Report Summary

Deliverable Overview

The animal health team at Grand View Research has estimated and forecasted a trend report of the Pet Training Service Providers for key countries across the globe. The trend report consists of a list of 400 pet training service providers including parameters such as headquarter, service offerings, website links, type of pet species served, service cost, contact details, and establishment year. The countries covered in the report represent key markets where pet population, pet expenditure, pet humanization, and the penetration of pet services were estimated to be the highest. The dataset is provided in Excel format.

Report Overview

The global pet services market size is expected to reach USD 50.07 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to grow at a CAGR of 9.21% from 2023 to 2030. The key factors driving the market growth include an increasing number of pet owners and spending on pets. The rising cost of pet ownership is indicative of a larger cultural trend where pets are now seen as essential family members as opposed to mere pets. People are more likely to prioritize spending on their pets' well-being as they become wealthier and more urbanized, which includes buying them upscale food, high-quality medical care, grooming, and accessories.

Pets provide companionship and emotional support, especially in stressful or solitary moments. More people are realizing the advantages of having pets as mental health awareness is increasing, which is expected to drive the spending by consumers on pet-related products and services.

For instance, in November 2023, the U.S. Bureau of Labor Statistics conducted a study tracking expenditure on pets over 8 years, i.e., from 2013 to 2021. The study revealed that there was a 77.9% rise in spending on pets in the U.S. This study also concluded that compared to total spending, average annual income, and other entertainment expenses, pet expenses rose more quickly.

According to data published by Hepper in January 2024, pet ownership increased during the pandemic, with 59% of UK households now owning at least one pet and many owning two or more. As a result, an estimated USD 10.1 billion is spent annually on food and treats for pets, in addition to USD 1.3 billion on pet insurance and USD 5.1 billion on veterinary care & other services.

The growing trend of pet humanization, where pets are seen as family members rather than possessions, combined with a lack of pet-friendly travel options, has significantly increased the adoption of pet services such as pet boarding. As pet owners prioritize their pets' well-being and struggle to find suitable travel accommodations, they turn to professional boarding facilities that offer specialized, high-quality care. This shift has led to higher demand for pet boarding services, with many facilities reaching full capacity well in advance of peak seasons, such as holidays and summer.

Pet training service providers offer specialized programs to help pet owners teach their pets proper behavior, commands, and skills. These services can range from basic obedience training to more advanced or specialized programs, such as behavior modification, service animal training, or even agility and sports training. Key factors shaping the pet training service market include increased pet ownership, pet humanization, and others. As more households adopt pets, the demand for professional pet training services has risen, especially with first-time pet owners seeking guidance. Moreover, with urbanization and smaller living spaces, many pets face stress, leading to behavioral problems like excessive barking or separation anxiety. Service providers focus on resolving these issues to ensure a harmonious household.

Furthermore, people are more aware of the psychological benefits of strong bonds with their pets. This has led to higher demand for training services that promote better communication and understanding between pets and their owners, fostering a sense of emotional well-being. Just like humans, pets can experience anxiety, stress, or behavioral issues. Pet training services are evolving to include specialized programs that address these mental health challenges, aiming to reduce pet stress and improve overall well-being.

|

Sr. No |

Service Providers |

Establishment Year |

HQ/ Location |

Revenue, 2023* |

Type of Services |

Pet Type |

Contact Details |

Service Cost* (USD) |

Website Link |

|

1 |

West Tennesse K9 |

2013 |

U.S. |

- |

Obedience Training |

Dogs |

(901)283-2323 |

775 for 5 sessions |

https://wtnk9.com |

|

|

|

|

|

|

Board and Train |

|

|

|

|

Pet Training Service Providers Report Scope

The deliverable consists of around 400 pet training service providers along with their headquarter, service offerings, website links, type of pet species served, contact details, and establishment year.

|

Report Attribute |

Details |

|

Total number of tabs in the database |

10 |

|

Total number pet training service providers |

400 |

|

Deliverable format |

Excel |

|

Service scope |

Obedience Training, In-Home Training, Board and Train, Sports Training, Personal Protection Training, Others |

|

Pet Scope |

Dogs, Cats, Other Pets |

|

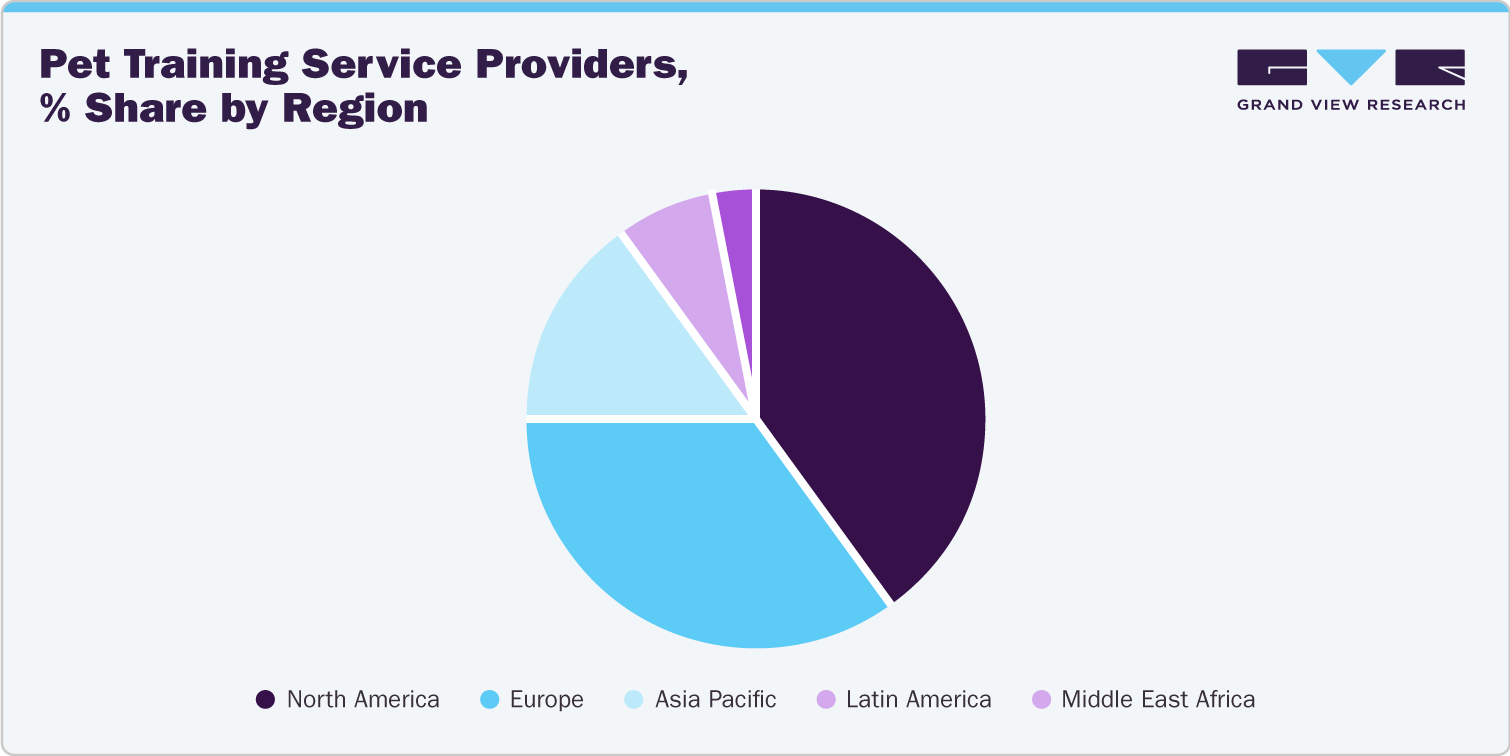

Region Scope |

North America, Europe, Asia pacific, Latin America, Middle East Africa |

|

Country Scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Customization scope |

Free report customization (equivalent to up to 4 analysts' working days) with purchase. Addition or alteration to country, & regional scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |