- Home

- »

- Reports

- »

-

Rental Cars Procurement & Supplier Intelligence Report, 2030

![Rental Cars Procurement & Supplier Intelligence Report, 2030]()

Rental Cars Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2023

- Report ID: GVR-P-10519

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Rental Cars - Procurement Trends

“The rental cars market growth is driven by the significant increase in the travel and tourism industry.”

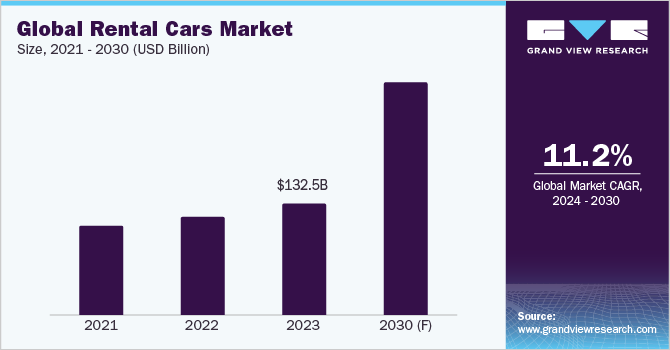

Procurement of rental cars has become sought after in the wake of soaring business travel and growth in the tourism industry. The global market is expected to grow at a CAGR of 11.2% from 2024 to 2030. Further, the rising urban population with an increasing tendency towards adventure and travel is also promoting industry growth. Besides, an uptick in online car booking and the penetration of rental aggregator platforms have provided an impetus to rental car suppliers.

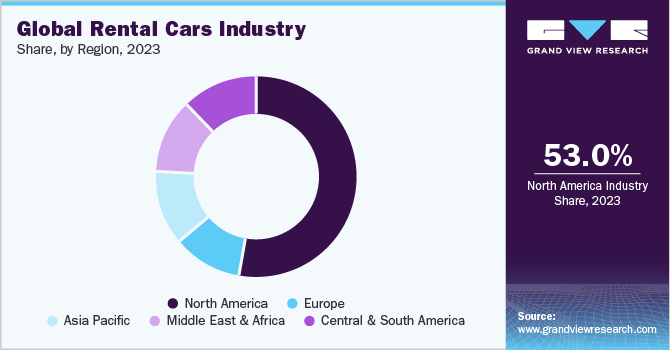

The global rental cars market size was valued at USD 132.48 billion in 2023. The rising footprint of dedicated mobile apps for car rental services has boded well for industry participants. For instance, in June 2021, Amazon started online car rental services in the UAE, which dispatches to the chosen location taking as little as two to three hours from the time of reservation. In 2022, more than 50% of this category's global revenue was attributed to North America due to the rising number of business and leisure trips across the region.

Increased urbanization has resulted in fewer parking places, more traffic congestion, and tougher automobile ownership laws. As a result, many people in cities are turning towards automobile rental services as a more flexible alternative to owning a car. Renting a car allows the commuter to travel without having to deal with parking issues or maintenance expenditures. Furthermore, an increasing footfall of electric vehicles (EVs) and the use of AI-based software have made rental car procurement a promising portfolio.

Car rental firms provide a diverse selection of vehicles, including budget cars, SUVs, luxury automobiles, and specialized vehicles. This variation appeals to clients with varying demands and tastes, allowing them to select a vehicle that meets their unique needs. Customers may choose the most appropriate vehicle for their intended purpose, whether it's a family holiday, a work trip, or an exciting expedition. The availability of a wide range of vehicle alternatives increases the appeal and flexibility of automobile rental services, appealing to a bigger client base and propelling the rental cars market forward.

In addition, car rental companies now provide low-cost car rental services, especially for leisure markets, and are expected to aid the category expansion.

Supplier Intelligence

“How is the nature of rental cars industry? What are some of the initiatives taken by the key suppliers?”

