an inability to obtain components from Asian suppliers. The risk of higher costs is also being flagged by British retailers such as Tesco and Marks and Spencer Group. In 2024, as per Business Standard, shipping delays are especially challenging for individual shipments. For instance, individual components for new manufacturing facilities/sites that are on their way to Asia. Rerouting ships is further adding 40% in voyage distance.

In 2024, as per Xeneta estimates, there was a 62% surge in the volume of air shipments from Vietnam to Europe, a vital transportation route (used by many companies operating in the supply chain space) for clothing, by the end of January 2024. Other carriers/shipping companies are transporting commodities to Europe overland through Kazakhstan, avoiding Russia.

China, being the largest trading nation in the world, currently imports about 50% of its crude oil from the Middle East. Additionally, China exports more to the European Union than it does to the United States. Despite the ongoing conflict in the Red Sea, China has yet to become involved. This is partly because the Houthis have stated that they will not target Chinese ships as per supply chain industry experts in 2024.

Some mitigation strategies suggested by Pipeline

Companies must continue to examine geopolitical environments and diversify sourcing methods to reduce the effects of these conflicts. The impacts of these geopolitical risks and supply chain disruptions extend beyond logistics to huge financial implications. When security risks increase, it can negatively affect the efficiency of supply chains and the financial stability of businesses in the affected region. Here are some mitigation strategies that GVR has adopted or suggested during these times:

-

Providing real-time data and insights on commodities with respect to market fluctuations

-

Providing supply chain diversification recommendations and alternative sourcing options

-

Offering tailored consultancy services to help organizations adapt their procurement strategies to the evolving geopolitical landscape to ensure business continuity.

-

Offering risk assessment reports to identify potential disruptions.

-

Developing alternative sourcing options for critical materials

-

Facilitating collaboration between suppliers and buyers to ensure smooth operations amidst geopolitical challenges.