Comparative Analysis Of The Top 13 Banking Solutions For Healthcare Providers And Payers In The U.S. Market

- Published: Oct, 2024

- Report ID: GVR-MT-100281

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Market Overview

The U.S. banking solutions for healthcare payers and providers market was estimated at USD 34.8 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. The market growth is primarily driven by the need for regulatory compliance, given the stringent healthcare regulations such as Medicare Access and CHIP Reauthorization Act (MACRA) that mandate data security & privacy. In addition, the need to optimize operations is another key driver, as healthcare payers and providers leverage technology to streamline administrative processes, cut costs, and improve operational efficiency. Furthermore, the intersection of banking and healthcare is evolving rapidly as providers and payers adapt to changing regulations, technology advancements, and shifting consumer expectations.

The key trends influencing banking solutions in the U.S. healthcare sector, focus on payment processing, financial management, strategic initiatives, and innovation.

1. Trends In Payment Solutions:

-

Contactless and Digital Payments: The adoption of contactless and digital payment methods has surged, particularly due to the COVID-19 pandemic. A 2023 survey by the Healthcare Financial Management Association (HFMA) indicated that 75% of healthcare providers have implemented or are planning to adopt digital payment platforms. Institutions like the Cleveland Clinic have integrated payment options via mobile apps, allowing patients to pay bills directly.

2. Trends In Financial Management Tools:

-

Revenue Cycle Management (RCM): Banks are partnering with healthcare providers to enhance RCM solutions. This includes automating billing processes and improving collections through advanced analytics. For instance, In May 2023, Fifth Third Bancorp announced the acquisition of Big Data LLC, a technology solutions provider specializing in healthcare payments and remittances. This acquisition enhances Fifth Third's national healthcare revenue cycle capabilities, addressing clients' complex needs in this sector and aligning with the bank's vision of digital innovation & focus on healthcare.

Similarly, in June 2018, Optum360, a subsidiary of Optum collaborated with U.S. Bank to drive innovation aimed at improving the revenue cycle management for healthcare providers. This partnership leverages the complementary strengths of both entities, Optum's expertise in healthcare technology with U.S. Bank's financial acumen, to introduce an enhanced suite of capabilities designed to assist hospitals and healthcare providers in more effectively managing their revenue cycles.

-

Cash Flow Solutions: Solutions that provide real-time cash flow visibility are critical for healthcare organizations. Banks are developing tools that allow providers to forecast revenue more accurately and manage operational expenses effectively.

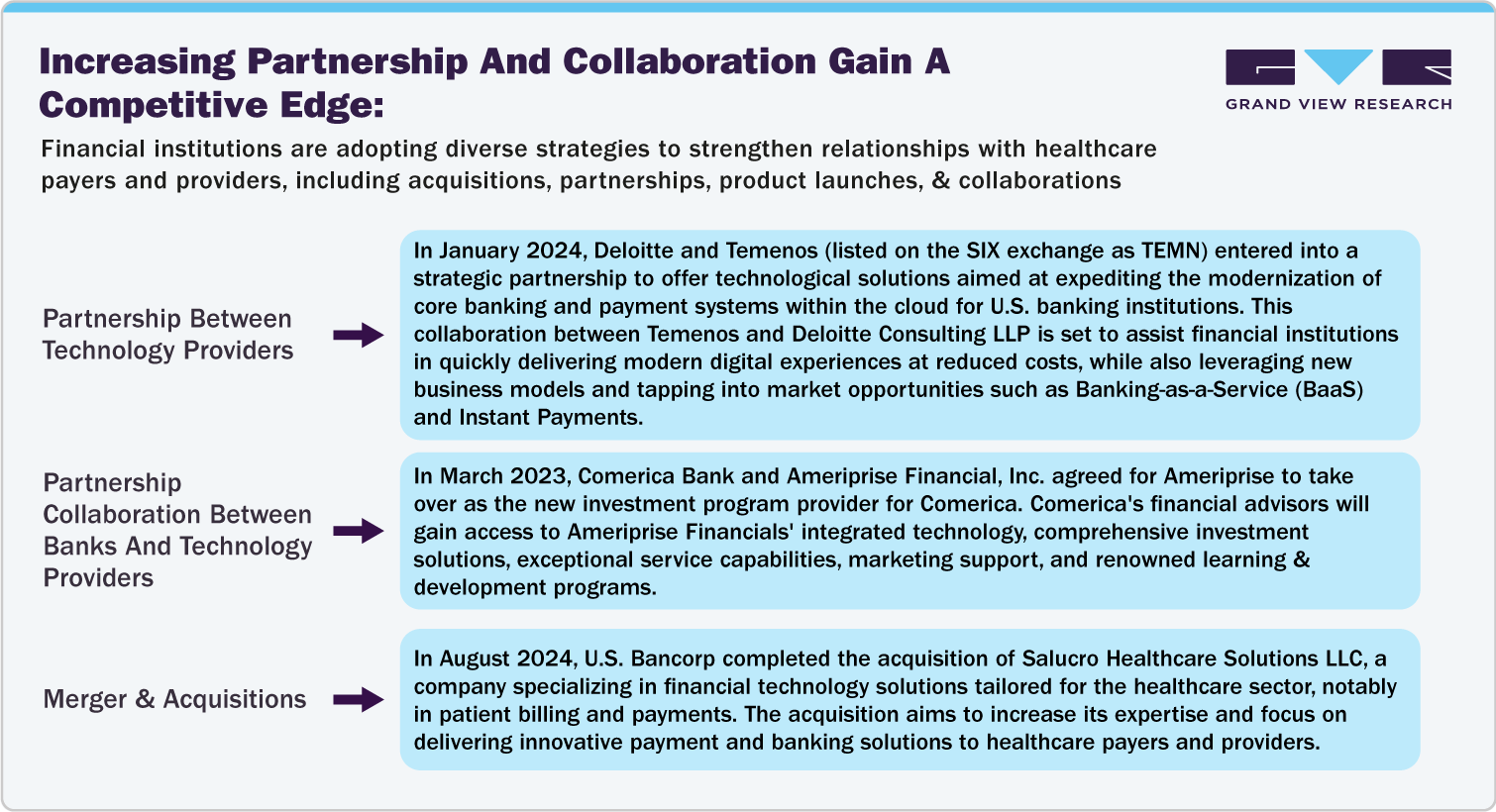

3. Increasing Partnership And Collaboration Gain A Competitive Edge:

Financial institutions are adopting diverse strategies to strengthen relationships with healthcare payers and providers, including acquisitions, partnerships, product launches, & collaborations.

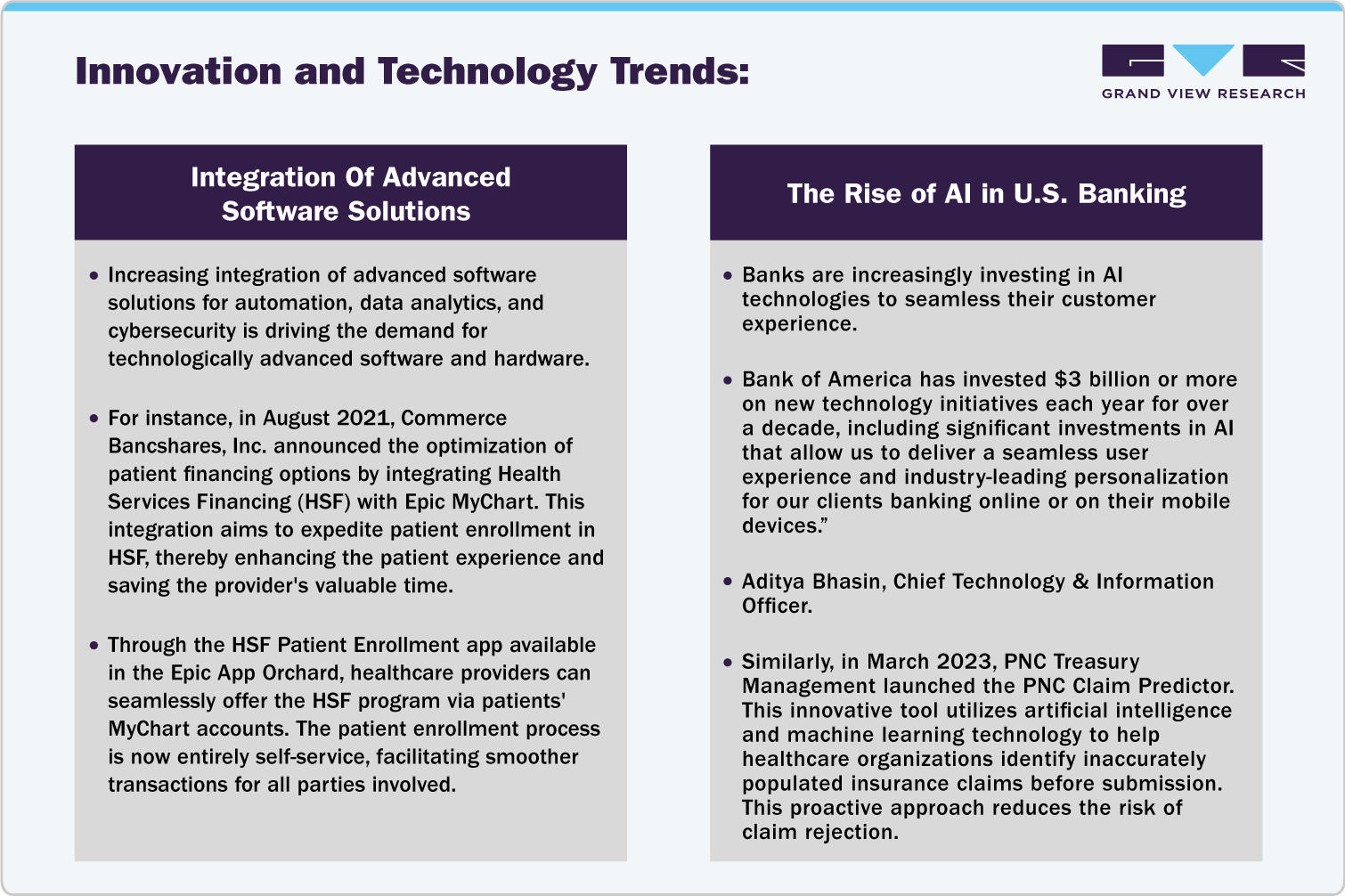

4. Innovation and Technology Trends:

Key U.S. Banking Solutions For Healthcare Payers And Providers Companies

-

PNC Bank

-

Bank of America

-

JP Morgan Chase

-

US Bank

-

Wells Fargo

-

KeyBank

-

Fifth Third Bank

-

Truist Bank

-

Citizens Bank

-

Regions Bank

-

Comerica Bank

-

M&T Bank

-

Commerce Bancshares, Inc.