- Home

- »

- Market Trend Reports

- »

-

Emerging Technologies In Orthopedic Industry Insights

Industry Insights

1.1 Emergence Of Smart Implants And Applications And Software In Orthopedic Industry

The orthopedic industry is experiencing a transformative shift due to the advent of smart implant technologies alongside innovative apps and software. Smart implants, equipped with sensors, offer real-time monitoring of implant health and surrounding tissue, enabling early detection of potential issues and ensuring timely interventions. At the same time, apps enhance patient engagement through personalized recovery plans, medication reminders, and direct communication with healthcare providers while wearable devices monitor progress. Furthermore, software solutions are revolutionizing surgical planning by utilizing patient-specific data to optimize implant selection and positioning with unparalleled precision.

1.1.1 Smart Orthopedic Implants

Osteoarthritis (OA) is a common condition that affects many people, and it is projected to impact almost a billion people by 2050, according to data published by the Institute for Health Metrics and Evaluation in August 2023. Furthermore, according to a recent study titled “Global, regional, and national burden of OA, 1990–2020 and projections to 2050,” the number of people diagnosed with OA has increased by 132.2% since 1990, with around 595 million globally diagnosed with the condition in 2020. The study also predicts that by 2050, cases of OA for the knee, hand, hip, and other types of OA will increase by significant percentages of 74.9%, 48.6%, 78.6%, and 95.1%, respectively.

Benefits Offered By Smart Orthopedic Implants:

-

Real-time monitoring

-

Personalized care

-

Patient engagement

-

Quality data

Technologies Used By Companies For Smart Implants:

-

Verasense

-

Sensor for the Spine

-

Smart Screw System:

-

BoneTag

Research Institutes/Universities Working on Smart Implants

-

Wireless Sensors for Smart Orthopedic Implants (The Ohio State University

-

Smart Bone Plates for Monitoring Fracture Healing (University of California, San Francisco)

-

Smart, Self-Powered Knee Implants (Binghamton University, University of Western Ontario, & State University of New York)

-

Smart Implant for Orthopaedic Surgery (SImOS – a Nano-Tera Project)

1.1.2 Orthopedic Apps, Platforms, And Software

The use of technology in orthopedic healthcare is growing as there is a rising demand for orthopedic apps, platforms, and software solutions. These tools offer various benefits, such as improved patient engagement, efficient practice management, and better clinical outcomes. From monitoring patients to guiding them through rehabilitation and assisting in surgical planning & decision-making, orthopedic apps and platforms cater to multiple aspects of orthopedic care delivery. The adoption of these solutions is expected to continue growing, especially with the increasing prevalence of musculoskeletal conditions and the growing focus on value-based care. By leveraging these tools, healthcare providers and patients can work together to optimize orthopedic treatment & management.

List of orthopedic apps that can help enhance patient care and educational resources in practice through advanced technology.

App Name

Description

Pros

Cons

Use Cases

Pricing

Exer Health

An AI-driven app measuring patient mobility and participation in Home Exercise Protocols (HEPs) postorthopedic surgery. Includes a messaging platform for personalized care. Collects patient data and X-rays for insights into treatment.

- Run higher-quality in-person sessions with less effort

- Achieve better recovery outcomes faster

- Collect more nuanced and reliable data

- Help avoid physical therapist burnout

- Offers search functionality for multimedia resources

- Requires in-depth knowledge of orthopedic practices

Perfect for orthopedic surgeons & residents and physical therapists needing efficient patient mobility measurement and HEP compliance monitoring.

Subscription-based model

1.2 Initiatives By Key Stakeholders in Orthopedic Industry

Orthopedic companies are launching a variety of products and services specifically designed for ambulatory surgical centers (ASCs):

-

Johnson & Johnson Medical Device Companies has developed a platform to provide ASCs with diverse pricing and contracting options and operational support. This includes capital programs for purchasing/leasing equipment, rebates, coding/reimbursement assistance, and infection risk-management services.

-

Stryker launched an ASC-focused business in 2020 that offers over 13,990 unique products across more than 22 procedure categories. Stryker provides flexible payment options for ASCs, including equipment leasing and customized payment plans.

-

Smith+Nephew launched its Aria platform, designed to help coordinate care between the ASC, physicians, and patients. It provides tools for patient selection, care pathways, feedback/reporting, and patient engagement.

These companies are investing in research and development to create innovative products specifically for the ASC setting, such as smaller and more portable equipment, disposable instruments, and customized solutions to address ASCs' needs around cost control, workflow efficiency, scalability, and growth.

Orthopedic device companies are also adapting their distribution and inventory management models to serve better the unique requirements of ASCs, such as limited storage space. This includes implementing just-in-time delivery, consignment inventory, and improved demand forecasting.

Overall, the shift of orthopedic procedures to the ASC setting has prompted major device companies to develop tailored products, services, and business models to effectively compete in this growing market.

1.3 Orthopedic Technology Trends for 2024

1.3.1 Deep Learning (DL) And Generative Artificial Intelligence (AI) in Orthopedic industry

In orthopedics, integrating Deep Learning (DL) and Generative Artificial Intelligence (AI) is revolutionizing preoperative planning through enhanced speed and precision. This evolution transforms the approach to orthopedic surgeries, enabling surgeons to utilize AI-driven insights for increased accuracy and patient-specific interventions. Deep learning significantly improves medical imaging analysis for preoperative planning. By training on vast datasets of orthopedic images, DL algorithms have become adept at identifying minute discrepancies, fractures, and complex structural differences. This advancement gives surgeons a comprehensive understanding of a patient's musculoskeletal condition, leading to more precise preoperative evaluations.

1.3.1.1 Recent Developments And Strategies In AI Technology In Orthopedic Industry

-

In December 2023, Sancheti Hospital, India, launched OrthoAI, a pioneering generative AI tool designed to assist orthopedic specialists by providing them extensive access to medical literature. This leverage artificial intelligence in orthopedics, aims to equip doctors with up-to-date knowledge by aggregating thousands of articles and videos in a single platform, thereby enhancing their decision-making capabilities.

1.3.1.2 Benefits Of Using AI In Orthopedics

AI technologies are at the forefront of transforming orthopedic medicine by significantly improving various aspects of the field. These advancements are key in enhancing diagnostic accuracy and optimizing operational efficiencies. For example, an advanced Deep Learning (DL) algorithm has showcased its capability by identifying nine distinct types of knee arthroplasty implants from four different manufacturers with a remarkable 99% accuracy rate. This is set to reduce the time and cost involved in accurately determining the manufacturer and model of implants for patients undergoing revision surgeries such as Total Knee Arthroplasty (TKA), Unicompartmental Knee Arthroplasty, or Distal Femoral Replacement.

1.3.2 Diagnostic Imaging

Diagnostic imaging plays a crucial role in the assessment, planning, and follow-up of orthopedic implants.

-

Preoperative Planning: Before implantation, diagnostic imaging techniques such as X-rays, CT scans, and MRI scans are used to assess a patient's anatomy, identify the extent of the injury or degeneration, and determine the appropriate implant size, type, & placement.

-

Implant Selection and Positioning: Diagnostic imaging assists surgeons in selecting the most suitable orthopedic implant and determining its optimal position and alignment during surgery.

-

Assessment of Implant Integration: After implantation, diagnostic imaging is used to evaluate the integration of the implant with the surrounding bone and tissues. X-rays and CT scans can assess bone healing, implant stability, and any signs of loosening or failure.

-

Detection of Complications: Diagnostic imaging helps detect and diagnose complications associated with orthopedic implants, such as infection, implant failure, hardware loosening, and periprosthetic fractures.

-

Long-term Monitoring: Diagnostic imaging is used for long-term monitoring of patients with orthopedic implants to assess implant performance, detect potential complications, and guide treatment decisions.

1.3.3 Smart Sensor - Enabled Technologies And Implants

Smart sensor-enabled technologies have revolutionized the field of orthopedic implants, offering advancements in monitoring, feedback, and customization. These technologies utilize sensors to gather real-time data on implant performance, patient movement, and physiological parameters, allowing personalized treatment & improved outcomes. For enhanced patient care throughout the treatment, smart implants feature inbuilt sensors that give surgeons real-time information for positioning and postoperative evaluation. These implants may reduce periprosthetic infection, which is becoming more common in orthopedic surgery.

1.3.4 Picture Archiving And Communication System (PACS)

A Picture Archiving and Communication System (PACS) is a medical imaging technology used primarily in healthcare organizations to securely store and digitally transmit electronic images and clinically relevant reports. The PACS system is designed to replace traditional film-based systems and provide easy access to images and related data across different physical locations.

Types of PACS Systems

-

Traditional PACS

-

Cloud-Based PACS

-

Hybrid Systems

Future Outlook

-

Cloud-Based PACS: Increasingly, PACS are moving to cloud-based solutions, offering scalability, cost savings, and enhanced accessibility.

-

Artificial Intelligence: AI is being integrated into PACS to assist in image analysis, potentially improving diagnostic accuracy and workflow efficiency.

-

Enhanced Mobility:

Mobile PACS solutions enable healthcare professionals to access images and reports on tablets and smartphones, improving flexibility and response times.

1.3.5 3D Printing Technology

Orthotics, medical gadgets, and customized implants may now be created via 3D printing using a variety of materials. The use of 3D printing technology shortens recovery times after surgery, saves money, improves the durability of the implant over time, and enhances the clinical results of surgical treatments. In November 2021, Smith+Nephew launched a cementless total knee arthroplasty system integrated with the advanced technology of 3D printed porous titanium, LEGION CONCELOC.

3D printing technology has significantly impacted the field of orthopedic implants, offering numerous advantages in design flexibility, customization, and manufacturing efficiency.

1.4 Investments in the Orthopedic Industry

1.4.1 Orthopedic Industry Funding

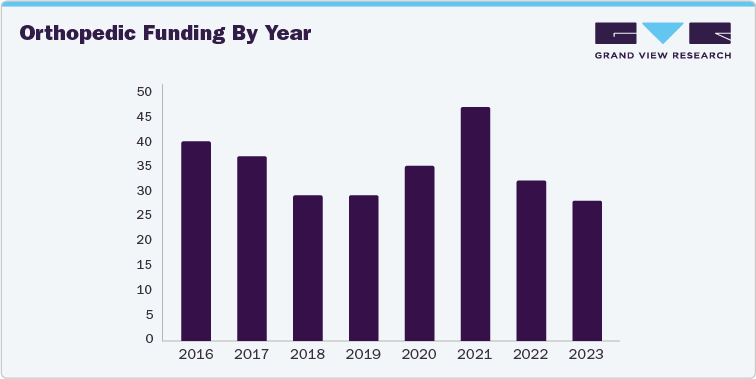

Investors within the orthopedic sector are demonstrating caution, leading to a deceleration in investment flow. However, current trends indicate a pivot in investor interest towards sectors characterized by innovation, specifically enabling technology and sports medicine.

Based on data extracted from 282 orthopedic funding announcements from 2016 to the present, a 5% increase in total funding post-COVID has been observed, with notable activity increased by the unique market conditions of 2021.

While overall investment activity has decreased in the last two years, investments with disclosed funding amounts have seen a 10% growth post-pandemic, particularly towards later-stage companies and substantial investments aimed at driving profitability.

1.5 U.S. Orthopedic Industry

1.5.1 Overview

The U.S. market for orthopedic devices is driven by factors such as an increase in healthcare expenditure across the globe, and an increase in the applications of 3D printing in the healthcare sector. The regulatory compliance requisites and the requirement of high capital investment are restricting the entry of new players into the market.

1.5.2 Competitive Scenario

Companies offering various types of devices are increasingly adopting expansion strategies, such as product launches, mergers, acquisitions, partnerships, and collaborations.

-

In March 2023, Bioretec Ltd received FDA approval for its bioresorbable metal product, RemeOs trauma screw, for the healing of bone fractures. This product is a combination of traditional surgical techniques with the latest bioresorbable polymer implants, which is patient-friendly and eliminates the need for implant removal operations.

-

In June 2021, Orthofix Medical, Inc., a multinational medical device firm with a focus on spine and orthopedics, announced the launch of its 3D-printed FORZA Titanium Posterior Lumbar Interbody Fusion (PLIF) spacer system in the U.S. and its first patient implantation. The system comprises Nanovate technology and is a lumbar interbody device with titanium that allows the bone to grow into and through the spacer. The device was created to improve PLIF surgeries.

1.5.3 Regulatory Framework

Aspect

Details

Regulatory Body

Food and Drug Administration (FDA)

Applicable Regulations

Title 21 of the Code of Federal Regulations (CFR), Part 888

Legislation

Medical Device Amendments (MDA) of 1976, Safe Medical Devices Act (SMDA) of 1990

Product Marking

Unique Device Identification (UDI) system, FDA Registration

1.5.4 Emerging Technologies

Emerging technologies in orthopedics in the U.S. are revolutionizing the field, offering innovative solutions, and improving patient outcomes. Some of the advanced technologies transforming orthopedic surgery include:

-

3D Printing: This technology allows for the creation of patient-specific implants and surgical instruments, enhancing precision and customization.

-

Robotics: Robotic-assisted surgery provides higher accuracy and precision, improving implant placement and alignment and improving outcomes.

-

Augmented Reality (AR): AR overlays virtual information onto the surgeon's field of view, offering real-time guidance and enhancing surgical accuracy.

-

Smart Implants and Wearable Technology: Equipped with sensors, these devices monitor patient movement, load distribution, and implant performance, aiding in postoperative progress assessment and personalized treatment plans.

-

Online-based Orthopedic Visits: Telemedicine allows remote consultations with orthopedic specialists, making healthcare more accessible and convenient for patients.

-

Digital Templating: Advanced imaging technology and software facilitate precise implant selection and placement, improving surgical accuracy and reducing surgical time.

-

Synergy Spine Advances with Equity Financing: Synergy Spine Solutions closed a Series A equity financing of USD 30 million to propel its cervical artificial disc development. The investment will facilitate clinical trial enrolment and review of Premarket Approval applications, further increasing its cervical disc portfolio. The company’s Synergy Disc trials are positioned to assess safety and efficacy vis-à-vis anterior cervical discectomy and fusion for degenerative disc disease treatment.

1.5.5 Investments And Funding Analysis

-

Synergy Spine Advances with Equity Financing: Synergy Spine Solutions closed a Series A equity financing of USD 30 million to propel its cervical artificial disc development. The investment will facilitate clinical trial enrolment and review of Premarket Approval applications, further increasing its cervical disc portfolio. The company’s Synergy Disc trials are positioned to assess safety and efficacy vis-à-vis anterior cervical discectomy and fusion for degenerative disc disease treatment.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified