- Home

- »

- Market Trend Reports

- »

-

Respiratory Devices Market Trend Report: Key Trends & Competitive Analysis

![Respiratory Devices Market Trend Report: Key Trends And Competitive Report]()

Respiratory Devices Market Trend Report: Key Trends And Competitive Analysis

- Published: Aug, 2024

- Report ID: GVR-MT-100224

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Market Overview: Evolving Trends In Respiratory Devices Market

Key Trends In The Respiratory Devices Market:

1. Anticipated Impact Of GLP-1 Medications On PAP Devices For Obstructive Sleep Apnea (OSA):

-

In June 2024, phase III SURMOUNT-OSA trial data from Eli Lilly highlights the potential of GLP-1s in managing OSA. The trial compared the efficacy of GLP-1s alone and in combination with positive airway pressure (PAP) over 12 months. The combination therapy showed a 62.8% reduction in apnea-hypopnea index (AHI), compared to a 55.0% reduction with GLP-1 alone.

Table 1 The below table highlighted the impact of GLP-1 medications and anticipated changes:

Factor

Current Impact

Anticipated Change

AHI Reduction (PAP + GLP-1)

62.8%

Increase in combination therapy adoption

AHI Reduction (GLP-1 alone)

55.0%

Improved awareness is expected to drive more diagnoses

Stock Impact (ResMed)

-6%

Stabilization and potential growth

Patient Propensity to Start PAP

10.5% higher in GLP-1 users

Expected to further increase

-

A recent market analysis revealed that while overall GLP-1 use is increasing, it reached only few among patients considered candidates for a specific medical device. In addition, device use within this GLP-1 using population dropped only slightly, resulting in an overall impact on device use of less than 1%.

Table 2 Impact of GLP-1 initiation on device uptake for MedTech market:

2020 GLP-1 Initiation

2021 GLP-1 Initiation

2023 GLP-1 Initiation

% of total

Device Uptake 2020-present

% of total

Device Uptake 2020-present

% of total

Device Uptake 2020-present

Precursor patients with GLP-1

7%

62%

10%

59%

12%

57%

Precursor patients without GLP-1

93%

65%

90%

65%

88%

65%

Weighted Average

65%

64%

64%

-

Market dynamics: Initial demand for PAP devices is expected to remain stable, but long-term demand may decline as patients experience improved OSA symptoms and reduced dependency on these devices.

2. Increasing Product Recalls:

Product recalls are currently trending in the respiratory devices market, particularly due to recent high-profile incidents involving major manufacturers.

Impact On Respiratory Devices Industry

-

Phillips: In June 2021, Philips announced a recall of certain ventilators, bi-level positive airway pressure impacting over 15 million devices in the U.S. In 2021, the company recorded a 23% decline it its Connected Care business segment revenue owing to the impact of COVID-19 and significant impact of Respironics product recalls.

-

ResMed: The Philips recall had a positive impact on ResMed's financial performance, as it led to increased demand for ResMed's respiratory devices. ResMed capitalized on the market gap, significantly boosting its revenue. In fiscal year 2022, ResMed's revenue reached nearly $3.6 billion, with continued growth into fiscal year 2023. The company reported its highest-ever quarterly revenue of $1.03 billion in Q2 FY2023, a 16% increase year-over-year.

-

Baxter International: In July 2024, Baxter issued an urgent medical device recall for its Life2000 ventilator due to potential battery charger dongle damage. The recall leads to disruptions in sales, increased costs related to device replacements, and potential loss of customer trust, which could adversely affect the company's financial performance.

3. Competitive Landscape In The Respiratory Device Market:

Companies are increasingly exiting the respiratory devices market as part of strategic refocusing efforts. They may choose to divest from less profitable segments to concentrate on core businesses or more lucrative markets.

Exits Strategies Of Key Companies Impacting The Respiratory Devices Industry:

Exit Players

Exit Market

Key Updates

Market Impact

Philips Respironics

Oxygen Concentrator & Mechanical Ventilator

- In January 2024, Philips stopped the sales of various respiratory device product lines in U.S.

- Philip plans to restructure its business with a smaller, more focused product portfolio, with severance costs and savings from building shutdowns uncertain at this time.

Invacare Corporation

Oxygen Concentrator

- In November 2022, Invacare Corporation discontinue its respiratory products line, including HomeFill and stationary & portable oxygen concentrators.

- According to the consolidated report by the company, in Q23, Incarve's net sales decreased by 17.7% due to the divestiture of respiratory products and product rationalization.

Medtronic

Mechanical Ventilator

- In February 2024, Medtronic announced to exit the ventilator business and merge its PMRI segments into a new unit called Acute Care and Monitoring (ACM).

- By discontinuing the unprofitable ventilator line, Medtronic reallocated resources to other segments within the ACM unit. This move is expected to enhance investment in areas with better growth potential and higher profitability.

Impact Of Notable Player Exits On Market Dynamics

Strategic innovation opportunities: The exit of Philips creates both challenges and opportunities for other market players, prompting innovation in response to home care provider needs. Companies like GCE Healthcare are stepping in with new product offerings to fill gaps in the market.

Optimistic scenario for competitors: The exit of Respironics open lucrative opportunity for companies like GCE Healthcare, Inogen, CAIRE, DeVilbiss, and Rhythm Healthcare to strengthen their market position and financial performance by pursuing strategic initiatives.

4. Other Ongoing Trends In The Respiratory Devices Industry

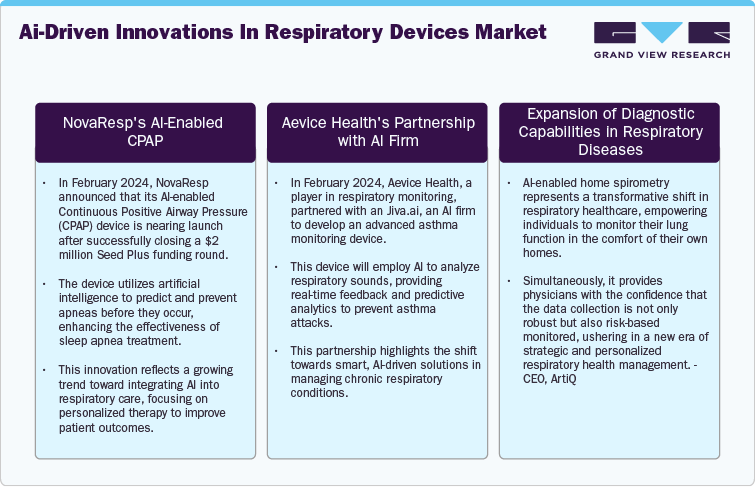

AI-driven innovations in respiratory devices market

The ongoing trends in the respiratory devices industry are heavily influenced by the integration of AI and advanced diagnostics. The quantitative growth in market penetration, investment, and early detection rates underscores the transformative impact these innovations are expected to have on respiratory care, leading to more effective treatments and cost savings in healthcare.

List Of Notable Players Operating In The Respiratory Devices Market

-

GE Healthcare

-

ICU Medical (Smiths Medical)

-

React Health

-

Medtronic

-

Fisher & Paykel Healthcare

-

ResMed

-

CAIRE, Inc. (Acquired by Niterra Co., Ltd. formarly known as NGK SPARK PLUG CO., LTD.);

-

Linde

-

Mindray

-

Chart Industries

-

Drägerwerk AG & Co. KGaA

-

Drive DeVilbiss International

-

Inogen, Inc.

-

Novartis International AG

-

Hamilton Medical.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified