- Home

- »

- Market Trend Reports

- »

-

Pricing Analysis For Key DMEs

Overview of Durable Medical Equipment Industry

The Durable Medical Equipment (DME) industry plays a crucial role in healthcare, providing essential equipment that aids in patient care, rehabilitation, and mobility. DME refers to medical equipment that can withstand repeated use and is primarily used for medical purposes. This includes items like wheelchairs, oxygen equipment, hospital beds, and prosthetics. The prevalence of chronic diseases, such as urological disorders, cancer, cardiovascular disease, neurovascular diseases, and various other chronic conditions, is significantly increasing, leading to a considerable rise in hospital admission rates, thus driving the growth of the durable medical equipment market globally. For instance, as per the WHO, every year, 17 million people die from Non-Communicable Diseases (NCDs) before age 70, and most of these early deaths, around 86%, happen in low- and middle-income countries. Among NCDs, cardiovascular diseases cause the most deaths, affecting 17.9 million people annually. Following closely are cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, which includes deaths from kidney disease caused by diabetes).

Durable Medical Equipment Product Outlook

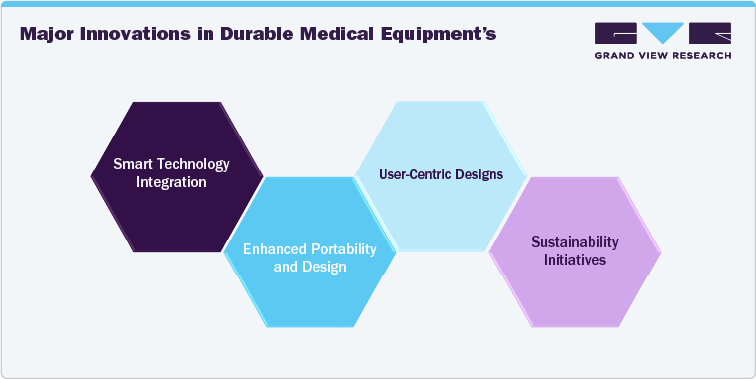

The durable medical equipment sector encompasses a wide range of products designed to assist patients with medical needs, rehabilitation, and mobility. The outlook for DME products reflects evolving healthcare trends, technological advancements, and changing patient demographics.

Mobility Aids

-

Wheelchairs and Scooters: Manual and powered options are crucial for patients with limited mobility. Innovations include lightweight materials and improved battery technology for electric scooters.

-

Walkers and Canes: Adjustable and foldable designs enhance convenience and usability for elderly patients and those recovering from injuries.

Respiratory Equipment

-

Oxygen Concentrators: Demand for home oxygen therapy is rising, particularly for chronic respiratory diseases. Portable units are becoming more common for patient mobility.

-

CPAP Devices: Continuous positive airway pressure devices for sleep apnea management are increasingly integrated with smart technology for monitoring and compliance tracking.

Hospital Beds and Accessories

-

Adjustable Beds: These beds allow patients to change positions easily, which is essential for comfort and recovery.

-

Mattresses and Pressure Relief Products: Specialized mattresses reduce the risk of pressure ulcers, especially for immobile patients.

Rehabilitation Equipment

-

Physical Therapy Devices: Products such as resistance bands, balance trainers, and exercise machines are critical for rehabilitation.

-

Prosthetics and Orthotics: Advanced materials and 3D printing technologies are improving the fit, function, and customization of prosthetic limbs.

Monitoring Devices

-

Blood Pressure Monitors: Home monitoring is increasingly common for chronic disease management, with devices that connect to mobile apps for data tracking.

- Glucose Monitors: Continuous glucose monitoring systems are transforming diabetes management, providing real-time data and alerts.

Overview of Pricing Analysis of Key DMEs

The pricing structure of DMEs is influenced by several factors, including manufacturing costs, regulatory requirements, reimbursement rates from insurance providers, and the competitive landscape. Typically, DMEs fall into categories such as mobility aids (like wheelchairs and walkers), respiratory equipment (including CPAP machines), and monitoring devices (such as blood glucose meters). Each category presents unique pricing challenges; for instance, mobility aids often require customization, impacting costs, while respiratory equipment may have fluctuating demand based on seasonal health trends, influencing prices. Moreover, regulatory changes and the introduction of new technologies can disrupt established pricing models, necessitating continuous market monitoring.

The implementation of value-based care models further complicates pricing strategies, as stakeholders increasingly focus on outcomes rather than service volume. This shift encourages DME manufacturers to demonstrate the efficacy and cost-effectiveness of their products, often leading to collaborative pricing agreements with healthcare organizations. Furthermore, the rise of telehealth and remote monitoring technologies is reshaping the DME market, prompting adjustments in pricing as new products emerge. With the increasing focus on patient-centered care, DMEs that offer superior functionality or enhanced user experience may command higher prices, while those unable to differentiate may face pricing pressures.

Market segmentation also plays a critical role; premium products may be priced higher due to brand reputation and perceived quality, while budget-friendly options cater to cost-conscious consumers. In conclusion, the pricing analysis of key DMEs is a multifaceted process that requires a deep understanding of market trends, regulatory environments, and patient needs. By continually assessing these variables, stakeholders can make informed decisions that align pricing with value delivery, ensuring accessibility and sustainability within the healthcare system.

Pricing Range of Durable Medical Equipment: By Type

Wheelchairs: Wheelchairs are mobility devices designed to assist individuals who have difficulty walking due to illness, injury, or disability. They can be manually propelled by the user or a caregiver or powered by a battery. For instance, in January 2024, Robooter, a mobility device manufacturer specializing in robotic technology for the elderly and disabled, introduced its innovative power wheelchair X40 at the Consumer Electronics Show (CES) 2024 in Las Vegas

Types:

-

Manual Wheelchairs: Require user or caregiver propulsion.

-

Electric Wheelchairs: Powered by batteries and controlled with a joystick.

-

Specialty Wheelchairs: Designed for specific needs, such as sports or heavy-duty use.

Country

Price Range (USD)

U.S.

USD 300 - USD 3,000

Canada

USD 400 - USD 2,500

UK

USD 500 - USD 2,800

Germany

USD 450 - USD 2,600

India

USD 100 - USD 800

Australia

USD 350 - USD 2,000

Oxygen concentrators: They are medical devices that filter and concentrate oxygen from the ambient air, providing patients with a continuous supply of oxygen. They are essential for individuals with respiratory conditions like COPD or asthma. In July 2022, OMRON Healthcare launched a new portable Oxygen Concentrator, enhancing its offerings in the oxygen therapy category. This concentrator utilizes a medical molecular sieve to provide a continuous oxygen supply of 5 liters per minute, delivering over 90% concentration. It is designed specifically to support home care providers in managing the therapy and lifestyle needs of patients with COPD and other respiratory issues.

Types:

-

Portable Oxygen Concentrators: Lightweight and battery-operated for mobility.

-

Stationary Oxygen Concentrators: Designed for home use and require an electrical outlet.

Country

Price Range (USD)

U.S.

USD 50 - USD 500

Canada

USD 40 - USD 400

UK

USD 60 - USD 450

Germany

USD 50 - USD 400

India

USD 10 - USD 100

Australia

USD 30 - USD 350

Factors affecting Pricing of Durable Medical Equipment

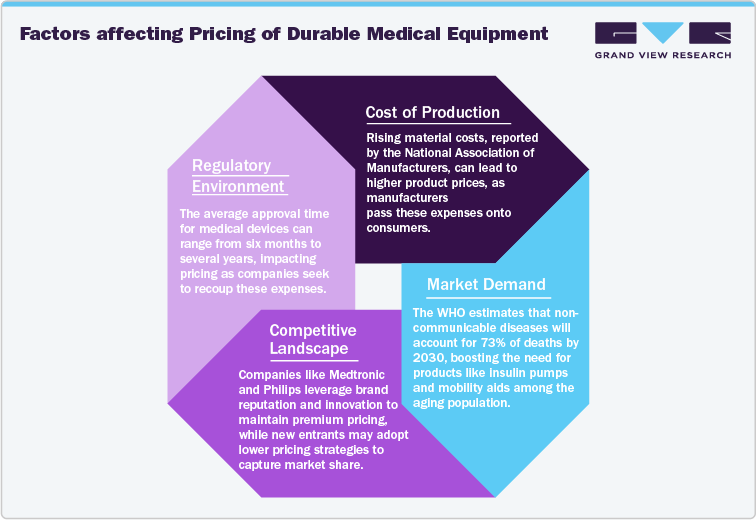

Cost of Production

One of the primary drivers of DME pricing is the cost of production. This includes expenses related to raw materials, labor, and overhead. For instance, the cost of high-quality materials-such as advanced polymers or electronic components-can significantly affect pricing. According to a report from the National Association of Manufacturers, material costs for manufacturing in the U.S. have risen steadily, contributing to overall production expenses. Labor costs are another critical factor; as the demand for skilled labor increases, wages can rise, impacting the final price of DME products. Overhead costs, including utilities and rent, further compound these expenses. As production costs rise, companies often pass these increases onto consumers, resulting in higher prices.

Market Demand

Market demand plays a significant role in shaping DME prices. The increasing prevalence of chronic diseases and an aging population drive demand for various medical devices. According to the WHO data published in 2022, by 2030, one out of every six people worldwide will be 60 years or older. During this period, the number of individuals in this age group will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of those aged 60 and above is anticipated to double, reaching 2.1 billion. Moreover, the number of people aged 80 years or older is projected to triple by 2050, reaching a total of 426 million, compared to the figures recorded in 2020. This, in turn, is estimated to augment the demand for DME products over the coming years.

Competitive Landscape

The competitive environment also influences pricing strategies. Companies must consider competitor pricing when establishing their own prices. A market characterized by numerous players can lead to price wars, driving down costs, while a lack of competition can allow companies to set higher prices. For instance, companies like Medtronic and Philips Healthcare, which dominate the market with innovative technologies, may maintain premium pricing strategies due to their brand reputation and advanced product features.

Regulatory Environment

Regulatory factors significantly impact DME pricing. Compliance with regulations set by bodies such as the Food and Drug Administration (FDA) in the U.S. and the European Medicines Agency (EMA) in Europe involves considerable costs. These regulatory processes ensure the safety and efficacy of medical devices but can also delay product launches and increase costs. According to the FDA, the average time for medical device approval can range from six months to several years, depending on the device classification. The financial burden of meeting these regulations is often reflected in the final pricing of the products.

Competitive Landscape Of Durable Medical Equipment Market

The competitive landscape of the Durable Medical Equipment (DME) market is characterized by a diverse range of global players, including established companies like Philips Healthcare, OMRON Healthcare, and Medtronic, as well as emerging firms that focus on innovative solutions. Key strategies employed by these players include expanding product portfolios to include advanced technologies such as telehealth integration and smart devices, forming strategic partnerships for distribution and development, and investing in research and development to enhance product efficacy and usability. Additionally, companies are increasingly focusing on personalized care solutions and entering emerging markets to capitalize on the growing demand driven by an aging population and rising chronic disease prevalence. This dynamic environment necessitates continuous adaptation to regulatory changes and shifts in consumer preferences, fostering a highly competitive atmosphere in the DME sector.

-

In January 2024, Sunrise Medical has launched the Switch-It Vigo head control, a wireless and proportional alternative drive system designed for power wheelchairs. The system developed by Now Technologies LTD which joined Sunrise Medical in 2022. Vigo allows users to navigate their power wheelchairs and devices with subtle head movements. Its innovative technology has received acclaim in various markets and secured awards, including the 2023 Mobility Product Award in the "Alternative Driving Controls" category from Mobility Management publication. Vigo's addition complements Switch-It's range of advanced controls for power wheelchairs. This strategic move is anticipated to contribute to the increased adoption of U.S. Durable Medical Equipment in the near future.

-

In January 2024, Medline introduced the OptiView Transparent Dressing with HydroCore technology as the latest addition to its advanced wound care portfolio. The company aim is to enhance efficiency with tools like OptiView, addressing healing barriers and elevating care standards. Users have reported benefits such as improved treatment and prevention of pressure injuries, along with cost savings due to longer wear time and reduced dressing changes. Thus, due to such advancements, the market is expected to grow in the near future.

-

In October 2023, Home Care Delivered, Inc., successfully acquired Medline Industries, LP's DMEPOS supplier business unit. This strategic acquisition aims to boost HCD's market presence, expand its geographical reach, and broaden its customer base. The move reinforces relationships with patients, healthcare plans, providers, and manufacturers.This strategic move is anticipated to contribute to the increased adoption of U.S. Durable Medical Equipment in the near future.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified