Contract Development Manufacturing Organization Market Procurement Intelligence, Supplier Intelligence & Ranking, Pricing & Cost Structure Intelligence, Best Practices, Engagement Model, Low & Best Cost Country, Day One Analysis Report, 2020 - 2025

- Published Date: Sep, 2021

- Base Year for Estimate: 2020

- Report ID: GVR-P-10502

- Format: Electronic (PDF)

- Historical Data: 2018-2019

- Number of Pages: 60

Category Overview

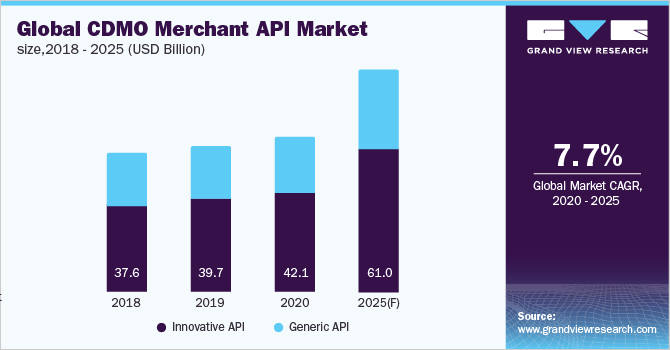

“The CDMO market is poised to grow at 7.3 % CAGR between 2020 and 2025 with the potential to reach a revenue of USD 61 billion in 2025.”

The global contract development manufacturing organization market is expected to witness sustainable growth (CAGR of 7.3%) from 2020 to 2025 with innovative APIs driving market growth. The COVID pandemic has had several positive as well as negative impacts on the industry. The demand for investigational treatments and ICU medications, to aid medical centers tide over the pandemic, has substantially increased resulting in increased demand for APIs. At the same time, scarcity of APIs, especially in countries that procure them from China, has led to supply chain disruptions.

Requirements for accelerated time to market, increasing operational flexibility, and GDUFA guidelines streamlining GMP of Asian countries to maintain parity with manufacturing practices of the USA is driving the need for pharmaceutical companies to outsource its manufacturing needs to CDMOs.

Supplier Intelligence

“The global merchant API market is fragmented with small scale CROs having limited contract manufacturing capabilities operating regionally, affecting the market share of larger CDMOs.”

The API manufacturing market for contract development manufacturing organization is fragmented. The top 8 players in the industry barely make up 41% of the share. Remaining 59% approvals are supported by CDMOs with less than 3% market share.

Several large-scale contract development manufacturing organizations are leading the API manufacturing marketplace. Some of the major players are Pantheon, Lonza, Siegfried. The presence of several API manufacturers, both contractual, like CDMOs, as well as pharmaceutical companies with in-house manufacturing capabilities, limits the bargaining power of suppliers. At the same time, this also increases competitive rivalry between the market players.

Pricing and Cost Intelligence

“Batch manufacturing activities are the largest component and makeup approximately around 65% of the overall cost for manufacturing APIs”

The cost heads for CDMOs manufacturing can be segregated into five major categories. There are project planning and management costs, drug product analytical development, batch manufacturing activities, supplier management, and operational cost. Of these, batch manufacturing practices occupy 65% of the overall cost. For batch manufacturing, raw material costs are the largest cost head, occupying 38% of the total cost of batch manufacturing activities.

In addition to these costs, there are several costs that gets added up to the lifetime cost. Three of the major cost heads are the cost of quality control, custom clearance cost, and insurance cost. In fact, the cost of quality control supersedes the other manufacturing costs.

There are several pricing models prevalent in the industry. However, value-based pricing model has gained prominence recently. However, there are significant cost transparency issues with less room for negotiation margins. However, this model of pricing does provide high value to their customer.

Sourcing Intelligence

“The supply chain disruptions caused by the pandemic have forced companies to think about diversifying and venturing outside China to set up their manufacturing bases.”

For API manufacturers, China has been the largest exporter of their raw materials.

However, the COVID pandemic has resulted in disrupted supply chains for several contract development manufacturing organizations. This has led API manufacturers to realize the need for diverse sourcing options. Singapore and Belgium are thus becoming two other hotspots from where API manufacturers are sourcing their requirements.

In-house product development and full service outsourcing are the two most commonly followed engagement models followed. Pharmaceutical companies either manufacturer their medicines and APIs or outsource the job entirely to contract development manufacturing organizations.

The market, currently, is fragmented with several players operating in the marketspace. Also, there are instances of mergers and acquisitions, and with this trend continuing, the market will become comparatively more consolidated with the top players occupying the majority market share. However, chances of smaller regional CDMOs manufacturing APIs will always remain due to the diversification of manufacturing hubs. The report also provides details of the quick wins, portfolio analysis, and key negotiation strategies of the key suppliers.

Frequently Asked Questions About This Report

b. The global CDMO API manufacturing market is expected to record a CAGR of 7.0% over the forecast period 2020-2025, reaching USD 253.0 billion by 2025.

b. The rising geriatric population and associated chronic illnesses are expected to drive the demand for API manufacturing.

b. The global CDMO API manufacturing market size was valued at USD 180.3 billion in 2020.

b. Some of the major CDMO API manufacturers are Merck, AbbVie, and Bristol-Myers Squibb.

b. The CDMO API manufacturing market is moderately consolidated as the top five players occupy more than 50% of the market.

b. The raw materials account for 58.2% of the overall manufacturing cost of CDMO API manufacturing.

b. LCC/BCC sourcing analysis states China as the key sourcing destination for CDMO API manufacturing.

b. Value-based pricing is one of the most prevalent pricing strategies followed in the CDMO API manufacturing industry.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.