Report Overview

In China, growing concern for aesthetic appearance has driven a significant increase in the number of aesthetic procedures. The abundance of aesthetic treatments in China can be attributed to the widespread availability of advanced techniques and affordable treatment options. The rising use of botulinum toxin in various aesthetic procedures such as treating forehead lines, performing chemical brow lifts, and addressing glabellar lines is anticipated to boost the demand for botulinum toxin products in China. In addition, the use of these products in China has risen due to positive feedback, including fewer adverse effects and quicker recovery times after these procedures.

The brand and competitive analysis report, compiled by Grand View Research, is a collection of the trends and competitive scenarios in China. Qualitative information regarding the trends, competitive strategies, existing competition, and pipeline analysis will be provided in the report. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

China Botulinum Toxin: Trends And Competitive Analysis Report Scope

|

Attributes |

Details |

|

Areas of Research |

Industry trends, market opportunity, aesthetic penetration in China, competitive and product revenue analysis |

|

Report Representation |

Consolidated report in PDF format |

|

Country Coverage |

China |

|

Product Coverage |

|

|

Highlights of Report (Competitive & Revenue Landscape, by Product) |

|

China Botulinum Toxin: Trends And Competitive Analysis Coverage Snapshot

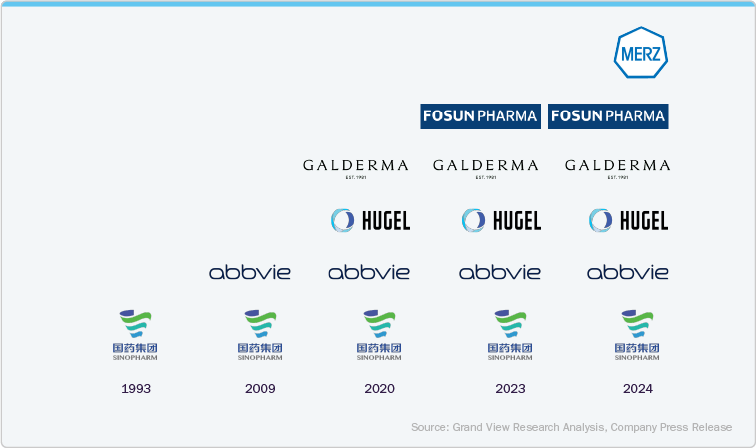

Currently, the Chinese market has only six approved botulinum toxin products: Hengli by Sinopharm Group, Botox by AbbVie/Allergan, Letybo by Hugel Inc., Dysport by Galderma, RT002 by Shanghai Fosun Pharmaceutical Industrial Development Co., Ltd., and Xeomin by Merz Pharma. The representation of company product launches by year is given as below,

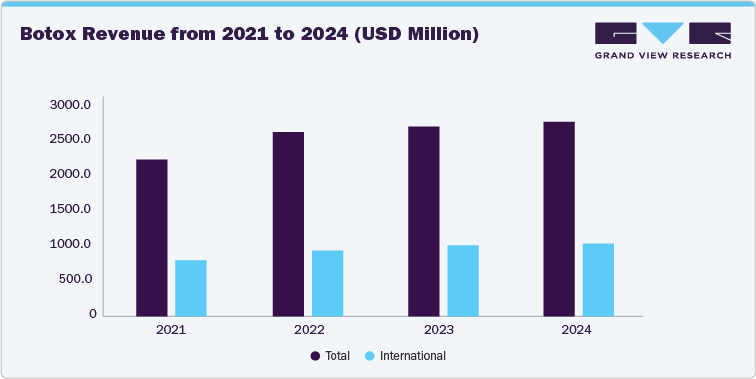

The rise in a number of botulinum toxin product entries in the Chinese market has indicated a large penetration of botulinum toxin in the country. Before 2020, only two botulinum toxin products were approved by China’s National Medical Product Administration (NMPA). However, post-2020, numerous recognized market players gained product approvals, while some others are in the pipeline. Established brand such as Botox by Abbvie have seen significant growth in revenue from 2021 to 2024. In addition, similar growth trends in revenue are observed across key brands due to positive customer feedback, product availability, advanced marketing strategies by new players, and social media influence.

There is huge botulinum toxin market potential in China due to continuous rise in the number of beauty-loving people in China, the surge in spending power & consumption willingness of people, and the high acceptance of foreign aesthetic products, especially those from South Korea. With the continuous launch of foreign brands, aesthetic solutions that are painless, safe, and simple have been springing up in China. In addition, by implementing reasonable pricing strategies, marketing projects, and strong communication with medical institutions & physician groups, the companies are getting market recognition for their botulinum toxin brands in China. For instance, Mr. Jihoon Sohn, CEO of Hugel, Inc., said: "Our cooperation with Sihuan Pharmaceutical reflects the strong collaboration of the international pharmaceutical industry and can maximize the synergistic advantages of each other in channels and products. We are full of confidence and expectation that Letybo 100U will become the No.1 botulinum toxin product in the Chinese market, paving the way for Hugel to introduce more innovative and leading medical aesthetic products to China in the future."

Industry leaders such as Botox by Abbvie, Hugel’s Letybo, and Dysport by Ipsen/Galderma position themselves as premium choices in China, offering to customers who prioritize top-tier brands. South Korean companies are increasing their botulinum toxin market share in China, where collaborations & partnerships with local Chinese firms are significant to overcome the entry barrier. For instance, in October 2023, Medytox Inc., a South Korean company, announced its plan to enter the Chinese market for botulinum toxin with its product, Newlux. The company is planning partnerships with foreign companies to enter the Chinese market quickly.

A number of botulinum toxin products are in the pipeline to enter the Chinese market. For instance, Daewoong Pharmaceutical applied for marketing approval to China’s National Medical Products Administration (NMPA) for its botulinum toxin product, Nabota, in 2021 and is presently awaiting the outcome.

Some of the key developments recorded in the China botulinum toxin industry-

|

Companies |

Year |

Month |

Details |

|

Merz Pharmaceutical GmbH |

2024 |

February |

Merz Pharmaceutical GmbH received approval for its botulinum toxin product Xeomin in China. The time from acceptance to approval was nearly 1,141 days. The product is indicated to treat severe canthus wrinkles (crow’s feet) in adults |

|

Sinclair |

2023 |

October |

Sinclair, a subsidiary of Huadong Medicine Co., Ltd. & ATGC Co., Ltd., announced a strategic collaboration and licensing agreement through, which Sinclair shall develop and commercialize ATGC’s BoNT-A, ATGC-110 for an aesthetic and therapeutic indication |

|

Shanghai Fosun Pharmaceutical Co., Ltd. |

2023 |

July |

Shanghai Fosun Pharmaceutical Co., Ltd. received approval from the National Medical Products Administration (NMPA) for its product, RT002, to treat moderate to severe glabellar lines in adults |

|

Daewoong Pharmaceutical |

2023 |

May |

Daewoong Pharmaceutical, announced investing USD 74.6 million to build a third plant to produce BoNT-A, Nabota, in response to a growing global market. |

|

Huons |

2022 |

May |

Huons, a South Korean manufacturer of botulinum toxin, announced that its product, Hutox (BoNT-A), is currently under Phase III clinical trial within China and expects marketing approval by mid-to-late 2024. |