- Home

- »

- Market Trend Reports

- »

-

U.S. FemTech Trends And Competitive Analysis

![U.S. FemTech Trends And Competitive Report]()

U.S. FemTech Trends And Competitive Analysis

- Published: Jul, 2024

- Report ID: GVR-MT-100191

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Report Overview

The U.S. femtech market size was valued at USD 33.92 billion in 2023 and is expected to grow at a CAGR of 16.30% from 2024 to 2030. The study focuses on femtech market trends and provides insights into local trends for stakeholders looking to engage with this evolving market.

The femtech industry in the U.S. exhibits a significant evolution in the market, driven by technological advancements, increased investment, and a growing awareness of women's health issues. In March 2024, The U.S. President Biden administration launched a significant initiative, allocating USD 100 million in federal funding to enhance R&D in women's health. This funding addresses the longstanding issue of inadequate investment in women's health, which has historically received only about 2% of the total funding in the health tech sector. The initiative is part of a broader effort to transform the landscape of women's health research and support emerging femtech startups that often struggle to secure private investment.

Industry Trends: Future Insights and Growth Opportunities

-

The U.S. femtech industry is highly developed in both technological and structural aspects. It allows entry for new participants, enabling them to realize their potential. The U.S. is broadly involved in the healthcare sector, and the interconnections between healthcare and femtech make the country's market increasingly attractive to femtech companies, leading to a higher number of participants

-

The FemTech industry has gained attention from increasing numbers of users worldwide. U.S. companies and startups such as Maven Clinic, Kindbody, Elvie, and Flo provide services used by thousands of women globally every day

-

Approximately 50% of femtech companies operate in the areas of reproductive health and contraception, pregnancy and nursing, and general health care. Companies providing pregnancy and nursing solutions, such as Expectful, make up 21% of the market. Companies operating in the menstrual health, such as March Health, reproductive health & contraception segment, such as Phexxi and Carrot, account for 17% of the market. Whereas general health care companies, such as Tia and Syantra, each account for 14% of the market

-

Menstrual health products such as cups, reusable absorbent sanitary items, and flushable pads, which provide safe, convenient, and environmentally friendly options, are gaining popularity

-

FemTech diagnostic solutions dominate General Health Care (31%), while apps and software are popular in the FemTech Mental Health subsector (33%)

-

The U.S. presents a significant opportunity for the further development of the femtech industry. New and emerging companies are expected to receive funding from private investors and several nonprofit organizations

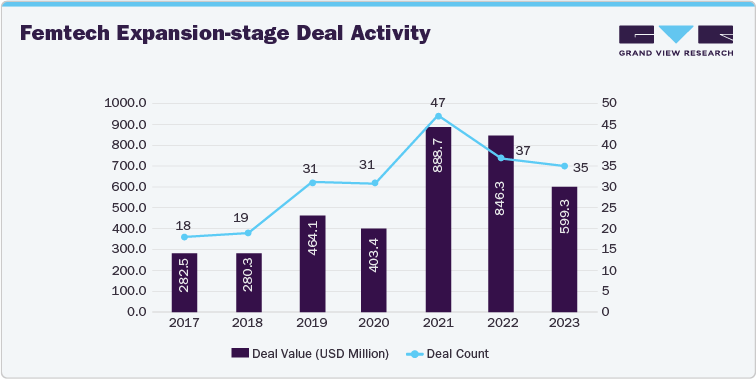

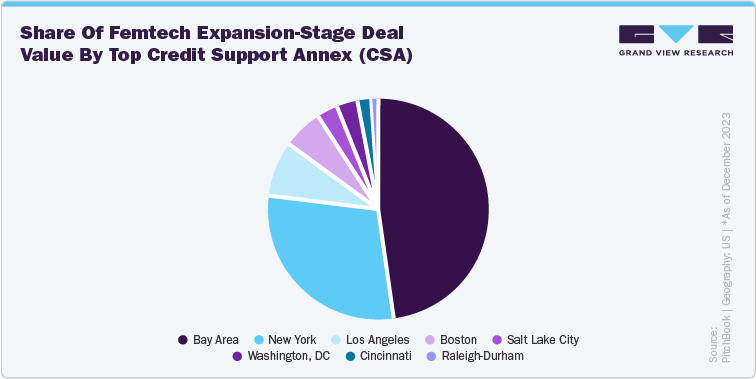

Furthermore, the femtech industry experiences varied investment sizes, making it essential to study the financing activities of 2023 across major cities and to analyze trends over the past years. Most Venture Capital (VC) funding and deals in the U.S. are concentrated in the Bay Area and New York City. Additionally, there have been notable deals in emerging startup hubs such as Salt Lake City, Fort Lauderdale, and Atlanta during this timeframe. Overall, the funding landscape in femtech primarily focuses on early-stage ventures, reflecting the total value of the deals made.

Innovation thrives in vibrant metropolitan economies and research institutions. Despite recent economic downturns, certainstartup ecosystems are proving resilient, experiencing growth in deal-making activities. This resilience indicates a favorable outlook for an increase in femtech deal-making within these dynamic environments.

Investment Deals in Femtech

Company Name

Month

year

Remarks

Maven Clinic

November

2022

It is a virtual women's and family health clinic and has secured USD 90 million in Series E funding to expand its virtual health services for women and families. This latest funding round brings Maven's total funding to USD 300 million, indicating the increasing global demand for health services tailored for women and families.

EngagedMD

October

2022

The company has successfully secured USD 1 million to broaden its SaaS platform beyond fertility services. The EngagedMD platform is utilized by fertility practitioners globally to enhance operational efficiency and improve the patient experience. The company specializes in eLearning and design solutions tailored for the rapidly expanding fertility sector, supporting over half of all fertility patients in the UK, the U.S., and Canada.

Delphinus Medical Technologies, Inc.

September

2022

The company is a leader in advanced ultrasound technology. It has developed a new technique for dynamic breast imaging, which utilizes sound and water. The company has secured USD 30 million in Series D funding to facilitate the market introduction of its 3D breast ultrasound system.

Gameto

September

2022

Gameto, a biotechnology firm focused on cell engineering to create therapeutics for female reproductive health, has secured an additional USD 17 million in funding. This latest round of financing increased the company's total capital, which has increased to USD 40 million since its inception.

Competitive Scenario: U.S. Femtech Market

The Femtech market in the U.S. is highly competitive and experiencing rapid growth due to the increasing awareness of women's health issues and technological advancements. Major players in the market include Flo Health, Glow, Clue, Natural Cycles, Google, Apple, and Withings. These companies focus on innovative solutions across various segments, such as reproductive health, pregnancy tracking, and menopause management. Flo is the most downloaded app in this sector, with over 200 million downloads, primarily focusing on menstrual period and fertility tracking. The femtech market is characterized by a mix of established companies and startups that create a dynamic and competitive environment. Startups are making technological advances, collaborations, and investments to strengthen their market position. The market remains fragmented, allowing opportunities for small, focused players to thrive.

Key players and market segmentation

Company name

Establishment year

Funding

(USD Million)

Segment

Ava

(FemTec Health, Inc..)

2014

38.00

(As of 2021)

A wearable and mobile app for fertility

Bloomlife

2014

18.21

(As of 2021)

A wearable device monitoring contractions, displaying real-time data via a mobile app

Glow

2013

23

(As of 2019)

A mobile fertility app

Lia

2015

2.6

(As of 2019)

Biodegradable and flushable at-home pregnancy test

Lola

2014

35.2

(As of 2019)

A subscription service for menstrual and sexual health products

NaturalCycles

2013

106.53

(As of 2024)

The first FDA-approved fertility tracking app

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified