- Home

- »

- Market Trend Reports

- »

-

Middle East & Africa Plastic Packaging List of Companies Database

![Middle East & Africa Plastic Packaging List of Companies DatabaseReport]()

Middle East & Africa Plastic Packaging List of Companies Database

- Published: Oct, 2023

- Report ID: GVR-MT-100165

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 22

- Report Coverage: 2024 - 2030

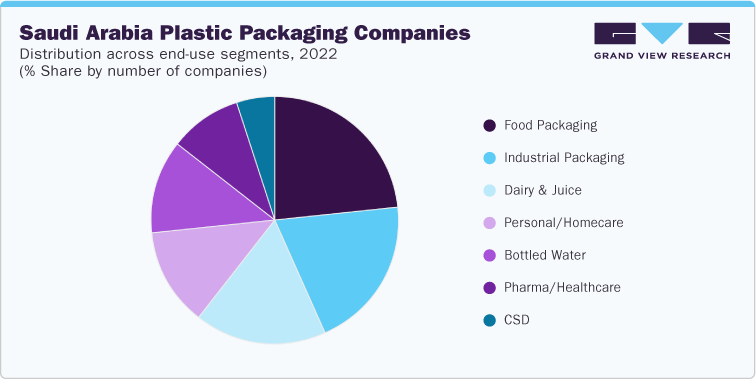

Industry Overview

Saudi Arabia is considered one of the largest markets for the plastic and packaging sector in the Middle East region. It is attributed to the presence of a significant number of manufacturers in the country, a wide range of industrial activities, and a wide customer base. According to the Saudi Industrial Development Fund (SIDF), there were 45 pharmaceutical manufacturing facilities, 196 textile and apparel manufacturing facilities, and 964 food and beverage manufacturing facilities operating in the Kingdom of Saudi Arabia. The presence of end-use manufacturers offers a large-scale opportunity for the plastic packaging market growth in Saudi Arabia.

Due to strict government regulations and land restrictions, Bahrain has substantially lower plastic consumption and producers than other GCC nations. Additionally, the Kingdom of Bahrain adopted legislation in June 2019 that aims to phase out plastic bags and ban their import and usage in specific supermarkets and malls. Also, the Supreme Council for the Environment together with the Ministry of Industry, Commerce and Tourism are working on guidelines and policies to ensure a smooth transition of plastic products manufacturers to a suitable alternative which can drive the demand for recycled plastics based and other sustainable packaging materials.

The packaging sector in the Middle East is thriving on account of the presence of several plastic resin manufacturers in the region. It also, improves the manufacturers' easy access to lower-cost feedstock and raw materials like polypropylene, polyethylene, and others, thus promoting cost-effective local manufacturing of plastic packaging products. The governments in GCC countries are inviting manufacturers to set up manufacturing facilities within the countries to become major suppliers catering to European and African requirements. For instance, in April 2023, Garofalo’s, a pasta manufacturer started using biaxially oriented polypropylene (BOPP) for packaging as an element of SABIC’s Trucircle program, as it builds to provide manufacturers access to sustainable material to boost the growth of the circular economy.

In addition, the GCC countries have a serious water shortage, thus their governments have built up desalination facilities to supply clean water for drinking. However, the people in these nations believe that tap water is unfit, which fuels the demand for bottled water and boosts the expansion of the plastic packaging industry. The government in the region has introduced sin taxes on account of customers' growing health consciousness which is anticipated to be the main driver of the Middle Eastern juice sector, resulting in increased demand.

Deliverable Overview

More than 1,200 plastic packaging manufacturers are situated in Middle East & Africa region. Global manufacturers are also investing significantly in the region to gain a competitive advantage by establishing a regional presence. For instance, In April 2023, UAE-based Hotpack Global, a biodegradable packaging manufacturer, and supplier agreed to develop a specialized food packaging project in Saudi Arabia worth USD 266 million. The planned investment would boost the growth of biodegradable packaging in the country.

Scope Details

Attribute

Details

Total number of Tabs in the database

22

Total number of companies in the database

1150

Deliverable format

Excel

Country scope

Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain, Lebanon, Jordan, Iraq, Syria, Palestine, Egypt, Yemen, Sudan, Tunisia, Algeria, Libya, Morocco, South Africa, Kenya, Uganda, and Somalia

End-use industries covered

Food Packaging, Industrial Packaging,

Dairy & Juice, Bottled Water, Carbonated Soft Drink (CSD), Pharma/Healthcare, and Personal/Homecare

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified