- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape Of Leading Blood Glucose Monitoring And Continuous Glucose Monitoring Devices

![Competitive Landscape Of Leading Blood Glucose Monitoring And Continuous Glucose Monitoring DevicesReport]()

Competitive Landscape Of Leading Blood Glucose Monitoring And Continuous Glucose Monitoring Devices

- Published: Aug, 2024

- Report ID: GVR-MT-100197

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Overview of the Diabetes Industry

Diabetes is increasingly becoming a global concern, affecting a significant portion of the population worldwide. According to data published by the International Diabetes Federation, in 2021, approximately 536.6 million people aged 21 to 79 years were affected by diabetes globally. This number is estimated to rise to 783.7 million by 2045. Diabetes mellitus, characterized by chronic hyperglycemia, requires consistent monitoring and management to prevent complications. Blood Glucose Monitoring (BGM) and Continuous Glucose Monitoring (CGM) devices are essential tools for managing diabetes. BGM devices involve periodic blood tests, while CGM systems provide real-time glucose readings and trends.

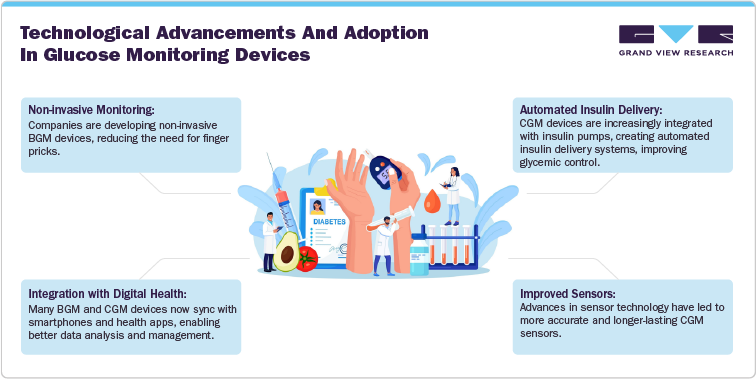

Technological Advancements and Adoption

The diabetes management industry has seen rapid technological advancements, enhancing both BGM and CGM devices' accuracy, usability, and convenience.

The adoption of these devices is driven by increasing diabetes prevalence, patient awareness, and a shift toward personalized healthcare. The convenience of real-time monitoring and data-driven insights has accelerated the adoption of CGM devices over traditional BGM devices.

Competitive Landscape

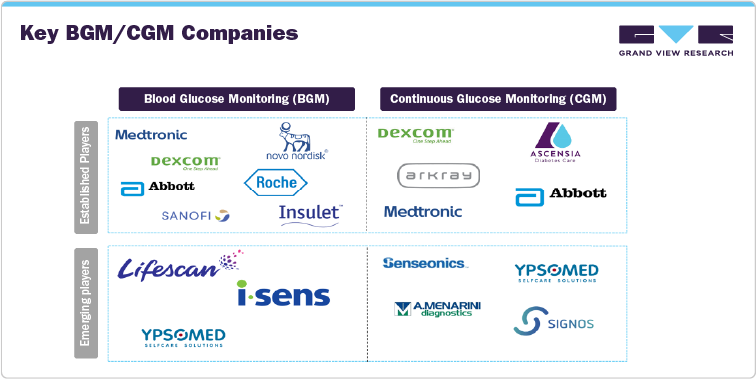

Several key players dominate the BGM and CGM markets with their respective brands, employing various strategies to maintain and grow their market share.

Key BGM/CGM Companies

Key Companies in BGM/CGM Devices Market: Brand Analysis

F. Hoffmann-La Roche Ltd

A leading player in the BGM market, Roche's Accu-Chek brand is well-regarded for its accuracy and ease of use. The company holds a significant market share through continuous innovation and strategic partnerships.

Ascensia Diabetes Care

Known for its Contour series, Ascensia has a strong presence in the diabetes monitoring devices market. The company's focus on user-friendly interfaces and accurate readings has garnered a loyal customer base.

Abbott

Abbott's Freestyle Libre series has revolutionized the CGM market with its sensor technology and affordability. The Libre 3's integration with digital health platforms has further strengthened Abbott's market share. While primarily known for its CGM devices Abbott also competes in the BGM market with its Freestyle series. The company leverages its strong brand reputation and global distribution network.

Sanofi

With its iBGStar and MyStar Extra products, Sanofi integrates blood glucose monitoring with digital health platforms, appealing to tech-savvy consumers.

Novo Nordisk

Novo Nordisk's BGM devices are part of its comprehensive diabetes care portfolio, emphasizing quality and reliability.

Dexcom

A pioneer in CGM technology, Dexcom leads the market with its G6 and G7 systems. The company's continuous innovation and focus on user experience have solidified its dominant position.

Medtronic

Medtronic's Guardian CGM systems, integrated with its insulin pumps, offer comprehensive diabetes management solutions, maintaining a strong market presence.

Ypsomed

Ypsomed's mylife YpsoPump integrates with CGM systems, providing a seamless diabetes management experience. The company's focus on patient-centric solutions drives its market growth.

Recent Developments and Strategic Initiatives

The glucose monitoring devices industry is marked by continuous innovation and strategic initiatives by major players such as Medtronic, Abbott Laboratories, Dexcom, and Roche. These companies are dedicated to enhancing diabetes management through advanced product development and securing necessary regulatory approvals. A significant focus is placed on expanding their market reach and technological capabilities through partnerships, mergers, and acquisitions. Investment in research and development is also a priority, with a strong emphasis on integrating cutting-edge technologies like artificial intelligence to offer more precise and real-time glucose monitoring solutions. These efforts aim to make diabetes management more efficient, user-friendly, and accessible, driving significant growth in the industry.

-

In July 2024, DexCom Inc. and Abbott Laboratories were preparing to launch their first over the counter (OTC) continuous glucose monitors (CGMs) in the upcoming months of 2024. Dexcom's Stelo and Abbott's Lingo and Libre Rio, which received FDA clearance in March and June respectively, are set for release. These devices utilize the same hardware as previous CGMs but are designed for individuals who do not take insulin.

-

In July 2024, Roche announced the marketing of a new device utilizing artificial intelligence to predict potential nocturnal hypoglycemia, improving the quality of sleep for individuals with diabetes.

-

In June 2024, Abbott announced FDA clearance for two new over-the-counter CGM systems, Lingo and Libre Rio, based on their FreeStyle Libre technology, now used by approximately 6 million people globally.

-

In April 2024, Senseonics Holdings, Inc. and Ascensia Diabetes Care announced that their Eversense system has received an integrated CGM (iCGM) designation from the US FDA. As the first fully implantable device in this category, Eversense has been approved through the FDA’s De Novo pathway, establishing it as a predicate device for future 510(k) submissions for similar devices.

The BGM and CGM markets are highly competitive, with significant technological advancements driving growth. Companies are focusing on innovation, integration with digital health platforms, and user-centric designs to differentiate themselves. As diabetes prevalence rises, the demand for efficient and accurate monitoring solutions will continue to grow, shaping the future landscape of diabetes management.

Key Companies Covered in the Study:

-

Thermo Fisher Scientific (Patheon)

-

Abbott

-

Medtronic plc

-

F. Hoffmann-La Roche Ltd

-

Ascensia Diabetes Care Holdings AG

-

Dexcom, Inc.

-

Sanofi

-

Novo Nordisk

-

Insulet Corporation

-

Ypsomed Holdings

-

Glysens Incorporated

-

Dexcom, Inc.

-

Senseonics Holdings, Inc.

-

A. Menarini Diagnostics S.r.l.

-

Signos, Inc.

The " Competitive Landscape of Leading Blood Glucose Monitoring (BGM) and Continuous Glucose Monitoring (CGM) Devices " trend report by Grand View Research offers an in-depth analysis of the leading companies in the blood glucose monitoring (BGM) and continuous glucose monitoring (CGM) device market. The report examines the product portfolios of these companies, highlighting the range and innovations in their offerings. It also provides insights into the financial status of these companies, assessing their market positions and competitive strengths. Additionally, the report details various strategic initiatives undertaken by these players, such as new product launches, obtaining government approvals, mergers and acquisitions, partnerships, and other significant activities aimed at strengthening their market presence and advancing diabetes management technologies.

Attributes

Details

Report Representation

Industry trends, market opportunity,

Company Coverage

15+ Companies

Report Representation

Consolidated report in PDF format

Contents of Report

-

Company Overview

-

Financial Performance

-

Product Benchmarking

-

Strategic Initiatives

-

Product Launch/Approval

-

Partnership & Collaborations

-

Merger & Acquisition

-

Expansion

-

Others

-

-

Company Position Analysis

-

Key Company Market Share Analysis, BGM Devices

-

Key Company Market Share Analysis, CGM Devices

-

Company Categorization (Emerging Players, Innovators and Leaders)

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified