- Home

- »

- Market Trend Reports

- »

-

Europe In-office Clear Aligner - A revolutionary Orthodontic Treatment Analysis

![Europe In-office Clear Aligner - A revolutionary Orthodontic Treatment Report]()

Europe In-office Clear Aligner - A revolutionary Orthodontic Treatment Analysis

- Published: Aug, 2024

- Report ID: GVR-MT-100196

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 22

- Report Coverage: 2024 - 2030

Europe In-office Clear Aligner - A revolutionary Orthodontic Treatment Analysis

The in-office clear aligner market in Europe is transforming orthodontic treatment, offering a revolutionary approach to dental care. These transparent, custom-made aligners provide an effective and discreet alternative to traditional braces, catering to the growing demand for aesthetic and convenient orthodontic solutions. The market growth is driven by the high prevalence of malocclusion, rapid technological advancements in dental health, and rising demand for customized aligners in Europe. The region is experiencing a notable rise in oral health challenges, driving market growth. According to a WHO article published in April 2023, 50.1% of Europe’s adult population suffers from significant oral diseases, the highest rate among all WHO regions. This prevalence is increasing the demand for treatments like clear aligners, especially for malocclusion and dental alignment issues.

Europe In-office Clear Aligner-A revolutionary Orthodontic Treatment Analysis Report Scope

Attributes

Details

Areas of Research

Industry trends, market opportunity, in-office penetration across countries, clear aligner growth analysis

Report Representation

Consolidated report in PDF format

Country Coverage

8+ countries

Age Group Coverage

-

Teens

-

Adults

Distribution Channel Coverage

-

Online

-

Offline

Highlights of Report

-

Number of orthodontic procedures performed from 2018 to 2030

-

France

-

Italy

-

Spain

-

Germany

-

-

The proportion of orthodontists who perform clear aligner treatments in-office & Growth of Procedures from 2018 to 2030

-

France

-

Italy

-

Spain

-

Germany

-

-

Year-on-year Growth of Clear Aligner Procedures in-Office in Germany, Spain, Italy, and France

-

Clear aligners treatment growth per year from 2018-2030

Europe In-office Clear Aligner-Analysis Coverage Snapshot

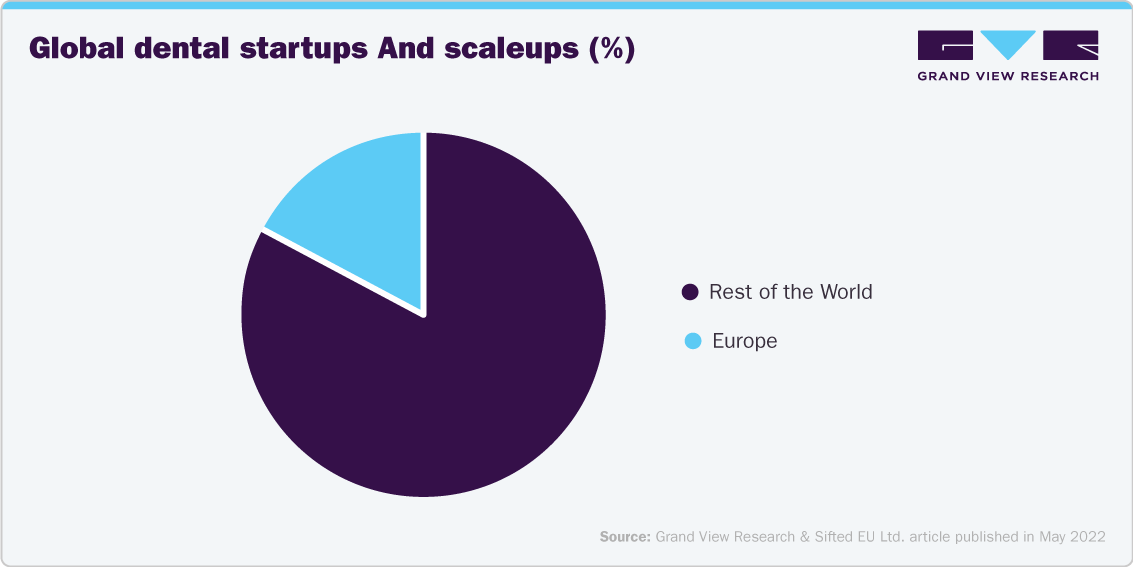

Europe is witnessing a surge in dental technology innovation. According to a Sifted EU Ltd. article published in May 2022, the region accounts for 17% of the world’s dental startups and scaleups. This robust ecosystem includes over 370,000 dentists across the EU and UK, all expected to gain from and contribute to these advancements.

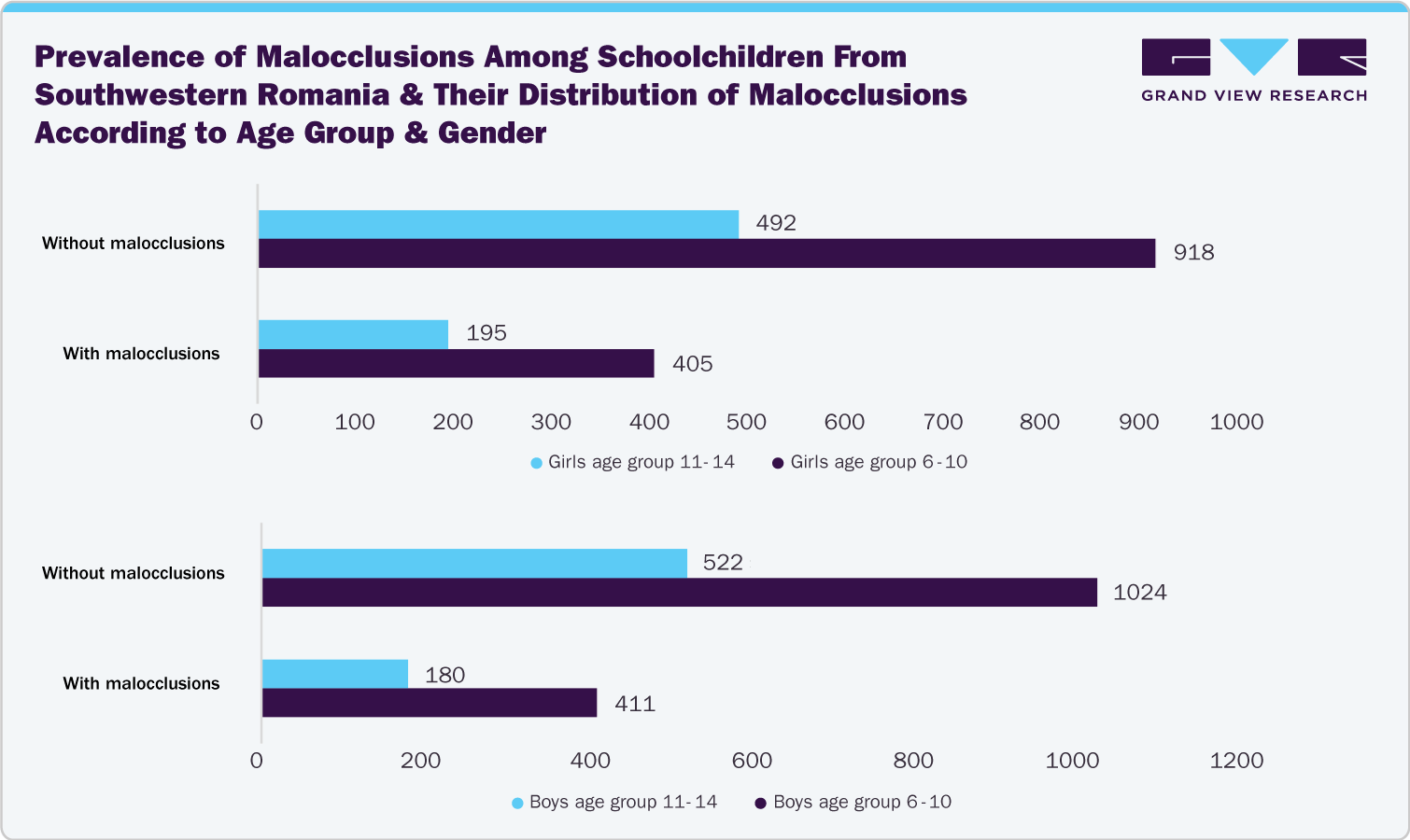

The high prevalence of malocclusions found among schoolchildren in Southwestern Romania is expected to propel market growth over the forecast period. According to the MDPI article published in March 2024, a study carried out in Southwestern Romania revealed a high prevalence of malocclusions among schoolchildren, with numerous showing various types of dental misalignment. This highlights the extensive nature of this issue across Europe and emphasizes the need for timely intervention to avoid long-term complications. Among the 4,147 participants in the study, around 816 children aged 6–10 were found to have malocclusions, with 405 being girls and 411 boys. In the 11–14 age group, around 375 children had malocclusions, including 195 girls and 180 boys. The remaining 2,956 participants showed no signs of malocclusions.

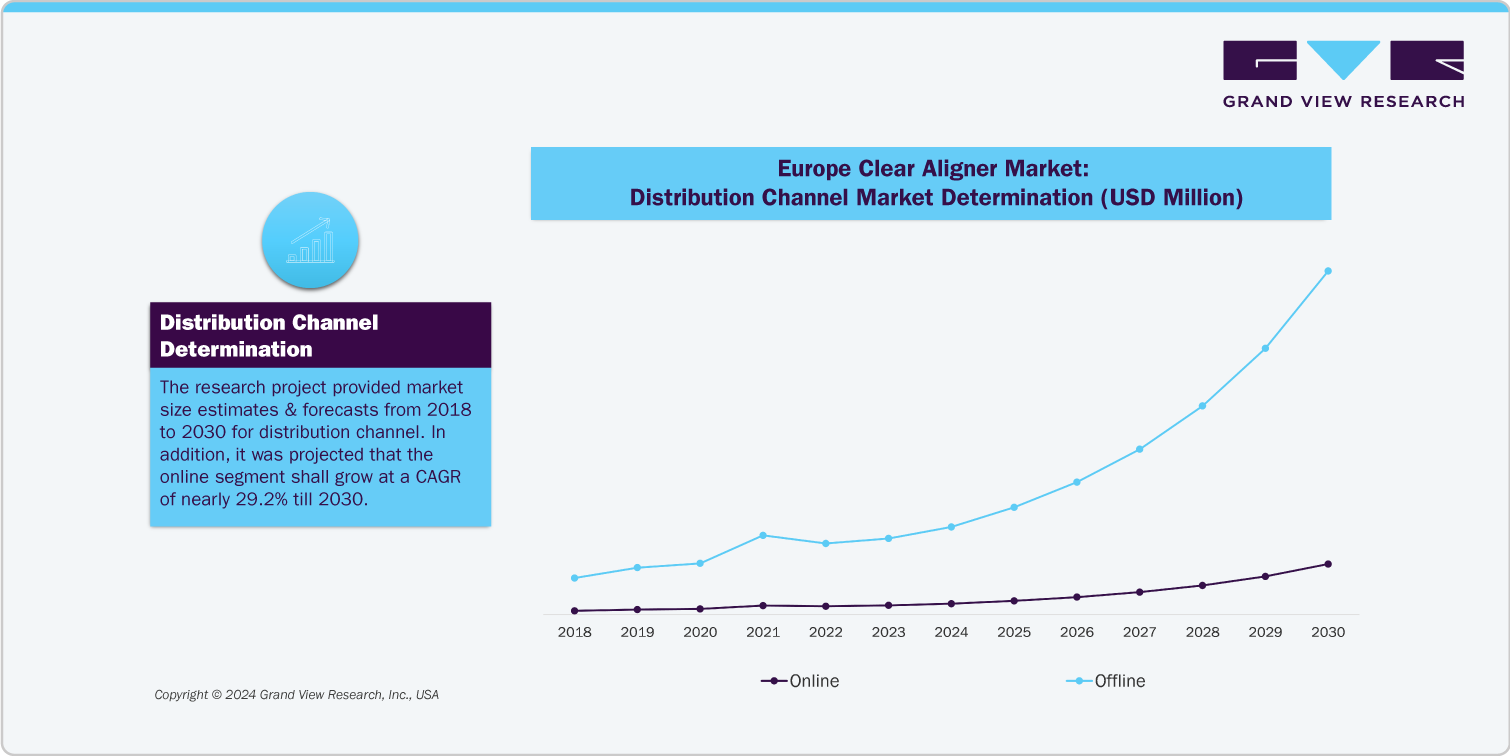

Distribution Channel Trend Analysis

A rise in the number of Direct-to-Consumer (DTC) clear aligner companies in Europe has resulted in the high adoption of the online sales channel. DTC aligners served as a significant growth driver in the market due to several factors. According to Dentistry.co.uk, in August 2022, they offer unparalleled convenience by allowing patients to manage their treatment remotely, reducing the need for frequent in-person visits to dental or orthodontic offices. Moreover, DTC aligners are often perceived as a more affordable alternative to traditional orthodontic treatments, appealing to cost-conscious consumers seeking effective dental solutions at a lower cost. These aligners leverage digital platforms and telehealth capabilities, expanding their reach to a wider audience, including individuals in remote or underserved areas.

The increasing number of strategic initiatives by key manufacturers is another factor expected to boost market growth over the coming decade. For instance, in August 2023, Ormco launched Spark Clear Aligners Release 14, which includes the introduction of Spark Approver Web and integration with DEXIS IOS, among other updates. This launch focuses on expanding the capabilities and features of the clear aligner product line, enhancing treatment planning, and integrating with digital tools for orthodontic professionals.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified