Healthcare Assistive Robots Market

The global healthcare assistive robots market size was estimated at USD 27.3 billion in 2023 and is projected to grow at a CAGR of 16.6% from 2024 to 2030. The healthcare assistive robot market encompasses a range of segments such as surgical, exoskeleton, pharmaceutical, cleanroom, prosthetics, medical service, and companion robots. This trend report from the GVR research team will deliver comprehensive qualitative and quantitative insights specifically on the surgical, exoskeleton, medical service, and companion robots segments.

Surgical Robots Market Key Performance Indicators

The surgical robots market accounted for a revenue of USD 5.7 billion in 2023. Increasing number of joint replacement surgeries across the globe is fostering market growth.

Recent initiatives by market leaders include

-

Intuitive Surgical's da Vinci 5 Robot Launch: In July 2024, Intuitive Surgical reported a strong second quarter, driven by the rapid rollout of its da Vinci 5 robotic surgery system, which surpassed Wall Street expectations. The company placed 70 units in the quarter, a significant increase from eight in the previous quarter, and accounted for 47% of U.S. placements. Customer feedback has highlighted improvements in precision and efficiency, and the company anticipates continued growth in placements through 2024 despite supply challenges.

-

Meril's MISSO Surgical Robot: In June 2024, Indian medical device company Meril launched its MISSO surgical robot for knee replacement surgeries, claiming a 98% success rate. This indigenously developed system is designed to be cost-effective, reducing investment by 66% compared to imported systems. It makes robotic surgery more accessible, especially in smaller hospitals. The technology has received approval from the CDSCO and is awaiting CE and USFDA approvals.

-

Moon Surgical Received FDA Approval

-

Sony's Microsurgery Robot Development

-

Investment by West Hertfordshire Teaching Hospitals NHS Trust

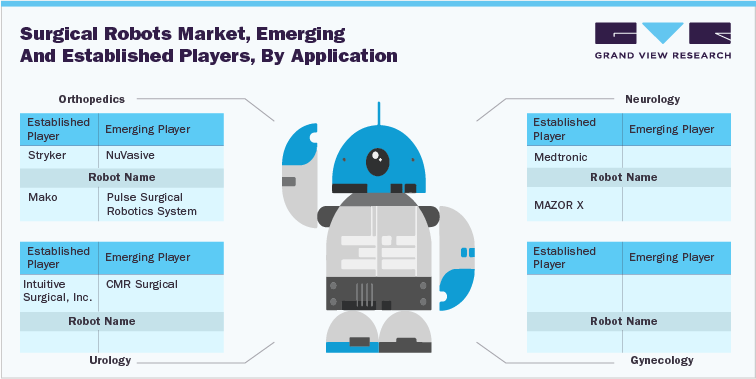

Surgical Robots Market, Established and Emerging Players Analysis

|

Established Companies |

Emerging Companies |

|

Intuitive Surgical |

CMR Surgical |

|

Overview |

|

|

Intuitive Surgical, Inc. is a global robotic assisted, minimally invasive surgery leader. Established in 1995, the company's flagship product, the da Vinci Surgical System, was the first to receive FDA approval for general laparoscopic surgery. The surgical system comprises a patient-side cart with robotic arms, a high-performance vision system, a surgeon's console, and proprietary EndoWrist instruments. Intuitive Surgical's technology has revolutionized surgery across multiple disciplines, including urology, gynecology, thoracic surgery, and general surgery. |

CMR Surgical, a UK-based medical device manufacturer in Cambridge, is known for creating Versius, a robotic surgery system. In February 2024, the company revealed a notable enhancement to the Versius system, incorporating a new imaging technology designed to visualize ICG (Indocyanine Green). Further, in March 2024, CMR Surgical shared an achievement of completing over 20,000 surgical procedures using the Versius system, with the milestone 20,000th procedure conducted at the East and North Hertfordshire NHS Trust in the UK. |

|

Growth Strategies |

|

|

Focuses on continuous innovation, expanding the capabilities of the da Vinci system, increasing the number of procedures it can perform, and expanding into new geographic markets. It also invests heavily in training programs for surgeons. |

|

|

Product Pipeline |

|

|

da Vinci 5 Robot |

|

|

Products |

|

|

|

|

Business Line |

|

|

Develops the da Vinci Surgical System, a robotic platform using a minimally invasive (MIS) approach designed to enable complex surgery. |

|

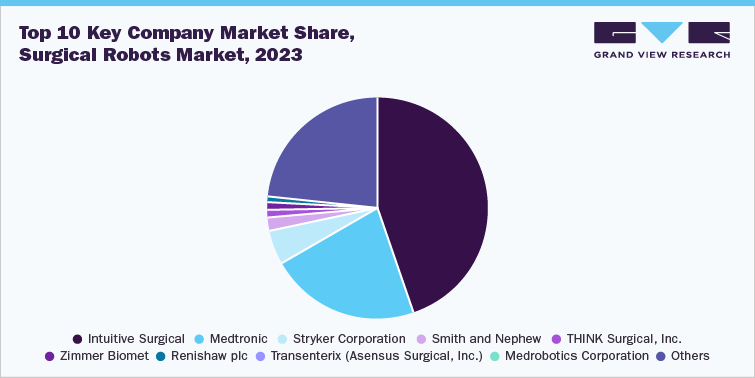

Top 10 Surgical Robot Companies

-

Intuitive Surgical: Intuitive Surgical, headquartered in the U.S., is one of the top companies offering robotic-assisted surgery (RAS) and minimally invasive surgical solutions. The company's flagship RAS platforms, the da Vinci systems, have been utilized in over 12 million surgeries globally as of 2022. Integrating the Ion endoluminal system into its lineup further broadened Intuitive Surgical's reach into diagnostics. In 2023, the revenue generated from the sale of instruments and accessories reached USD 4.28 billion, marking a 21.6% increase from the previous year. This growth is attributed to a 22% rise in surgical procedures conducted using the da Vinci systems compared to 2022. In March 2024, Intuitive Surgical revealed that the da Vinci 5, their latest multivalent robotic system, obtained clearance from the U.S. Food and Drug Administration (FDA) under the 510(k) process.

Intuitive Surgical: Surgical Robots Portfolio

|

Key Parameters |

Description |

|

Surgical Robots Offered |

|

|

Stage of Development |

|

|

Technology / Software Used |

|

|

Deployment Model |

|

|

AI Integration |

|

|

Type of Surgical Procedure Supported |

|

|

Application Area |

|

|

End User |

|

Similar Analysis would be provided the companies mentioned below:

-

Abott

-

Johnson & Johnson

-

Medtronic

-

Renishaw

-

Smith+Nephew

-

Stryker

-

Zimmer Biomet

-

THINK Surgical, Inc.

-

Transenterix (Asensus Surgical, Inc.)

Innovative Trends Shaping the Next Generation of Surgical Robotics Market:

Miniaturization and Nano and Micro-robotics

|

Parameters |

NanoRobots |

MicroRobots |

|

Classification (Size) |

The scale of nanotechnology is within the nanometer range (10^-9 meters), with nanorobots typically measuring between 0.5 and 3 micrometers in diameter. These devices are built from components that vary in size from 1 to 100 nanometers. |

A microrobot typically has dimensions smaller than 1 millimeter, while a millirobot's size is under a centimeter. Mini-robots would measure less than 10 cm (about 4 inches), and small robots are described as having sizes under 100 cm (or 39 inches). |

|

Drivers |

Nanorobots have the potential to revolutionize treatment for many diseases, including cancer, diabetes, and neurodegenerative disorders. They could deliver drugs with pinpoint accuracy, stimulate immune responses, and even repair damaged tissues.

|

Microrobots can perform tasks with a high degree of precision and accuracy, which is crucial in medical applications such as targeted drug delivery or precise surgery on a microscale.

|

|

Competitive Scenario |

Key participants in the nanorobots in healthcare market Bruker, Ginkgo Bioworks, JEOL Ltd., Klocke Nanotechnik GmbH, Kleindiek Nanotechnik GmbH, SmarAct GmbH, and Nanonics Imaging Ltd. |

Some of the key players in the market include Medtronic, Mazor Robotics, Intuitive Surgical, Sony, Medrobotics, Smith & Nephew, Titan Medical, among others. |

|

Recent Developments |

|

Sony presented a microsurgery robot equipped with 4K 3D cameras

|

|

Need of Innovation |

Upgrade report license to gain access to the complete analysis |

Upgrade report license to gain access to the complete analysis |

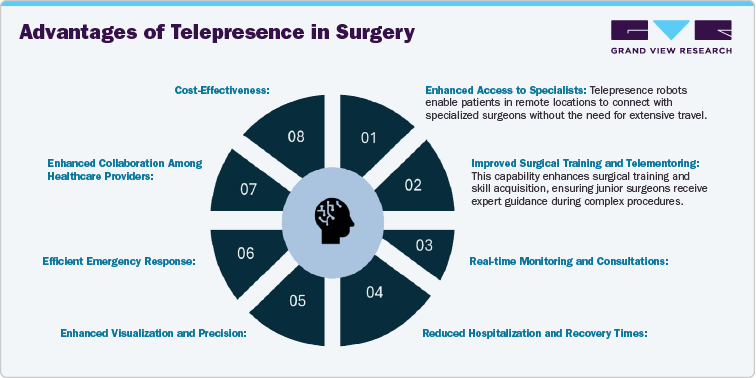

Telepresence in Surgery

Telepresence robots in surgery serve several critical functions that enhance surgical practices and improve patient outcomes. Telepresence surgeries surged during the COVID-19 pandemic, with a 50% increase in remote surgical procedures facilitated by robotic surgery platforms, reflecting growing acceptance of remote healthcare delivery. The potential benefits of telesurgery include:

-

Increased consistency in surgical outcomes.

-

Improved access to care.

-

Enhanced efficiency in surgical procedures.

Furthermore, as the demand for surgical care grows, telesurgery could help mitigate the anticipated shortage of surgeons by allowing them to treat more patients concurrently.

Recent Developments

-

In January 2022, Intuitive India, an innovator in minimally invasive care and robotic-assisted surgery, introduced the country's inaugural remote surgical case observation technology, ' Intuitive Telepresence' (ITP). This cutting-edge technology allows surgeons to gain insights and learn from expert professionals without the necessity of traveling or taking time off their busy schedules.

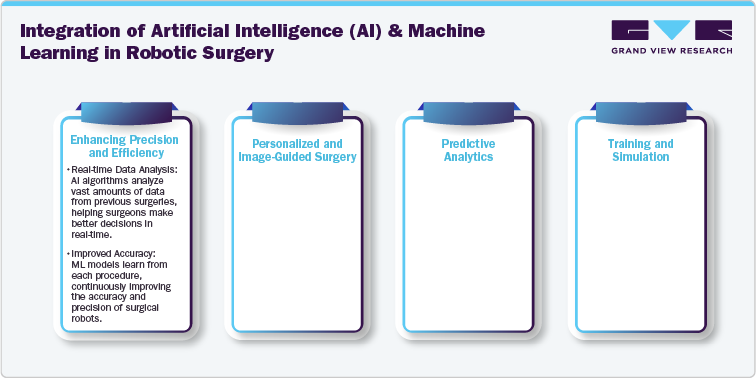

Integration of Artificial Intelligence (AI) and Machine Learning

Integrating artificial intelligence (AI) and machine learning (ML) in surgical robots is revolutionizing the medical field, enhancing precision, efficiency, and outcomes in surgical procedures.

Leading Companies and Innovations

-

Intuitive Surgical:

Its da Vinci Surgical System leverages AI for enhanced robotic control and precision.

Future Trends

-

Integration with IoT: Combining AI with Internet of Things (IoT) devices for real-time monitoring and data exchange.

Expansion of Ambulatory Surgery Centers (ASCs)

ASCs are increasingly adopting surgical robots due to the lower costs associated with procedures performed in these settings than traditional hospitals. This trend is expected to enhance market penetration.

Key Drivers for Expansion

-

Minimally Invasive Procedures: Robotic-assisted surgery enables highly precise, minimally invasive procedures, leading to faster recovery times and reduced postoperative pain for patients. This is particularly beneficial for ASCs, which focus on outpatient procedures.

Surgical robots approved in 2023

-

Think Surgical's TSolution One: Approved for use in total knee replacement surgeries, this robot enhances precision in bone preparation, leading to improved implant placement and patient outcomes.