- Home

- »

- Market Trend Reports

- »

-

Ophthalmic Devices Industry: A $10.27Bn Ultrasound Systems Opportunity

Global Ophthalmic Devices Industry Outlook

Artificial intelligence (AI) is creating significant opportunities in the early detection of eye diseases like diabetic retinopathy. AI-powered systems identify subtle abnormalities in retinal images that eliminate human observation. This has the potential to significantly improve patient outcomes by enabling earlier intervention and treatment.

Asia Pacific (APAC) region is anticipated to have the highest growth opportunity in the coming years. Regional growth is driven by several factors such as rising demand for eye care, aging population, government initiatives, increasing growth strategies by key market players and technological advancements.

In December 2023, Kubota Vision Inc., a clinical-stage ophthalmology company, secured a strategic partnership with AUROLAB, an Indian manufacturer of ophthalmic consumables. This agreement grants AUROLAB an exclusive license for the development, manufacturing, supply, and distribution of Kubota Vision's eyeMO device.

In January 2024, German tech company Carl Zeiss sees India as a key market for its AI-powered medical devices due to the rising number of diabetic retinopathy cases across India.

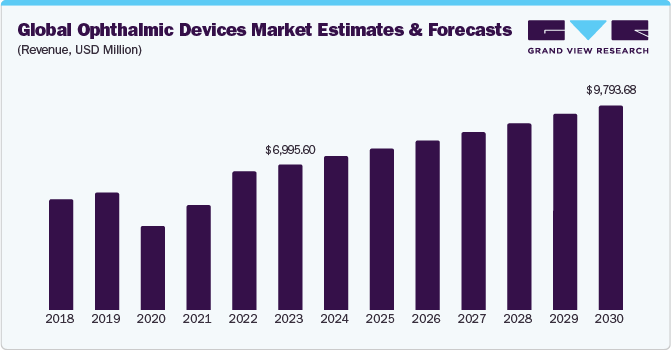

The global ophthalmic devices market is anticipated to witness substantial growth, projected to escalate from USD 7.0 billion in 2023 to USD 9.79 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 4.9%

As the global population ages, the prevalence of age-related eye diseases such as cataracts, glaucoma, and macular degeneration is rising significantly. This creates a growing demand for diagnostic tools, surgical equipment, and intraocular lenses (IOLs) for treatment. Cataract surgery is one of the most common operations in the U.S. For instance, as per National Eye Institute by age 80, over half of the population over 80 either has cataracts or has undergone cataract surgery.

Minimally invasive surgical techniques such as laser vision correction and micro incisional cataract surgery are gaining popularity. These procedures offer faster recovery times, reduced patient discomfort, and potentially quicker visual restoration, leading to a higher adoption rate of ophthalmic devices.

Ophthalmic Devices Industry Competitive Landscape

Companies are increasingly focusing on developing and emerging markets with a growing demand for affordable ophthalmic devices. The market is dominated by a few well-established companies with a diversified product portfolio and strong global presence. Examples include Alcon, Bausch Health Companies Inc., Carl Zeiss Meditec AG, Johnson & Johnson Vision Care, Inc and others.

These leading players compete across various segments, including cataract surgery devices, intraocular lenses (IOLs), refractive surgery platforms, and diagnostic equipment. They invest heavily in research and development (R&D) to stay ahead of the curve with new technologies and product innovations.

For instance, in April 2024, Warburg Pincus invested significantly in Appasamy Associates, bolstering India's dominant player in the ophthalmic equipment and intraocular lens market. Established players acquire emerging companies to gain access to their technology or expertise, further consolidating the market. For instance, in a strategic move to expand its ophthalmic device portfolio, Carl Zeiss Meditec signed an acquisition agreement with the Dutch Ophthalmic Research Center in December 2023.

Ophthalmic Devices Market Opportunity

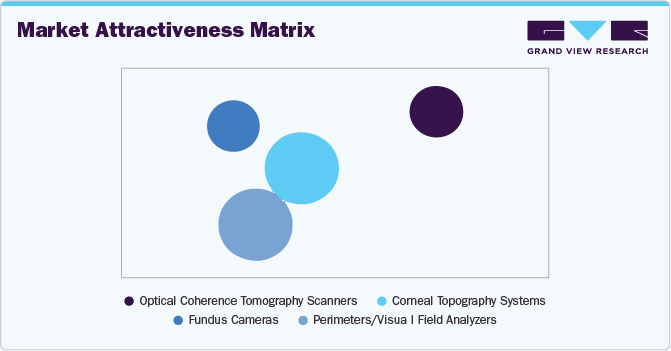

Optical Coherence Tomography (OCT) Scanners hold the largest market share within the ophthalmic devices market. OCT scanners offer a non-invasive and detailed view of the eye's internal structures, making them highly versatile for various purposes preoperative planning and evaluation during cataract surgery, imaging the cornea for refractive surgery procedures and others. Compared to traditional diagnostic methods, OCT scans are painless, quick, and require minimal patient preparation. This makes them more comfortable and convenient for patients. OCT scanners provide high-resolution cross-sectional eye images, allowing ophthalmologists to detect subtle abnormalities and make more accurate diagnoses. Additionally, advancements in OCT technology are also further fueling market growth. Newer OCT scanners offer faster image acquisition times, improving patient comfort and efficiency. Advancements in technology are leading to higher resolution images with clearer visualization of different retinal layers. Development of portable and more affordable OCT devices is expanding their reach into remote areas and facilitating wider adoption.

Cataract dominates the application segment owing to the rising cases of cataract across the globe. Cataracts are the leading cause of vision loss globally, affecting a significant portion of the aging population. This creates a constant demand for cataract surgery and the devices used to perform it. The field of cataract surgery is constantly evolving, with advancements such as phacoemulsification and foldable intraocular lenses (IOLs) making the procedure minimally invasive and more efficient. These advancements lead to increased adoption of novel devices.

Hospitals and eye clinics hold the largest market share in the end-use segment of the ophthalmic devices market. Hospitals and eye clinics are the primary healthcare settings where ophthalmologists practice and perform eye surgeries and procedures. This makes them the natural hub for using a wide range of ophthalmic devices. Hospitals and clinics require a diverse range of ophthalmic devices to cater to various diagnostic and treatment needs.

Global Ophthalmic Devices Industry Trends

AI powered Diagnostics: Artificial intelligence is revolutionizing early disease detection through retinal image analysis. This can lead to improved patient outcomes and reduced healthcare costs.

Manufacturers are heavily investing in research and development to create AI algorithms for analyzing retinal images and detecting eye diseases. This involves collaborating with research institutions and data scientists. For instance, February 2024, RetinAI, a company using AI for ophthalmic image processing, unveiled the RetinAI Discovery for Clinics platform, offering powerful AI tools for improved decision-making.

Early detection of eye diseases is crucial for preventing vision loss. AI analyzes large datasets of retinal images and identify subtle abnormalities that escape human observation. This allows for earlier intervention and treatment, potentially leading to better patient outcomes and reduced risk of vision loss.

AI systems analyze retinal images much faster than human doctors. This reduces ophthalmologists' time to focus on more complex cases and patient care, improving overall efficiency within the healthcare system.

Early detection and treatment of eye diseases lead to significant cost savings for healthcare systems. By preventing vision loss and associated complications, AI-powered diagnostics potentially reduce the need for costly interventions such as laser surgeries or treatments for advanced stages of eye diseases.

Robotic-assisted Surgery: Robotic systems are being developed to assist surgeons in performing delicate eye surgeries. These robots provide greater precision and control, potentially reducing complications and improving surgical outcomes.

Robotic arms hold surgical instruments with a much steadier hand than a human surgeon. This translates to minimal tremor and improved accuracy during delicate eye procedures, potentially reducing the risk of complications like unintended tissue damage. Robotic assistance led to the development of even more minimally invasive surgical techniques. Smaller incisions translate to faster patient recovery times and reduced discomfort.

Ophthalmic device companies are partnering with robotics companies to develop and refine robotic surgical systems specifically designed for delicate eye procedures. Manufacturers such as Preceyes Surgical System, Lensar, Ophthorobotics AG, Foresight Robotics and others are creating and developing latest robotic eye surgery for gaining larger market share.

Teleophthalmology Expansion: Teleophthalmic technologies are expanding access to eye care services in underserved regions, improving overall healthcare delivery.

Manufacturers are creating portable and easy-to-use retinal cameras and other imaging devices specifically designed for teleophthalmic consultations. These devices allow healthcare providers in remote locations to capture high-quality images for remote evaluation by ophthalmologists. For instance, in April 2024, Researchers at the National Institutes of Health (NIH) have achieved a breakthrough in retinal imaging analysis using artificial intelligence (AI). Their novel system, P-GAN, offers a 100-fold improvement in processing speed compared to traditional manual methods. Similarly, in June 2023, Eyenuk secures FDA clearance for AI-powered diabetic retinopathy detection system.

Companies are developing user-friendly teleophthalmology platforms accessible to patients with varying technical expertise. These platforms incorporate features such as secure video conferencing, image sharing tools, and educational resources.

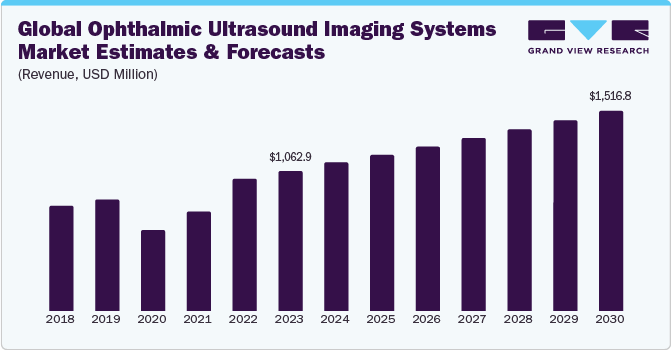

Micro incisional Techniques: The shift towards minimally invasive surgeries like micro incisional cataract surgery is gaining momentum. These procedures offer faster recovery times and improved patient experiences. Ultrasound plays a crucial role in guiding minimally invasive surgical techniques, like cataract surgery.

Manufacturers are focusing on ultrasound imaging systems that offer real-time visualization and improved image quality to support these procedures. For instance, in May 2024, ArcScan Inc., announced that ArcScan Insight 100 Ophthalmic Ultrasound Imaging System has received regulatory approval from the National Medical Products Administration (NMPA) of China.

Ultrasound remains a more affordable diagnostic tool compared to some advanced technologies like OCT. This cost-effectiveness is a trend, particularly in resource-limited settings, leading to the development of portable and user-friendly ultrasound systems for broader accessibility.

Disposable ophthalmic devices: Disposable instruments are generally designed for single use, eliminating the need for sterilization processes that damage the instrument or dull its effectiveness. This potentially translates to a more comfortable and less invasive patient experience during procedures. Disposables streamline workflows in busy clinics by eliminating the need for instrument cleaning, disinfection, and sterilization processes. This reduces staff time and potentially improves overall operational efficiency. While the initial cost of disposable devices is higher than reusables, the eliminated need for reprocessing equipment, maintenance, and potential instrument damage leads to long-term cost savings for healthcare facilities. A 2023 study published in the Journal of Hospital Administration found that the use of disposable ophthalmic instruments significantly reduced hospital-acquired infection rates in a large ophthalmic surgery center.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified