- Home

- »

- Market Trend Reports

- »

-

Facial Injectables: Top Brands And Competitive Landscape

Report Overview

Facial injectables continue to grow across regions and countries. The growing access to services through aesthetic clinic chains, medical spas, and beauty bars, alongside the accelerating consumer purchasing power, has allowed facial injectables to penetrate emerging markets. Furthermore, changing consumer attitudes toward aesthetics have increased awareness and acceptance of these products, allowing them to penetrate newer market segments, such as men and millennials.

The brand and competitive analysis report, compiled by Grand View Research, is a collection of the trends and competitive scenarios in more than 20 countries. Qualitative information regarding the trends, competitive strategies, existing competition, and pipeline analysis will be provided in the report. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Facial Injectables: Trends and Competitive Analysis Report Scope

Attributes

Details

Areas of Research

Industry trends, market opportunity, aesthetic penetration across countries, competitive and product revenue analysis

Report Representation

Consolidated report in PDF format

Country Coverage

20+ Countries

Product Coverage

-

Dysport

-

Juvederm

-

Restylane

-

Radiesse

-

Profhilo

-

Rejuran

-

Juvelook

-

Xeomin

-

Botulax

-

Botox

Highlights of Report (Competitive & Revenue Landscape, by Product)

-

Product Revenues from 2018 to 2030

-

Brand Penetration in 20+ Countries

-

Product Market Share Evolution

-

Consumer Behavior Analysis

-

Strategic Initiatives from 2018 to 2024

-

SWOT Analysis by Manufacturers

Facial Injectables: Trends and Competitive Analysis Coverage Snapshot

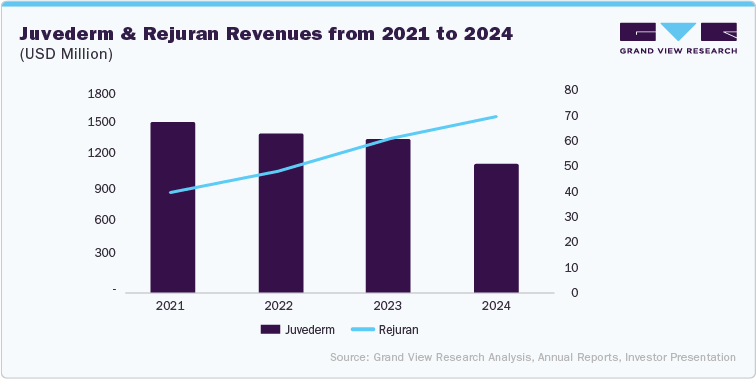

Recent trends indicate penetration of skin boosters in the facial injectable market. Moreover, established brands, such as Juvederm by Allergan, have seen a steady decline in their revenue from 2021, while brands, such as Rejuran by PharmaResearch Co., Ltd., have seen significant growth in the same period. Moreover, similar trends are seen across novel brands owing to superior technology, changing consumer sentiment from fillers to rejuvenation, and advanced marketing strategies by new players.

Some of the potential drawbacks highlighted by an aesthetic and oculoplastic surgeon in Beverly Hills in April 2024, “Hyaluronic acid fillers cause tissue expansion - it’s like a sponge attracting water. If too much filler is injected, it will result in the slow expansion of your natural tissue, stretching the skin and potentially accelerating the appearance of aging as the skin becomes less elastic. We now understand more about them and the potential negative consequences. This includes the knowledge that they can block lymphatics, causing swelling, but also the relatively new discovery that ‘while we initially thought that these products would only last between six to 12 months, we now know they can stay there for years.”

Critically, skin boosters can address volume issues and have become the physician’s choice for addressing rejuvenation and skin health. According to an aesthetic clinic, Belotero, a skin booster, helps in “deeply hydrating the skin, without creating unwanted volume.” Similarly, Profhilo, another skin booster primarily used in Europe, has seen a growing demand. An aesthetician commented, “Profhilo is great for those patients concerned with crepey skin that has lost its elasticity-it softens fine lines and helps plump up the skin.”

Neuromodulators, such as botulinum toxin, have maintained dominance in facial injectables. Moreover, novel brands are entering the developed markets of the U.S. & China, which are expected to cause significant changes in the forecast period. Medytox, Hugel, Daewoong, and Huons BioPharma, are some of the key South Korean manufacturers entering the two largest botulinum toxin markets in the U.S. and China.

Some of the key developments recorded in the facial injectable industry

Companies

Year

Month

Details

Daewoong Pharmaceutical

2024

June

Daewoong Pharmaceutical revealed that its global partner, Evolus, has launched Nuceiva in the Spanish market. Nuceiva, developed by Daewoong, is the same botulinum toxin (BTX) product marketed as Nabota in Korea and Jeuveau in North America

PharmaResearch Co., Ltd.

2024

May

Pharma Research obtained approval in South Korea for its botulinum toxin type A product, Reintox 100 units.

CGbio

2024

May

CGBio announced its entry into the European Aesthetic Market with its two injectable products: LUXX, a Polydioxanone (PDO) suture thread lift, and EGF skin booster

Merz Pharmaceutical GmbH

2024

February

Merz Pharmaceutical GmbH received approval for its botulinum toxin product Xeomin in China. The time from acceptance to approval was nearly 1,141 days. The product is indicated to treat severe canthus wrinkles (crow’s feet) in adults.

Medytox

2023

December

Medytox revealed that its subsidiary, NEWMECO, has introduced a new botulinum toxin product called NEWLUX. Approved by the Ministry of Food and Drug Safety in August, NEWLUX represents a next-generation formulation that eliminates animal-derived components from its raw material production.

Sinclair

2023

October

Sinclair, a subsidiary of Huadong Medicine Co., Ltd. & ATGC Co., Ltd., announced a strategic collaboration and licensing agreement through which Sinclair shall develop and commercialize ATGC’s BoNT-A, ATGC-110 for an aesthetic and therapeutic indication.

LG Chem

2023

October

LG Chem & BR Pharm signed a memorandum of understanding (MOU) to accelerate the former company’s skin booster, HP Vitaran, in the Chinese market.

CGbio

2023

October

CGBio signed a USD 100 million license agreement for its CaHA filler, FACETEM, for five years to penetrate the Chinese market.

CGBio

2023

September

CGBio announced that its CaHA filler, FACETEM, has been launched in Indonesia.

CGBio

2023

August

CGBio applied for a permit in Middle Eastern countries for its hyaluronic acid (HA) filler, GISELLELIGNE.

CGBio

2023

July

CGBio’s HA filler, Aileene received approval from the Australian government. Moreover, the company signed KRW 40 billion or USD 28.99 million with Australia’s aesthetic distributor, Amore Aesthetics.

CGBio

2023

June

CGBio signed a contract with a Chinese distributor, Shanghai Bijeong Trading LLC, worth KRW 70 billion or USD 50.51 million, allowing it to enter the Chinese hyaluronic acid market.

Allergan Aesthetics

2023

May

Allergan received U.S. FDA approval for its skin booster product, SKINVIVE, by JUVÉDERM. With this approval, the company became the first product to enter the skin booster paradigm in the United States.

Daewoong Pharmaceutical

2023

May

Daewoong Pharmaceutical of South Korea revealed to invest of 100 billion South Korean won (about USD 74.6 million) to construct a third manufacturing facility in Korea. This expansion aims to meet rising global demand for its botulinum toxin product, Nabota.

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified