Market Overview: Evolving Regulatory Trends In Mainland China

Key Trends in the Mainland China Market:

- Implementation of Volume-Based Procurement (VBP) in Mainland China:

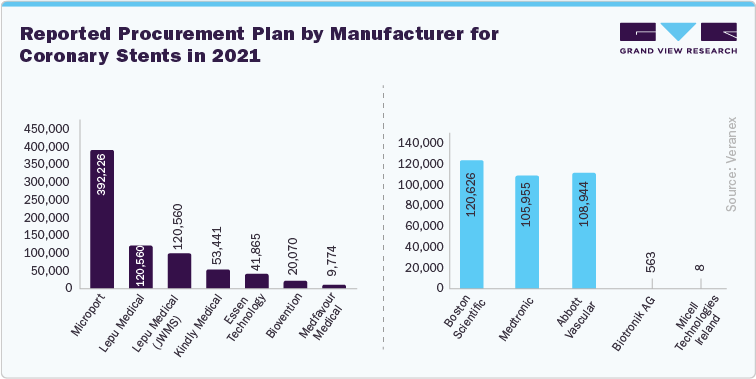

VBP in Mainland China has transformed the medical technology procurement landscape. Implemented in phases, this policy aims to lower the prices of medical consumables through volume-based tenders. VBP has significantly impacted both multinational and domestic companies, prompting trends such as strategic adjustments and a re-evaluation of commercial operations. The policy's rollout has progressively affected various product categories and regions over time.

Table 1 Impact of three national-level VBPs on medical devices:

|

Year |

Product Involved |

Cost Saving Success |

|

2022 |

Spinal & Orthopedic Products |

The average price reduction for spinal & orthopedic products is 84%, leading to estimated savings of 26 billion yuan (approximately USD 3.71 billion) based on a projected purchase volume of 1.09 million units. |

|

2021 |

Artificial Hip and Knee Joints |

The average price reduction is 82%, resulting in estimated savings of 16 billion yuan (US$2.29 billion) based on a projected purchase volume of 540,000 units. |

|

2020 |

Coronary Stents |

The average price reduction is 93% for domestic products and 95% for imported ones. The estimated annual savings, based on projected purchase volumes, is approximately 10.9 billion yuan (around US$1.56 billion). These changes significantly impacted market dynamics and competitiveness. |

The VBP policy has led to a significant reduction in medical device prices. For example, the average selling price of a total knee replacement system dropped from $5,000 to under $800. This price decrease has made the procedure more accessible for patients previously deterred by cost.

Impact Of VBP On International & Domestic Medtech Market In China:

Before the implementation of VBP, multinational MedTech giants such as Medtronic held significant market shares. As per Beroe Inc., October 2022 insights, in China, domestic competition has intensified dramatically. Initially, major global device manufacturers controlled 75% of the drug-eluting stent market. The domestic Chinese manufacturers now hold over 75% of the market share. However, VBP has facilitated the expansion of local competitors. Domestic companies such as MicroPort and AK Medical have increased their market presence under this new pricing model. AK Medical led in joint replacement rollouts, securing over 15% of the first-year tenders, while MicroPort achieved a 10% increase in overall market coverage.

- Authorization Of The Import Of Essential Drugs And Medical Devices In Hainan Province China:

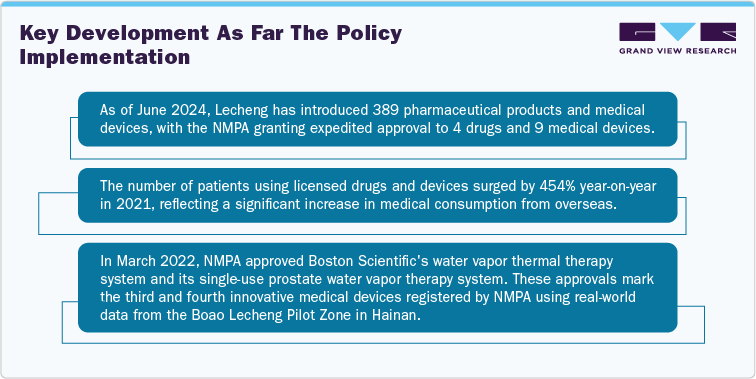

Starting May 2023, Hainan's Boao Lecheng International Medical Tourism Pilot Zone implemented new regulations to streamline the import of urgent need of drugs & medical devices. These guidelines allow internationally un-approved in vitro diagnostics, medical devices, & drugs to be used in the Pilot Zone if they are deemed urgent and no suitable alternatives are available. This policy builds on the 2019 regulations, facilitating faster market entry for international manufacturers and enabling them to collect real-world data in China to support national registration approval.

Key Highlights Of The Policy:

-

Medical devices and drugs approved in other countries can be utilized in medical institutions within the pilot zone with the National Medical Products Administration(NMPA) approval.

-

Clinical data from imported drugs and medical devices used in the pilot zone can support NMPA import registration applications.

-

Multicentre clinical studies conducted in the pilot zone's medical and R&D institutions are recognized as provincial-level projects.

-

The pilot zone benefits from duty-free importation and warehousing.

-

Direct sales to hospitals within the pilot zone are permitted.

- Policy Landscape For Unapproved Devices In China Under The Great Bay Area (GBA) And Hainan NMPA Initiatives:

Regulations On The Administration Of Urgent Use Imported Drugs And Medical Devices

-

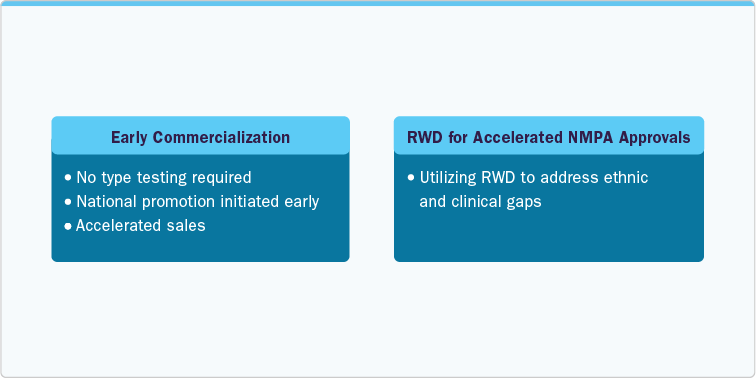

On March 28, 2023, the Hainan government released the "Regulations on the Administration of Urgent Use Imported Drugs and Medical Devices in the Boao Lecheng International Medical Tourism Pilot Zone of Hainan Free Trade Port," effective May 1, 2023. This policy allows for accelerated commercial access to the China Boao zone compared to the national approval process. Unlike the national process, it does not require local type testing or substantial proof of burden. However, not all products qualify for this special zone.

-

Key Features Includes:

Eligible Devices: The policy covers imported medical devices deemed clinically urgent, already approved for sale overseas but not yet approved by China’s NMPA.

Accelerated Approval: The policy permits the use of overseas unapproved medical devices, IVDs, and drugs in China, provided they have clinical urgency status. Manufacturers can leverage this opportunity to gather real-world data (RWD) and real-world studies (RWS) in Hainan to support national NMPA registration. The special program can reduce market access time to as little as four months.

Application & Review Process: Hainan Provincial Health Commission (HHC): HHC assesses the qualifications of medical institutions for the clinically urgent use of imported medical devices and drugs within 10 business days.

While the official review period is 22 working days, additional factors such as hospital qualification, documentation, ethics committee approval, contract negotiations, and logistics can extend the timeline to a few months-still significantly faster than the national approval process.

Real World Evidence To Support Regulatory Decisions On Medical Devices

-

Real World Data (RWD) from the GBA Connect Scheme can be standardized into clinical evidence for National Medical Products Administration (NMPA) registrations, enabling product approval across all provinces and regions in China. This process expedites approval timelines while ensuring the safety and efficacy of medical products in real-world settings.

The GBA Connect Scheme as of March 2024, has granted 59 urgently needed imported medical products from Macau & Hong Kong, benefiting over 5,000 patients. The growing impact highlights the increasing sophistication of RWD collection and analysis in the GBA.

Key Opportunity For China Medtech Industry: The new policy opens a unique early entry pathway with many benefits.

- Expedite Market Entry In China Through Green Pathways:

China's NMPA introduced several fast-track registration channels for medical devices. In addition, to further streamline these green channel pathways, China announced that approved innovative products will benefit from special pricing, premium reimbursement, and exemptions from Volume-Based Purchasing (VBP).

|

Fast-track registration channels |

Description |

|

Innovative Medical Device (IMD) |

The IMD pathway fosters innovation in technology and drives industrial development. |

|

Priority Evaluation Approval (PEA) |

The PEA route is designed for urgent clinical use. Applications are submitted alongside the standard registration process. If approved, the technical review and quality audit will be expedited. If not approved, the product will continue through the standard review process. |

|

Emergency Use Approval (EUA) |

The Emergency Use Authorization (EUA) process is designed to address public health emergencies swiftly and effectively by allowing expedited approval of necessary medical devices. EUA is activated when there is a declared public health emergency or a substantial risk of one that threatens national health. For example, during the early stages of the COVID-19 outbreak in 2020, EUA enabled Mainland China to quickly review and approve diagnostic test kits and equipment for detecting the virus. For foreign applicants seeking EUA in Mainland China, it is required to appoint a local agent or representative (Marketing Authorization Holder, or MAH) to handle applications. All technical documents must be submitted in Chinese, and English documents must be notarized in the applicant’s home country. |

As the second-largest MedTech market and the only one with consistent double-digit growth, China offers significant opportunities for overseas companies. By leveraging these special pathways, including the innovation-focused pre-market submission process available to both domestic and international manufacturers, overseas companies can accelerate market entry and capture growth in China.

- Notable Approvals For Medical Devices By The NMPA In 2023:

The National Medical Products Administration (NMPA) of China continued to play a crucial role in regulating medical devices, ensuring their safety, efficacy, and quality before they could be marketed and used in the country. Here are key highlights regarding the applications and approvals of medical devices under the NMPA in 2023:

In 2023, the NMPA received 13,260 applications for medical devices, a 25.4% increase from 2022. Of these, 12,213 were approved, covering Class II and Class III devices. Approvals were mainly for medical devices (75%) and IVDs (25%). The NMPA's streamlined processes and focus on innovation led to significant increases in the registration of passive implantable and dental devices, with major contributions from countries like the USA, Germany, and Japan. Special approvals were granted to 69 innovative devices, emphasizing China's growing importance in global medical device markets.