Report Overview

Key factors driving the research, development, and launch of gene therapy products include increasing regulatory support, patient demand, technological advancements in gene editing techniques, and market potential for innovative treatments for chronic diseases. Gene therapies hold significant promise for addressing previously untreatable genetic disorders, as demonstrated by the recent approval of therapies like Luxturna and Zolgensma, which have shown remarkable efficacy in treating rare inherited diseases.

There is a growing acceptance and recognition of the role played by gene therapies in personalized medicine. By targeting specific genetic mutations or deficiencies unique to each patient, gene therapies can potentially tailor treatments to individual genetic profiles, enhancing therapeutic outcomes and reducing adverse effects.

Moreover, advancements in biotechnology, particularly in viral vector technology and gene editing tools like CRISPR-Cas9, have accelerated the development and refinement of gene therapy approaches. These innovations have expanded the scope of diseases that can be targeted and have improved the efficiency and safety of gene delivery mechanisms. As a result, several regulatory approvals have been announced in recent years. For instance, in November 2023, the regulatory authority in the UK authorized Casgevy (exagamglogene autotemcel), the first-ever CRISPR–Cas9 gene editing therapy globally. The therapy targets transfusion-dependent β-thalassemia and sickle cell disease representing a pioneering treatment jointly developed by Vertex Pharmaceuticals and CRISPR Therapeutics.

Gene Therapy Pipeline Analysis Overview

On the regulatory front, authorities such as the FDA in the U.S. and the EMA in Europe have established frameworks to oversee gene therapy development. These authorities are offering support and expedited pathways for approvals, such as the FDA's Fast Track and Breakthrough Therapy designations that have streamlined the development process. For instance, in July 2024, AskBio, a gene therapy company received the U.S. FDA Fast Track Designation for AB-1005 therapy which is currently in development for moderate Parkinson's disease. There is also a growing trend for investments in the gene therapy space for novel therapeutic areas. For instance, in July 2024, Beacon Therapeutics Holdings Limited, specializing in ophthalmic gene therapy aimed at preserving and restoring vision in patients with severe retinal diseases, secured USD 170 million in Series B financing. Such investments and regulatory incentives have fueled an expanding pipeline of gene therapy candidates.

Global Gene Therapy Pipeline Analysis, By Quarter, 2023

|

Global Status |

Q1 2023 |

Q2 2023 |

|

Preclinical |

1,493 |

1,539 |

|

Phase I |

245 |

240 |

|

Phase II |

247 |

260 |

|

Phase III |

30 |

30 |

|

Preregistration |

7 |

6 |

Gene Therapy Approved Product Analysis Overview

In addition, the rising prevalence of genetic disorders, coupled with an aging population and increasing healthcare expenditures, has highlighted the need for new and improved gene therapy treatment options. To meet this growing need, companies operating in this space are undertaking new product development activities for advanced therapeutics. As a result, new gene therapies are receiving regulatory approvals every quarter.

List of gene therapies approved in Q4 2023

|

Product name |

Generic name |

Disease(s) |

Locations approved |

Originator company |

|

Casgevy |

exagamglogene autotemcel |

Sickle cell anemia; thalassemia |

US, UK |

CRISPR Therapeutics |

|

inaticabtagene autoleucel |

inaticabtagene autoleucel |

Acute lymphocytic leukemia |

China |

Juventas Cell Therapy |

|

Lyfgenia |

lovotibeglogene autotemcel |

Sickle cell anemia |

US |

bluebird bio |

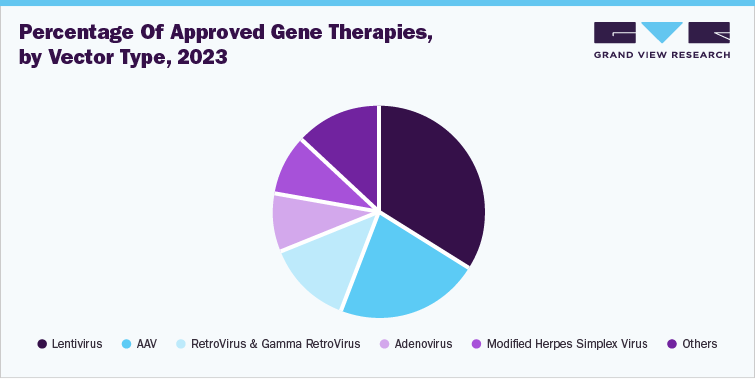

A variety of vector types are used for the development and manufacture of gene therapies. Some of the most used vector types include lentivirus, adeno-associated virus (AAV), and retrovirus vectors, among others. These vectors are pivotal in gene therapy due to their unique capabilities and safety profiles. For instance, lentiviruses, a subgroup of retroviruses, are adept at infecting both dividing and non-dividing cells, making them versatile carriers for gene therapy. Their ability to integrate genetic material into the host genome ensures sustained expression of therapeutic genes, crucial for treating diseases such as certain types of immune deficiencies and neurological disorders. Therapies such as Zynteglo and Breyanzi use this type of vector.

Similarly, AAV are small, non-pathogenic viruses that have gained prominence in gene therapy due to their low immunogenicity and ability to infect a broad range of cell types. AAV vectors can deliver genetic payloads with high efficiency and have shown promise in treating genetic disorders like hemophilia, muscular dystrophy, and retinal diseases. For instance, Luxturna and Zolgensma use this vector type. Furthermore, retroviruses possess the natural ability to integrate their genetic material into the host genome. This property has been harnessed in gene therapies such as Tecartus and Yescarta.

Competitive Landscape Insights

Key players operating in the gene therapy market are involved in the development of advanced therapeutic strategies for the treatment of rare diseases. For instance, in June 2023, BioMarin received U.S. FDA approval for Roctavian, a gene therapy using an adeno-associated virus vector for treating severe hemophilia A in adults. Such initiatives are playing a key role in propelling market growth.

Some prominent players in the gene therapy space include:

-

Amgen

-

Orchard Therapeutics

-

Novartis

-

Spark Therapeutics (Roche)

-

Kite Pharma (Gilead)

-

bluebird bio

-

BioMarin

-

CRISPR Therapeutics

-

Sarepta Therapeutics

-

Krystal Biotech