Household Cleaners Contract Manufacturing Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jan, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10503

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Household Cleaners Contract Manufacturing - Procurement Trends

“High demand for household cleaners driven by the rising focus on sanitization in the post-pandemic era is fueling the market growth.”

Procurement of household cleaners contract manufacturing has become pronounced with surging demand for environmentally friendly and natural products and penetration of manufacturing technology. The global market could depict an 11.0% CAGR from 2024 to 2030. The robust outlook is attributed to be driven by high demand for household cleaners due to the trend for sanitization, the growth of international supply chains and a surge in private equity funding for contract manufacturing. However, prevailing and impending challenges such as high investment costs, low margins, quality control, and managing compliance with regulations provide an uphill task for contract manufacturing service providers.

The global household cleaners contract manufacturing market size stood at USD 30.6 billion in 2023. Global supply chains have witnessed a paradigm shift, including increased market accessibility, reduced production costs and expedited lead times. Service providers are gearing up to explore geographical advantages, create strong supplier networks, and generate profit from economies of scale. This global expansion allows businesses to increase operational efficiency while maintaining a competitive advantage in the market. Contract manufacturing firms provide growing prospects for the public and private domains. Organizations in these sectors are severely hampered by labor-intensive manufacturing, inefficient production of various goods, and poor management. They are also crucial for tackling complicated situations since a single organization is less effective in bringing about change.

In the current hypercompetitive and dynamically altering business landscape, the need for contract manufacturing looks to be a true game-changer, an irreplaceable stimulant pushing enterprises to the pinnacle of success. The manufacturers of household cleaners have witnessed significant growth since the outbreak of the COVID-19 pandemic. The demand for high-quality cleaning products/cleaners is currently rising rapidly, with previously unidentified markets recording a significant rise in demand. Contract manufacturing has also benefited from this boom. If a company is producing its goods, it is likely to require multiple production sites across the nation. This means that goods must be carried from the manufacturing facility to distant locations for sale, which raises the costs of both transportation and the final product. Companies can tackle this situation and expand the market for their goods by entering into contracts with various service providers in each location.

The prevailing trends suggest Industry 4.0, big data and analytics, blockchain, robotics and automation, digitalization, AI and 3D printing have brought a seismic shift in the procurement landscape. For instance, robotic process automation, which uses robots to do hazardous and/or repetitive jobs, including material handling and assembling, has augured well for smart manufacturing.

Repetitive operations can be completed by robotics technology far more quickly and precisely than by human labor, increasing product quality and lowering faults. In essence, Industry 4.0-powered digitalization has allowed companies to streamline operations, raise standards, and cut expenses. Industry 4.0 helps contract manufacturers gather and analyze massive volumes of data in real-time, giving them insightful information about the status of their operations.

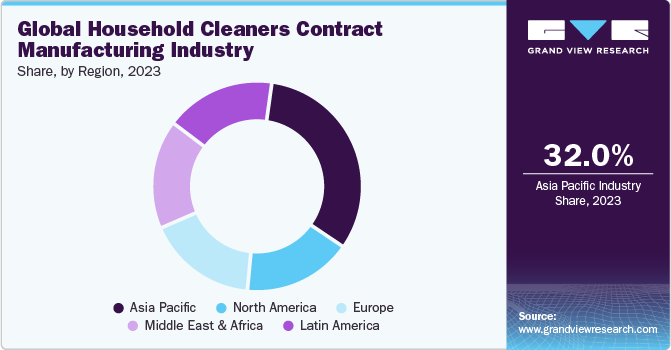

Asia Pacific dominates the global market, accounting for a substantial market share. A rise in demand for products such as surface cleaners and laundry detergents, particularly after the outbreak of the COVID-19 pandemic, in emerging nations such as China and India is attributed to drive the growth of the regional market during the forecast timeframe. The rapid growth rate in the household cleaners sector can also be explained by the fact that most international firms are shifting their manufacturing bases to India and China in order to reduce the cost of their products. The governments in this region have also taken steps to provide low labor costs and an advanced technological infrastructure for manufacturing facilities, which has enabled the growth of contract manufacturing in this area. Europe is also witnessing moderate growth in the global category, owing to increased focus on hygiene and sanitation, especially in nations such as the U.K., Spain, France, Italy, and Germany.

Supplier Intelligence

“What best describes the nature of the household cleaners contract manufacturing? Who are some of the main participants?”

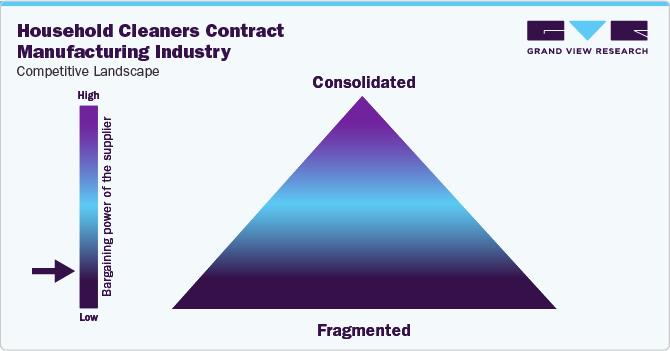

The industry is fragmented, exhibiting intense competition among the service providers. The key players have carved a niche for themselves by leveraging their unique capabilities and skills. They are influencing the direction of household cleaners production with an emphasis on quality, cutting-edge technologies, and a customer-centric approach. In addition, the services offered by the players provide opportunities for the public and private domains. The need for contract manufacturing with more precision and reduced time constraints has prompted procurement leaders and suppliers to invest in strategic initiatives.

Owning the contract manufacturing streamlines the supply chain and expedites production while also cutting costs overall, as it eliminates the overhead costs associated with purchasing equipment, supplies, and additional labor. Buyers (businesses who want to outsource their manufacturing activities) possess moderate to high negotiating capability due to the presence of a significant number of service providers who possess the required capabilities, covering everything from manufacturing to packaging. This creates pressure on the service providers to offer the best available options at the most economical prices, without compromising on the product quality.

Key suppliers covered in the industry:

-

Abdos

-

Advance Research Chemicals, Inc.

-

CleanPak Products, LLC

-

Colep Consumer Products

-

Formula Corp.

-

Guy & O'Neill, Inc.

-

McBride plc

-

Megamorph Marketing Pvt. Ltd.

-

Nicols S.A

-

PLZ Corp.

-

Premier Care Industries

-

Rockline Industries

Pricing and Cost Intelligence

“What is the cost structure for household cleaners contract manufacturing? What variables affect the prices?”

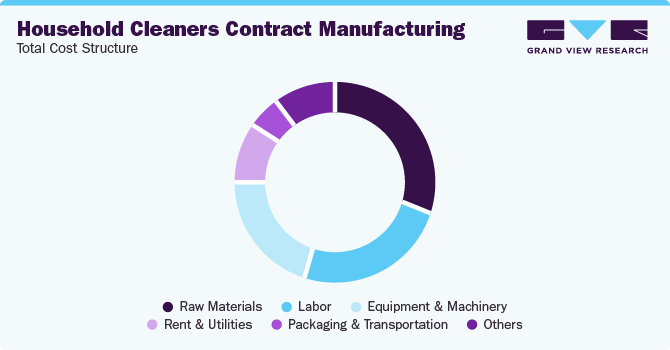

Raw materials, labor, equipment & machinery, rent & utilities, packaging & transportation, and other costs constitute the cost structure of the global household cleaners contract manufacturing. The other costs include research & development (R&D), administrative expenses, taxes & insurance, maintenance & repairs, depreciation, and interests. Prominently, raw material costs constitute a major chunk of the cost structure.

The cost of employing a service provider (contract manufacturer) may influence procurement decisions. A number of direct and overhead costs are associated with manufacturing these products such as raw materials, labor costs (including pay and benefits), production equipment, and other operational expenses. If the production requires customized setup or tools, the service provider may charge extra, in addition to the cost of shipping and packaging the completed goods to their intended locations.

Service providers may also impose additional costs related to facility and equipment upkeep. These costs may vary depending on the availability and state of manufacturing facilities and equipment. To put this into perspective, new and well-equipped facilities could cost more than the obsolete or under-equipped ones. The nature of a product may affect the price. Besides, costs may increase due to more complex designs, the need for specialist equipment, the kind and caliber of materials, or particular manufacturing techniques.

The price charged by a service provider might differ based on a number of variables, including the complexity of the project, the amount of output and inputs, location, raw material pricing, and more. Business enterprises (brand owners) need to assess what they expect while entering into a business relationship with a contract manufacturer. For instance, service providers in this category source raw materials and ingredients from several nations. Supply chain disruptions and inflation may result in an upsurge in raw material prices and sourcing challenges.

The charges may vary depending on the region or nation due to differences in labor prices, tax laws, regulatory frameworks, and logistical challenges. The average hourly rate for the companies offering contract manufacturing services in different countries is USD 99.9 to USD 148.9 (in the U.S.), USD 24.9 to USD 48.9 (in India), USD 49.9 to USD 98.9 (in the UK), USD 25.9 to USD 49.9 (in Canada), USD 49.9 to USD 98.9 (in Australia), and USD 24.9 to USD 48.9 (in Mexico, Poland, and Spain).

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components as illustrated below:

Sourcing Intelligence

“How do household cleaners contract manufacturing service providers engage? What is the type of engagement model?”

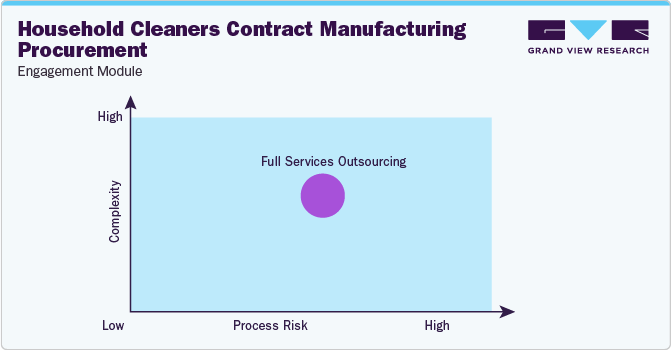

In terms of global household cleaners contract manufacturing sourcing intelligence, businesses (brand owners) commonly follow a full-service outsourcing model to engage with their suppliers wherein the service provider (contract manufacturer) performs an end-to-end manufacturing process i.e. sourcing raw materials, producing finished goods and packaging.

Outsourcing the entire manufacturing process enables the business to save time from the sophisticated process of production and focus on other important activities such as research & development to formulate new products, branding, and marketing. In addition, the business gets relieved from the challenging task of managing labor, adherence to government regulations, and management of the production supply chain and can solely focus on the sales aspect.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

While selecting the service providers (contract manufacturers), the businesses (brand owners) typically go for an approved provider operating model, a procurement strategy where a service provider is selected based on criteria such as prior proven performance, quality standards, and meeting a predefined set of qualifications. The operating models of approved providers minimize risks and enhance opportunities for profit creation. As a result, it is anticipated that providers will eventually switch from providing generic services to proprietary services. Outsourcing enables businesses to minimize high setup costs in the nations where they lack production facilities. They focus on ingredients used by the service provider and the certifications a service provider possesses, as a key criterion for selection. They would rather collaborate with service providers who employ organic materials in their manufacturing process.

India is the preferred low-cost/best-cost country for sourcing household cleaners contract manufacturing service providers. The Asian giant is a lucrative hub for businesses aiming to provide services to the Middle East and Southeast Asian markets (because of its good geographic position). India has been making efforts to enhance the ease of doing business and the business climate.

Companies looking for a more efficient manufacturing experience may find it more appealing if reforms are implemented to streamline procedures and lower red tape. In addition, the Indian government has launched programs like "Make in India" to boost manufacturing and draw in outside capital. Support from the government and advantageous policies may be attractive to businesses wishing to start manufacturing operations.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape – the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Household Cleaners Contract Manufacturing Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Growth Rate |

CAGR of 11.0% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

5% - 10% increase (Annually) |

|

Pricing Models |

Cost-plus pricing, competition-based pricing, demand-based pricing, hourly pricing, and fixed pricing |

|

Supplier Selection Scope |

Cost and pricing, past engagements, productivity, geographical presence |

|

Supplier Selection Criteria |

Geographical service provision, years in service, employee strength, quality management system, technologies deployed in manufacturing, regulatory compliance & IP protection, assembly & storage capacity, transportation support, lead time, and others |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

Abdos, Advance Research Chemicals, Inc., CleanPak Products, LLC, Colep Consumer Products, Formula Corp., Guy & O'Neill, Inc., McBride plc, Megamorph Marketing Pvt. Ltd., Nicols S.A, PLZ Corp, Premier Care Industries, and Rockline Industries |

|

Regional Scope |

Global |

|

Revenue Forecast in 2030 |

USD 63.6 billion |

|

Historical Data |

2021 - 2022 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global household cleaners contract manufacturing market size was valued at approximately USD 30.6 billion in 2023 and is estimated to witness a CAGR of 11.0% from 2024 to 2030.

b. High demand for household cleaners due to increasing apprehensions about sanitization and well-being in the post-pandemic era, growth of international supply chains, continuous development in manufacturing technology, and growing amount of private equity funding for contract manufacturing are driving the growth of the market.

b. According to the LCC/BCC sourcing analysis, India and China are the ideal destinations for sourcing household cleaners contract manufacturing.

b. This category exhibits a fragmented landscape with intense competition. Some of the key players are Abdos, Advance Research Chemicals, Inc., CleanPak Products, LLC, Colep Consumer Products, Formula Corp., Guy & O'Neill, Inc., McBride plc, Megamorph Marketing Pvt. Ltd., Nicols S.A, PLZ Corp, Premier Care Industries, and Rockline Industries.

b. Raw materials, labor, equipment & machinery, rent & utilities, packaging & transportation, and other costs are the major key cost components of this market. Other costs can be further bifurcated into research & development (R&D), administrative expenses, taxes & insurance, maintenance & repairs, depreciation, and interests.

b. Assessing if a service provider is flexible enough and can scale the production as and when required, reviewing the technologies that a service provider utilizes in the production process, the service provider should be spoken about their documentation and communication process, evaluating the charges of multiple service providers are some of the best sourcing practices considered in this industry.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.