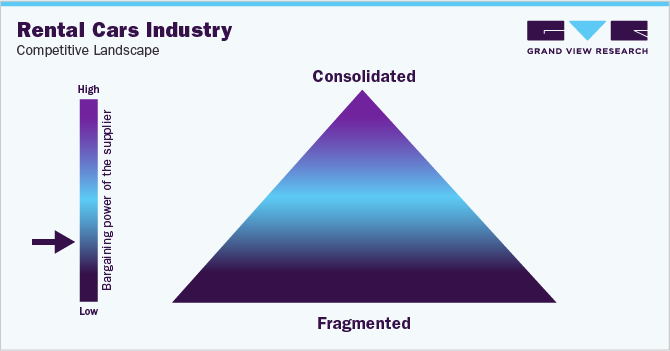

The industry is moderately fragmented, with the presence of several players. Companies are trying to gain a higher market share by adopting various strategies, such as investments, partnerships, and mergers & acquisitions. For instance, in May 2021, Uber and CarTrawler entered a strategic partnership to launch Uber Rent, a new car rental service. Under the terms of the agreement, CarTrawler will provide Uber with its car rental technology platform, which will be used to power Uber Rent across the United States. There is no single, dominant car rental platform that is widely adopted by businesses and consumers.

In recent years, mergers and acquisitions (M&A) have become a key growth strategy for rental car companies seeking to increase their market share, revenue and procurement strategies. Major players in the rental car industry have also sought partnerships with airlines, hotels, and travel agencies to offer integrated travel packages and enhance the customer experience. For example, in October 2022, Autohellas, a leading car rental company in Greece, acquired more than 85% share in Portuguese company HR Aluguer de Automóveis S.A. This acquisition is part of Autohellas' strategic plan to double its revenue from the international rentals segment.

Key suppliers covered in the industry:

-

Sixt SE

-

Localiza

-

Avis Budget Group

-

Europcar

-

Enterprise Holdings Inc.

-

The Hertz Corporation

-

Toyota Rent-a-Car

-

Alamo Rent-a-Car LLC

-

Carzonrent India Pvt Ltd

-

ANI Technologies Pvt. Ltd

Pricing and Cost Intelligence

“What are some of the major cost components involved while offering this service? Which factors impact the cost of rental car services?”

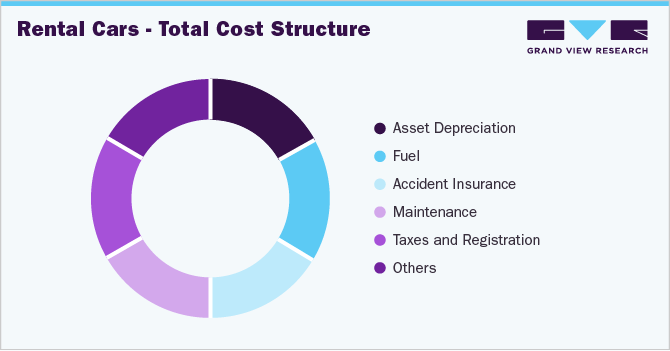

Asset depreciation, fuel, accident insurance, and maintenance form the major cost components when it comes to rental car services. There are a number of other factors that can affect the cost of these services, including local taxes, registration, and administrative overheads. Businesses should carefully consider all these factors during the procurement of rental services to ensure that they are competitive and profitable.

Insurance and liability expenses are significant operating costs for car rental companies. In the United States, car rental companies spend an average of USD 1,000 to USD 1,500 per year per vehicle on insurance and liability expenses, which represents 10%-15% of their total operating costs.

The following chart provides various costs incurred in implementing this technology. The major cost heads are shown below:

The cost of implementing and operating rental cars can be influenced by several factors. First, the age & size of the fleet employed can impact costs. The annual cost of maintaining and repairing a single rental car is around USD 1,000 - USD 1,200. This includes both routine maintenance like oil changes and unplanned repairs and replacements due to wear and tear or accidents. A rental car company with a 500-car fleet would have to allocate more than USD 500,000 just for fleet maintenance and repairs. Additionally, companies need to factor in various operating costs such as insurance & liability expenses. One of the main factors contributing to the high insurance & liability expenses is the risk associated with renting out vehicles to unknown drivers. Furthermore, technology & software expenses drive up the costs. The majority of the expenses are incurred by installing and maintaining a rental management system (RMS).

Sourcing Intelligence

“Which countries are the leading sourcing destination for rental cars?”

North America and especially the U.S., provides compelling opportunities due to the lack of a well-established public transit system. Meanwhile, China has emerged as a major automotive manufacturing hub with manufacturing facilities of many global automotive players as well as Chinese brands. Over 50% of the automobiles manufactured in 2022 in China were of Chinese brands. Besides, China’s share in global passenger vehicle production rose from 9.5% in 2020 to 15% in 2022. In terms of rental car sourcing intelligence, the top five countries preferred for this service are China, Japan, the U.S., Germany, and South Korea.

In China, the government strongly supports the automobile sector and is one of the largest manufacturers of automobiles. The number of passenger vehicles produced increased to 11,943,200 in 2022. Chinese automakers can build an electric vehicle (EV) for almost USD 25,000 less than European automakers. While the average price of electric cars in Europe has climbed from roughly USD 55,000 to USD 60,000 and from USD 57,000 to USD 70,000 in the United States, it has fallen in China to USD 35,000 from USD 73,000, bringing it below the price of gasoline cars. This creates new opportunities for car rental enterprises that are moving towards de-carbonizing the industry by replacing older cars with EVs. This is in part due to lower labor costs and easily available raw materials. Thus, China emerges as one of the leading destinations for sourcing in this landscape.

In terms of engagement, large-scale companies opt for a partial outsourcing model. Companies outsource operations such as IT and customer service. While employing an internal team can be beneficial, companies in the healthcare, real estate, insurance, and logistics sectors are facing significant challenges, such as talent shortages, onboarding issues, and infrastructure costs, which can have a significant budgetary impact. As a result, these companies are increasingly turning to full outsourcing models to achieve increased transparency, reduced risks and fraud, and higher security against outside attacks. Full outsourcing models also give companies access to specialized teams that can be beneficial in the long run. Additionally, it has been observed that employing an offshore strategy can help an organization reduce labor costs by more than 50% - 60%.

“In a basic provider model, the supplier operates under a simple buy-sell arrangement, whereby buyers typically pay a set “transaction” price for the products or services.”

A basic provider model is one of the most common operating models. In this model, the rental car service provider operates under a simple buy-sell arrangement where buyers typically pay a set “transaction” price for products or services.

When sourcing car rental services, it is important to consider the needs, budget, and renting period. One can save money by booking in advance, using a discount code, or renting from a less well-known supplier. Best deals can also be found by using a comparison website.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Rental Cars Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 11.2% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

3% - 7% (annual)

Pricing Models

Cost plus pricing, tier-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Vehicle type, booking options, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Avis Budget Group, Europcar, Enterprise Holdings Inc., The Hertz Corporation, Toyota Rent-a-Car, Sixt SE, Alamo Rent-a-Car LLC, Carzonrent India Pvt Ltd, Localiza, ANI Technologies Pvt. Ltd

Regional Scope

Global

Historical Data

2021 - 2022

Revenue Forecast in 2030

USD 186.53 billion

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global rental cars market size was valued at approximately USD 132.48 billion in 2023 and is estimated to witness a CAGR of 11.2% from 2024 to 2030.

b. A significant growth in the travel and tourism industry, tough automobile ownership laws, increased urbanization, and an increasing tendency towards adventure and travel are driving the growth of this industry.

b. According to the LCC/BCC sourcing analysis, China, and the U.S., are the ideal destinations for sourcing rental cars.

b. This market is moderately fragmented with the presence of many large players competing for the market share. Some of the key players are Avis Budget Group, Europcar, Enterprise Holdings Inc., The Hertz Corporation, Toyota Rent-a-Car, Sixt SE, Alamo Rent-a-Car LLC, Carzonrent India Pvt Ltd., Localiza, and ANI Technologies Pvt. Ltd.

b. Asset depreciation, fuel, accident insurance, and maintenance are the major key components of this industry. Other key costs include taxes, registration, and administrative overheads.

b. Cost-saving measures such as the use of a variety of channels, negotiation, and considering the total cost of ownership with suppliers to address any issue are some of the best sourcing practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified