- Home

- »

- Market Trend Reports

- »

-

Europe Cancer Treatment Facilities Database

![Europe Cancer Treatment Facilities DatabaseReport]()

Europe Cancer Treatment Facilities Database

- Published: Oct, 2024

- Report ID: GVR-MT-100275

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Report Overview

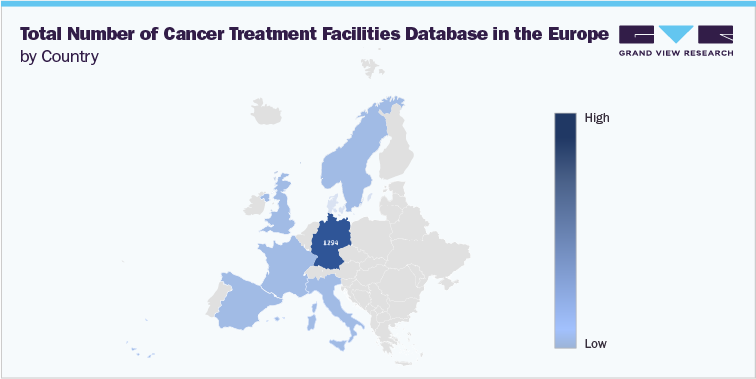

The Europe cancer treatment facilities database size was valued at USD 10.44 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.75% from 2023 to 2030. The study covers cancer treatment facilities at country level which helps to understand details regarding their overall revenue, headquarters, and ZIP code.

Europe Cancer Treatment Facilities Database Coverage

Cancer Treatment Facilities Analyzed for Below Mentioned Pointers

Name

ZIP Code

Headquarters

Overall Revenue, 2023 (USD Million)

Competitive Scenario: Europe Cancer Treatment Facilities Market

The Europe cancer treatment facilities market is highly fragmented, with the presence of large national chains and smaller, independent, and profit & nonprofit operators. For instance , the European Institute of Oncology (IEO) is one of the institutions dedicated to cancer research and treatment. Established as an independent, non-profit foundation, the IEO has been at the forefront of oncology since its establishment. Its primary mission is to advance knowledge in cancer prevention, diagnosis, and therapy through innovative research and high-quality patient care.

The key players control a significant portion of the market, but numerous regional and local providers also have a substantial presence. Larger players often expand geographically to capture market share in underserved areas. Mergers and acquisitions are common strategies for entering new markets or consolidating a presence in existing ones. For instance, In August 2024, the Finnish Competition and Consumer Authority (FCCA) granted approval for the merger between Mehiläinen, and Docrates Cancer Center. This merger is significant as it aims to enhance the range of services offered by Mehiläinen in the field of oncology.

Cancer treatment facilities are increasingly adopting technology to improve care quality and operational efficiency. This includes electronic health records, personalized medicine, diagnostic technologies, and tailored treatment approaches such as

-

The European Cancer Imaging Initiative is a collaborative effort aimed at enhancing cancer research and treatment through the development of a comprehensive “atlas” of cancer-related images. This initiative is crucial for several reasons, including improving diagnostic accuracy, facilitating research, and fostering innovation in cancer detection and treatment.

-

The European Federation for Cancer Images (EFCI) is an initiative aimed at leveraging advanced imaging technologies to enhance cancer diagnosis, treatment, and research across Europe. The federation focuses on integrating various imaging modalities such as MRI, CT scans, PET scans, and ultrasound into a cohesive framework that improves patient outcomes through better detection and monitoring of cancer.

The market is characterized by a diverse landscape of healthcare providers, technological advancements, and regulatory frameworks that shape service delivery. The market comprises various stakeholders, including hospitals, specialized cancer treatment centers, and outpatient facilities. Companies are increasingly focusing on enhancing patient outcomes through the integration of advanced technologies such as precision medicine, immunotherapy, and radiotherapy innovations.

Collaboration fosters an environment conducive to research and innovation in cancer treatments. Specialists within the network can work together on clinical trials and studies that explore new therapies or combinations of existing treatments. A virtual assembly of cancer specialists from various European nations was conducted in June 2024, to deliberate on the treatment strategies for patients suffering from rare and complicated gynecological cancers. A comprehensive study spanning six years revealed that these collaborative discussions led to the formulation of new treatment guidelines and enhanced access to clinical trials for patients across Europe. The results of this study are set to be presented at the ESMO Gynecological Cancers Congress in 2024.

The European Federation of Pharmaceutical Industries and Association (EFPIA) report published in October 2023 , discusses the pressing need for a reevaluation of cancer services across Europe. It highlights that the current healthcare systems may not be adequately prepared to meet the increasing demand for cancer care due to several factors, including an aging population, advancements in cancer treatments, and rising incidence rates of various cancers. The report serves as a critical reminder of the evolving landscape of cancer care in Europe and urges stakeholders at all levels healthcare providers, policymakers, and patients to collaborate on strategies that will ensure effective service delivery.

Database of Cancer Treatment Facilities in UK

Sr. No.

Company Name

Zip Code

Headquarters

Overall Revenue, 2023 (USD Million)

1

Charité - University Medicine Berlin

10117

Berlin

1,978.30

2

Breast Center

(Robert Bosch Krankenhaus GmbH)70376

Stuttgart

395.20

3

Klinikum Esslingen

73730

Esslingen am Neckar

20.60

4

Marienhospital Stuttgart

70199

Stuttgart

10.00

5

Alb Fils Klinikum GmbH

73035

Göppingen

7.40

6

Knappschaftsklinikum Saar GmbH

66113

Saarbrücken

<5.00

7

Certified Oncology Center

Health North (Klinikum Bremen-Mitte)28205

Bremen

7.90

8

Hannover Medical School (Medizinische Hochschule Hannover: Brustzentrum)

30625

Hannover

1,000.00

9

DRK Clinic Service Company Saxony mbH (Brustkrebszentrum)

09117

Chemnitz

NA

10

South Tyrolean Health Service

I-39012

Meran

NA

11

AGAPLESION DIAKONIEKLINIKUM HAMBURG gGmbH

20259

Hamburg

15.60

12

The München Klinik gGmbH

81925

München

1,000.00

13

West German Tumor Center Essen (WTZ)

45147

Essen

NA

14

University Hospital Würzburg

97080

Würzburg

48.10

15

Hanau Hospital GmbH

63450

Hanau

260.30

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified