Clinical Research Organizations Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2023

- Report ID: GVR-P-10522

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Clinical Research Organizations - Procurement Trends

“The clinical research organizations market growth is driven by the increasing healthcare expenditure, rise in the number of drug development activities, technology advancement, and increasing outsourcing & globalization of clinical trials”

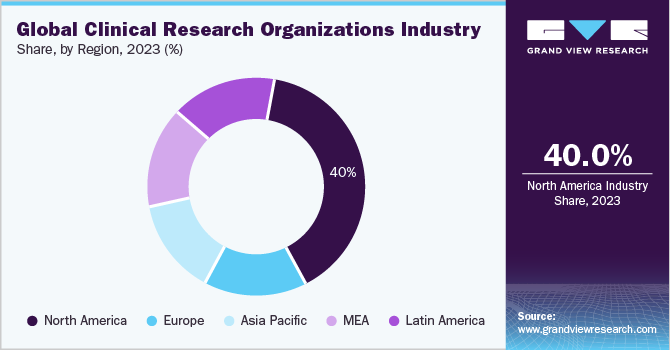

Clinical research organizations procurement has become vital to keep up with the rising number of clinical trials, which have become patient-centric, decentralized and complex. The global market is poised to depict a CAGR of 12.2% from 2024 to 2030. Factors such as increasing healthcare expenditure, rise in the number of drug development activities and increasing globalization of clinical trials are fueling the market growth.

Rising healthcare costs have encouraged funding for clinical research and development, creating more clinical trials and demand for CROs. In 2022, high-income countries account for nearly 80% of global health spending, with the U.S. alone accounting for more than 40%. In essence, the supply chain of clinical research plays an instrumental role in clinical trials amidst surging demand for innovative healthcare products and therapies.

This global clinical research organizations market size was estimated at USD 90.4 billion in 2023. A renewed focus on logistics and transportation to spur the supply of temperature-sensitive products, such as biological samples and drugs, bodes well for the market growth. Moreover, an uptick in the spending on prescription drugs, hospital stays, medical equipment, and other costs, has prompted procurement leaders to expand their penetration.

The regulatory environment plays a significant role in the clinical research organization market. The requirements for conducting clinical trials vary by country and region, and these regulations can have a major impact on the demand for CRO services, the cost of clinical trials, and the profitability of CROs. Government policies, such as regulations on quality standards, can also have a significant impact on the CRO market. For example, the Drugs and Cosmetics Act (1940) in India regulates the import, manufacture, and distribution of drugs and cosmetics and ensures that these products are safe, effective, and meet essential quality standards.

Technology advancements and outsourcing of clinical trials may foster future pipeline scenarios. For instance, the pharmaceutical and biotechnology sectors now frequently outsource clinical trials. Clinical trials are intricate and demand a lot of resources, such as specialized tools, facilities, and employees. Several pharmaceutical and biotech businesses outsource their clinical trial activities to clinical research organizations to cut costs, reorganize business processes, and boost productivity. As more pharmaceutical companies outsource their clinical trials, the demand for CROs rises.

In addition, the growing requirement like an increased focus on personalized medicine and demand for specialized services are expected to aid clinical research organization market expansion.

Supplier Intelligence

“How is the nature of the clinical research organizations? What are the initiatives taken by leading suppliers?”

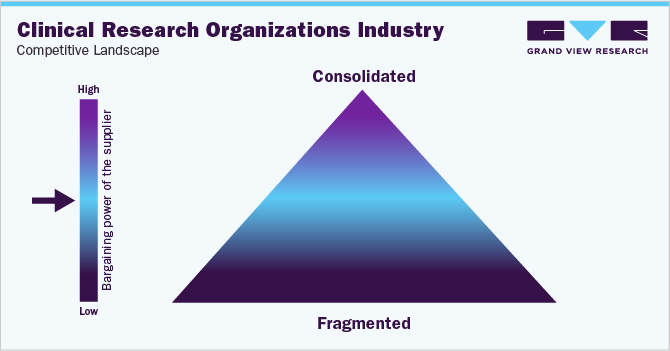

The industry is fragmented, depicting intense competition as market players aim to expand their consumer bases. Firms are adopting organic and inorganic growth strategies, such as research and development, acquisitions, partnerships, and regional expansion to grow their market share and foster procurement process.

- In March 2023, ICON plc announced that it would acquire Syneos Health for $3.3 billion. This acquisition is expected to create a global clinical research organization with over 15,000 employees and a presence in over 100 countries.

Big CROs engage with technologically advanced suppliers that provide the necessary equipment for clinical trials. The presence of many such equipment suppliers across different geographies decreases the bargaining power of suppliers.

Key suppliers covered in the industry:

-

Asymchem Laboratories (Tianjin) Co., Ltd

-

Charles River Laboratories.

-

Dalton Pharma Services

-

ICON plc

-

IQVIA Inc

-

Pharmaron Beijing Co., Ltd.

-

Piramal Enterprises Ltd.

-

Sun Pharmaceutical Industries Ltd.

-

Syneos Health

-

Thermo Fisher Scientific Inc.

-

Parexel International (MA) Corporation

-

WuXi AppTec Co., Ltd.

Pricing and Cost Intelligence

“What are some of the major cost components in clinical research organization? Which factors impact the cost of clinical research organization?”

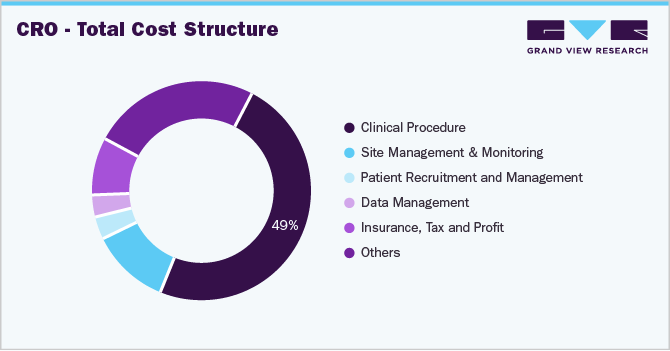

The major cost components in the procurement can vary depending on the specific services offered and the scope of the trial. The cost of clinical research organizations can be broken down into two main categories Capital Expenditures (CAPEX) costs and Operating Expenses (OPEX) costs. CAPEX costs are incurred in the initial setup and development of the CRO, such as the cost of hiring staff, purchasing equipment, and developing software. Operational costs are those costs that are incurred on an ongoing basis to run the CRO, such as the cost of data management, site monitoring, and regulatory compliance.

The following chart provides various costs incurred in this industry. The major cost heads are shown below:

The market has various factors that impact their costs, including patient population, the size and complexity of the trial, technology use, the number of sites involved, regulatory requirements, specific services offered, geographic location, experience, and quality of the CRO. Larger and more complex trials need more resources, time, and money, while trials with multiple sites require more management and monitoring. Rare diseases or patient populations with special needs also increase the cost of CROs. The use of technologies, such as electronic data capture systems, can reduce costs. Besides, experience also plays a role in the cost of CROs, as more skillful and competent CROs can conduct trials more efficiently and effectively, leading to lower costs.

Sourcing Intelligence

“Which countries are the leading sourcing destination for clinical research organizations?”

China, India, and the U.S. are the largest regions in the global clinical research organizations market. India is a major hub for CRO development, accounting for over 20% of the global market in 2023. The country has a large pool of skilled and low-cost scientific & clinical staff, which makes it an attractive destination for CROs and procurement leaders.

The United States is home to many of the world's leading pharmaceutical companies, who are exploring new ways to achieve supply chain flexibility with investments in CROs to conduct clinical trials. It also has a well-developed regulatory environment, which is important for CROs that need to comply with strict regulations.

- In 2021, there were over 12,000 clinical trials underway in the United States, and this number is expected to continue to grow in the coming years. As the number of clinical trials increases, so too does the demand for CRO services.

In terms of clinical research organization sourcing intelligence, a hybrid engagement model is used as it allows clients to maximize their own strengths and core competencies by utilizing the best of each outsourced type. To illustrate, a biotech company may need to hire a few full-time staff to help with study preparation until it is ready to outsource a project.

Alternatively, a client who has recently generated its first oncology product in-house but lacks substantial internal knowledge in running an oncology trial may begin with a full-service outsourcing (FSO) model and progress to a functional service provider (FSP) model as internal competence grows. Another advantage of selecting a hybrid model from a CRO that offers both FSO and FSP services is that the metrics are centralized. As a result, process enhancements motivated by those KPIs can be quickly and effectively implemented by the client and CRO. To find the best model for each project and identify areas for improvement, several important performance and quality indicators can be used.

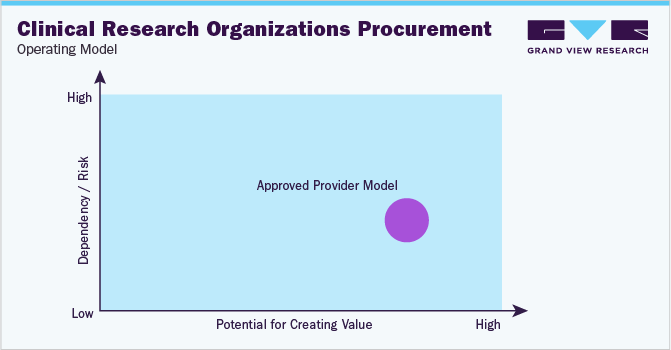

“In the approved provider model, the supplier meets the predefined set of qualifications, quality standards, and other criteria.”

The approved provider model offers a level of assurance that the CRO has the necessary expertise and experience to conduct the clinical trial effectively. It can help streamline the contracting process, as the sponsor does not need to go through a competitive bidding process. Furthermore, it can help build trust and collaboration between the CRO and sponsor, as they are working together on a long-term basis.

The approved provider model offers numerous advantages, including ensuring the CRO's expertise and experience, simplifying the contracting process, building trust and collaboration, improving communication, and increasing efficiency. The operating model becomes sought-after as the pre-existing relationship between the sponsor and CRO ensures a high standard of clinical trial conduct, especially in multi-country trials. Additionally, the model leverages economies of scale, reducing costs and reducing time and effort spent on evaluating multiple CROs.

The Clinical Research Organizations Procurement Intelligence report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape – the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Clinical Research Organizations Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Growth Rate |

CAGR of 12.2% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

3% - 4% (Annually) |

|

Pricing Models |

Cost Plus Pricing |

|

Supplier Selection Scope |

Cost and pricing, past engagements, productivity, geographical presence |

|

Supplier Selection Criteria |

Technical expertise, experience, cost and quality of service, capabilities, and reliability, research and development, customer service |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

Asymchem Laboratories (Tianjin) Co., Ltd, Charles River Laboratories., Dalton Pharma Services, ICON plc, IQVIA Inc, Pharmaron Beijing Co., Ltd., Piramal Enterprises Ltd., Sun Pharmaceutical Industries Ltd., Syneos Health, Thermo Fisher Scientific Inc., Parexel International (MA) Corporation, WuXi AppTec Co., Ltd. |

|

Regional Scope |

Global |

|

Historical Data |

2021 - 2022 |

|

Revenue Forecast in 2030 |

USD 202.3 billion |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global clinical research organization market size was valued at approximately USD 90.4 billion in 2023 and is estimated to witness a CAGR of 12.2% from 2024 to 2030.

b. Factors such as increasing healthcare expenditure, rise in the number of drug development activities, technology advancement, outsourcing of clinical trials, and increasing globalization of clinical trials are driving the growth of the market.

b. According to the LCC/BCC sourcing analysis, China, India and U.S are the ideal destinations for sourcing clinical research organization development.

b. This market is fragmented with the presence of many large players competing for market share. Some of the key players are Asymchem Laboratories (Tianjin) Co., Ltd, Charles River Laboratories., Dalton Pharma Services, ICON plc, IQVIA Inc, Pharmaron Beijing Co., Ltd., Piramal Enterprises Ltd., Sun Pharmaceutical Industries Ltd., Syneos Health, Thermo Fisher Scientific Inc.

b. The cost of hiring staff, purchasing equipment,developing software,cost of data management, site monitoring, and regulatory compliance are the key cost components for the clinical research organization.

b. Strategic supplier selection, establishing long-term partnerships, negotiating favorable contract terms, transparency, communication, trust, flexibility, and quality are some of the best sourcing practices.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.