Report Overview

The competitive landscape of laparoscopic devices is marked by rapid technological advancements and a diverse range of players, from established market players like Medtronic and Johnson & Johnson to emerging innovators such as Moon Surgical and Freyja. This sector is driven by the increasing demand for minimally invasive procedures, which offer benefits such as reduced recovery times and lower postoperative pain. Major trends include significant investments in advanced imaging systems, robotic-assisted technologies, and AI-driven solutions. Geographic growth is notable in North America, Europe, and the Asia Pacific region, with strategic product innovations, partnerships, and acquisitions shaping the market.

Major Trends And Competitive Insights In Laparoscopic Devices

|

Category |

Details |

|

Technological Advancements |

Enhanced Visualization and Imaging: Adoption of HD, 4K, and 3D imaging systems for clearer, more detailed surgical visuals. |

|

Robotic-Assisted Surgery: Increasing use of robotic systems (e.g., da Vinci) for improved precision and control. |

|

|

Single-Port Techniques: Development of instruments for single-port laparoscopic surgeries to reduce incisions and recovery time. |

|

|

Market Dynamics |

Growing Demand: Increased preference for minimally invasive surgeries due to benefits such as less pain and faster recovery. |

|

Rising Healthcare Expenditure: Growing investment in advanced medical technologies, especially in emerging markets. |

|

|

Aging Population: Higher incidence of age-related conditions driving demand for laparoscopic procedures. |

|

|

Competitive Landscape |

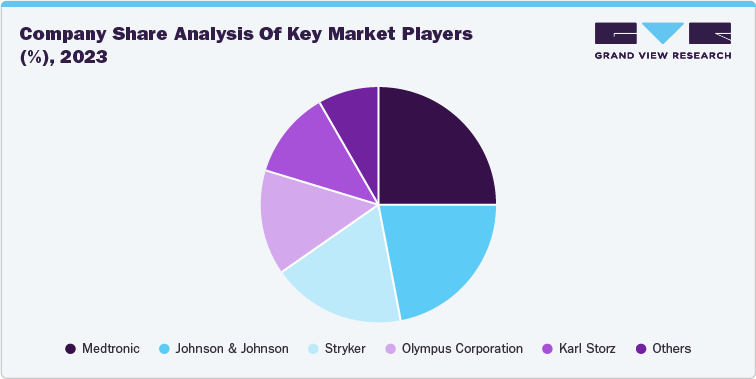

Key Players: Major companies include Medtronic, Johnson & Johnson, Stryker, Olympus, Karl Storz. |

|

Strategic Initiatives: Companies focus on partnerships, collaborations, and acquisitions to enhance their product portfolios. |

|

|

Innovation Focus: Emphasis on developing new technologies for surgical precision, including robotic systems and advanced imaging. |

Major Players and their market share

-

Medtronic: Known for a broad range of laparoscopic tools and advanced surgical systems.

-

Johnson & Johnson (Ethicon): Strong in innovative laparoscopic instruments and energy devices.

-

Stryker: Focus on endoscopy and laparoscopic visualization tools.

-

Olympus Corporation: Specializes in high-definition imaging and advanced endoscopic technologies.

-

Karl Storz: Offers a wide range of laparoscopic instruments and visualization systems.

Recent Breakthroughs In Laparoscopic Instruments

The continuous evolution of laparoscopic instruments has propelled this technique to new levels of precision and efficacy. Recent breakthroughs have significantly enhanced the capabilities of laparoscopic surgery, making complex procedures safer and more efficient. Innovations such as advanced imaging technologies, robotic assistance, and artificial intelligence are transforming how surgeons visualize and interact with the surgical field. Additionally, developments in miniaturization, single-incision techniques, and customized instrument design are pushing the boundaries of what can be achieved through laparoscopic methods.

Breakthroughs in laparoscopic instruments: Enhancing surgical precision

|

Category |

Details |

|

Miniaturization |

Smaller Instruments: Reduced incision size minimizes tissue trauma and scarring. Microscopic cameras and robotic arms provide magnified views for greater precision. |

|

Advanced Imaging Technologies |

High-Definition Cameras: Offer clearer, detailed visuals of the surgical field. |

|

Artificial Intelligence (AI) |

AI Algorithms: Analyze real-time data from imaging systems to support decision-making, identify critical structures, and predict complications, reducing errors and enhancing surgical precision. |

|

Haptic Feedback Systems |

Haptic Technologies: Provide tactile feedback through robotic instruments, helping surgeons perceive tissue characteristics and make more informed decisions, addressing the lack of touch in traditional laparoscopy. |

|

Single-Incision Laparoscopic Surgery (SILS) |

SILS: Consolidates multiple tools into a single access point (usually in the umbilicus), reducing scarring and offering cosmetic benefits while maintaining surgical precision. |

|

Energy Devices |

Ultrasonic Shears, Electrosurgical Devices, and Lasers: Allow precise cutting and coagulation of tissues, expediting surgery, reducing blood loss, and enhancing recovery times. |

|

3D Printing for Customized Instrument |

3D Printing: Enables the creation of customized laparoscopic instruments tailored to specific patient needs or procedures, ensuring optimal functionality and navigating unique anatomies more effectively. |

|

Training Simulators and Virtual Reality |

Training Simulators: Provide risk-free environments for practicing procedures, improving hand-eye coordination and familiarity with different scenarios. Virtual Reality (VR): Offers realistic surgical simulations for skill development. |

Competitive Analysis of Johnson & Johnson in Laparoscopic Devices

|

Category |

Details |

|

Market Position and Share |

Market Position: Johnson & Johnson, through its Ethicon division, is a leading player in the laparoscopic device market. - Market Share: J&J holds around 22% share of the market due to its extensive portfolio and strong brand presence. |

|

Product Portfolio |

- Current Products: J&J offers a comprehensive range of laparoscopic devices, including advanced surgical instruments, staplers, and energy devices. - Focus: The focus is on delivering high-quality, innovative tools that enhance precision and ease of use in laparoscopic procedures. - Recent Releases: Recent innovations include advanced laparoscopic staplers, robotic-assisted systems, and next-generation energy devices. |

|

R&D and Innovation |

- Investment: J&J invests heavily in R&D, aiming to develop cutting-edge technologies and improve existing products. - Innovative Features: Notable innovations include advanced imaging systems, minimally invasive robotic platforms, and smart energy devices that offer greater control and efficiency. |

|

Strategic Initiatives |

- Partnerships: J&J has formed strategic partnerships with other tech firms and medical institutions to advance laparoscopic technologies and expand its market presence. For instance, In November 2023, Johnson & Johnson has unveiled an AI-powered Surgical Simulation Platform at the American Association of Gynecological Laparoscopists (AAGL) Global Congress, designed to enhance skill development for both current and future surgeons. - Acquisitions: Acquisitions such as the purchase of Auris Health (a robotics company) have strengthened its position in robotic-assisted surgery and related technologies. |

|

Market Strategy |

- Pricing Strategies: J&J employs a premium pricing strategy for its advanced technologies while also offering a range of products at various price points to cater different market segments. - Distribution Channels: The company utilizes a global distribution network, with extensive reach into hospitals and surgical centers worldwide. The company seeks to collaborate with approximately 38,500 global suppliers to leverage their collective innovation and reshape the future of health for humanity. |

|

Clinical Evidence and Approval |

- Clinical Trials: J&J’s laparoscopic devices are supported by robust clinical trials demonstrating their safety and efficacy. - Regulatory Approvals: Products are FDA approved and hold CE marking, ensuring compliance with international standards. |

|

Competitive Advantages and Challenges |

- Strengths: J&J's strengths include its extensive experience in the medical device industry, a strong portfolio of laparoscopic products, and significant investment in innovation. - Challenges: Challenges include competition from other major players with innovative technologies and the need to continuously evolve to maintain market leadership. |

|

Financial Performance |

- Revenue: J&J reports strong financial performance with significant revenue from its medical device segment, including laparoscopic products. - Investment in Innovation: The company allocates substantial resources to R&D, ensuring ongoing development and enhancement of laparoscopic technologies. |

|

Future Outlook |

- Emerging Trends: J&J is expected to continue leading in innovations such as robotic surgery and advanced imaging systems. - Strategic Directions: Future strategies may include further expansion in robotic-assisted laparoscopic surgery, integration of AI, and expansion into emerging markets. |

Research funding and investments in laparoscopic devices

-

In June 2024, Ronovo Surgical has successfully closed a Series B funding round of $44 million to advance its modular robotic system, Carina, which offers configurable robotic assistance for laparoscopic surgeries and aims to enhance minimally invasive surgical procedures.

-

In May 2024, Nami Surgical, focused on revolutionizing the robotic-assisted surgery market with its cutting-edge ultrasonic platform, has successfully secured £3.2 million in investment and grant funding.

-

In February 2024, EnAcuity is set to develop visualization technology designed to enhance minimally invasive surgeries. Their technology aims to improve laparoscopic procedures by providing surgeons with crucial functional information that is otherwise difficult to see with the naked eye, thereby increasing safety and effectiveness.

-

In May 2023, Moon Surgical has recently secured $55.5 million in funding for its robotic laparoscopy assistant, which has received regulatory approval in both the U.S. and European Union.

-

In August 2021, FlexDex Surgical has announced the successful completion of a $13 million Series AA funding round to advance the development of next-generation laparoscopic devices.

Strategic Initiatives Adopted By Key Market Players

-

In June 2024, Moon Surgical, a French-American leader in surgical innovation, has announced FDA clearance for the commercial release of its distinctive Maestro surgical system. The Maestro System is designed specifically for the extensive laparoscopy market.

-

In May 2024, Freyja has received FDA clearance for its VereSee device, a 2mm video-entry tool designed for abdominal access in laparoscopic women's health surgeries.

-

In April 2024, Medtronic introduced new AI capabilities with its Touch Surgery Live Stream, featuring 14 advanced algorithms for enhanced post-operative analysis and AI insights in laparoscopic and robotic-assisted surgeries.

-

In November 2023, Johnson & Johnson (Ethicon) has unveiled a groundbreaking AI-powered laparoscopic training platform at the AAGL Global Congress, integrating augmented reality, AI-guided assessment, and tactile feedback to improve training for general, gynecological, and laparoscopic surgeons.