Overview of Electric Beds Industry

The electric beds industry is a rapidly growing sector within the broader healthcare and medical equipment market, driven by an increasing aging population and a rising demand for home healthcare solutions. Electric beds, which feature adjustable positions for both comfort and medical necessity, are essential for hospitals, nursing homes, and home care settings. These beds enhance patient mobility and safety, reducing the risk of falls and improving overall care quality. The increasing demand for electric bed is attributed to the rising number of hospitals in developing countries, increasing patient population, growing geriatric population, and rising adoption of technologically advanced products. The global burden of chronic diseases, such as diabetes, cardiovascular diseases, and respiratory conditions, continues to rise. According to the World Health Organization (WHO), chronic diseases account for approximately 71% of global deaths, necessitating effective care solutions like electric beds.

Disease Epidemiology for Electric Beds

Disease epidemiology is a crucial factor influencing the demand for electric beds, particularly as healthcare systems worldwide adapt to meet the needs of aging populations and the rising prevalence of chronic diseases. Electric beds serve an essential role in hospitals, nursing homes, and home care settings, providing patients with comfort, safety, and improved care management. Understanding the epidemiological landscape related to the conditions that necessitate the use of electric beds is vital for stakeholders in the healthcare sector, including policymakers, manufacturers, and healthcare providers.

Prevalence and Incidence of Chronic Diseases in Major Countries

- United States

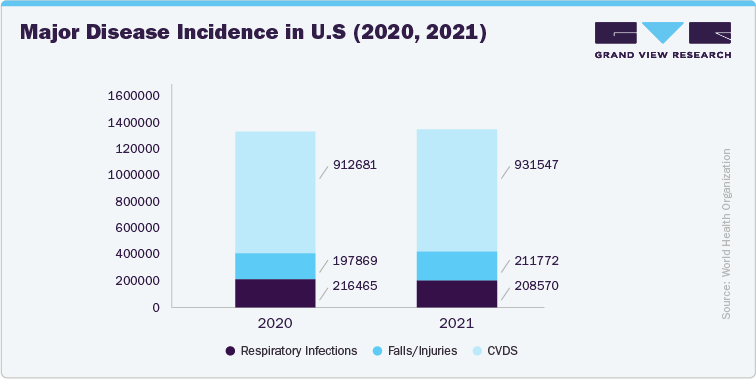

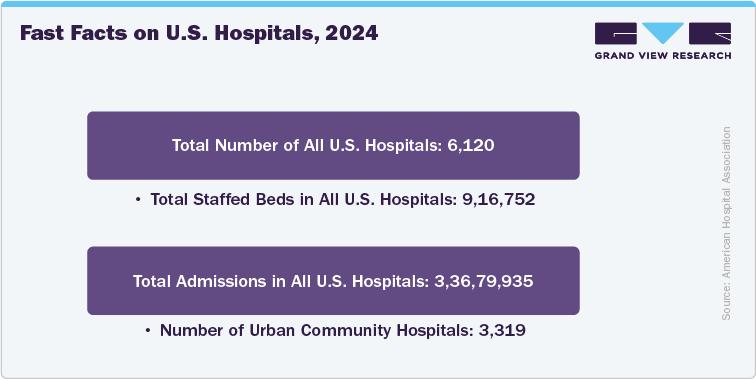

In U.S., chronic diseases are a significant public health concern, with approximately 60% of adults living with at least one chronic condition. The Centers for Disease Control and Prevention (CDC) estimates that nearly 29.7 million Americans have diabetes, while 702,880 people died from heart disease in 2022. The increasing prevalence of these conditions is closely tied to lifestyle factors, including poor diet, lack of physical activity, and obesity. As the population ages-projected to reach over 83 million individuals aged 65 and older by 2050-the demand for electric beds will likely increase. Electric beds provide essential features that cater to the needs of patients with mobility limitations, such as adjustable height, side rails, and built-in safety mechanisms. In acute care settings, these beds facilitate better patient management by allowing healthcare providers to position patients easily for examinations and treatment. The market for electric beds in the U.S. is expected to grow, driven by rising healthcare expenditures, increasing investments in home healthcare, and the expansion of rehabilitation services.

- Germany

Germany faces significant challenges with chronic diseases, as 46% of adults report at least one condition according to National Institute of Health. The country has a strong healthcare system focused on long-term care, requiring specialized medical equipment like electric beds, which enhance comfort and safety in nursing homes and rehabilitation centers. With substantial investments in elder care and a push for advanced technologies in patient care, the demand for electric beds is expected to increase, supporting the recovery and quality of life for older adults.

- India

India faces a unique health challenge with a rapidly growing population and a high prevalence of both communicable and non-communicable diseases, particularly chronic conditions like diabetes and hypertension. The WHO estimates about 77 million people in India have diabetes, a number expected to rise due to lifestyle changes. While electric beds are still rare in rural areas, their use is increasing in urban hospitals and clinics. As India’s healthcare system evolves, investments in medical equipment like electric beds are crucial for enhancing patient care and addressing the growing burden of chronic diseases.

- South Africa

In South Africa, chronic diseases present a substantial public health challenge, with conditions such as hypertension, diabetes, and HIV/AIDS affecting millions. This burden is further compounded by social determinants of health, including poverty and limited access to healthcare services, which hinder effective disease management. In 2021, 11.8% of the UAE's population was affected by diabetes according to the Government of UAE, illustrating a global trend driven by lifestyle factors. In response to the increasing prevalence of chronic diseases, the demand for electric beds is growing, particularly in urban healthcare facilities where these conditions are more common. Electric beds significantly enhance patient comfort and safety, especially for individuals with mobility issues or those requiring long-term care. As the South African government and healthcare providers strive to improve healthcare infrastructure and accessibility, strategic investments in electric beds and other essential medical equipment will be crucial in addressing the healthcare needs of the population, ultimately fostering a more resilient and effective healthcare system.

- China

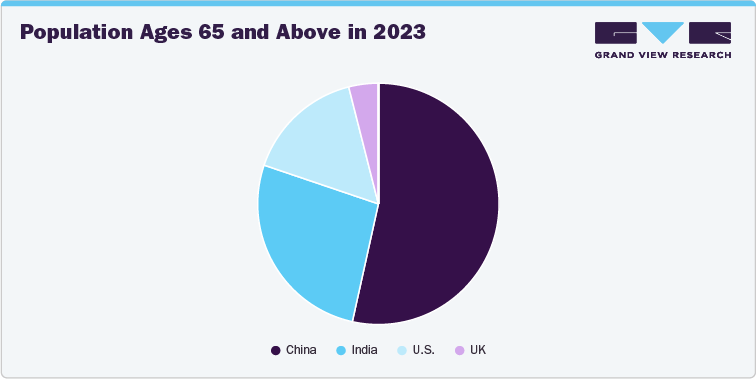

China is facing a rapidly aging population alongside a rising burden of chronic diseases, with around 300 million people affected by conditions like diabetes and cardiovascular diseases. Projections indicate that by 2040, 28% of the population will be over 60, significantly increasing healthcare demand, including the need for electric beds. These beds are increasingly adopted in hospitals and elder care facilities, providing essential support for patients with chronic illnesses. The Chinese government has made substantial investments in healthcare infrastructure to enhance patient care and outcomes. As the demand for specialized medical equipment grows, electric beds will be vital in improving the quality of care for elderly patients and those with mobility challenges.

Aging Population in Key Countries

- United States

In the U.S., the aging population is rapidly increasing, with projections indicating that by 2030, nearly 1 in 5 Americans will be 65 or older according to the U.S. Census Bureau. Factors such as advances in healthcare and declining birth rates contribute to this trend. As the elderly population grows, the demand for healthcare services, long-term care, and age-specific medical equipment, like electric beds, is also rising, creating challenges for healthcare systems to adapt and expand services.

- India

According to the NITI Aayog, India’s aging population is rising but from a younger demographic base. By 2050, it is expected that over 300 million Indians will be aged 60 and above. Rapid urbanization and changing lifestyles are contributing factors. While the elderly population remains a smaller percentage compared to Western countries, the sheer number poses challenges for healthcare delivery, highlighting the need for accessible medical care and facilities to support aging.

- China

China is experiencing one of the most dramatic demographic transitions, with projections suggesting that by 2040, over 28% of its population will be over 60 according to the WHO. This shift is driven by decades of population control policies and increased life expectancy. The government is responding by investing in healthcare infrastructure to support the elderly, including enhancing long-term care facilities and integrating modern medical technologies.

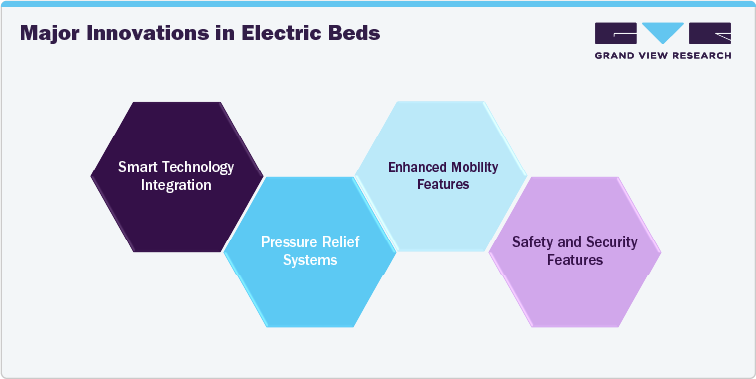

Electric beds are crucial in modern healthcare settings, providing comfort and safety for patients while facilitating care for healthcare providers. The market for electric beds has been experiencing robust growth, driven by several factors:

- Technological Advancements: Innovations such as integrated monitoring systems, pressure relief technologies, and smart bed features have made electric beds more appealing.

- Healthcare Infrastructure Development: Governments and private entities are investing in healthcare infrastructure, particularly in emerging markets, leading to an uptick in electric bed installations.

- COVID-19 Impact: The pandemic highlighted the need for effective healthcare solutions, driving increased investment in hospital beds and associated equipment.

Types of Electric Beds

Electric beds can be segmented based on their applications, primarily into:

-

Hospital Beds:

-

Intensive Care Beds: Equipped with advanced features for critically ill patients.

-

Standard Ward Beds: Basic electric beds used in general wards.

-

Surgical Beds: Designed for use in operating rooms with adjustable components.

-

-

Home Care Beds:

-

Adjustable Home Beds: Designed for patients who require assistance at home, these beds offer similar features to hospital beds.

-

Specialized Beds for Specific Conditions: Beds designed for patients with conditions such as sleep apnea, mobility issues, or pressure sores.

-

Regulatory Landscape

Government Regulations and Policies: The market for electric beds is influenced by various regulations and standards aimed at ensuring patient safety and product quality. Key regulatory bodies include:

-

Food and Drug Administration (FDA) (U.S.): The FDA regulates the manufacturing and marketing of medical devices, including electric beds, ensuring they meet safety and efficacy standards.

-

European Medicines Agency (EMA): In Europe, electric beds must comply with the Medical Devices Regulation (MDR) to ensure safety and performance.

-

ISO Standards: Many manufacturers adhere to International Organization for Standardization (ISO) standards related to medical devices, ensuring global compatibility and safety.

-

Health Canada: Regulates medical devices in Canada, ensuring compliance with safety and performance requirements.

-

National Health Service (NHS) Guidelines (UK): The NHS provides guidelines on the procurement and use of medical equipment, including electric beds, focusing on patient safety and effectiveness.

Competitive Landscape of Electric Beds

The competitive landscape of electric beds is shaped by various factors including technological advancements, market demand, and key players in the healthcare sector. Electric beds are increasingly recognized for their role in enhancing patient comfort, safety, and care efficiency, particularly in hospitals, nursing homes, and home healthcare settings. Major manufacturers such as Hill-Rom, Invacare, Stryker, and LINET dominate the market. These companies invest heavily in research and development to innovate features such as smart technology integration, improved ergonomics, and advanced safety mechanisms. Competition is also evident among regional players who cater to specific markets, particularly in Asia and Europe, where demand for electric beds is growing due to aging populations and rising chronic disease rates.

-

In January 2024, Joerns Healthcare has made a significant announcement: They have launched updated models for their popular EasyCare and UltraCare beds, which are renowned in the market for their advanced features.

-

In February 2023, Stryker's launch of SmartMedic is a significant development in the Indian healthcare industry. By introducing the first ICU bed upgrade platform, they've addressed a critical need for enhancing patient care and caregiver safety.

In August 2022, Dozee and Midmark India have partnered to create a smart hospital bed for non-ICU settings. The bed includes Dozee's AI-powered sensor technology, which continuously monitors patients' vital signs, including heart rate, respiration, temperature, oxygen levels, and ECG, without physical contact. This information is used to trigger early warning alerts for healthcare providers, enabling timely interventions.