- Home

- »

- Market Trend Reports

- »

-

Europe Residential Solar PV Market Competitive Landscape

![Europe Residential Solar PV Market Competitive LandscapeReport]()

Europe Residential Solar PV Market Competitive Landscape

- Published: Jul, 2023

- Report ID: GVR-MT-100127

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 0

- Report Coverage: 2024 - 2030

Europe Residential Solar PV Industry Overview

The Europe residential solar PV panels industry was estimated at USD 34.74 billion in 2022 and is projected to grow at a CAGR of more than 7.0% over the forecast period of 2023 to 2030. The residential solar panels market in Europe has been experiencing significant growth in recent years due to increasing awareness about renewable energy, government incentives, and the declining cost of solar technology. Germany, the UK, Italy, France, and Spain are among the top countries in Europe holding a revenue share of about 70.0% in 2022.

Competitive Overview

The market is fragmented with players in the space adopting various strategic initiatives such as product launches, collaborations, and partnerships to sustain their position in the market.

The market consists of big players such as Daikin, E.ON SE, EDF Group, Engie, JinkoSolar, and TotalEnergies. Moreover, several start-ups are slowly moving their way to capture market share in the competitive environment. For instance, in December 2022, Germany-based new entrants like 1Komma5, Zolar, Sunhero, Enpal, Einhundert, and Sunvigo received funding for solar panels. In addition, Spain-based start-up Samara raised USD 6.5 million in 2022 to provide their offerings in the market.

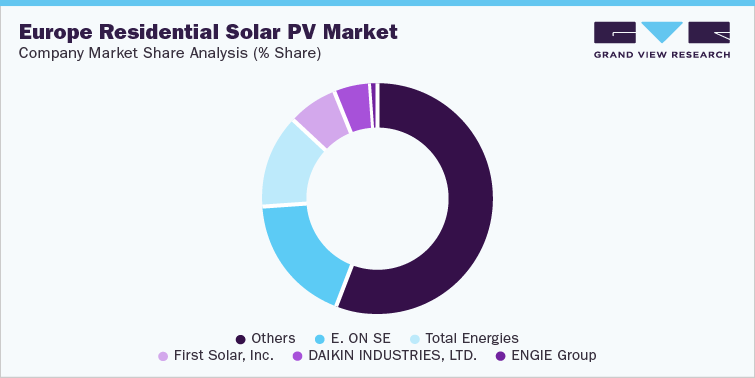

E.ON SE; TotalEnergies; First Solar, Inc.; Daikin Industries, Ltd.; and ENGIE Group are among the prominent vendors in Europe for residential solar PV panels. These companies accounted for about 40%-52% of the European market in 2022.

Some of the recent initiatives of the major manufacturers are:

i. In April 2023, Luciole & Basilic, a France-based company, launched a tracker for residential PV installations that reportedly provides 12% of higher energy production. The company developed an adjustable mounting system that is linked to the Zenitrack application, which displays the best angle of inclination of the solar panels toward the zenith.

ii. In March 2023, Sunhero raised USD 10 million to bring solar power to more households across Europe. The strategy has been adopted to increase its footprint in the Spanish market and leverage its product outlines in the solar market.

iii. In April 2022, E.ON launched a smart network system for greener home developments. The smart network system integrates all energy requirements such as heating, transportation, and other residential uses in the solar PV panel installation for more efficient usage of electricity generated by solar PV panels.

iv. In December 2022, Blackstone Inc. and Rivean Capital acquired Esdec Solar Group B.V., based in Deventer, Netherlands, for the residential, commercial, and industrial markets. Esdec develops and offers qualified solar rooftop mounting systems.

v. In March 2022, Altor acquired a significant minority stake in Svea Solar with a significant investment aimed at boosting the installer's expansion in the European residential rooftop market. Altor will acquire its present shareholder Axsol AB to become a key investor in Svea Solar, which aims to become a market leader in the European home solar industry by 2026, encompassing 80% of the continent.

The residential solar PV panels value chain consists of raw material suppliers, manufacturers, distributors, installers, and customers. Solar photovoltaic (PV) panel installers in Europe typically need to obtain specific certifications and qualifications to ensure that they possess the requisite knowledge and skills necessary to perform their job safely and effectively. For example, European Solar PV Installer Certification (CEPV), which includes certification of a high level of competence in the design and installation of solar PV systems.

Deliverable Overview

Attributes

Details

Areas of research

- Competitive intelligence

Report representation

- Consolidated report in PDF format

Major countries covered

- UK, Germany, Spain, Italy, France,Netherlands

Highlights of report

- Top 5 countries and their manufacturers

- Average price point analysis of top 5 companies in key countries

- Solar sales of key companies in Europe

- Company market share analysis, 2022

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified