- Home

- »

- Market Trend Reports

- »

-

Top 10 Oncology Drugs in 2022: Market Trend Analysis

![Trend Report]()

Trend Analysis on Top 10 Oncology Drugs in 2022

- Published: Oct, 2023

- Report ID: GVR-MT-100170

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 20

- Report Coverage: 2024 - 2030

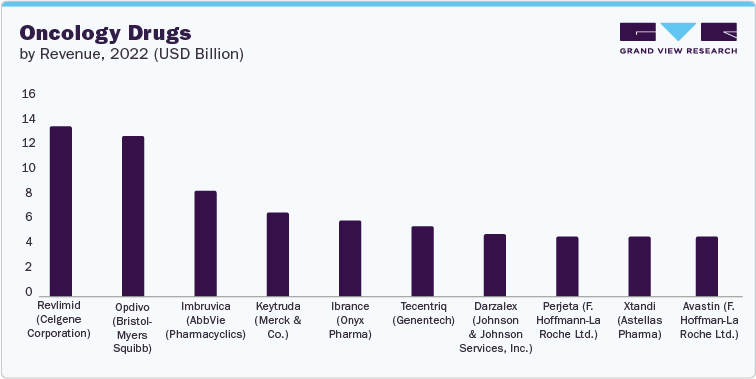

Top 10 Oncology Drugs in 2022

1.1 Revlimid

-

Generic name: Lenalidomide

-

Company: CELGENE CORPORATION (Now part of Bristol-Myers Squibb Company)

-

2022 sales: USD 13.44 billion

-

Current indications: Follicular Lymphoma; Mantle-Cell Lymphoma; Marginal Zone B-Cell Lymphoma; Multiple Myeloma; Myelodysplastic Syndromes

Revlimid has been a market leader for over a decade, driving significant growth since its launch. It has established itself as a highly successful drug and is a key component of the company's hematology franchise.

In the realm of newly diagnosed multiple myeloma, a potential competitor, Amgen's Kyprolis, faced a setback when it failed its initial trial, solidifying Revlimid's position as a preferred first-line treatment option. However, not all of the company's efforts to extend Revlimid's applications have yielded positive results. The drug fell short in the phase 3 REMARC trial, hindering its expansion into maintenance therapy for a subtype of NHL and diffuse large B-cell lymphoma. Nonetheless, Revlimid is still undergoing testing for another form of the disease, follicular lymphoma. Celgene is optimistic about Revlimid's role in lymphoma treatment, asserting that lymphoma will drive growth beyond 2022.

Revlimid's growth prospects are reinforced by ongoing clinical trials investigating its use as a backbone for combination therapies. However, generic competition will lead to a significant drop in the share of Revlimid over the coming years. The company has settled the patent litigation with India's Natco Pharma, allowing for the limited rollout of an authorized generic version. In March 2023, Natco Pharma launched Revlimid's generic version through its marketing partner Teva Pharmaceuticals in the U.S. market. Similarly, in February 2022, Sandoz and Stada Arzneimittel announced the launch of generic versions of Revlimid in Europe.

1.2 Opdivo

-

Generic name: Nivolumab

-

Companies: Bristol-Myers Squibb; Ono Pharmaceutical

-

2022 sales: USD 12.62 billion

-

Current indications: Colorectal Cancer; Gastric Cancer; Head And Neck Cancer; Hodgkin's Disease; Liver Cancer; Malignant Melanoma; Mesothelioma; Non-Small Cell Lung Cancer; Esophageal Cancer; Renal Cell Carcinoma; Squamous Cell Cancer; Urogenital Cancer

Opdivo and Keytruda are leading drugs in the PD-1/PD-L1 inhibitor class, with Opdivo being the first to gain approval in Japan in 2014, followed by Keytruda's FDA approval a few months later. These two drugs have been competing for dominance ever since.

Opdivo faced a setback when it did not meet its objectives in the CheckMate-026 trial for first-line non-small cell lung cancer (NSCLC). This was mainly because the study did not limit its participant pool to patients with high-level PD-L1 expression. As a result, Opdivo likely lost control of that territory to other drugs in the class, particularly Keytruda, which obtained its first-line approval in the U.S. in October 2021. Roche's Tecentriq is also pursuing first-line approval. However, if Opdivo had succeeded in this trial, it would have been the leading cancer drug in 2022.

Although, Opdivo's second-place position in the market puts the first-line failure into perspective. The drug has a vast clinical trial program, both as a monotherapy and in combination with other cancer drugs, which may uncover new uses in various solid tumors such as breast, colorectal, small cell lung, and gastric cancers, as well as hematological malignancies like follicular lymphoma and diffuse large B-cell lymphoma.

Moreover, in September 2022, Opdivo has shown promising results in the adjuvant setting for patients with completely resected stage IIB/C melanoma. This comes shortly after Merck & Co.'s Keytruda received approval as an adjuvant treatment for earlier-stage melanoma. In the late-stage CheckMate -76K trial, Opdivo was tested as a monotherapy in the adjuvant setting. Bristol Myers Squibb announced that the drug achieved its primary endpoint and demonstrated both statistically significant and clinically meaningful benefits in preventing disease recurrence or death compared to a placebo.

Importantly, there were no new safety concerns identified during the interim analysis of Opdivo, as highlighted by Bristol Myers Squibb. These positive findings suggest that Opdivo may soon expand its use beyond advanced-stage diseases.

1.3 Imbruvica

-

Generic name: Ibrutinib

-

Companies: AbbVie (Pharmacyclics); Johnson & Johnson

-

2022 sales: USD 8.29 billion

-

Current indications: Chronic Lymphocytic Leukemia; Mantle Cell Lymphoma; Waldenström Macroglobulinemia

Since its initial launch in 2013, the first-in-class BTK inhibitor Imbruvica has experienced rapid growth and achieved blockbuster sales. The drug has established itself as the market leader in the second-line treatment of chronic lymphocytic leukemia (CLL), and it is also utilized in previously treated mantle cell lymphoma and Waldenström macroglobulinemia.

However, the growth of Imbruvica may face challenges due to competition from other drugs in the market. Imbruvica will face strong competition in the upcoming years by Bristol-Myers Squibb Company's aspirations for Revlimid in lymphoma placing it in direct opposition to AbbVie and J&J's drug. In addition, Imbruvica is also encroaching on Bristol-Myers Squibb Company's territory with a trials program in multiple myeloma, indicating an imminent fierce marketing battle.

Similarly, BeiGene's Brukinsa has shown promising results in preventing disease progression or death in patients with previously treated chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL). The data from the final analysis of the phase 3 ALPINE trial in October 2022 demonstrated the superiority of Brukinsa over Imbruvica.

In February 2022, BeiGene submitted a new application to the FDA by combining data from the ALPINE trial and the phase 3 SEQUOIA trial in newly diagnosed chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL). This submission poses a challenge to Imbruvica as Brukinsa demonstrates a significant win in progression-free survival, intensifying the competition between the two drugs in the CLL/SLL field.

Brukinsa has shown notable advantages over Imbruvica in terms of tumor shrinkage and cardiac toxicity. In an interim analysis of the ALPINE study, Brukinsa exhibited a statistically significant improvement in tumor shrinkage, successfully meeting the study's primary endpoint. Furthermore, Brukinsa has demonstrated a considerably lower incidence of atrial fibrillation or flutter, a common concern with drugs in the same class as Imbruvica (BTK inhibitors).

1.4 Keytruda

-

Generic name: Pembrolizumab

-

Company: Merck & Co.

-

2022 sales: USD 6.56 billion

-

Current indications: Breast Cancer; Cervical Cancer; Colorectal Cancer; Diffuse Large B Cell Lymphoma; Gastric Cancer; Head And Neck Cancer; Hodgkin's Disease; Liver Cancer; Malignant Melanoma; Non-Small Cell Lung Cancer; Esophageal Cancer; Pancreatic Cancer; Renal Cell Carcinoma; Solid Tumours; Squamous Cell Cancer; Urogenital Cancer.

Keytruda made history as the first PD-1/PD-L1 inhibitor to gain FDA approval in the U.S., beating out Opdivo by Bristol-Myers Squibb. Despite this achievement, Keytruda has consistently lagged behind its competitor in terms of sales. However, the landscape may shift in Keytruda's favor based on recent trial results for Opdivo, potentially influencing its position in the market in the coming years.

While Keytruda competes directly with Opdivo in melanoma, second-line non-small cell lung cancer (NSCLC), and head and neck cancer, it managed to differentiate itself by securing FDA approval for first-line NSCLC treatment, an area where Opdivo failed to meet its primary endpoint. This approval opens up significant opportunities for Keytruda, particularly in previously untreated NSCLC patients with high levels of PD-L1 expression, representing approximately 25% of the overall patient population. The emphasis on PD-L1 testing could drive greater utilization of Keytruda in patients who have not responded to prior treatments.

Keytruda has faced challenges in the second-line setting due to its reliance on PD-L1 testing, while Opdivo can be used in a broader range of patients. Additionally, Roche's Tecentriq has also gained approval for second-line use in lung cancer. However, as Keytruda gains momentum in first-line NSCLC patients, it will likely extend its success to other indications and positively impact sales over the coming years.

Furthermore, similar to Bristol-Myers Squibb, Merck is exploring the potential of Keytruda in various other indications. Furthermore, Merck is investigating the drug's role in combination therapies, which is where the full potential of immuno-oncology drugs is expected to be realized. For example, in September 2022, Merck reported promising results from a study involving first-line NSCLC patients, demonstrating a 70% response rate when Keytruda was combined with Eli Lilly's Alimta (pemetrexed) and platinum doublet therapy. It is important to note that this outcome was observed in a limited number of patients.

1.5 Ibrance

-

Generic name: Palbociclib

-

Company: Onyx Pharmaceuticals/Pfizer

-

2022 sales: USD 6.01 billion

-

Current indication: Metastatic Breast Cancer

Ibrance, the first CDK 4/6 inhibitor introduced by Pfizer in the U.S. market in February 2015, has achieved remarkable success. Initially launched as a combination therapy with letrozole for hormone receptor-positive (HR+) and HER2-negative metastatic breast cancer, its momentum has continued to grow in 2022 and is expected to continue in the coming years.

In 2022, Ibrance's success was driven by further approval and expansion. The company received approval for its combination therapy with AstraZeneca's Faslodex (fulvestrant) for the treatment of women whose disease had progressed after hormone therapy. Additionally, In December 2022, the FDA expanded the approval of Ibrance to include newly diagnosed HR-positive, HER2-negative metastatic breast cancer patients, regardless of their menopausal status. This was a notable development as the combination therapy was previously restricted to postmenopausal women. Pfizer estimates that pre/perimenopausal women make up approximately 17% of the HR+/HER2- breast cancer patient population.

However, Ibrance faces potential competition from Novartis' Kisqali (ribociclib) and Eli Lilly's Verzenio, both CDK4/6 inhibitors marketed for breast cancer. Novartis has reported positive results that could significantly expand the market potential of Kisqali. Kisqali, when used on top of endocrine therapy after surgery, demonstrated a significant reduction in the risk of invasive disease recurrence compared with endocrine therapy alone in HR-positive, HER2-negative early breast cancer. Similarly, Eli Lilly's Verzenio is marketed as a CDK4/6 inhibitor for adjuvant therapy in HR-positive, HER2-negative early breast cancer. Verzenio is currently approved only for patients at high risk of recurrence with lymph node involvement. In contrast, Novartis conducted the NATALEE trial for Kisqali, which included patients at intermediate risk. Novartis has recently announced that Kisqali has shown a "consistent benefit" in stages 2 and 3 of early breast cancer, irrespective of nodal status.

To maintain its lead in the market, Pfizer is making significant investments. The company is conducting extensive testing of Ibrance in 38 other types of cancer, aiming to capitalize on its current advantage.

1.6 Tecentriq

-

Generic name: Atezolizumab

-

Company: Genentech/F. Hoffmann-La Roche Ltd.

-

2022 sales: USD 5.53 billion

-

Current indications: Breast Cancer; Liver Cancer; Malignant Melanoma; Non-Small Cell Lung Cancer; Small Cell Lung Cancer; Urogenital Cancer

Tecentriq, developed by Roche, entered the PD-1/PD-L1 inhibitor market as the third player, following Opdivo and Keytruda. Despite its delayed entry, Tecentriq had a strong start and is expected to gain momentum. It quickly generated sales of USD 19 million within a few weeks of its launch in the U.S., primarily for bladder cancer, and has since received approval for lung cancer treatment.

The early approval of Tecentriq in bladder cancer ahead of its competitors provides Roche with an opportunity to establish a strong position in that therapeutic area, while also competing for market share in breast cancer, liver cancer, malignant melanoma, non-small cell lung cancer, and small cell lung cancer.

However, Atezolizumab is no longer available for the treatment of advanced or metastatic bladder cancer as of November 2022. The manufacturer decided to withdraw this indication from the U.S. after consultation with the FDA. While this withdrawal may hinder the growth of the drug market. Nevertheless, it does not impact other FDA-approved uses of atezolizumab in the U.S.

Tecentriq is indicated for second-line therapy in all non-small cell lung cancer (NSCLC) patients, regardless of their PD-L1 status. This positions Tecentriq as a direct competitor to Opdivo while differentiating itself from Keytruda, which requires PD-L1 testing. Roche conducted trials involving a larger patient population of over 1,200 individuals compared to the studies supporting the approvals of Opdivo and Keytruda in second-line NSCLC. The company expects to demonstrate that Tecentriq has a more durable anti-cancer effect with a lower likelihood of toxicity.

Roche can leverage its extensive experience and marketing expertise as a global leader in anticancer biologics, including Avastin, MabThera/Rituxan, and Herceptin, to support the success of Tecentriq. However, Roche needs Tecentriq to make rapid progress as its blockbuster brands face increasing competition from biosimilars.

1.7 Darzalex

-

Generic name: Daratumumab

-

Company: Johnson & Johnson Services, Inc.

-

2022 sales: USD 4.91 billion

-

Current indication: Multiple Myeloma

Johnson & Johnson faced the challenge of establishing its position in the market when it introduced Darzalex, a medication for multiple myeloma, in 2015. Initially, the drug was limited to fourth-line treatment, which put it behind competitors such as Amgen's Kyprolis and Celgene's Pomalyst in the treatment sequence. However, this setback was not significant as multiple myeloma patients usually undergo multiple rounds of treatment. Johnson & Johnson has already begun the process of shifting Darzalex to earlier stages of treatment.

In a Phase 3 trial presented at the annual meeting of the American Society of Clinical Oncology, data showed that Darzalex, when combined with Takeda's Velcade and dexamethasone as a second-line therapy, could reduce the risk of disease progression or death by around 61%. Johnson & Johnson emphasizes this data as a differentiating factor for its drug compared to competitors. In November 2016, the FDA approved the use of Darzalex in combination with dexamethasone and either Takeda's Velcade or Celgene's Revlimid for patients who had received only one prior therapy. This approval was positive news for the company, especially after obtaining breakthrough status from the FDA for the use of Darzalex in multiple myeloma patients who relapsed after one or more prior therapies.

There has been speculation about whether Darzalex, as a first-in-class anti-CD38 drug, will surpass competitors such as Takeda's Ninlaro, Pomalyst, Kyprolis, Novartis' Farydak, and Bristol-Myers Squibb/AbbVie's Empliciti in the increasingly competitive multiple myeloma market.

However, competitor such as Sanofi poses a challenge to Darzalex with the recent trial win of Sarclisa in May 2020. Sanofi's FDA approval of Sarclisa marks its entry into the field of oncology. The French pharmaceutical company highlights a clinical victory that opens the door for a new indication for Sarclisa in multiple myeloma. When combined with Amgen's Kyprolis and dexamethasone, Sarclisa significantly reduces the risk of cancer progression or death compared to the combination of Kyprolis and corticosteroid alone in patients with relapsed multiple myeloma.

1.8 Perjeta

-

Company: F. Hoffmann-La Roche Ltd.

-

Generic name: Pertuzumab

-

2022 sales: USD 4.73 billion

-

Current indication: HER2-positive Breast Cancer

When Roche introduced Perjeta in 2012, there were concerns about its ability to compensate for the anticipated decline in sales of its companion drug, Herceptin, due to competition from biosimilars. However, those doubts have largely been dispelled as Perjeta has emerged as one of Roche's fastest-growing products.

The key to Perjeta's success lies in its expanded approvals for early-stage HER2-positive breast cancer, going beyond its initial use in advanced disease. In 2022, Perjeta contributed significantly to lucrative sales, effectively offsetting the decline in Herceptin sales.

A significant milestone that fueled Perjeta's growth was its FDA approval in 2013 as the first cancer drug to be used before surgery. This opened up a vast new pool of eligible patients. The drug is administered in combination with Herceptin or docetaxel chemotherapy as a dual regimen to reduce the size of breast tumors. Notably, Perjeta also made history as the first cancer drug to gain FDA approval based on tumor shrinkage rather than survival data.

While Perjeta has experienced success, it is anticipated that biosimilar competition will hinder its growth and market share. The patent for pertuzumab is set to expire in May 2023 in Europe and June 2024 in the U.S. For instance, HLX11 has emerged as an independent biosimilar candidate of pertuzumab developed by Henlius. HLX11 has successfully met the primary endpoint in the Phase 1 clinical trial, demonstrating similar pharmacokinetic and safety profiles to the reference drugs from different providers. In June 2022, Organon, a globally recognized women's health company specializing in biosimilar commercialization, announced a significant development. They entered into a license agreement with Shanghai Henlius Biotech, Inc. Under this agreement, Organon acquired exclusive global commercialization rights (excluding China, Macau, Hong Kong, and Taiwan) for Henlius' investigational biosimilar candidates referencing Perjeta (pertuzumab). This collaboration allows Organon to expand its portfolio and leverage its expertise in the commercialization of biosimilars.

1.9 Xtandi

-

Generic name: Enzalutamide

-

Companies: Astellas Pharma; Pfizer

-

2022 sales: USD 4.71 billion

-

Current indication: Prostate Cancer

Pfizer's acquisition of Medivation for USD 14 billion, securing control of the rapidly growing prostate cancer drug Xtandi. Despite facing tough competition from Johnson & Johnson's blockbuster Zytiga, Xtandi has managed to maintain impressive growth. While Zytiga slightly outsold Xtandi in the previous year, Xtandi possesses certain advantages that contribute to its competitiveness.

One advantage is that Xtandi is administered as a monotherapy, whereas Zytiga requires concomitant use of the steroid prednisone to mitigate side effects. Doctors generally prefer to minimize the use of steroids when possible. Additionally, patients on Zytiga require regular monitoring of liver enzyme levels, and the FDA mandated stronger warnings about potential liver toxicity on the drug's label.

These distinctions have impacted the market. Medivation asserts that Xtandi has surpassed Zytiga in terms of market share, aided by its earlier use, resulting in prolonged patient treatment. Moreover, in the UK, the National Institute for Health and Care Excellence (NICE) approved the use of Xtandi as a prechemotherapy regimen but rejected Zytiga. However, NICE changed its position and agreed to fund Zytiga with certain discounts provided by J&J.

The results of the Plato trial, which involved 500 patients and evaluated the combination of Xtandi and Zytiga, showed no superior efficacy in disease control compared to the Zytiga-only regimen. Nevertheless, Xtandi is expected to maintain a significant lead in the prostate cancer market in 2022. Additionally, the drug might receive further approvals for breast and ovarian cancers, unlocking substantial new market opportunities.

However, Xtandi may encounter challenges ahead. The drug faces pricing pressures in the U.S., and health insurer CVS Health excluded it from its 2017 formulary due to cost considerations. Xtandi could also face competition from Bayer Healthcare's rapidly growing Xofigo and potentially from a resurgent Provenge if Valeant (Bausch Health Companies Inc.) can reinvigorate the struggling prostate cancer vaccine.

1.10 Avastin

-

Generic name: Bevacizumab

-

Company: F. Hoffmann-La Roche Ltd.

-

2022 sales: USD 4.68 billion

-

Current indications: Colorectal Cancer; Non-Small Cell Lung Cancer; Ovarian Cancer; Cervical Cancer; Renal Cell Carcinoma; Glioblastoma

Avastin has been a highly successful drug for Roche, continuously expanding its indications since its initial approval for colorectal cancer in 2004. Recently, it gained European approval for use alongside Tarceva in patients with EGFR-positive non-small cell lung cancer.

Despite its long tenure, Avastin remains one of Roche's top-selling drugs, often competing for the second spot with the long-standing breast cancer drug, Herceptin. Roche continues to explore opportunities to expand Avastin's label, including a planned filing for mesothelioma in 2017. Additionally, if clinical studies of Avastin in combination with Tecentriq for renal cell carcinoma and non-small cell lung cancer yield positive results, regulatory submissions for this combination therapy could occur the following year.

The upward trajectory of Avastin's sales is expected to slow down as biosimilar versions of the drug enter the market. Biosimilars are already available in emerging markets like India and Russia, and companies like Amgen, Allergan, Biocon, Mylan, and others have plans or versions under review for global regulatory submissions. In September 2022, the U.S. Food and Drug Administration (FDA) approved Vegzelma (bevacizumab-adcd), a biosimilar of Genentech's Avastin (bevacizumab), manufactured by Celltrion Healthcare's Vegzelma has been approved for the treatment of six different types of cancer, including recurrent or metastatic non-squamous non-small cell lung cancer (NSCLC), metastatic colorectal cancer, recurrent glioblastoma, persistent, recurrent, or metastatic cervical cancer, metastatic renal cell carcinoma, and epithelial ovarian, fallopian tube, or primary peritoneal cancer. This approval expands the options available to healthcare providers and patients in the treatment of these specific cancer types. Several other manufacturers, including Samsung Bioepis, Boehringer Ingelheim, Pfizer, AryoGen Biopharma, Reliance Life Sciences, and Fujifilm Kyowa Kirin Biologics, have Avastin biosimilars in phase 3 development.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified