- Home

- »

- Market Trend Reports

- »

-

Opportunity Analysis For Sunitinib Malate

![Opportunity Report]()

Opportunity Analysis For Sunitinib Malate

- Published: Sep, 2024

- Report ID: GVR-MT-100263

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 60

- Report Coverage: 2024 - 2030

Overview of Sunitinib Malate Industry

Sunitinib malate, a multi-targeted receptor tyrosine kinase inhibitor, has revolutionized the treatment landscape for various cancers since its FDA approval in 2006. Initially developed for renal cell carcinoma (RCC), its scope of application has broadened, presenting new opportunities in oncology and beyond. The Sunitinib Malate industry has been driven by increasing incidences of kidney and gastrointestinal cancers, which account for a significant share of cancer-related mortality. The global rise in cancer prevalence, coupled with greater access to advanced healthcare, has propelled the demand for effective treatments like Sunitinib. The drug is widely adopted in both developed and emerging markets, especially where personalized cancer therapy is on the rise.

Market Potential And Current Applications

Sunitinib Malate, an oral tyrosine kinase inhibitor, is primarily used in the treatment of cancers such as renal cell carcinoma (RCC), gastrointestinal stromal tumors (GIST), and pancreatic neuroendocrine tumors (pNET). Marketed under the brand name Sutent, it targets specific receptor proteins involved in cancer growth, making it a critical drug in targeted cancer therapy. Its mechanism of action involves inhibiting multiple receptor tyrosine kinases, which disrupt tumor cell growth and angiogenesis. This broad-spectrum efficacy has positioned it as a critical therapeutic option in oncology. The global market for RCC and GIST treatments is significant, with ongoing research and clinical trials expanding its use to other malignancies like pancreatic neuroendocrine tumors and certain brain tumors.

Opportunity Analysis For Sunitinib Malate

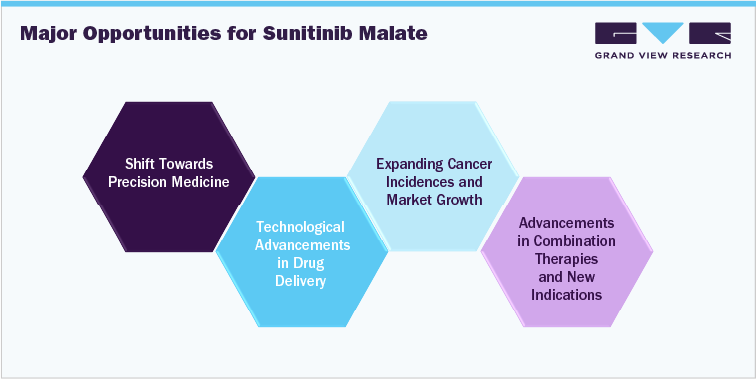

- Expanding Cancer Incidences And Market Growth

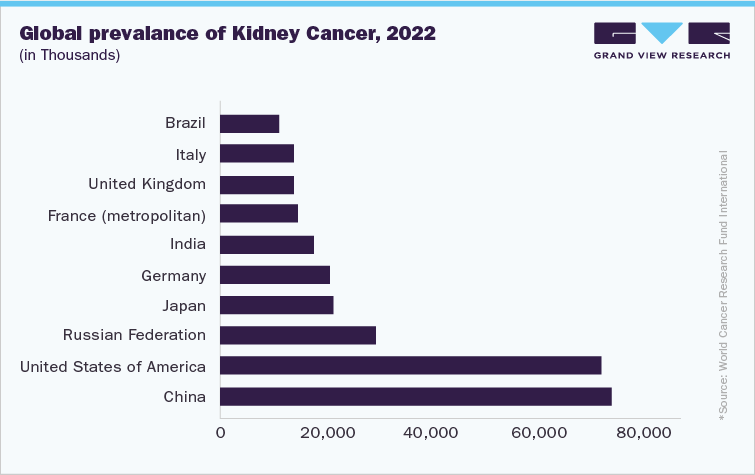

Sunitinib Malate is a well-established treatment option for several cancers, including renal cell carcinoma (RCC), gastrointestinal stromal tumors (GIST), and pancreatic neuroendocrine tumors (pNET). One of the key opportunities for the drug lies in the rising global cancer burden, particularly in regions experiencing rapid urbanization and lifestyle changes, which have led to an increase in cancer incidences.

-

Renal Cell Carcinoma: RCC, a leading form of kidney cancer, is on the rise globally, especially in industrialized countries. The increasing prevalence of RCC, which is closely linked to smoking, obesity, and hypertension, presents a continued demand for effective treatments like Sunitinib.

-

Gastrointestinal Stromal Tumors: GIST, a rare cancer affecting the digestive tract, represents a niche market that is highly reliant on targeted therapies. Although the GIST patient pool is smaller, the lack of alternative treatment options enhances the value of Sunitinib in this domain.

-

Pancreatic Neuroendocrine Tumors (pNET): The incidence of pancreatic neuroendocrine tumors is also growing, though more slowly than other forms of cancer. However, the increasing awareness and improved diagnostic capabilities for pNET further expand the potential market for Sunitinib.

In developing regions such as Asia-Pacific, Latin America, and Africa, where there is both a growing cancer burden and improving access to healthcare, Sunitinib has significant growth potential. Governments and private healthcare providers in these regions are investing heavily in cancer care infrastructure, opening doors for increased Sunitinib uptake.

- Shift towards Precision Medicine

The field of oncology is undergoing a transformation with the rise of precision medicine, which aims to tailor treatments to the individual genetic and molecular profile of each patient. Sunitinib, as a tyrosine kinase inhibitor (TKI), is at the forefront of this shift. It targets specific receptor proteins involved in the growth of cancer cells, offering a more personalized and effective treatment option compared to traditional chemotherapy.

-

Biomarker Identification: The identification of biomarkers and genetic mutations that predict a patient's response to Sunitinib has the potential to optimize treatment outcomes. Ongoing research in biomarkers can open opportunities for Sunitinib to be prescribed to a more targeted patient population, enhancing its efficacy and market appeal.

-

Combination Therapies: Research into combination therapies, where Sunitinib is paired with immunotherapies or other targeted drugs, is another opportunity. Such combinations have shown promise in boosting patient response rates and improving overall survival. The development of new combination regimens can help extend Sunitinib's use to additional cancer types and stages.

- Growing Generic Market

The expiration of Pfizer’s patents for Sutent in several key markets, including the U.S., Europe, and Japan, has created an influx of generic versions of Sunitinib. This shift brings both challenges and opportunities for market players.

-

Affordability: The introduction of generics has lowered the price of Sunitinib, making it more accessible to patients in price-sensitive regions. As healthcare systems, particularly in low- and middle-income countries, seek to provide cost-effective cancer treatments, generic Sunitinib presents a valuable opportunity for manufacturers to capture market share.

-

Regional Expansion: Generics also present an opportunity for regional expansion. Countries with underfunded healthcare systems or limited access to innovative therapies can now afford to include Sunitinib as part of their standard treatment protocols. For instance, in markets like Southeast Asia, Africa, and parts of Latin America, where healthcare infrastructure is improving, generic manufacturers can significantly increase the availability of Sunitinib.

-

Volume Growth: With generics driving down costs, there is potential for increased volume of prescriptions. Governments and insurance providers are more likely to include Sunitinib in their formularies, further expanding patient access.

- Combination Therapies and New Indications

Ongoing research in oncology is uncovering new ways to use existing drugs, and Sunitinib is no exception. Several opportunities exist for Sunitinib in combination therapies and new treatment indications:

-

Immune Checkpoint Inhibitors: Immune checkpoint inhibitors, such as pembrolizumab and nivolumab, are revolutionizing cancer treatment by enhancing the body's immune response against cancer cells. When combined with Sunitinib, there is evidence of improved survival rates in RCC and other cancers. The approval of combination regimens that include Sunitinib could significantly extend its market presence.

-

Expansion into Non-Oncological Uses: Researchers are also exploring the use of Sunitinib for conditions outside its approved cancer indications. For example, studies have been investigating Sunitinib's potential in treating fibrotic diseases and other non-cancerous conditions where tyrosine kinase inhibition could play a therapeutic role. While these are still in early stages, they represent potential future markets.

- Emerging Markets

Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, present some of the most promising opportunities for Sunitinib. These regions have a growing middle class, increasing healthcare expenditure, and a rising incidence of cancer due to lifestyle and environmental factors.

-

Healthcare Infrastructure: Countries like India, China, and Brazil are expanding their healthcare infrastructure, enabling better diagnosis and treatment of cancer. As more patients are diagnosed and treated for cancer, the demand for effective treatments like Sunitinib is expected to rise.

-

Government Initiatives: Many emerging markets are also seeing government-led initiatives aimed at improving cancer care. For example, China’s Healthy China 2030 plan prioritizes cancer treatment, and India’s National Cancer Grid is working to improve the availability of cancer treatments nationwide. These initiatives create an environment conducive to the uptake of targeted therapies like Sunitinib.

-

Local Partnerships: In many emerging markets, establishing partnerships with local pharmaceutical companies or healthcare providers is a key strategy to gaining market access. By partnering with local players, companies that produce Sunitinib, both branded and generic, can more effectively navigate regulatory environments and reach a broader patient population.

- Technological Advancements in Drug Delivery

Advances in drug delivery systems represent another opportunity for the Sunitinib market. The development of new formulations that improve the drug's bioavailability, reduce side effects, or increase patient adherence could extend the product lifecycle of Sunitinib and increase its competitiveness in the market.

-

Extended-Release Formulations: Extended-release versions of Sunitinib could offer benefits in terms of patient convenience, compliance, and reduced side effects. By maintaining more consistent drug levels in the bloodstream, these formulations could enhance the drug’s efficacy and reduce the need for frequent dosing.

-

Nanotechnology: Nanoparticle-based drug delivery systems are another area of exploration. By encapsulating Sunitinib in nanoparticles, researchers aim to improve the drug's targeting abilities and reduce its toxicity, especially for patients with comorbidities or those undergoing combination therapies.

- Regulatory Approvals and Market Exclusivity

While the loss of patent protection has spurred the development of generics, the introduction of new formulations, combination therapies, or extended indications for Sunitinib could provide opportunities for renewed regulatory exclusivity. If companies are able to secure approval for new combinations or uses of the drug, they may benefit from extended market exclusivity, even in the face of generic competition.

Competitive Landscape Of Sunitinib Malate

Sunitinib Malate, marketed under the brand name Sutent by Pfizer, has been a significant player in the targeted cancer therapy market for over a decade. Its primary indications include renal cell carcinoma (RCC), gastrointestinal stromal tumors (GIST), and pancreatic neuroendocrine tumors (pNET). As a pioneering tyrosine kinase inhibitor (TKI), Sutent enjoyed market exclusivity for several years. However, the expiration of key patents in regions such as the U.S., Europe, and Japan has led to the introduction of generic versions, altering the competitive landscape.

Pfizer's Sutent was the first and most widely recognized brand for Sunitinib Malate. It gained FDA approval in 2006 for RCC and quickly became a leading treatment option due to its efficacy in targeting multiple tyrosine kinase receptors. Pfizer capitalized on its first-mover advantage, establishing a strong global presence in oncology. Despite its patent expiration, Pfizer continues to maintain significant brand recognition and market share.

Several pharmaceutical companies, particularly from India, have been quick to develop and market generic versions of Sunitinib. Companies like Cipla, Sun Pharma, and Dr. Reddy's Laboratories have become major competitors, particularly in emerging markets where cost constraints make generic alternatives more appealing. These generics have driven down the cost of treatment, expanding access but also intensifying price competition.

Challenges For Sunitinib Malate

Safety and Tolerability Concerns: Although Sunitinib has demonstrated efficacy in treating cancers like renal cell carcinoma (RCC), gastrointestinal stromal tumors (GIST), and pancreatic neuroendocrine tumors (pNET), it is associated with a range of side effects that can impact patient compliance and quality of life. Common adverse events include hypertension, fatigue, gastrointestinal issues, and hand-foot syndrome. As oncology treatments evolve, there is increasing emphasis on therapies that not only prolong survival but also improve patient quality of life. Sunitinib’s side effects make it less competitive compared to newer, less toxic options, particularly for patients with advanced cancer.

Evolving Treatment Paradigms: The oncology field is undergoing a transformation with the rise of immunotherapies and combination treatments. Immune checkpoint inhibitors, such as nivolumab and pembrolizumab, have shown significant promise in treating cancers that were traditionally managed by tyrosine kinase inhibitors like Sunitinib. While there is ongoing research into combining Sunitinib with immunotherapies to improve outcomes, these combinations have yet to be fully embraced in clinical practice. Furthermore, the competition from newer, more potent combination therapies poses a significant threat to Sunitinib’s relevance in cancer treatment protocols.

Regulatory and Reimbursement Hurdles: Navigating the regulatory environment is a constant challenge for any pharmaceutical product, and Sunitinib is no exception. With healthcare systems under pressure to contain costs, securing favorable reimbursement for high-cost oncology drugs is becoming more difficult. Reimbursement bodies, such as the U.S. Centers for Medicare & Medicaid Services (CMS) and the U.K.’s National Institute for Health and Care Excellence (NICE), are placing increasing emphasis on cost-effectiveness. Sunitinib’s relatively high cost, particularly for the branded version, makes it harder to justify its widespread use, especially as generics become more available. As healthcare systems focus more on reducing costs, the pressure on Sunitinib to demonstrate clear value is growing.

Conclusion

Sunitinib malate presents substantial opportunities for expanding its therapeutic applications beyond RCC and GISTs. By leveraging ongoing research into new cancer indications and combination therapies and addressing competitive and regulatory challenges, sunitinib has the potential to enhance its position in the oncology market. Strategic investments in clinical trials and market access strategies will be vital to unlocking its full potential and delivering continued value to patients and healthcare providers.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified