- Home

- »

- Market Trend Reports

- »

-

Regulatory & R&D Funding Landscape In Clinical Trials Market

![Regulatory & R&D Funding Landscape In Clinical Trials MarketReport]()

Regulatory & R&D Funding Landscape In Clinical Trials Market

- Published: Sep, 2024

- Report ID: GVR-MT-100254

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 35

- Report Coverage: 2024 - 2030

Report Overview

Our healthcare portfolio has been developing since our inception in 2014, wherein we have tracked numerous sub-domains and their R&D activities. To help understand and highlight the clinical trials development journey, we have made this special study by analyzing the state of R&D funding and initiatives by the market players. This report accesses the trends in clinical trials which includes regulatory and R&D funding landscape as well as R&D spending scenario.

The clinical trials landscape has changed significantly from the past few years, due to the advancements in drug development and innovation and therapeutics in trial design methods and innovation. Moreover, growing shift towards decentralized clinical trials (DCT) during the pandemic has benefitted several healthcare and pharmaceutical companies. High data quality, lower costs, and a convenient and improved patient trial experience by DCTs have transformed clinical trials by accelerating the launch of new drugs into the market and making it cheaper.

Furthermore, clinical trials have witnessed significant growth in the emerging countries due to growing population, low operational costs, and growing burden of diseases which requires better treatment options. For instance, over the past few years, India’s participation in the global clinical trials have increased significantly due to low operational costs, size of the patient population, changing economic environment, and various regulatory reforms. According to the data published in 2023 by clinical Trial Registry India (CTRI), 54,547 clinical trials registered in 2022 and are currently ongoing in India. Thus, these factors are constantly changing the clinical trials landscape, further making the drug development process more effective and faster.

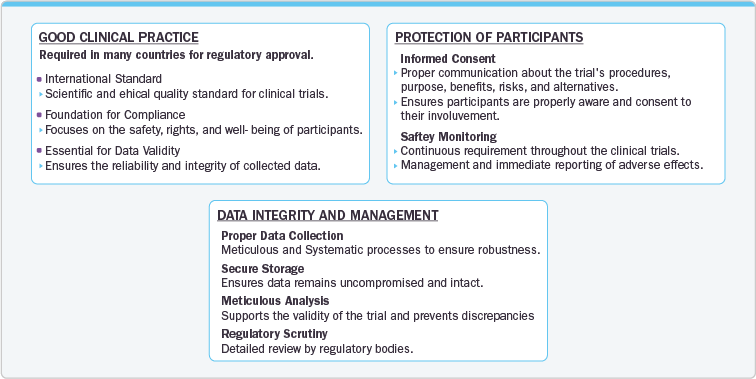

Regulatory Landscape In Clinical Trials

The regulatory landscape for clinical trials is complex and continually evolving, influenced by various legal, scientific, and ethical factors. The primary regulatory authority overseeing clinical trials in the U.S. is the Food and Drug Administration (FDA), which establishes guidelines to ensure the safety and efficacy of investigational drugs and biological products.

Advancements in technology have revolutionized how clinical trials are conducted and regulated. The integration of digital health tools, such as wearable devices and mobile health applications, has enabled real-time data collection and remote monitoring of participants. These technologies facilitate more precise and continuous tracking of health outcomes, potentially leading to more efficient and responsive trials. However, they also introduce new challenges related to data privacy and cybersecurity, which regulatory bodies are increasingly addressing through updated guidelines and standards.

R&D Funding Landscape

R&D funding levels have rebounded in 2023, after a significant decline witnessed from 2020-2021.

The biopharmaceutical sector has its most extensive and varied clinical development pipeline ever, as the number of drugs under development surged from 3,200 in 2012 to 6,100 by 2022. This ability to support such a broad pipeline has been significantly bolstered by government funding. For instance, approximately USD 18 billion was allocated for Operation Warp Speed, while the National Institutes of Health (NIH) invests about USD48 billion annually in research. Furthermore, in August 2024, the UK government announced the launch of a joint public-private investment program called Voluntary Scheme for Branded Medicine Pricing, Access and Growth (VPAG). This program aims to provide funding of USD 443.91 million into the UK's health and life sciences sector over the next five years.

In addition, venture capital firms have also played a significant role in funding clinical trials, particularly for early-stage biotech companies. VC firms invest in startups that show promise in developing innovative therapies or technologies. According to the data published by Clinical Leader in March 2024, the VCs have invested more than USD 20 billion to fund several biotech and health tech companies. Thus, increasing support by the VCs would further accelerate the research and development process and would change the clinical trial landscape.

Below is the list of some of the grants offered by California Institute for Regenerative Medicine (CIRM), a California state agency that funds stem cell research and regenerative medicine, 2024

Recipient Institution

Grant Type

Grant Title

Award Value

University of California, San Diego

Discovery Stage

Modeling the genetic basis of psychopathology in schizophrenia and autism

USD 12,703,708

University of California, San Francisco

Discovery Stage

CIRM Center for Neuropsychiatric Stem Cell Proteomics

USD 13,781,522

Scripps Research Institute

Discovery Stage

Translational epigenomics: dissecting cell type-specific function of neuropsychiatric risk genes in vivo

USD 11,376,314

Scripps Research Institute

Discovery Stage

Multiomic Studies of Idiopathic Intellectual Disability and Autism Spectrum Disorder (ID/ASD)

USD 17,365,387

University of California, San Francisco

Discovery Stage

Deep phenotyping of human brain organoid models of autism spectrum disorder to unravel disease heterogeneity and develop biomarkers and treatments

USD 12,297,272

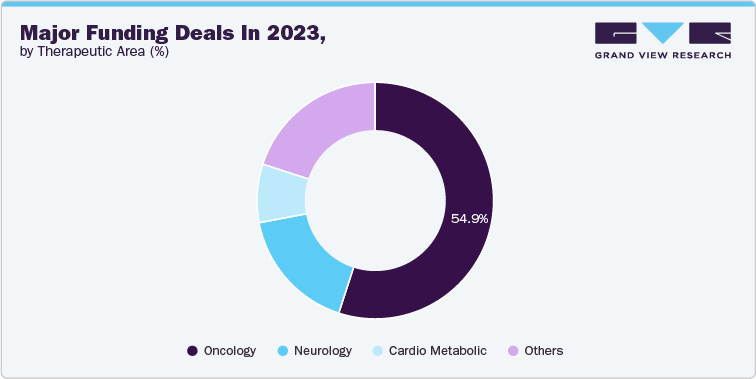

Furthermore, in 2023, there were 31 deals announced, each valued above USD 2 billion, accumulating a total of USD 200 billion. Of these deals, 55% of the market share captured by the oncology segment. This influx of capital would accelerate research activities further leading to more rapid development and potentially bringing new therapies to market sooner.

R&D Expenditure

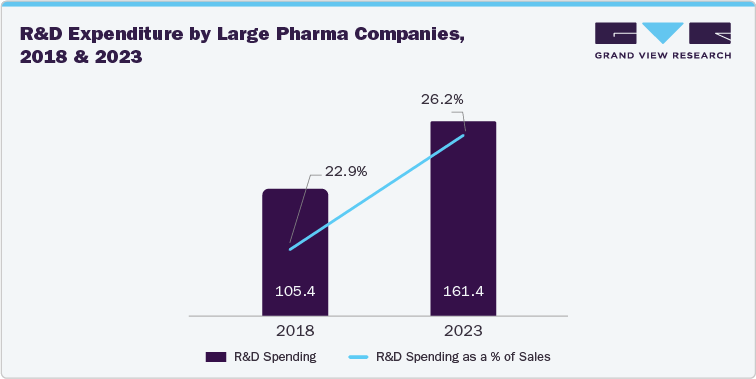

Several pharmaceutical companies such as Pfizer Inc., Novartis AG, Merck & Co. are contributing significant resources to clinical trials. These firms not only fund trials but also navigate complex regulatory pathways to bring new treatments to market. Their extensive R&D budgets and established regulatory departments enable them to manage the intricacies of drug development and approval processes effectively. Research and development expenditure by top pharmaceutical companies totaled around USD 161 billion in 2023, an increase of approximately 50% was witness from 2018.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified