- Home

- »

- Market Trend Reports

- »

-

A Comprehensive Review Of Ongoing Clinical Trials In The Diabetes Devices Industry

![A Comprehensive Review Of Ongoing Clinical Trials In The Diabetes Devices IndustryReport]()

A Comprehensive Review Of Ongoing Clinical Trials In The Diabetes Devices Industry

- Published: Aug, 2024

- Report ID: GVR-MT-100237

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 40

- Report Coverage: 2024 - 2030

Overview Of The Diabetes Industry

The diabetes industry includes diverse products and services, such as glucose monitoring devices, insulin delivery systems, medications, and digital health solutions. As the global prevalence of diabetes rises, fueled by aging populations and lifestyle changes, the industry is growing to address the increasing need for more effective and accessible management options. Key growth areas include technological advancements such as continuous glucose monitors and artificial pancreas systems. Additionally, there is growing investment in research and development aimed at enhancing patient outcomes and quality of life.

R&D Activities In Diabetes Devices

The growth of research and development (R&D) activities in diabetes devices industry is being driven by the rising number of diabetes cases worldwide, growing awareness about the importance of effective management and prevention, and growing diabetes related healthcare expenditure. As a result, researchers are increasingly focused on inventing new technologies that can enhance the quality of care and improve patient outcomes.

Diabetes-related health expenditure per person, USD

Region

2021

2030

North America and Caribbean

8,208.9

1,767.90

Europe

3,086.4

5,505.00

South and Central America

2,190.40

2,678.40

Western Pacific

1,203.8

30,913.40

Africa

547.1

1,886.00

Middle East and North Africa

465.5

1,625.50

South-East Asia

112

22,816.90

Factors Driving R&D Growth

Increasing Diabetes Cases: The global prevalence of diabetes is on the rise, particularly type 2 diabetes, due to factors such as aging populations, urbanization, and lifestyle changes. This has created an urgent need for innovative devices that can help manage the condition more effectively.

Growing Awareness: With more public and professional awareness of diabetes and its complications, there is a growing demand for advanced technologies that can aid in early detection, continuous monitoring, and personalized treatment of the disease.

Innovation in Diabetes Technology

Continuous Glucose Monitors (CGMs): Researchers are developing more accurate and less invasive CGMs, which provide real-time glucose readings, helping patients better manage their blood sugar levels.

Insulin Delivery Systems: Innovations such as insulin pumps and hybrid closed-loop systems (artificial pancreas) are improving how insulin is administered, allowing for more precise and automated control of blood glucose levels.

Wearable Devices: The development of wearable technology for diabetes management is a major focus, offering convenience and real-time data tracking for patients.

The integration of artificial intelligence (AI) into diabetes devices marks a significant advancement in diabetes management. AI enhances the capabilities of devices like continuous glucose monitors (CGMs) and insulin pumps by allowing them to analyze large volumes of data in real-time, delivering more accurate and personalized insights for patients. With AI algorithms, these devices can predict blood glucose trends, automatically adjust insulin delivery, and provide individualized recommendations based on a patient’s unique patterns and lifestyle.

Support Through Grants And Funding

R&D activities in this field often receive significant support through various grants and funding programs. These are typically provided by:

-

Government Agencies: Various government organizations such as National Institutes of Health (NIH) offer grants that support medical research, including the development of new diabetes devices.

-

In July 2024, Diabetes Australia launched a new funding initiative aimed at advancing life-changing diabetes technologies. The Diabetes Technology Research Accelerator Grant program is specifically designed to expedite the development of innovative diabetes technologies by fostering collaboration between the medical technology, biotechnology, and pharmaceutical industries, as well as academics and clinicians. With funding of USD 250,000, this program aims to create practical solutions for those living with diabetes.

-

In May 2024, Diabetes Scotland announced that the Scottish Government has pledged up to Euro 8.8 million in additional funding for diabetes technology. This investment underscores a national commitment to ensuring that all children and a greater number of adults living with type 1 diabetes in Scotland will have access to closed-loop system technology.

-

In July 2023, The Government of Canada and JDRF Canada have jointly committed USD 33 million to research aimed at defeating diabetes.

-

Non-Profit Organizations: Foundations such as the Juvenile Diabetes Research Foundation (JDRF) and Diabetes UK provide funding to researchers working on innovative diabetes technologies.

-

In March 2024, The Juvenile Diabetes Research Foundation has awarded researchers at the University of Arizona College of Medicine – Tucson, part of UArizona Health Sciences, a USD 2.7 million grant for diabetes research. This funding will support clinical trials for an implantable device designed to eliminate the need for glucose testing and insulin injections in managing Type 1 diabetes.

-

Industry Collaborations: Pharmaceutical and medical device companies often collaborate with academic institutions and startups, offering grants and funding to accelerate the development of new diabetes treatments and technologies.

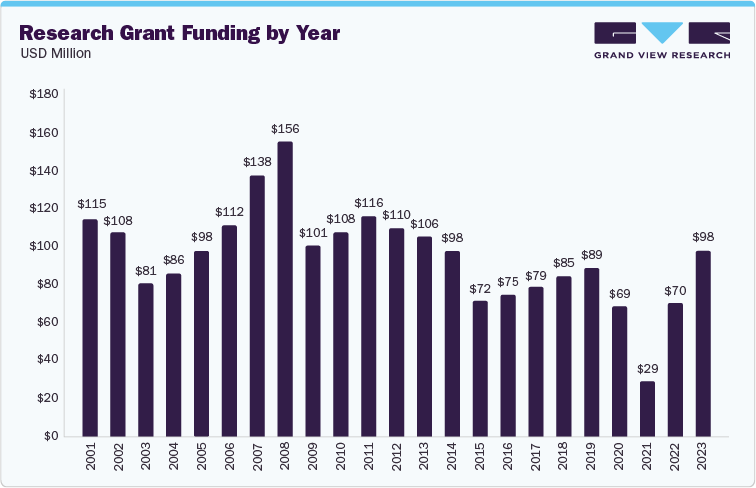

Increasing research investment is anticipated to positively affect the industry. For instance, the 2023 financial statement from the Juvenile Diabetes Research Foundation (JDRF) revealed that USD 98 million was allocated to research grants, marking the highest amount since 2013. Notably, research grant expenditures represented 44% of JDRF’s total income, the highest proportion of revenue dedicated to research in a decade

Pipeline Analysis of Diabetes Devices

NCT Number

Study Title

Conditions

Interventions

Sponsor

Start Date

Completion Date

NCT04386005

Continuous Glucose Monitoring in At-Risk Newborns

Neonatal Hypoglycemia

DEVICE: Continuous Glucose Monitoring Device

Milton S. Hershey Medical Center

8/9/2021

Estimated

2026-06NCT06416202

Closed Loop Pumps vs. Traditional Open Loop Pumps in Managing Blood Glucose Levels in T1DM Patients Fasting in Ramadan.

Insulin Pump Therapy

DEVICE: Advanced hybrid closed loop insulin pump|OTHER: Open Loop Insulin Delivery system

King Fahad Medical City

2/1/2024

Estimated

3/29/2025NCT05299177

Feasibility of Automated Insulin Delivery With an Interoperable Algorithm Using an Alternative Insulin Pump

Type 1 Diabetes

DEVICE: InControl

Imperial College London

4/1/2022

Estimated

2/28/2023NCT05238142

In-Home Study With MiniMedâ„¢ 780G Pump Automated Control in Type 2-Evaluation of the AHCL System in Adults With Insulin-requiring Type 2 Diabetes

Type 2 Diabetes Treated With Insulin

DEVICE: MiniMedâ„¢ 780G Insulin Pump system

Medtronic Diabetes

2/25/2022

Estimated

2025-02NCT05059860

Dexcom Hybrid Closed Loop Insulin Pump Study in Type 1 Diabetes

Type 1 Diabetes Mellitus

DEVICE: Tandem Control IQ Hybrid Closed Loop Insulin Delivery System

NHS Lothian

6/9/2023

Estimated

2025-11The comprehensive study titled "Ongoing Clinical Trials in the Diabetes Devices Industry Analysis, 2018-2030" offers crucial insights into the dynamics of the diabetes devices industry, focusing on ongoing clinical trials and pipeline developments. This analysis helps explore the current and future landscape of diabetes devices, highlighting key trends, emerging technologies, and the progress of clinical trials. The report is particularly valuable for a wide range of stakeholders, including medical device manufacturers, healthcare providers, researchers, and investors, as it provides a detailed understanding of the industry and the potential impact of new innovations on diabetes management.

Report Scope

Attributes

Details

Report Coverage

Ongoing Clinical Trials in the Diabetes Devices Industry

Report Study Period

2018 to 2030

Contents of Report

- Industry Dynamics

- Ongoing Products in the Clinical Pipeline Trials

- Continuous Glucose Monitoring (CGM)

- Blood Glucose Monitoring (BGM)

- Flash Glucose Monitoring (FGM)

- Insulin Pumps

- Pipeline Analysis based on Aspects

- NCT Number

- Title

- Condition

- Treatment

- Study- Start Date

- Study- Completion Date

- Sponsor Collaboration

Delivery Format

Excel Spreadsheet

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified