- Home

- »

- Market Trend Reports

- »

-

Top Palm Oil Manufacturers - Database

![Top Palm Oil Manufacturers - DatabaseReport]()

Top Palm Oil Manufacturers - Database

- Published: Jul, 2023

- Report ID: GVR-MT-100134

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 5

- Report Coverage: 2024 - 2030

Deliverable Overview

The deliverable comprises an extensive list of market participants present across the globe. The list includes information about the companies, their presence in the value chain, contact details, and their geographical presence.

Top Manufacturers of Palm Oil

Palm oil is one of the most consumed vegetable oils used in several packaged product formulations available in supermarkets. The product witnesses a high demand in the formulation of ice creams, margarine, chocolates, and cookies, imparting a smooth, shiny appearance and creamy taste & texture. The global palm oil market is consolidated as the number of players with product operations is high only in the developing economies of Indonesia, Malaysia, Thailand, Colombia, Nigeria, Ecuador, India, and Brazil. The market is characterized by the presence of a large number of manufacturers with strong technical know-how.

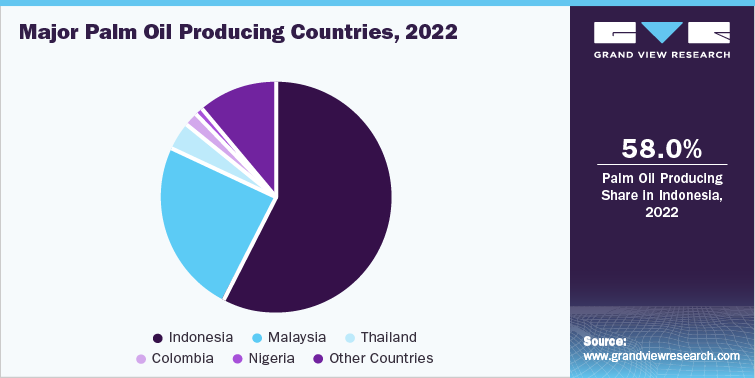

Small amounts of palm oil are grown in many countries, but the global market is dominated by only two: Indonesia and Malaysia with Indonesia accounting for 58% and Malaysia producing 24%. Around 90% of the world's oil palm trees are grown on a few islands in Malaysia and Indonesia−with Earth’s most biodiverse tropical forests. This is attributable to its increasing use in the food & beverage industry. The demand is also driven by its neutral taste, desired melting points, health benefits, and versatile usage as an ingredient in cooking oils, frying fats, margarine, confectionery, supplements, and condiments. Furthermore, the tropical climates in Indonesia and Malaysia are well-suited for product cultivation.

Over the past years, large-scale deforestation from palm oil has been a severe issue; therefore, manufacturers are shifting to sustainable cultivation methods. Currently, approximately 20% of the production is through sustainable means, which is expected to grow at very high rates, especially after the proposal to ban imports of the product in the EU which are not produced through sustainable methods. Several alliances, such as RSPO and Rainforest alliances, along with other regulatory and certified bodies, are taking stringent measures to cater to the problems caused by large-scale deforestation.

Europe has revised its regulations to restrict future product imports, specifically for biofuels, and focuses more on palm oil inclusion in food products. However, surging demand in the Asia Pacific region, especially in Malaysia and Indonesia, where more than 80% of the product is produced. Shell, an international energy company, has undertaken important purchasing policies for biofuels produced from palm oil and soy from South America to increase the use of independently certified sustainable biofuels.

Palm oil is purchased widely due to its lower prices than other vegetable oils. Developing economies have an advantage over production costs as compared to developed countries. Manufacturers are still looking for better alternatives to reduce the total production costs of the product. Key players in the market are inclined toward complying with several production standards and are competing over quality and prices.

The market is consolidated and highly competitive. The product prices fluctuate rapidly and are influenced by global crude oil prices. The global palm oil market comprises international players, including ADM and Wilmar International Ltd., making the market more competitive. Major players have acquired plantations or contracts with cultivators to ensure a constant supply of raw materials. Volatility in the raw material prices adversely affects the product’s profitability.

The key manufacturers engage in capacity expansion strategies, continuous R&D activities, and other strategies to gain a competitive advantage. Furthermore, manufacturers are inclined toward collaborations with other key players and research institutes to increase production levels. For instance, in April 2020, Kuala Lumpur Kepong Berhad announced buying 60% stakes worth USD 82.15 million of the PT Pinang Witmas Sejati (PWS) to expand its brownfield product plantation landbank.

Some prominent players in the market space include Asian Agri, United Plantations Berhad, ADM, IOI Corporation Berhad, Kuala Lumpur Kepong Berhad, Kulim (Malaysia) Berhad, PT Sampoerna Agro Tbk, PT. Bakrie Sumatera Plantations tbk, Univanich Palm Oil Public Company Ltd., Sime Darby Plantation Berhad, and Wilmar International Ltd.

Scope Details: Top Palm Oil Manufacturers - Database

Attribute

Details

Total Number of Tabs in the Report

5

Total Number of Companies in the Database

75

Regional Scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Deliverable Outcome

Excel

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified