Overview Of The Computed Tomography Devices Industry

The computed tomography industry is rapidly evolving within medical imaging, characterized by significant technological advancements and growing demand for precise diagnostic tools. This device provide detailed cross-sectional images essential for diagnosing conditions such as cancer, cardiovascular diseases, and trauma. The industry is led by key players like GE Healthcare, Siemens Healthineers, and Philips Healthcare, who focus on innovations to improve image quality, minimize radiation exposure, and integrate AI for enhanced diagnostics. Furthermore, this industry growth is fueled by growing prevalence of chronic disorders, increasing healthcare needs, and an increasing aging population. However, the industry faces challenges such as high costs of equipment, stringent regulatory standards, and competition from other imaging technologies like MRI and ultrasound.

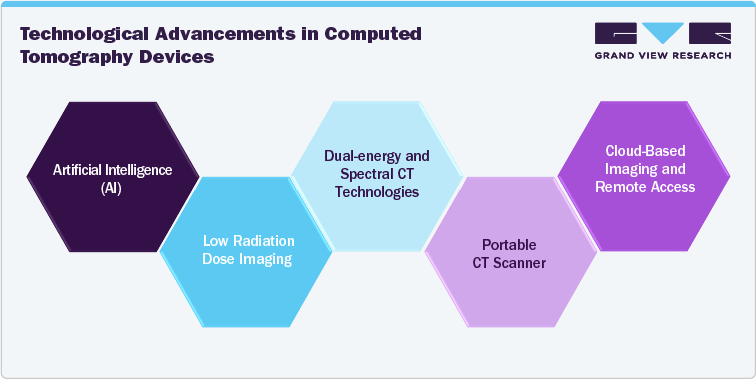

Major Advancements Transforming the Computed Tomography Devices Industry

The computed tomography (CT) devices industry is experiencing significant advancements that are reshaping the landscape of medical imaging. Innovations such as the integration of artificial intelligence, development of low-dose imaging techniques, and the introduction of photon-counting detectors are enhancing diagnostic precision by improving image quality and safety. Dual-energy and spectral CT technologies offer more refined tissue characterization and material differentiation, particularly benefiting complex diagnoses. Additionally, the development of portable and ultra-fast CT scanners is expanding accessibility, allowing for broader use across various medical settings.

Some of the most notable advancements include:

Artificial Intelligence (AI): The growing integration of artificial intelligence (AI) in computed tomography (CT) is transforming the field of medical imaging by enhancing both diagnostic accuracy and workflow efficiency. AI technologies, such as machine learning and deep learning algorithms, are increasingly being incorporated into CT systems to automate various aspects of image acquisition and interpretation. These AI systems can analyze CT scans with high precision, detecting and highlighting abnormalities such as tumors, fractures, or lesions that might be missed by the human eye. For instance, AI can provide automated measurements, suggest potential diagnoses, and even predict patient outcomes based on imaging data.

-

Several companies are at the forefront of integrating artificial intelligence (AI) into CT devices, driving significant advancements in the field. For instance, Siemens Healthineers developed the "AI-Rad Companion", a suite of AI-driven tools that enhance the diagnostic capabilities of CT imaging. The AI-Rad Companion utilizes machine learning algorithms to assist radiologists by automating the detection and analysis of abnormalities such as lung nodules or brain hemorrhages. This system provides automated findings and quantitative measurements, streamlining the diagnostic process and improving accuracy.

Low Radiation Dose Imaging: Low-dose imaging in CT incorporates advancements like iterative reconstruction techniques and photon-counting detectors to lower radiation exposure while maintaining or even enhancing image quality. Iterative reconstruction improves image clarity by refining scans obtained with reduced radiation doses, ensuring diagnostic accuracy is not compromised. Photon-counting detectors capture more precise details from each x-ray photon, allowing for clearer images with less radiation. These innovations contribute to safer CT scans by reducing patient radiation risk while delivering high-quality diagnostic outcomes.

- Several companies are pioneering the development of photon-counting technology in computed tomography (CT), which is revolutionizing the field by enhancing image quality and reducing radiation dose. For example, Siemens Healthineers has introduced the Naeotom Alpha CT scanner, which utilizes photon-counting detectors to capture x-ray photons with high precision.

Dual-energy and Spectral CT Technologies: These technologies enhance tissue characterization and material differentiation by capturing images at multiple energy levels. This approach allows for more detailed and precise diagnostic information, particularly useful for complex conditions. Dual-energy CT utilizes two different x-ray energy levels to distinguish between various tissue types and materials, improving the accuracy of diagnoses such as identifying kidney stones or differentiating between types of tumors. Spectral CT takes this a step further by capturing a broader spectrum of x-ray energies, enabling even finer differentiation of tissues and materials. These advancements provide radiologists with more comprehensive and accurate imaging, facilitating better decision-making and patient care.

- Several leading companies are advancing dual-energy and spectral CT technologies, driving significant improvements in diagnostic imaging. Siemens Healthineers is a prominent contributor with its SOMATOM Drive CT scanner, which features dual-energy imaging capabilities. This system captures images at two distinct energy levels, improving material differentiation and tissue characterization, and delivering more detailed diagnostic information for radiologists.

Portable CT Scanner: The development of more compact, portable CT scanners and ultra-fast imaging systems is expanding accessibility and allowing for their use in a variety of settings, including emergency rooms, intensive care units, and ambulances. These advancements make it possible to obtain high-quality diagnostic images quickly and efficiently, even in challenging environments where space is limited, or immediate imaging is crucial.

Cloud-based Imaging and Remote Access: Cloud-based imaging and remote access leverage cloud technology to offer secure storage, sharing, and analysis of CT images. This innovation facilitates teleradiology by allowing healthcare providers to access and review CT scans from any location, promoting remote consultations and enabling collaborative diagnostics across different facilities.

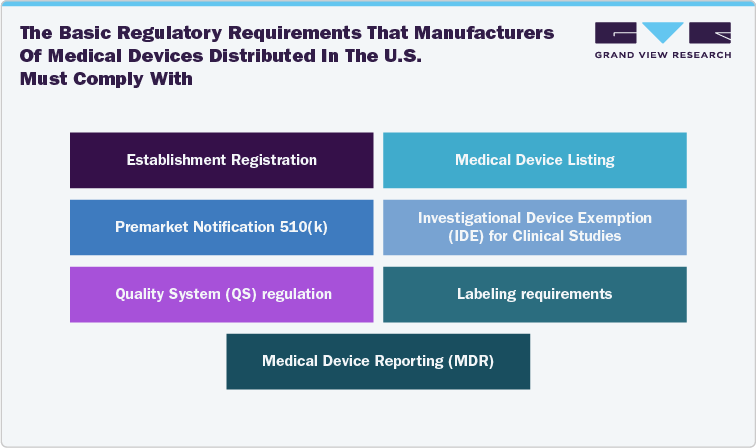

Overview of Medical Device Regulation in the U.S.

The FDA's Center for Devices and Radiological Health (CDRH) oversees the regulation of companies that manufacture, repackage, relabel, or import medical devices for sale in the U.S. Manufacturers of medical devices distributed in the U.S. must comply with the following basic regulatory requirements:

Competitive Scenario Of The Computed Tomography Devices Industry

The computed tomography (CT) devices industry is highly competitive, driven by rapid technological advancements and a growing demand for advanced imaging solutions. Major companies like Siemens Healthineers, Philips Healthcare, and GE Healthcare are at the forefront of this competitive landscape. These industry leaders are continuously pushing the boundaries of technology to develop advanced CT systems with improved imaging capabilities, reduced radiation doses, and enhanced diagnostic precision.

Moreover, the competition in this industry is further growing by the emergence of new companies and startups that are bringing forward advanced technologies and innovative approaches. These emerging players often introduce technologies that challenge the dominance of established firms. The industry is also affected by regulatory changes, cost constraints, and the need to address diverse global healthcare needs, contributing to a dynamic and competitive market where both established leaders and new entrants compete to succeed.

The report analyses the competitive landscape in this industry based on parameters mentioned below:

|

Competitive Landscape: Top 10 Computed Tomography Devices Manufacturers Overview |

||||

|

Market Outlook |

Company Categorization |

Company Share Analysis (Top 10 companies) |

Company Position Analysis |

List of Key Companies by Region |

|

Company Overview |

Product Benchmarking |

Financial Performance |

Recent Strategic Initiatives |

SWOT Analysis |

|

Emerging Players: Overview of 35+ Emerging Players and Startups in the CT Industry |

||||

|

Company Overview |

Establishment Year |

Headquarters |

Business Verticals |

Employee Count |

|

Investor Information |

Total Funding (USD) |

Product Benchmarking |

Strategic Initiatives |

SWOT Analysis |

Company Profiles:

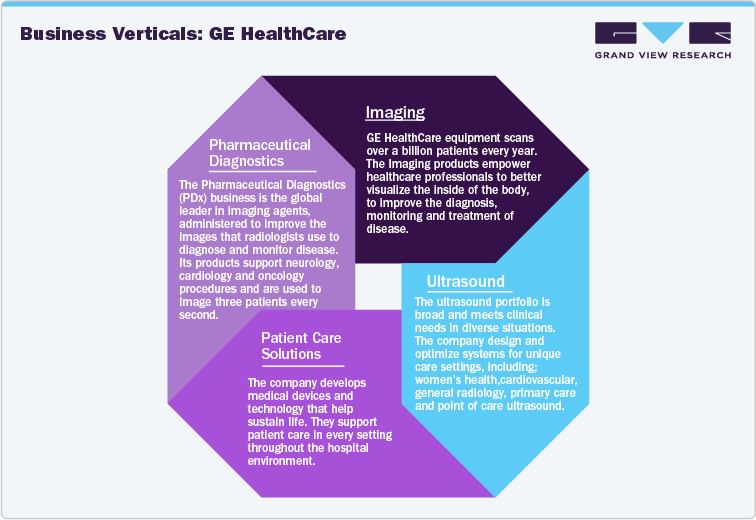

GE HealthCare

Establishment Year: 1892

Headquarters: Chicago, Illinois, U.S.

Number of Employees: ~50,000

GE HealthCare is a global innovator in medical technology, pharmaceutical diagnostics, and digital solutions. As a division of General Electric, GE Healthcare provides a comprehensive range of products and services designed to improve patient care and streamline healthcare operations. Committed to delivering integrated solutions, services, and data analytics, The company aims to enhance hospital efficiency, empower clinicians, improve treatment precision, and promote patient well-being and satisfaction. With a presence in over 160 countries, the company holds over 11 thousand patents granted worldwide.

Product Portfolio Of GE HealthCare

|

Product Name |

Description |

|

Revolution ACT |

Revolution ACT enables to enhance patient care for a larger number of individuals affordably |

|

Revolution EVO Gen 2 Defying time |

This system comprises ASiR, recognized as the world’s most widely utilized iterative reconstruction (IR) method, and ASiR-V*, the next generation of GE's iterative reconstruction technique. Together, they enable you to consistently reduce the radiation dose during examinations while maintaining or even improving diagnostic accuracy. |

|

Revolution HD |

This system provides a spatial resolution of 0.23 mm throughout the entire two-meter scan length, temporal resolution of 29 milliseconds, and Smart MAR technology specifically engineered to unveil anatomical details concealed by metal artifacts. This assists clinicians in diagnosing diseases with enhanced confidence. |

|

Revolution Frontier |

The system's brand-new imaging chain incorporates the advanced PerformixTM HD Plus X-ray tube, notable for its significant reduction in wear compared to conventional ball bearing technology. This leads to shorter tube warm-up times between patients and extends tube life by up to two times. |

|

Optima CT540 |

This system consists of HiLight Matrix Detector equipped with 24 reference elements and a rotation speed of 0.5 seconds. |

|

Revolution ACTs Expert Edition |

Revolution ACTs provides advanced imaging with 32 slices |

|

Revolution ACTs ES |

Revolution ACTs ES provides high spatial resolution, dose reduction, and high image quality |

|

Revolution ACTs EX |

Revolution ACTs EX provides superior imaging for unique and new clinical applications |

|

DISCOVERY RT |

DISCOVERY RT system is dedicated to radiation therapy |

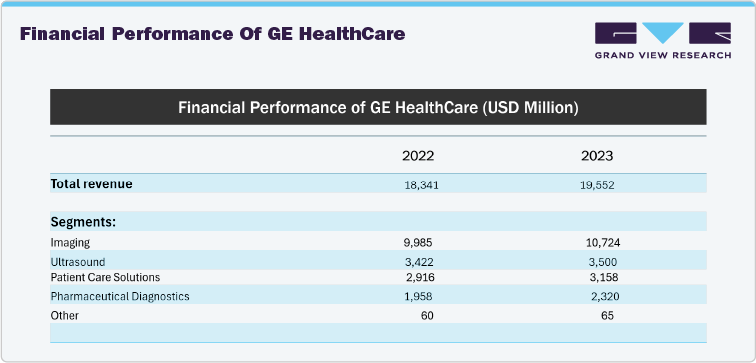

Financial Performance Of GE HealthCare

Strategic Initiatives

Companies drive growth through a blend of strategies, including significant investments in innovation and research to develop new products and technologies. They expand their market presence by entering new regions and targeting diverse customer segments, while strategic partnerships and acquisitions enhance their capabilities and competitive edge. Additionally, a strong focus on customer-centric approaches ensures exceptional experiences, fostering loyalty and driving long-term success.

Recent developments by GE HealthCare:

-

In February 2024, GE Healthcare and MedQuest Associates (MedQuest) announced a three-year collaboration aimed at delivering excellence in patient care. This partnership combines GE Healthcare's innovative technologies with MedQuest's infrastructure and resources, enhancing the optimization of multi-site outpatient imaging networks for success. The collaboration underscores a commitment to providing access to advanced healthcare solutions while prioritizing patient care and satisfaction.

-

In January 2024, the company announced its agreement to acquire MIM Software, a renowned global provider of medical imaging analysis and artificial intelligence (AI) solutions. MIM Software specializes in serving the fields of radiation oncology, molecular radiotherapy, diagnostic imaging, and urology across imaging centers, hospitals, specialty clinics, and research organizations globally. GE Healthcare anticipates harnessing MIM Software's expertise in imaging analytics and digital workflow to drive innovation and enhance its solutions across different healthcare domains. This strategic move aims to bring greater benefits to patients and healthcare systems worldwide.

-

In January 2023, GE HealthCare entered into an agreement to acquire a France-based company, IMACTIS, an innovator in the quickly expanding area of Computed Tomography (CT) interventional guide across the variety of healthcare settings.

-

In April 2022, Unilabs, a European diagnostic services provider, agreed on the partnership with GE Healthcare to provide advanced imaging equipment and digital technology in Portugal. This partnership covered MRI & CT scanning technology, ultrasound devices, mammography, and X-ray machines, as well as innovative imaging fleet services.

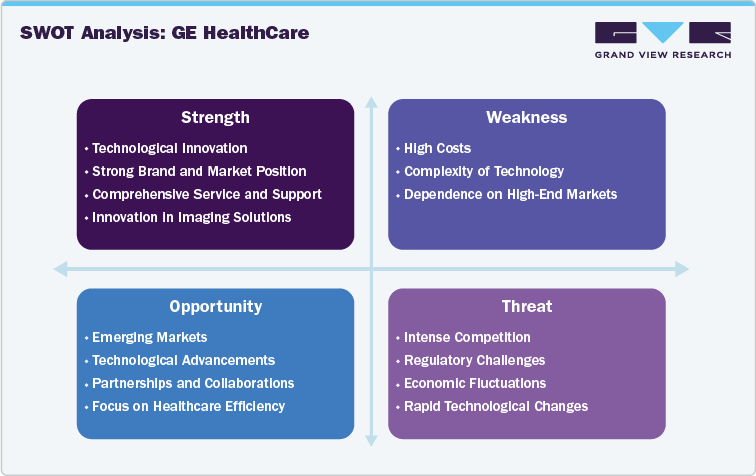

SWOT Analysis

Emerging Players in Computed Tomography Devices

Emerging players in the computed tomography devices market are making notable advances through innovative technologies and distinct strategies to establish a strong market presence. Here are some companies and their approaches.

-

United Imaging Healthcare: United Imaging Healthcare, a rapidly growing company from China, is making significant growth in the CT market with its uCT series, including the uCT 520 and uCT 760 models. These systems feature advanced technologies such as high-definition imaging, AI-enhanced image processing, and low-dose radiation capabilities. By offering high-performance, cost-effective solutions, the company aims to compete with established players and increase its market share.

-

Samsung Medison: Samsung Medison's advancement in portable CT systems marks a major breakthrough, enabling high-quality imaging in a broader array of settings, such as emergency and remote areas. This increased portability addresses crucial needs in urgent care and field diagnostics, thereby broadening the application of CT technology.

The "Computed Tomography Devices: Competitive Landscape Overview and Future Outlook" trend report provides a comprehensive analysis of the competitive dynamics within the global computed tomography devices market, offering insights from 2018 to 2030. This detailed report evaluates the key players, emerging trends, and technological innovations shaping the computed tomography market. It also delves into market segmentation by technology, application, and end use.

The report further examines the market’s geographical distribution, analyzing regional competitive landscapes in North America, Europe, Asia-Pacific, and other key regions. Additionally, the report features expert analysis on the evolving market strategies, partnerships, and mergers & acquisitions that are influencing the competitive environment. An executive summary provides a snapshot of the market’s current status and future outlook, highlighting the factors driving growth, such as advancements in imaging technology, increasing demand for early diagnosis, and the rising prevalence of chronic diseases. This report serves as a crucial resource for stakeholders seeking to understand the competitive forces and future opportunities in the computed tomography devices market.

|

Attributes |

Details |

|

Report Coverage |

Competitive Analysis of 10+ key Computed Tomography Devices Manufacturers; 35+ Emerging Players and Startups |

|

Report Study Period |

2018 to 2030 |

|

Report Representation |

|

|

Contents of Report |

Market Overview Company Categorization

Company Market Share Analysis (Top 10 Players) Company Market Position Analysis List of Key Players, by Region List of Emerging Players/Startups (35+ Players) Company Profiles (Any 15)

|