Deliverable Overview

The deliverable comprises market demand, supply, and price trend information on global and Egypt medium density fiberboard. The estimates and forecasts shall be provided in terms of volume (Thousand Cubic Meters) for the year range 2023 to 2034.

Global & Egypt Medium Density Fiberboard Market Analysis

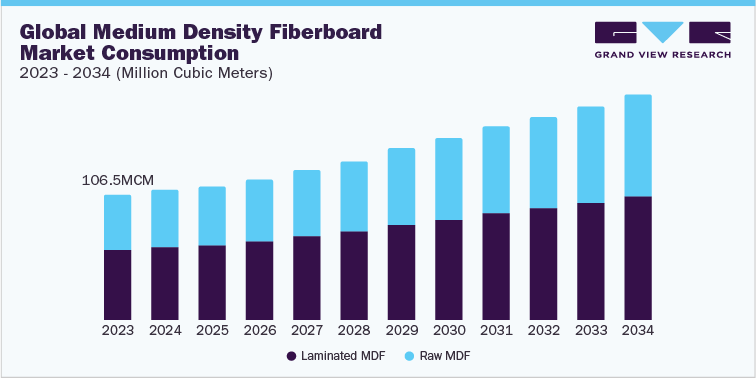

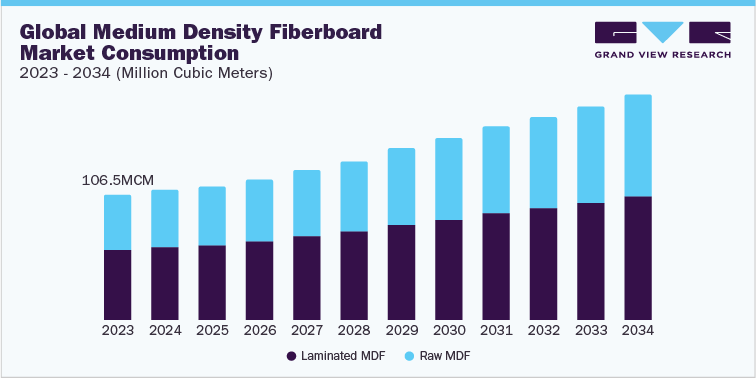

The demand for global medium density fiberboard market was estimated at 106.5 million cubic meters in 2023 and is estimated to grow at a CAGR of 5.4% over the forecast period. MDF panels find use in numerous applications such as siding, flooring, window panels, and, door panels, manufacturing in construction industry. These panels have the potential to replace other construction materials including cement, glass, plywood, and plastic in the aforementioned applications. As a result, with the growth of construction industry, the demand for MDF panels is also anticipated to ascend over the forecast period.

Increasing construction spending in the emerging markets in order to meet rising residential housing is expected to be a major factor driving the demand for MDF panels in construction industry over the forecast period. MDF is recyclable and readily available in the market in various types and sizes, at competitive prices. Innovations in traditional woodworking industry to produce furniture from more sustainable products is expected to boost the market growth in the near future.

The Asia Pacific region led the global demand for the medium density fiberboard (MDF) and is expected to maintain its position over the forecast period. The rapid growth of the furniture manufacturing industry has been the primary driving factor this rapid growth in the demand for the general purpose MDF. Furthermore, growing spending on renovation and interior decoration activities are also projected to positively impact market demand over the coming years.

The MDF market in Egypt faces a supply deficit due to a relatively limited number of manufacturers operating in the country. This scarcity of local MDF production facilities can result in insufficient supply to meet the growing demand, particularly in the context of a rapidly expanding economy and construction industry. With only a few manufacturers, the market may struggle to keep up with the rising needs of various sectors that rely on MDF, including construction, furniture, and interior design.

Egypt's MDF market exhibits significant growth potential due to the supply deficit. The increasing demand for MDF in the construction and furniture industries, driven by a growing economy, underscores the attractiveness of this market for foreign investors. FDI in the sector can tap into this expanding market, offering opportunities for investment in production facilities, distribution networks, and supply chain infrastructure. Additionally, the growth of the building and construction industry is expected to provide a major boost to the MDF demand and production over the projected period.

Topics Covered under this study

|

Attribute

|

Details

|

|

Base Year

|

2022

|

|

Forecast Year Range

|

2023 - 2034

|

|

Units

|

Volume (Thousand Cubic Meters)

|

|

Segments

|

Type (Raw MDF, Laminated MDF)

|

|

Region

|

|