Report Overview

The global in vitro diagnostics quality control market size was estimated at USD 1.28 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030. An increasing number of accredited clinical laboratories worldwide and the presence of favorable regulatory policies are expected to drive the market over the forecast period. Due to the high prevalence of diseases such as diabetes, cardiovascular diseases, and infectious diseases, diagnostic laboratories have gained demand. Many private and public laboratories undergo laboratory accreditation procedures to meet industry standards, improve their procedural volume, and attract more patients. Laboratories accredited by CLIA are eligible for reimbursement through Medicare and Medicaid.

Controls encompass various substances and analytes crucial for assessing various health parameters, likely contributing to the segment’s leading share. Controls are essential components within the realm of in vitro diagnostics quality control, ensuring the accuracy, reliability, and consistency of diagnostic tests conducted in clinical laboratories and healthcare settings.

The controls segment in the in vitro diagnostics quality control market is witnessing robust growth, driven by several key factors. Stringent regulatory standards mandate the use of controls to ensure the accuracy and reliability of diagnostic tests, requiring healthcare facilities to invest in quality control measures. For instance, in July 2023, the U.S. FDA mandated requirements set for the laboratories to adhere to specific quality control protocols to ensure the accuracy and reliability of blood glucose measurements. As part of these protocols, laboratories must use quality control materials, including glucose controls, to validate the accuracy of their testing procedures.

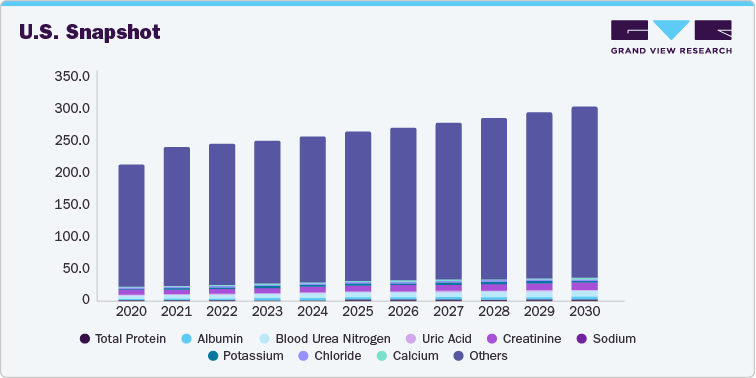

Controls such as Total Protein, Albumin, Blood Urea Nitrogen, Uric Acid, Creatinine, Sodium, Potassium, Chloride, Calcium, Magnesium, Inorganic Phosphorus, Aspartate Transaminase, Creatine Kinase, Gamma Glutamyl transferase, Total Bilirubin, Glucose, Iron, Alanine Transaminase, Alkaline Phosphatase, Alpha Amylase, Total Cholesterol, Triglyceride, Lactate Dehydrogenase, Immunoglobulin G, Immunoglobulin A, Immunoglobulin M, Complement 3, Complement 4, C-Reactive Protein, Rheumatoid Factor, Anti-Streptolysin -O, Beta 2 Micorgloblin, Cystatin-C, Myoglobin, Troponin T and I, and Others have been considered in the study scope. Immunoglobulin A held the largest market share in terms of revenue and volume.

Ongoing advancements in IgA measurement technologies contribute to the development of more sensitive and specific methods for IgA testing. Enhanced instrumentation, reagents, and assay protocols improve the accuracy and reliability of IgA measurements, enabling precise assessment of mucosal immunity and related medical conditions. Studies have shown that IgA deficiencies can increase susceptibility to autoimmune diseases. This finding underscores the importance of IgA in maintaining the immune balance and preventing the body's immune response from attacking its own tissues.

Revenue and Volume for 40 IVD Quality Controls and Calibrators, by Countries Report Scope

|

Attributes |

Details |

|

Areas of Research |

Controls and Calibrators |

|

Report Representation |

Excel format |

|

Highlights of Report |

Revenue and Volume (2018-2030) for

|

Market Overview