- Home

- »

- Market Trend Reports

- »

-

Demand For Korean Brands & Competitive Landscape Of South Korea Botulinum Toxin Market

![South Korea Botulinum Toxin Market: Growing Demand For Korean Brands & Competitive LandscapeReport]()

South Korea Botulinum Toxin Market: Growing Demand For Korean Brands & Competitive Landscape

- Published: Aug, 2024

- Report ID: GVR-MT-100240

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 30

- Report Coverage: 2024 - 2030

Report Overview

Korean brands for botulinum toxins are gaining significant traction worldwide. Korean brands are primarily gaining sales momentum in developed aesthetic markets such as the U.S. while simultaneously gaining recognition in Asian regions such as China and Thailand. Some of the key factors affecting their demand in the region are their price positions and marketing strategies.

Furthermore, changing consumer attitudes towards neuromodulators have increased awareness and acceptance of these products, allowing them to penetrate newer market segments, such as men's and millennials.

The brand and competitive analysis report, compiled by Grand View Research, is a collection of the trends and competitive scenario. Qualitative information regarding the trends, competitive strategies, existing competition, and pipeline analysis will be provided in the report. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

South Korea Botulinum Toxin Market: Growing Demand for Korean Brands & Competitive Analysis Report Scope

Attributes

Details

Areas of Research

Industry trends, market opportunity, botulinum toxin penetration, competitive and product revenue analysis

Report Representation

Consolidated report in PDF format

Product Coverage

- Dysport

- Xeomin

- Botulax

- Letybo

- Nabota

- Neuronox

- Hutox

- Botox

- Liztox

- Wondertox

Highlights of Report (Competitive & Revenue Landscape, by Product)

- Product Revenues from 2018 to 2030

- Product Market Share Evolution

- Consumer Behavior Analysis

- Strategic Initiatives from 2018 to 2024

- SWOT Analysis by Manufacturers

South Korea Botulinum Toxin: Trends and Competitive Analysis Coverage Snapshot

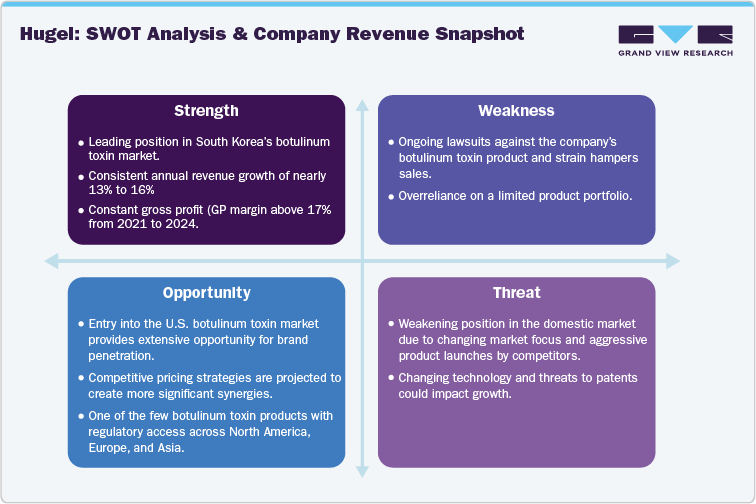

Recent trends indicate penetration of Korean brands in the International botulinum toxin marketplace. Moreover, established brands and manufacturers such as Letybo by Hugel have seen a significant increase in demand from the time of approval, i.e., March 2024 in the U.S. Critically, Hugel became the first Korean company to have its product present in three key aesthetic markets, i.e., U.S., Europe, and China. Moreover, similar product approvals are expected in the U.S. owing to superior technology, changing consumer sentiment, and advanced marketing strategies by Korean brands.

According to Hugel’s Chairman post-approval for its botulinum toxin product, “As a leading global medical aesthetic company, we are delighted to enter the United States, the world's largest and yet still fast-growing market. We believe our long-standing track-record in South Korea, growing global market position and premium brand positioning, thought leadership in the field and the comprehensive medical affairs programs will create significant value to all constituents including our global customers, strategic partners and shareholders.”

Growing Competition in the Domestic Korean Market

The domestic botulinum toxin marketplace is eyeing intense competition in the upcoming years. As of January 2024, more than ten companies were competing in the neuromodulator space, while two companies gained product approvals post-February 2024. Critically, large market cap companies such as Hugel, Daewoong, and Medytox are now focusing on international growth, thereby creating opportunities for new-age players to enter the domestic marketplace with enhanced pricing positions and marketing strategies, amongst others.

A growing company with a leading skin booster product (Rejuran), Pharma Research Bio obtained approval from the Ministry of Food and Drug Safety for its botulinum toxin product, 100 units of Leintokju. Critically, the company has been exporting the neuromodulator for some period; however, it plans to enter the domestic market in 2024. Furthermore, BMI Korea, another Korean company, entered the domestic botulinum toxin market in 2024 with its product, 100 units of Hi-Tox Liquor. Lastly, Chong Kun Dang Bio, another domestic company, is conducting phase 3 clinical trials for its botulinum toxin product, CKDB-501A. The product has already gained export authorization, while the ongoing trials focus on the domestic market. Therefore, in the next five years, it is projected that more than 20 companies will operate in the domestic botulinum toxin market.

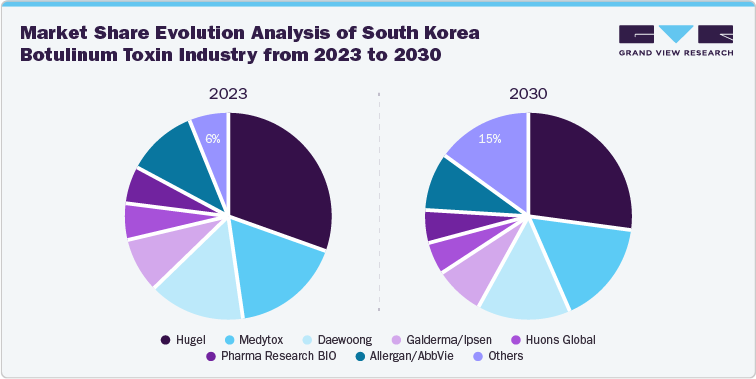

The below representation showcases the change in market share in the domestic botulinum toxin market from 2023. Critically, the share of others is expected to shift from 6% in 2023 to nearly 15% by 2030 owing to the ongoing product approvals from newer companies and weakening domestic sales by market leaders. Furthermore, Hugel is expected to maintain its market-leading position in the country, though losing some market share over the next five years.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified