- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape Of Top 50 U.S. Durable Medical Equipment Players

![Competitive Landscape Of Top 50 U.S. Durable Medical Equipment PlayersReport]()

Competitive Landscape Of Top 50 U.S. Durable Medical Equipment Players

- Published: Sep, 2024

- Report ID: GVR-MT-100262

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

U.S. DME Market

The U.S. DME market size was estimated at USD 63.14 billion in 2023 and is projected to grow at a CAGR of 5.63% from 2024 to 2030. The increasing geriatric population and the growing focus of industry participants on developing novel products contribute to the market growth. For instance, in May 2024, Medline introduced the Hudson RCI TurboMist small volume nebulizer to help people suffering from respiratory diseases. Many industry participants consider it the fastest small volume nebulizer on the market. In April 2022, Abbott, Ypsomed, and CamDiab collaborated to develop an automated insulin delivery system for helping people with diabetes. These innovative product launches will propel market growth in the coming decade.

Experts expect a significant increase in the demand for home healthcare services due to the growing number of older individuals and the lower costs associated with home care. The increasing prevalence of chronic conditions is another major factor expected to drive the demand for home healthcare. Furthermore, companies operating in the durable medical equipment market are working on developing equipment and devices that can be easily used in home care settings. For instance, in May 2024, CURLIN 8000 Ambulatory Infusion System from Moog Inc. obtained U.S. FDA 510(k) clearance. This infusion system has a specific design that allows for convenient use in home infusion settings. Such approvals from the regulatory authorities for home healthcare medical devices are expected to drive market growth.

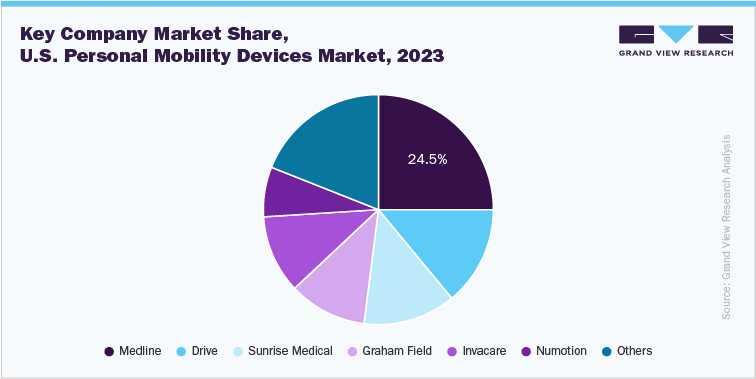

Market Share Analysis For Top U.S. DME Players

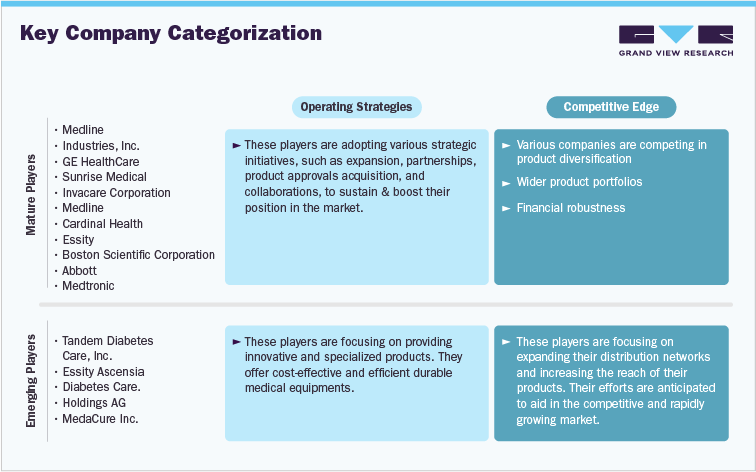

Some of the key players in DME market are Invacare Corporation; Sunrise Medical; Arjo; Cardinal Health; Medline Industries, Inc.; and Carex Health Brands. The development of new products, collaborations, and mergers & acquisitions are among the key initiatives undertaken by players in this industry. For instance, in January 2024, Sunrise Medical announced the launch of QUICKIE Q50 R Carbon, the lightest folding power wheelchair in the QUICKIE lineup, weighing just 32 lbs. This compact and easily transportable wheelchair is designed for effortless storage and maneuverability, offering an ideal solution for individuals who wish to stay active & independent without the hassle of a bulky & heavy mobility device.

To stay competitive, companies must focus on offering innovative products and vying for market share in the intense durable medical equipment market. Companies must stay competitive and focus on innovation to maintain their position in the booming market, which poses a significant challenge for industry participants. Established players such as Stryker, Arjo, Invacare Corporation, and Baxter are operating in the market. In addition, emerging players, such as WHILL Inc. and Afon Technology Ltd. offer innovative, durable equipment in the U.S. market. The presence of established players makes it challenging for emerging players to gain market share.

Recent Initiatives By Market Leaders Include

-

In March 2024, Medline Industries, Inc. successfully gained the manufacturing rights and intellectual property for AG Cuffill from Hospitech Respiration Ltd. This compact, user-friendly device, resembling a syringe, offers a precise solution for measuring both the pressure and volume of airway cuffs across various clinical settings.

-

In January 2024, Sunrise Medical launched the Switch-It Vigo head control. This wireless, proportional device enables users to manage their power wheelchairs and other equipment through subtle and intuitive head movements.

-

In April 2024, GE Healthcare announced that its Portrait VSM vital signs monitor received 510(k) clearance from the U.S. FDA.

Key 50 U.S. DME Players

1. Invacare Corporation

2. Sunrise Medical

3. Arjo

4. Medline Industries, Inc.

5. GE HealthCare

6. GF Healthcare Products, Inc.

7. Carex Health Brands, Inc.

8. Cardinal Health

9. Drive DeVilbiss Healthcare

10. NOVA Medical Products

11. Kaye Products, Inc.

12. Karman Healthcare, Inc.

13. Numotion

14. Pride Mobility Products Corporation

15. Inogen, Inc.

16. CAIRE, Inc. (Niterra Group)

17. Portable Oxygen Solutions

18. Rhythm Healthcare, LLC

19. MedaCure Inc.

20. Compass Health Brands

21. Thermo Fisher Scientific, Inc.

22. Abbott

23. F. Hoffmann-La Roche Ltd.

24. Medtronic

25. Ascensia Diabetes Care Holdings AG

26. Byram Healthcare Centers, Inc. (Owens & Minor)

27. Novo Nordisk

28. Insulet Corporation

29. Baxter

30. B. Braun SE

31. Micrel Medical Devices SA

32. Boston Scientific Corporation

33. Tandem Diabetes Care, Inc.

34. BD (Becton, Dickinson & Corporation)

35. Moog, Inc.

36. IRadimed Corporation

37. Koninklijke Philips N.V.

38. Siemens Medical Solutions USA, Inc.

39. Essity

40. Coloplast Corporation

41. Paul Hartmann AG

42. Hollister Incorporated

43. Convatec Group PLC

44. Enovis Corporation

45. Zynex, Inc.

46. ZOLL Medical Corporation (Asahi Kasei Corporation)

47. Össur (Embla Medical)

48. Breg, Inc.

49. Bauerfeind USA, Inc.

50. BiotronikCardinal Health: Profile

Cardinal Health - Overview

Company

Establishment Year

Headquarter

Employee Strength

Verticals

Cardinal Health

1970

U.S.

48,000

Cardinal Health is a healthcare services company offering a broad range of products and services to healthcare providers & manufacturers. Its offerings include pharmaceutical distribution, packaging & repackaging, retail pharmacy franchising, drug-delivery technology development, and healthcare information systems. In addition, the company provides consulting and supply chain management services to the healthcare industry. Its corporate development team focuses on expanding and sustaining its market presence through ongoing mergers & acquisitions in the nuclear pharmacy, pharmaceutical, medical services sectors, & related industries to diversify its portfolio.

Cardinal Health - Product Benchmarking

Company Name

Product Type

Sub-product Type I

Sub-product Type II

Product Name

Cardinal Health

PersonalMobility Devices

Wheelchairs

Manual Wheelchairs

Swing away footrests - chrome finish

Swing away footrests - powder coat finish

Elevating leg rests - chrome finish

Elevating leg rests - powder coat finish

Walkers

CWAL0006

CWAL0008T

CWAL0010B

CWAL0007N

CWAL1028H

CWAL240KS

Rollators

CRL0007

CRL0008

CRL0009B

Crutches

CA901AD

CA801ADB

CA901TL

CA801TLB

CA901YTH

CA901CH

CA801FYTH

Canes

CNE00013V

CNE0012

CNE0014

CNE0001

CNE0020B

CNE0021

CNE0022B

CA801FCH

Bathroom Safety Devices and Medical Furniture

Commodes and Toilets

CPAT0002

CPAT0009

CPAT0009D

CPAT003F

CPAT0008D

CABU0010

CABU0010B

CABU0007B

CBAS0026

CBAS0027

CBAS0028

CSR00041

Mattress & Bedding Devices

Disposable Bed Sheets and Pillowcases

Infant Heel Warmers and Infant Transport Mattress

Monitoring and Therapeutic Devices

Continuous Positive Airway Pressure (CPAP)

Argyle CPAP nasal cannula

Suction Pumps

CRD Suction Canister System

Other Equipments

Diabetic Supplies

Cardinal Health 2ACR Urinalysis Test Strip

Cardinal Health 10ACR Urinalysis Test Strip

Incontinence Products

Quilted Premium Strength Underpad

Latex Foley Catheters

Dover Silicone Foley Catheters

Dover Pediatric Latex Foley Catheters

Dover Pediatric 100% Silicone Foley Catheters

Wound Care Products

Kendall Hydrocolloid Dressings

Three-layer compression bandage system

Four-layer compression bandage system

Cardinal Health - Financial Performance

Company

Type

(Private/Public)Revenue 2022

(USD Million)Revenue 2023

(USD Million)Cardinal Health

Public

181,364.00

205,012.00

Cardinal Health - Initiatives

Company

Year

Month

Details

Cardinal Health

2023

March

Cardinal Health has announced a partnership with Signify Health to deliver in-home clinical and medication management services through its outcomes business. This collaboration seeks to lower costs and address gaps in care for more than 2.3 million members nationwide, enhancing their treatment journey from prescription and pharmacy to home.

Cardinal Health

2024

January

Cardinal Health is set to acquire Specialty Networks and its PPS Analytics platform. It is a technology-driven organization that specializes in multispecialty group purchasing and practice enhancement.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified