1.1 Orthopedic Devices Market Size & Trends

The global orthopedic devices market size was estimated at USD 60.4 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The market is driven by a high incidence of orthopedic disorders, a growing aging population, an increasing degenerative bone disease, and a growing number of road accidents. The early onset of musculoskeletal disorders caused by sedentary lifestyles and unhealthy habits is projected to fuel market growth.

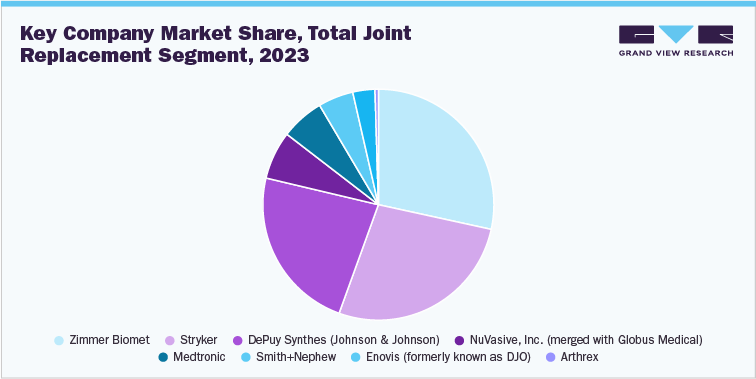

1.2 Total Joint Replacement/ Orthopedic Implants Segment Sales Performance

The joint replacement/orthopedic implants segment led the market with the largest revenue of USD 25.2 billion in 2023. Increasing number of joint replacement surgeries across the globe is fostering market growth. According to the American College of Rheumatology, over 450,000 hip replacements and more than 790,000 knee replacements are performed annually in the U.S. alone. Moreover, the adoption of robotic-assisted joint replacement surgeries is also contributing to the market. A study titled “Trends in Computer-Assisted Surgery for Total Knee Arthroplasty in Germany: An Analysis Based on the Operative Procedure Classification System between 2010 to 2021” found that robot-assisted Total Knee Arthroplasty (R-TKA) surgeries have increased significantly between 2018 and 2021, with an average annual increase rate of 84.74%. Furthermore, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are anticipated to influence segment growth positively.

The joint replacement/ orthopedic implants segment includes 4 sub segments such as lower extremity implants, spinal implants, dental, and upper extremity implants.

Lower Extremity Implants

The lower extremity implants segment growth can be attributed to the aging population, the increasing prevalence of orthopedic conditions, advancements in implant materials & designs, and the growing demand for improved quality of life through surgical interventions. In addition, the number of R&D initiatives is increasing to enhance these implants’ longevity, functionality, & biocompatibility through innovative materials and minimally invasive surgical techniques. Some of the strategic initiatives undertaken by key players in the market:

-

In October 2023, DePuy Synthes, a company within the Johnson & Johnson Medical Devices Companies, received FDA clearance for the TRILEAP Lower Extremity Anatomic Plating System. This system is designed to aid in the treatment of various lower extremity conditions, providing orthopedic surgeons with advanced tools to address patient needs effectively.

Upper Extremity Implants

The rising incidence of sports-associated injuries and the growing preference for implants due to their numerous advantages are expected to drive segment growth over the forecast period. In addition, the rising number of upper limb surgeries is facilitating the demand for artificial limbs and implants. According to recent data from the American Academy of Orthopedic Surgeons, over 53,000 shoulder replacement surgeries are performed in the U.S. annually, and shoulder & elbow replacement surgeries are among the top 10 most common orthopedic surgeries. Some of the strategic initiatives undertaken by key players in the market:

-

In September 2023, ONWARD, a healthcare company, obtained nine Breakthrough Device Designations from the FDA for its ARC Therapy platform. This therapy uses external ARC-EX or implantable ARC-IM systems to provide accurate spinal cord stimulation. ONWARD announced the successful use of the ARC-IM Stimulator with Brain-Computer Interface (BCI) in a human subject. This treatment aims to restore arm, hand, and finger functionality after experiencing spinal cord injury.

Spinal Implants

The increasing number of spinal cord injuries worldwide is one of the major factors expected to boost the segment. Spinal fusion is a procedure used to correct problems with the spine and for immobilization of the spinal column. The rising geriatric population, which is highly prone to spondylolisthesis & degeneration of discs, and an increasing number of trauma cases due to road accidents & sports injuries are expected to drive the demand for orthopedic implants for spinal fusion. Compression of the spinal cord or injury causes damage to the exterior of the cord. The primary causes of this compression include bone fractures, spinal degeneration, or diseases such as herniated or hematoma discs. Hence, the rising number of individuals suffering from these causes is expected to fuel segment growth over the forecast period. Some of the strategic initiatives undertaken by key players in the market:

-

In January 2023, Companion Spine acquired Backbone SAS. With the addition of Backbone’s primary medical device, the LISA implant, the acquisition expanded the number of companies offering medical implant solutions. Due to this, Companion Spine can provide a full range of therapy options for spine diseases, including lumbar stenosis and degenerative disc disease, by matching implants to the disease’s severity.

Dental Implants

Dental implants are artificial tooth roots that provide a solid basis for removable or fixed replacement teeth that are custom-made to match the original teeth. They are surgical components that interface with the bone of the jaw or skull to support prosthetics used for dental purposes, such as bridges, dentures, crowns, and facial prosthetics. In addition, these implants are used as orthodontic anchors holding dental and jaw bones in place. Hence, the increasing applications of dental implants in numerous therapeutic areas and the growing demand for prostheses are expected to propel segment growth. Some strategic initiatives in the dental implants segment include:

-

In May 2023, Straumann acquired GalvoSurge, a manufacturer of dental medical devices based in Switzerland. The company specializes in implant care and maintenance solutions, with its concept for supporting peri-implantitis treatment - the GalvoSurge Dental Implant Cleaning System GS 1000 - holding a CE mark and has been in the market since 2020.

Zimmer Biomet

- ROSA Robotics Expansion: Zimmer Biomet has received FDA clearance for its ROSA Shoulder System, the world's first robotic surgical assistant for shoulder replacement surgery. This joins their existing ROSA Knee and ROSA Hip systems, expanding their comprehensive ROSA Robotics portfolio.

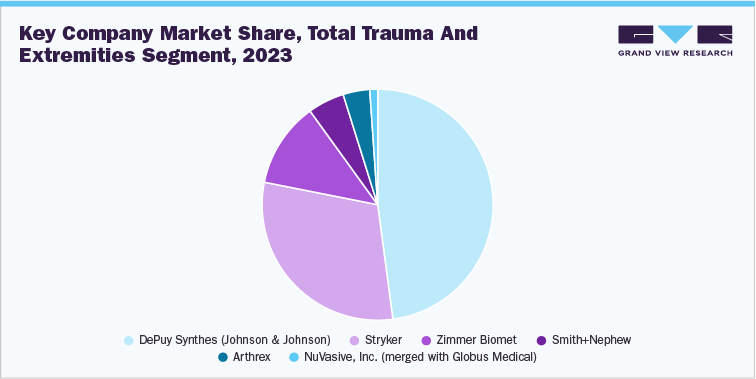

1.3 Total Trauma and Extremities Products Segment Sales Performance

The trauma segment is expected to witness significant growth over the forecast period with a revenue of USD 14.2 billion in 2023. Rising urbanization in developing countries, which leads to innumerable road accidents and improving healthcare facilities is anticipated to drive the growth of the segment. The percentage of road accidents in low-income countries is as high as 24% compared to the 9% observed in high-income countries. This is an attractive opportunity for smaller companies to expand their business into these regions. Local implants are preferred in low-income countries due to their low prices, thus adding to the advantages of these devices for the sector players. Furthermore, market players contribute to the growth through research and seeking approval for their innovative products. The National University of Science and Technology MISIS has developed a therapeutic product for medulla trauma, which damages the spinal cord. The R&D activities aimed at improving the quality of the existing products and making them biocompatible, surgeon-friendly, and affordable.

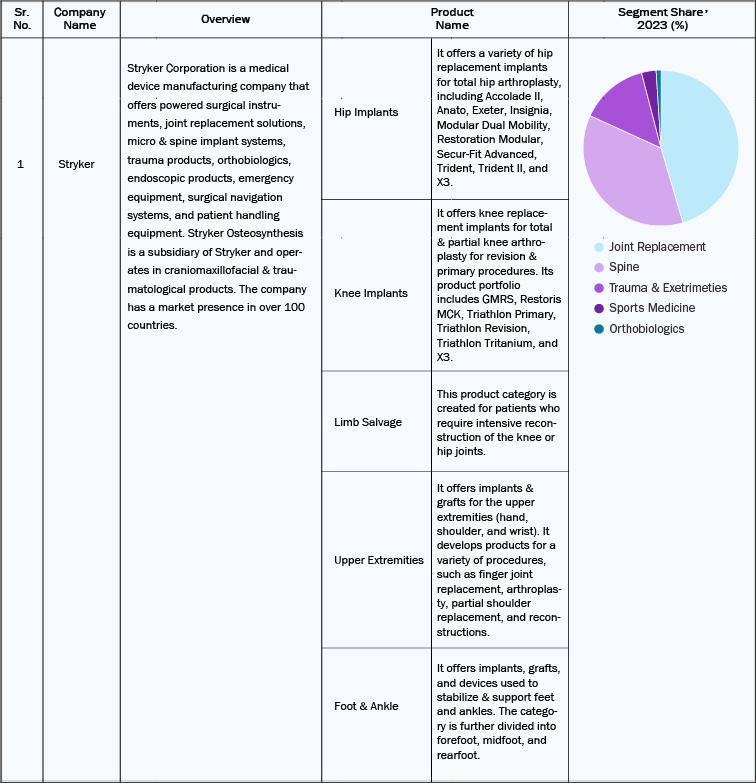

Stryker

-

Stryker has agreed to purchase Artelon, Inc., known for its pioneering soft tissue fixation solutions tailored for foot and ankle procedures and sports medicine. With this strategic move, Stryker aims to enhance its soft tissue fixation product line, delivering a wider and more comprehensive selection of offerings to meet the diverse needs within the foot, ankle, and sports medicine area.

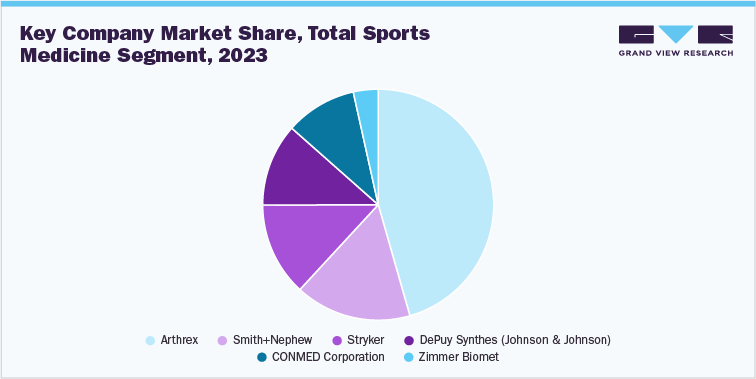

1.4 Total Sports Medicine Segment Sales Performance

The sports medicine market was estimated at USD 7.2 billion in 2023 and is expected to witness fastest growth over the forecast period. Demand for sports medicine has gained traction in recent years, owing to the rising incidences of sports injuries and growing participation in sports and fitness-related activities by people. In addition, a gradual shift from proactive care to preventive care concerning sports injuries is further projected to drive the market. For instance, according to The Johns Hopkins University, 30 million people participate in some kind of sports, and over 3.5 million injuries are reported annually in the U.S. Furthermore, the need for minimally invasive procedures is increasing due to reduced trauma and faster recovery compared to invasive alternatives. During minimally invasive knee replacement surgeries, fewer muscles & tendons are affected, offering more natural results. Wound closure is easier, and recovery time is shorter than traditional procedures. Growing concern about surgical scars is a major driver of this segment. Lesser blood loss is also an added advantage of these surgeries. For instance, in May 2021, Stryker Corporation installed more than 1,000 Mako surgical robots worldwide and performed more than 500,000 procedures with these surgical robots.

Smith+Nephew

-

Smith+Nephew launched a new approach for ACL surgery, the UltraTRAC QUAD ACL Reconstruction Technique. This innovative method comprises the QUADTRAC Quadriceps Tendon Harvest Guide System, the ULTRABUTTON Adjustable Fixation Devices series, and the X-WING Graft Preparation System. Its primary purpose is to facilitate less invasive harvesting of quadriceps grafts.

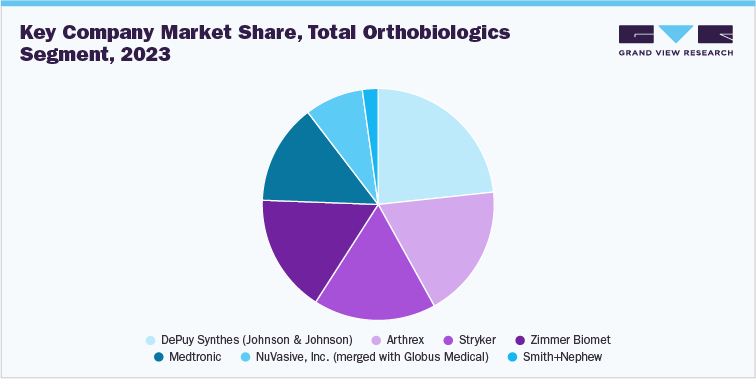

1.5 Total Orthobiologics Segment Sales Performance

The ortho-biologics segment is anticipated to witness at the fastest CAGR over the forecast period and was estimated at USD 6.4 billion in 2023. Increasing adoption of strategic initiatives by key market players to expand their product portfolio and geographic reach is driving segmental growth. In July 2023, Anika Therapeutics Inc. announced that its Tactoset injectable bone substitute has been granted clearance for further use with autologous bone marrow aspirate under FDA 510(k). In addition, in June 2022, Istos Biologics introduced a new product line called Influx Fibrant. These products are made of 100 percent cortical allograft. The Influx Fibrant line includes five different products: the Fibrant anchor, Fibrant pak, Fibrant wrap, Fibrant bullet, and Fibrant boat.

Medtronic

-

Medtronic received FDA device designation for its Infuse Bone Graft in transforaminal lumbar interbody fusion (TLIF) procedures. This designation applies to the use of Infuse with an intervertebral fusion device and metallic screw and rod system in TLIF surgical approaches for treating degenerative disc disease at one or two adjacent levels from L2 to S1.

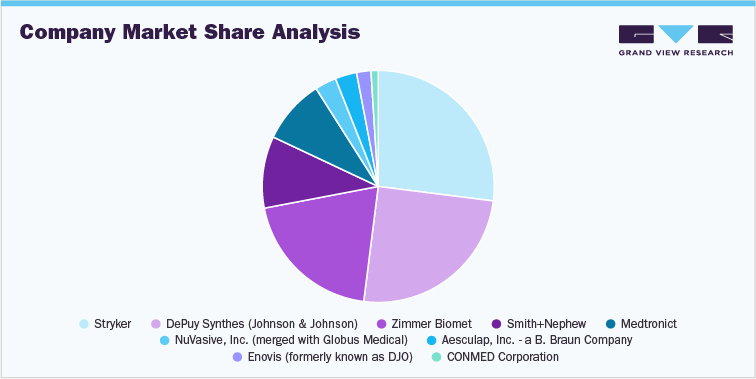

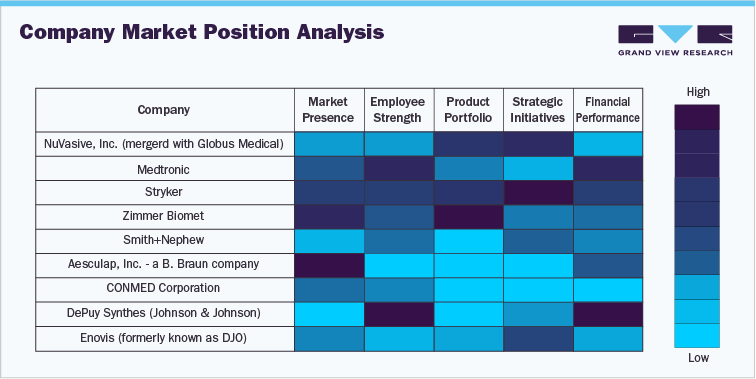

1.6 Company Market Position Analysis

1.7 Company Market Share Analysis