Catering Service Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2023

- Report ID: GVR-P-10511

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Catering Service - Procurement Trends

“The growing popularity of social events drives the catering service market growth.”

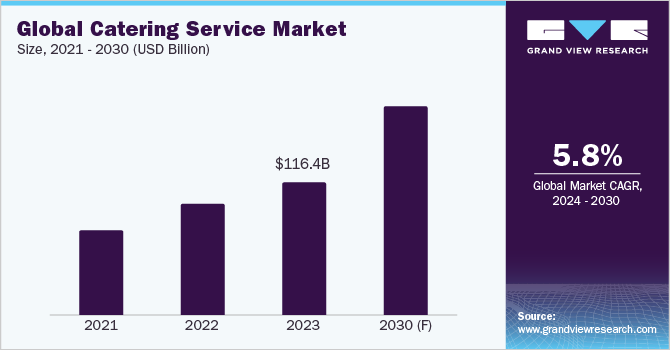

Catering service procurement has become a value generator to provide personalized experience and understand customer needs. The global market is likely to exhibit a CAGR of 5.8% from 2024 to 2030. The necessity to consume food, ideally nutritious food, at the workplace and increased demand from social & wedding events are the main factors driving growth. In the corporate world, having a reputable catering service is essential to attract new hires by giving them a high-end experience in hospitality, whereas, during a business event, the corporate catering service providers & professionals assist in building the company's reputation among clients.

The global catering service market size stood at USD 116.38 billion in 2023. One of the main factors driving the growth is the increasing demand for convenience. Many consumers are looking for services that offer easy ordering and delivery options, as well as menu options that can be customized to meet their specific needs.

The rising popularity of internet catering mostly drives the rise of the catering sector. New habits are becoming reinforced and the taste for foreign meals is rising as the urban population grows. The worldwide fast-food sector is expanding as a result of a variety of causes, including changing food preferences and an increase in the number of nuclear families. Consumers all around the world are experimenting with various cuisines as a result of exposure to other cultures and lifestyles, which is also opening up new growth potential for the global fast-food business.

Companies use technologies such as food tracking and traceability and smart appliances. Ann Sather uses food tracking and traceability to ensure the safety and quality of their food and to track the food from the farm to the table, which can help to prevent foodborne illness. Aramark uses smart appliances, which helps them save time and energy. These appliances can be programmed to cook food automatically, and they can also be monitored remotely.

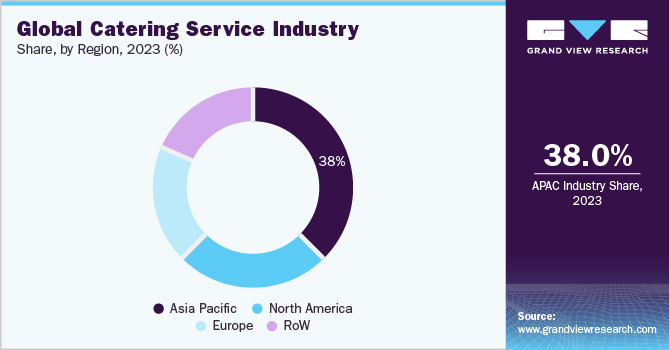

Asia Pacific has emerged as a promising destination to underpin the procurement of catering services. The burgeoning population and subsequent demand from industrial players in the organized sector have made catering services a lucrative proposition in the Asia Pacific.

With the introduction of new technologies like online ordering, where customers can browse menus, choose dishes, and place orders using smartphones, this industry has undergone a revolution. Automation is being used by businesses to improve productivity, cut costs, and streamline processes. Catering organizations, for instance, can cook huge quantities of food rapidly and consistently with the aid of automated food equipment.

Supplier Intelligence

“How is the nature of the catering service? What are the initiatives taken by the suppliers in this market?”

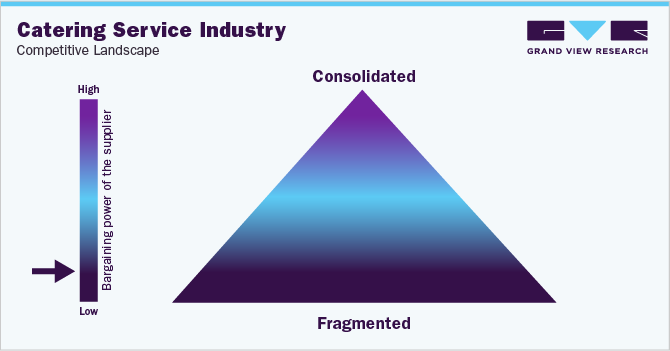

This industry is highly fragmented, with a variety of large and small market players in the sector. These market participants are undertaking several initiatives, including merger & acquisition and service launches, to increase their presence and boost procurement and market share. Numerous small market players (with a sizable market share) are anticipated to make a substantial contribution to the industry landscape.

The trend to offer different types of services, including menu flexibility and customizable menus, provides both challenges and opportunities for suppliers. Businesses will be well-positioned for success if they can differentiate themselves from the competition by delivering cutting-edge catering services, focusing on a certain sort of catering, or offering individualized catering services.

Key suppliers covered in the industry:

-

Ann Sather

-

Aramark Corporation

-

Aria catering

-

AVI Food Systems

-

Bartlett Mitchell

-

Black Olive Catering

-

Blue Plate

-

CH and Co Catering Group

-

Compass Group

-

Delaware North Companies.

Pricing and Cost Intelligence

“What are some of the major cost components in developing or implementing the catering service? Which factors impact the cost of its development?”

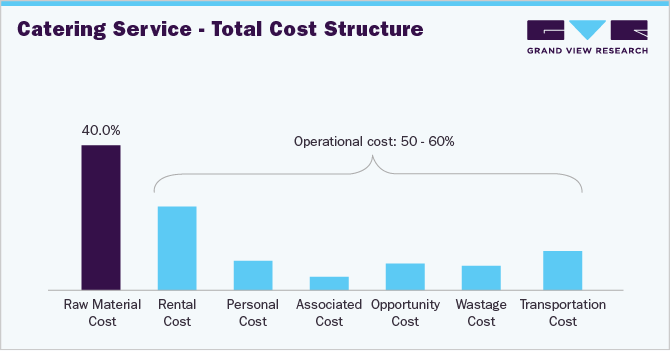

The major cost components in this industry include raw materials, such as food ingredients, which account for 40% of the total cost, where the companies need to purchase the necessary ingredients to prepare the food. The cost of these ingredients can vary depending on the quality and quantity required. The distance to be traveled, the size of the event, the type of food being transported, and the time of day are a few of the variables that might affect the transportation cost for a catering service.

Overall, the cost components involved can vary depending on the size and scope of the company. By managing these costs, companies provide high-quality services to clients while maintaining profitability.

The following chart provides various costs incurred in catering services. The major cost heads are shown below:

Companies generally use a fixed pricing method for the menu selection, where they charge a fixed price per person for the food and service. This is an easy-to-understand pricing strategy that offers precise explanations of the pieces and fixed rates that do not vary based on the number of people, scope, or taste and preferences. Both privately owned catering businesses and restaurants with catering divisions frequently employ this pricing structure. The simplicity and sincerity of this approach appeal to clients.

Sourcing Intelligence

“Which countries are the leading sourcing destination for catering service?”

The U.S. is one of the biggest hubs, with a wide range of services for weddings, corporate events, and other special occasions. The United Kingdom is also a major player with a strong tradition of catering for high-end events, such as royal weddings and state banquets. Germany and France are known for their high-quality cuisine and catering services, with many Michelin-starred chefs. China is also a growing market and is expected to grow significantly in the coming years, driven by rising incomes and changing consumer preferences.

In 2022, the APAC catering market had a sizeable portion of the global market. Offices, enterprises, and organizations typically contract the provision of food by catering services, and it is projected that the growing practice of eating in the workplace would increase contract catering service providers' revenue operating around those workplaces. Additionally, due to busy schedules, fewer people are spending time cooking, which has raised local demand for fast food. Additionally, this is anticipated to strengthen the concession catering business and have a favorable impact on the APAC market.

In terms of catering service sourcing intelligence, the majority of suppliers choose hybrid engagement models since they simplify internal logistics. Some international players collaborate with local companies and use a full-service outsourcing business model. The catering service will handle some of the tasks, such as planning and execution, while the business will handle others, such as food preparation and cleanup. This is a good option for businesses that want to save money but still want the convenience of having a catering service.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

Buyers can seek full services outsourcing model for the procurement of products, as they may find it difficult to produce in-house by solely deploying additional staff. Besides, an approved provider model is the most common form of operating model due to its potential for higher value creation. In this model, the catering service provider must meet the predefined set of qualifications, such as prior-proven performance, access to platforms, privacy terms, and various other criteria.

The Catering Service Procurement Intelligence Report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape – the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Catering Service Procurement Intelligence Report Scope

|

Report Attribute |

Details |

|

Growth Rate |

CAGR of 5.8% from 2024 to 2030 |

|

Base Year for Estimation |

2023 |

|

Pricing Growth Outlook |

7% - 9% (Annual) |

|

Pricing Models |

Fixed price pricing model |

|

Supplier Selection Scope |

Cost and pricing, past engagements, productivity, geographical presence |

|

Supplier Selection Criteria |

Quality, price, safety measures, cost and value, support and maintenance, regulatory compliance, flexibility, and others |

|

Report Coverage |

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model |

|

Key Companies Profiled |

Ann Sather, Aramark Corporation, Aria Catering, AVI Food Systems, Bartlett Mitchell, Black Olive Catering, Blue Plate, CH and Co Catering Group, Compass Group, Delaware North Companies |

|

Regional Scope |

Global |

|

Historical Data |

2021 - 2022 |

|

Revenue Forecast in 2030 |

USD 172.69 billion |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Customization Scope |

Up to 48 hours of customization free with every report. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions About This Report

b. The global catering service market size was valued at approximately USD 116.38 billion in 2023 and is estimated to witness a CAGR of 5.8% from 2024 to 2030.

b. Growing demand for healthy & sustainable food and an increasing number of social events are driving the growth of the market.

b. According to the LCC/BCC sourcing analysis, the US and the UK are the ideal destinations for sourcing the catering service market.

b. This industry is highly fragmented with the presence of many large players competing for the market share. Some of the key players are Aramark Corporation, Ann Sather, and Blue Plate.

b. Raw materials, rental costs, and transportation costs are the major key components of this market.

b. Quality control, innovations, and negotiating favorable contracts are some of the best sourcing practices.

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.