Overview of the Insulin Pump Industry

The insulin pump industry is experiencing robust growth driven by several key factors, including the increasing prevalence of diabetes, advancements in technology, supportive regulatory frameworks, and various government initiatives aimed at improving diabetes management. The insulin pump provides vital solutions for managing diabetes by delivering continuous insulin doses to patients, mimicking the function of a healthy pancreas. According to the International Diabetes Federation (IDF), approximately 1 in 10 adults have diabetes, and this prevalence is anticipated to reach 783 million by 2045. This escalating incidence of diabetes, particularly Type 1 diabetes, which typically requires insulin therapy from an early age, fuels the demand for advanced insulin delivery systems like pumps.

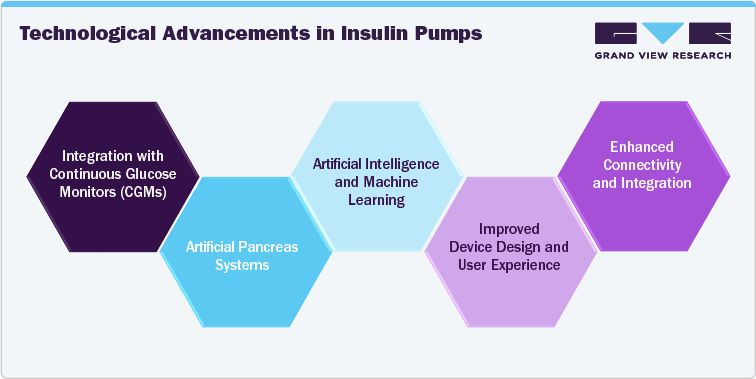

Key Innovations Transforming the Insulin Pump Industry:

The insulin pump industry has undergone significant transformations in recent years, driven by advancements in technology and innovations designed to improve diabetes management. Integration with continuous glucose monitors, the development of artificial pancreas systems, and advancements in device design are enhancing the functionality and appeal of insulin pumps. Additionally, remote monitoring, AI, and improved connectivity are shaping the future of diabetes management. As these technologies continue to evolve, they promise to offer even greater precision, convenience, and effectiveness in managing diabetes

Some of the most notable advancements include:

Integration with Continuous Glucose Monitors (CGMs): One of the most impactful innovations in insulin pump technology is the integration with continuous glucose monitors (CGMs). CGMs provide real-time glucose readings, allowing for more precise insulin delivery. This integration has led to the development of hybrid closed-loop systems, which automate insulin delivery based on CGM data. For instance:

-

Medtronic MiniMed 780G: This system integrates with the Guardian Sensor 3 CGM to adjust insulin delivery every five minutes. It features an advanced algorithm that aims to keep glucose levels within a target range, reducing the risk of both hyperglycemia and hypoglycemia. The system has received praise for its ability to improve glycemic control and ease the burden of diabetes management.

-

Tandem Diabetes’ Control-IQ Technology: This hybrid closed-loop system uses the Dexcom G6 CGM to predict glucose levels and adjust insulin delivery accordingly. The Control-IQ system can automatically increase or decrease basal insulin rates and deliver correction boluses, making it easier for users to maintain optimal glucose levels.

-

In April 2022, Ypsomed collaborated with Abbott and CamDiab to develop an integrated AID (automated insulin delivery) system. The new integrated AID system is being designed to link Abbott's FreeStyle Libre 3 with Ypsomed's MyLife YpsoPump to develop smart, and automatic procedure for delivering insulin with realistic glucose data

Artificial Pancreas Systems: Artificial pancreas systems represent a significant leap forward in diabetes management. These systems combine insulin pumps with CGMs and advanced algorithms to create a more automated and responsive insulin delivery system. Innovations in this area include:

-

Insulet’s Omnipod 5: The Omnipod 5 system is a tubeless insulin pump that works with the Dexcom G6 CGM. It features a control algorithm that adjusts insulin delivery based on real-time glucose data, creating a more seamless and automated experience. The Omnipod 5 also emphasizes user-friendly features, such as a mobile app for remote control and monitoring.

Artificial Intelligence and Machine Learning: Artificial intelligence (AI) and machine learning are starting to play a role in diabetes management through insulin pump technology. AI-driven algorithms can predict glucose trends and adjust insulin delivery in advance, reducing the likelihood of hypo- or hyperglycemic events. For instance, some systems use machine learning to improve the accuracy and responsiveness of insulin delivery adjustments. Machine learning can analyze individual patient data to create more personalized insulin delivery plans. These systems can adapt to changes in lifestyle, diet, and activity levels, providing a more tailored approach to diabetes management.

Improved Device Design and User Experience: Recent innovations have focused on making insulin pumps more user-friendly, discreet, and comfortable. Modern insulin pumps are more compact and lighter than earlier models. Many modern pumps feature intuitive touchscreens and compatibility with smartphones, allowing users to manage their insulin delivery and monitor their glucose levels more easily.

- Companies are developing insulin pumps that are easier to wear and less obtrusive. Insulet’s Omnipod system, for instance, is a tubeless pump that adheres directly to the skin, eliminating the need for external tubing and enhancing wearability.

Enhanced Connectivity and Integration: Connectivity features are making insulin pumps more versatile and integrated with other health technologies. Many insulin pumps now have companion apps that allow users to manage their insulin delivery, track glucose levels, and receive notifications directly from their smartphones. This integration enhances user engagement and convenience. Some insulin pumps are designed to work seamlessly with other health devices, such as fitness trackers and health management apps.

- Some of the notable players in the industry are Medtronic; Hoffmann-La Roche AG; Tandem Diabetes Care, Inc.; Insulet Corporation; Ypsomed; Sanofi S.A.; Sooil development; Jiangsu Delfu Co., Ltd.; Cellnovo Ltd; Valeritas, Inc.

Competitive Scenario of the Insulin Pump Industry

The insulin pump industry is a highly competitive and rapidly evolving sector, driven by several leading players and a dynamic market landscape. Major companies such as Medtronic, Tandem Diabetes, and Insulet are at the forefront, each distinguished by their innovative products and technological advancements.

The competitive landscape is further energized by emerging companies and startups that bring fresh perspectives and innovative solutions. These new entrants are exploring advanced technologies such as artificial pancreas systems and data-driven analytics to refine insulin delivery precision and enhance overall diabetes management. This influx of new technologies not only fosters a vibrant marketplace but also accelerates the pace of innovation, compelling established players to continuously adapt and evolve.

Overall, the insulin pump industry is marked by intense competition, characterized by significant R&D investments, technological advancements, and a strong emphasis on improving patient outcomes. The interplay between established leaders and emerging innovators ensures a dynamic and progressive market environment.

The report analyses the competitive landscape in this industry based on parameters mentioned below:

|

Competitive Landscape: Top 10 Insulin Pump Manufacturers Overview |

||||

|

Market Outlook |

Company Categorization |

Company Share Analysis (Top 10 companies) |

Company Position Analysis |

List of Key Companies by Region |

|

Company Overview |

Product Benchmarking |

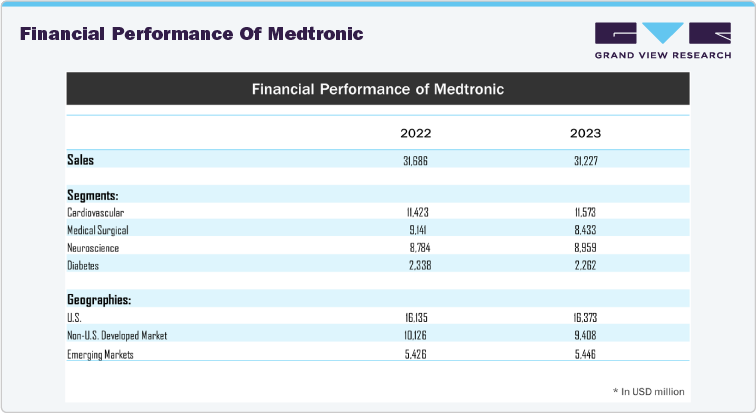

Financial Performance |

Recent Strategic Initiatives |

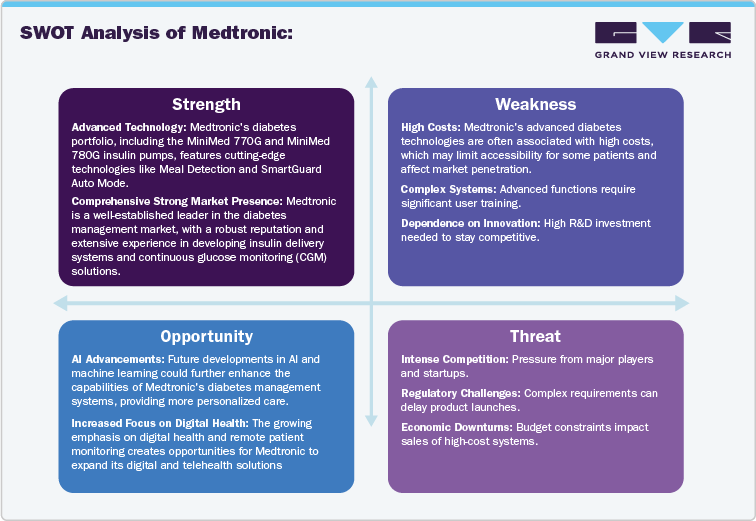

SWOT Analysis |

|

Emerging Players: Overview of 20+ Emerging Players and Startups in the Insulin Pumps Industry |

||||

|

Company Overview |

Establishment Year |

Headquarters |

Business Verticals |

Employee Count |

|

Investor Information |

Total Funding (USD) |

Product Benchmarking |

Strategic Initiatives |

SWOT Analysis |

Company Profiles:

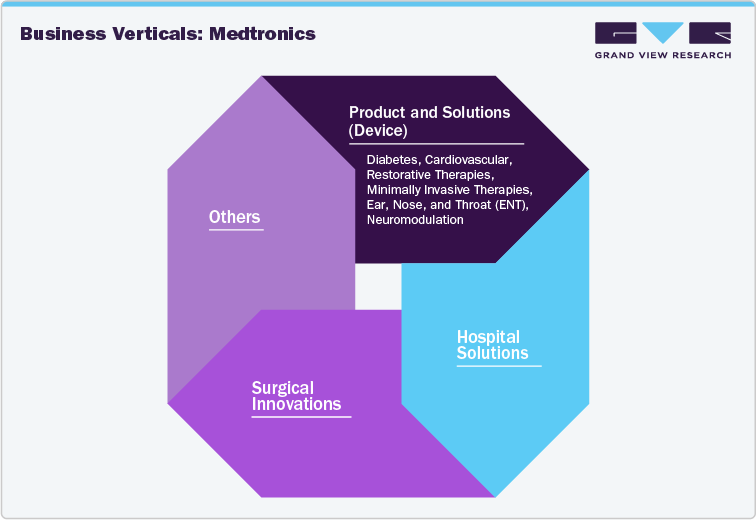

Medtronic

Establishment Year: 1949

Headquarters: Minneapolis, U.S.

Number of Employees: 95,000

Medtronic is a leading global player in medical technology and services, renowned for its comprehensive range of diabetes management solutions, particularly its insulin pump offerings. Medtronic operates across a wide array of medical fields including cardiovascular, diabetes, neurological, spinal, and minimally invasive surgical technologies. It operates in over 150 countries, with a diverse portfolio of products and therapies designed to address some of the world’s most challenging health conditions. The company’s insulin pump portfolio, under its Diabetes Group, includes some of the most advanced and widely used devices in the market. Medtronic’s insulin pump portfolio features several notable products. The MiniMed 780G system is the latest in their line, integrating advanced algorithms with continuous glucose monitoring (CGM) to deliver automated insulin adjustments.

Product Portfolio of Medtronic

|

Product Name |

Description |

|

MiniMed 780G system |

The MiniMed 780G system is a cutting-edge diabetes management solution designed to enhance glucose control and simplify insulin delivery. The MiniMed 780G system is compatible with the Medtronic Extended infusion set, the first and only infusion set designed for up to 7 days of wear. This extended wear capability offers greater convenience and fewer site changes, enhancing your overall diabetes management experience. |

|

MiniMed 770G System |

The MiniMed 770G insulin pump system provides advanced diabetes management with real-time monitoring and predictive capabilities. It features Meal Detection technology for automatic insulin adjustments every 5 minutes and SmartGuard Auto Mode to adapt to your glucose trends. Seamlessly connect and manage data via your smartphone. The FDA-approved MiniMed 780G system enhances this with no-fingerstick glucose monitoring using the Guardian 4 sensor. |

|

MiniMed 630G System |

The MiniMed 630G insulin pump system combines user-friendly features with advanced functionality. Its waterproof design, color screen with auto-brightness, and easy-to-navigate menu enhance usability. The pump offers remote insulin dosing via the highly accurate CONTOUR NEXT LINK 2.4 meter and customizable skins for a polished look. |

Strategic Initiatives

Companies drive growth through a blend of strategies, including significant investments in innovation and research to develop new products and technologies. They expand their market presence by entering new regions and targeting diverse customer segments, while strategic partnerships and acquisitions enhance their capabilities and competitive edge. Additionally, a strong focus on customer-centric approaches ensures exceptional experiences, fostering loyalty and driving long-term success.

Recent developments by Koninklijke Philips N.V.:

-

In March 2024, Sequel’s Twist Automated insulin delivery system received FDA Clearance. System features and benefits for people with type 1 diabetes. The twiist system is the first to directly measure insulin delivered with each dose. This allows for more precise insulin control. The system also integrates with Tidepool Loop technology, which uses CGM readings to adjust insulin delivery.

-

In April 2023, Insulet announced it has received FDA approval for its Omnipod GO, a basal-only insulin pod designed for people with type 2 diabetes aged 18 and older. This tubeless and waterproof device provides a consistent dose of rapid-acting insulin for 72 hours and does not require a handheld controller. It supports various U-100 insulins and offers eight programmed daily rates from 10-40 units.

-

In April 2023, FDA approved the Medtronic MiniMed 780G System, an advanced automated insulin delivery system for individuals aged 7 and older with type 1 diabetes. It is world's first insulin pump with ‘Meal Detection Technology’. This system uses continuous glucose monitoring (CGM) to track glucose levels and automatically adjusts insulin delivery. It includes a glucose sensor, wireless data transmission, and a smart insulin pump.

-

In February 2023, Roche Diabetes Care Inc. announced 510(k) approval for premarket for their Accu-Chek Solo micropump system with interoperable technology. Post this approval Roche can sell this micropump system without needing full FDA premarket approval because it's similar to already approved devices. The document specifies the regulatory class (Class II) and product code (QFG) for the device

-

In February 2023, Insulet Corporation acquired a portfolio of patents related to insulin pump technology from Bigfoot Biomedical for USD 25 Million. This acquisition aimed to strengthen Insulet's intellectual property portfolio in the field of diabetes management devices, including insulin pumps

Emerging Players in Insulin Pump Market

Emerging players in the insulin pump market are making notable advances through innovative technologies and distinct strategies to establish a strong market presence. Here are some companies and their approaches.

-

Bigfoot Biomedical: Bigfoot Biomedical aims to revolutionize diabetes management with its Bigfoot Unity insulin pump system. This innovative system features a closed-loop automated insulin delivery system that integrates with continuous glucose monitors (CGMs). The Bigfoot Unity offers personalized insulin dosing adjustments based on real-time data, aiming to simplify diabetes management and improve patient outcomes.

-

Sernova Corp: Sernova Corp focuses on innovative treatments for diabetes, with their Cell Pouch System being a significant advancement. This system is designed to house insulin-producing cells within a biocompatible pouch implanted in the body. The Cell Pouch aims to provide a potential cure for diabetes by enabling long-term insulin production and reducing the need for external insulin pumps.

-

Ypsomed: Ypsomed's YpsoPump is designed to offer a compact and intuitive insulin delivery solution. The YpsoPump features an easy-to-use interface, customizable insulin delivery options, and integration with CGM systems. Its design emphasizes user convenience and reliability, catering to individuals seeking a straightforward and effective insulin pump solution.

The “Insulin Pump Market Insights: Key Competitors and Emerging Trends" trend report provides a comprehensive analysis of the competitive dynamics within the global insulin pump market, offering insights from 2018 to 2030. This detailed report evaluates the key players, emerging trends, and technological innovations shaping the insulin pumps market. It also delves into market segmentation by type, product, accessories, end-use, region.

The report further examines the market’s geographical distribution, analyzing regional competitive landscapes in North America, Europe, Asia-Pacific, and other key regions. Additionally, the report features expert analysis on the evolving market strategies, partnerships, and mergers & acquisitions that are influencing the competitive environment. An executive summary provides a snapshot of the market’s current status and future outlook, highlighting the factors driving growth, such as rising diabetes prevalence, technological innovations, better patient outcomes, increased awareness, favorable reimbursement policies, and advancements in healthcare infrastructure. This report serves as a crucial resource for stakeholders seeking to understand the competitive forces and future opportunities in the insulin pump market.

|

Attributes |

Details |

|

Report Coverage |

Competitive Analysis of 10+ key Insulin Pump Manufacturers; 80+ Emerging Players and Startups |

|

Report Study Period |

2018 to 2030 |

|

Report Representation |

|

|

Contents of Report |

Market Overview Company Categorization

Company Market Share Analysis (Top 10 Players) Company Market Position Analysis List of Key Players, by Region List of Emerging Players/Startups (80+ Players) Company Profiles (Any 15)

|