Report Overview

Our healthcare outsourcing portfolio has been developing since our inception in 2014, wherein we have been continuously tracking several sub-domains such as clinical trials, CRO, CDMO, CMO, and specialty service providers space and their R&D activities, financial performance, strategic initiatives, service portfolio progression. We have seen the evolution of small molecule CDMO market participants from just a handful to now over 120 companies. To help understand and highlight their development journey, we have made this special study that focuses on the competitive landscape of Top small molecule Contract Development and Manufacturing Organizations (CDMO) in the industry.

|

Competitive Landscape: Top Small Molecule CDMOs Report Coverage |

||||

|

Market Outlook |

Company Categorization |

Company Position Matrix |

Service Offering Matrix |

List of Key CDMOs by Region |

|

Company Overview |

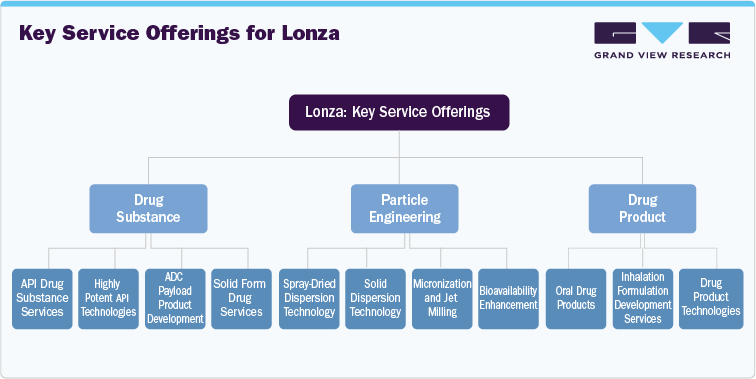

Key Service Offerings |

Financial Reporting |

Recent Strategic Developments |

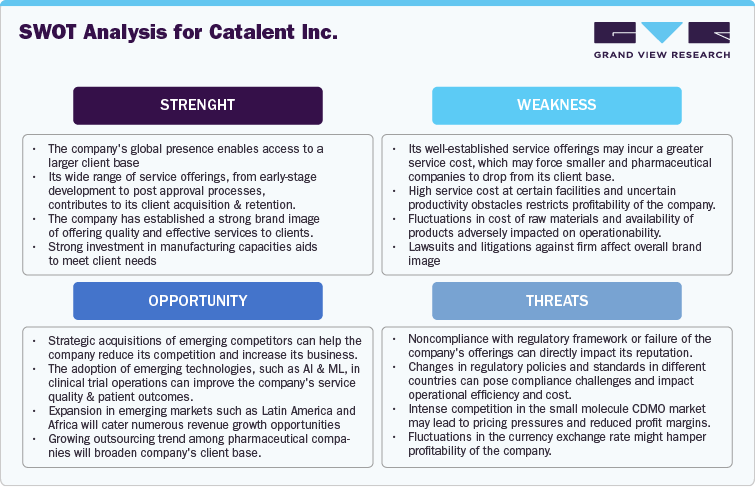

SWOT Analysis |

The CDMOs are the major contributors within the healthcare outsourcing industry closely followed by CROs and Healthcare IT. The pharmaceutical industry contributes for over USD 1.48 trillion in business, thus maintaining its status as a profitable business for years and promoting R&D activities to contribute to higher revenues. Moreover, high demand for small-molecule drugs, rising preference for outsourcing development and manufacturing services by pharmaceutical companies, and surge in the number of clinical trials are key aspects propelling industry competition. In addition, growing R&D investment in pharmaceutical industry for the development of novel small molecule and increasing demand for novel therapeutics are another key factors attracting new entrants in the small molecule CDMO market.

The industry life cycle graph indicates that current drug patents are verge on expiration, leading to an anticipated increase in competition, which is expected to significantly reduce profit margins. In response to this challenge, pharmaceutical companies are proactively investing in R&D activities, as well as implementing several inorganic growth strategies such as collaboration, acquisitions of smaller, innovative firms or seeking out outsourcing partners. For instance, in February 2024, Novo Holdings, a parent company of Novo Nordisk, announced acquisition of Catalent Inc., a key market player in the healthcare CDMO market. This acquisition will fortify long-term impact on overall CDMO industry as well as clientele of the company. Such detailed insights pertaining to each CDMO’s strategic plans, including information on mergers and partnerships partnerships, expansions, and collaboration will be provided in the study. It shall also elucidate on the key service offered by each of the listed CDMOs, to develop and manufacture small molecules.

Furthermore, there is strong presence of regional and local market players that are intensifying market competition owing to changing regulatory scenario, continuous reforms among several countries and increasing pricing pressure to mitigate clinical trial cost. Thus, a further deep dive into each CDMOs competitive landscape is a crucial parameter. The study shall provide insights into the market position analysis and list of major players by each region, and market assessment analysis. Moreover, this study will provide you with the landscape of the top CDMOs across the globe in terms of revenue. This section will include overall revenue, operating income, net income, EBIT/EBITA and asset turnover for publicly listed service providers, which cater valuable insights pertaining to company’s financial growth momentum, operational efficiency and strategic direction.

|

Financial Reporting for Catalent Inc. |

|||

|

Key Financials |

Revenue (in USD Million) |

||

|

As of dated 30th June |

2021 |

2022 |

2023 |

|

Net Revenue |

3,998.0 |

4,802.0 |

4,263.0 |

|

Operating Income/(loss) |

828.0 |

730.0 |

(163.0) |

|

EBIT |

715.0 |

579.0 |

(342.0) |

|

Net Income |

585.0 |

499.0 |

(256.0) |

|

Cash from operating activities |

433.0 |

439.0 |

254.0 |

|

Cash used in investing activities |

649.0 |

1,884.0 |

955.0 |

|

Asset Turnover |

43.88% |

45.70% |

39.56% |

Other aspects that shall be analyzed will include the market overview, company categorization, company position matrix, service offering matrix, and list of key CDMOs by region.

An in-depth analysis shall be provided for below listed 30 small molecule CDMOs

-

Lonza

-

Thermo Fisher Scientific Inc.

-

Catalent, Inc

-

WuXi Biologics

-

Samsung Biologics

-

Siegfried Holdings AG

-

Fujifilm Diosynth Biotechnologies

-

Recipharm

-

Boehringer Ingelheim

-

MilliporeSigma

-

AGC Biologics

-

PCI Pharma Services

-

Alcami Corporation

-

Cambrex Corporation

-

Veranova

-

Piramal Pharma Solutions

-

CoreRx, Inc

-

Wheeler Bio

-

Pharma Tech Industries

-

Curia Global

-

Ajinomoto Bio-Pharma

-

Quotient Sciences

-

Corden Pharma

-

Eurofins Scientific

-

Seqens

-

Pace Analytical Services, LLC

-

Aenova Group

-

Almac Group

-

Aurigene Pharmaceutical Services Ltd.

-

Aragen Life Sciences Ltd.