- Home

- »

- Market Trend Reports

- »

-

Implantable Opioids: Market Opportunities And Trends

![Implantable Opioids: Market Opportunities And TrendsReport]()

Implantable Opioids: Market Opportunities And Trends

- Published: Aug, 2024

- Report ID: GVR-MT-100204

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Implantable Opioids: Market Opportunities And Trends

The implantable opioids market is driven by key players such as Purdue Pharma L.P., Johnson & Johnson Services, Inc., Titan Pharmaceuticals, Inc., and Braeburn Inc., who are pioneering advancements in safe and effective opioid treatments. Technological innovations such as biodegradable implants are enhancing patient adherence and safety, exemplified by Delpor's year-long naltrexone implant. With significant growth opportunities in North America and emerging markets in Asia-Pacific, driven by chronic pain prevalence and governmental initiatives, the market is evolving in response to the opioid crisis, emphasizing the development of safer opioid treatments to mitigate overdose risks and misuse.

The trends and competitive analysis report, compiled by Grand View Research, is a collection of the trends and competitive scenarios in more than 20 countries. Qualitative information regarding the industry trends, market opportunity, and competitive analysis will be provided in the report. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Implantable Opioids: Trends and Competitive Analysis Report Scope

Attributes

Details

Areas of Research

Industry trends, market opportunity, ease of doing business across countries, competitive analysis

Report Representation

Consolidated report in PDF format

Country Coverage

20+ Countries

Highlights of Report (Competitive Landscape, by country)

- Key Players Competitive Landscape Analysis

- Technological Advancements in Implantable Opioids

- Patient Preferences and Demand Trends

- Regulatory Landscape and Market Impact

- Market Opportunities and Growth Potential

- Impact of Opioid Crisis on Market Dynamics

- Regional Insights at country level

Implantable Opioids: Trends and Competitive Analysis Coverage Snapshot

Key Players Competitive Landscape Analysis

The implantable opioids market features several major players, including Purdue Pharma L.P., Johnson & Johnson Services, Inc., Titan Pharmaceuticals, Inc., and Braeburn Inc. These companies are leading the market with their extensive research and development efforts aimed at creating safer and more effective opioid treatments. For instance, in January 2024, Purdue Pharma L.P. focuses on extended-release formulations, while Titan Pharmaceuticals, Inc. continues to develop long-term implantable opioid treatments that cater to chronic pain management needs.

Technological Advancements in Implantable Opioids

Recent technological advancements in implantable opioids include the development of biodegradable and bioresorbable implants. These innovations aim to provide sustained pain relief while minimizing the risk of addiction and misuse.

Advancements in drug delivery technology have transformed treatment approaches, especially through implantable devices that offer sustained release of medications over extended periods. These innovations improve patient adherence by eliminating the need for frequent dosing and enhancing therapeutic efficacy & safety profiles. From subcutaneous implants delivering opioid antagonists such as naltrexone to devices providing long-acting formulations of other critical medications, these technologies represent a significant leap forward in managing chronic conditions. Such developments hold promise in optimizing treatment outcomes and addressing challenges associated with traditional medication regimens. For instance, in May 2024, Delpor, supported by NIH HEAL Initiative funding, is developing a titanium implant for naltrexone to treat OUD. This implant, designed to release medication steadily for a year, aims to improve treatment adherence and support long-term recovery.

Patient Preferences and Demand Trends

Choosing implantable treatments for OUD, specifically utilizing medications, such as naltrexone and buprenorphine, involves thoughtful deliberation from both patients & providers. These considerations encompass various critical aspects to ensure optimal treatment outcomes and patient satisfaction:

Patient Considerations:

-

Patients prioritize the efficacy of implantable treatments in managing cravings and preventing relapse. Understanding how naltrexone and buprenorphine implants align with their treatment goals-whether it is sustained abstinence or harm reduction-is crucial.

Provider Considerations:

-

Providers conduct comprehensive assessments to determine if naltrexone or buprenorphine implants are suitable for the patient's clinical profile, including their OUD severity, medical history, and concurrent health conditions.

-

Implantable treatments are part of a holistic treatment approach. Providers integrate naltrexone and buprenorphine implants into a comprehensive care plan that may include behavioral therapies, counseling, and psychosocial support to address the multifaceted aspects of OUD.

Regulatory Landscape and Market Impact

The regulatory environment for implantable opioids is stringent, with significant oversight from government bodies such as the FDA. Companies are required to comply with strict guidelines to ensure the safety and efficacy of their products. The recent settlement between Johnson & Johnson Services, Inc. and Washington state, where J&J agreed to pay USD 149.5 million to resolve opioid-related claims, highlights the importance of regulatory compliance in this market. Such regulatory measures are crucial for market entry and ongoing product development, pushing companies to innovate while adhering to safety standards.

Market Opportunities and Growth Potential

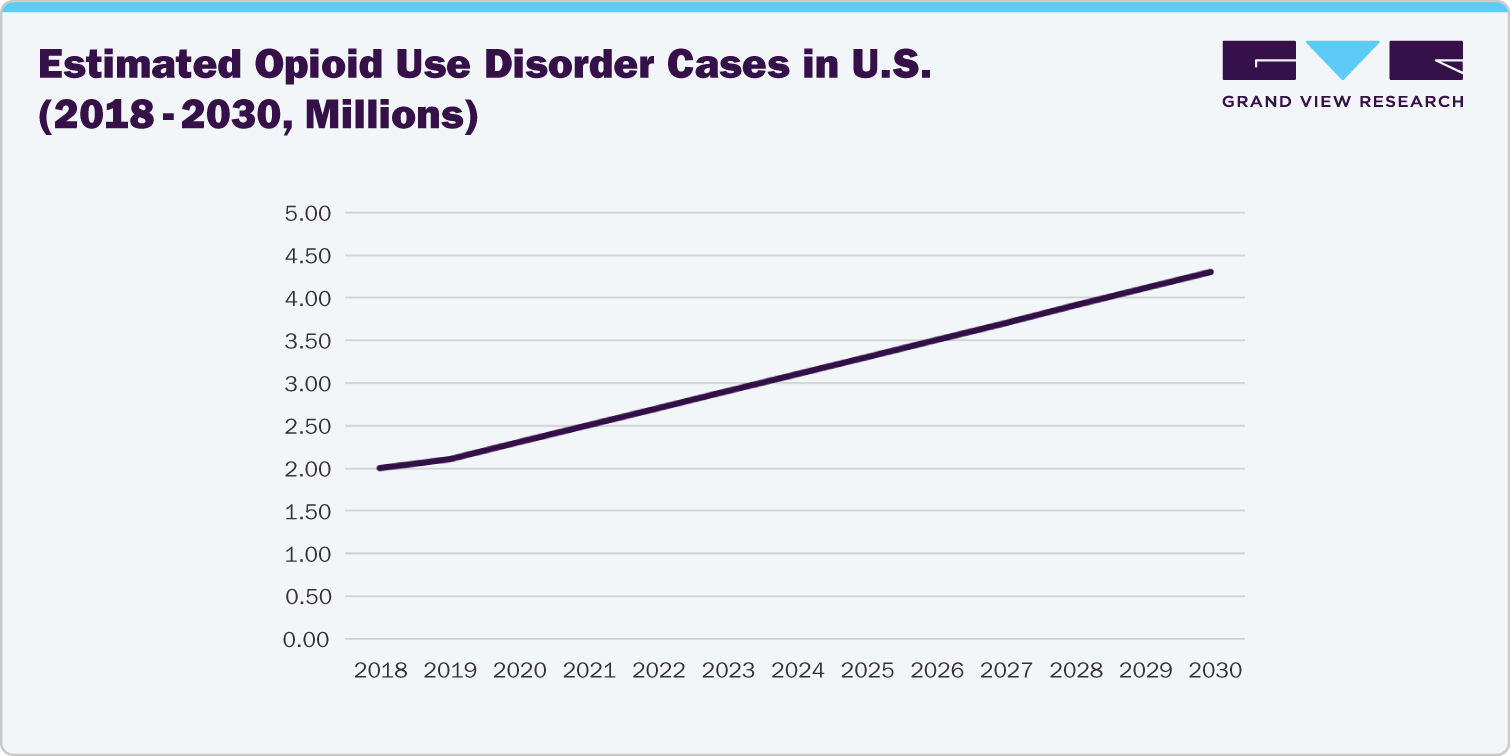

The implantable opioids market offers significant growth opportunities, especially in regions with high prevalence of chronic pain conditions. North America remains the largest market due to factors such as an aging population and the widespread use of opioids for pain management. Additionally, emerging markets in Asia-Pacific are expected to grow rapidly, driven by government initiatives to control opioid misuse and improve pain management infrastructure. Companies that can navigate the regulatory landscape and offer innovative, safe products are well-positioned to capitalize on these opportunities.

Impact of Opioid Crisis on Market Dynamics

The opioid crisis has significantly influenced market dynamics, shifting the focus towards safer and more controlled opioid treatments. The development of implantable opioids is a direct response to this crisis, providing solutions that reduce the risk of overdose and misuse. Purdue Pharma L.P.’s efforts to develop nalmefene hydrochloride injection, an opioid antagonist designed to reverse opioid overdose, reflect the industry's commitment to addressing the crisis. This shift is reshaping market trends and influencing both product development and regulatory policies.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified