- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape: Top Cell & Gene Therapy CDMOs

Report Overview

Our healthcare portfolio has been developing since our inception in 2014, wherein we have tracked numerous sub-domains and their R&D activities. We have actively been tracking the CDMOs space and have seen the evolution of these players from just a handful to now over 100 companies. To help understand and highlight their development journey, we have made this special study that focuses on the top cell & gene therapy CDMOs in the healthcare industry.

Cell and gene therapies have proven to be a promising treatment options for cancer and genetic diseases, however, the developers face several challenges before these treatments could reach to the patients. Therefore, several pharmaceutical companies are outsourcing their drug development and manufacturing activities to CDMOs which could increase reliability, speed, and reproducibility. In addition, the partnership with CDMO would help to reduce costs.

Increasing Number Of CDMOs Globally In Cell And Gene Therapy

Contract manufacturing and development organizations can help an early-stage cell and gene therapy developer to understand the limitations of their source cells. These outsourcing partners helps to navigate the changing regulatory landscape around CGT cell sources. Life sciences companies involved in the development of cell and gene therapies are entering into a long-term partnership agreement with a CDMO to address the challenges that companies face while manufacturing the therapies.

Competitive Landscape: Top Cell & Gene Therapy CDMOs Report Coverage

Market Outlook

Company Categorization

Company Position Matrix

Service Offering Matrix

List of Key CDMOs by Region

Company Overview

Key Service Offerings

Financial Reporting

Recent Strategic Developments

SWOT Analysis

Competitive Scenario: Cell and Gene Therapy CDMOs:

Overview:

The CDMOs are the major contributors within healthcare outsourcing industry. The spending in cell and gene therapies has rapidly increased and has reached USD 5.9 billion in 2023, an increase of 38% from 2022. The number of cell and gene therapies in development have increased significantly over the past few years and is projected to increase in the coming years. The increasing demand for innovative therapies that address previously untreatable conditions are driving the pharmaceutical companies towards the development of personalized medicine.

The market is characterized by a mix of established players and emerging firms, which are constantly working towards the manufacturing and development of new cell and gene therapies. Moreover, the market is fueled by significant investments in research and development activities. Key factors influencing competition include technological capabilities, regulatory compliance, scalability of manufacturing processes, and the ability to provide end-to-end solutions that encompass both development and production.

Companies such as AGC Biologics, Charles River Laboratories, FUJIFILM Cellular Dynamics, Millpore Sigma, Wuxi AppTec, AJINOMOTO BIO-PHARMA SERVICES, are some of the CDMOs which are capturing the significant amount of market share. Companies are actively working towards advancing their existing service portfolio to expand its global reach and make strong geographical presence.

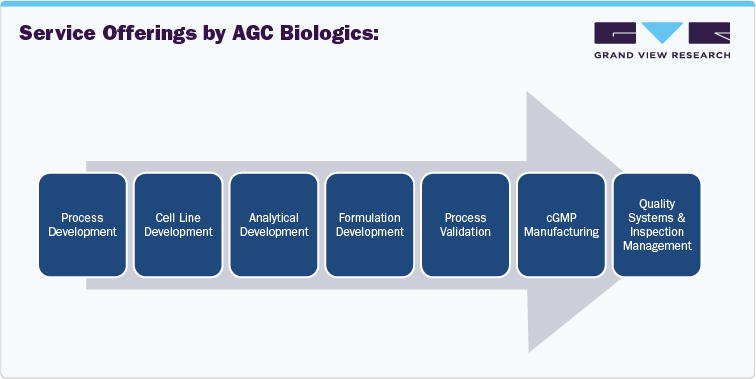

AGC Biologics: (AGC Inc.)

Headquartered: Washington, U.S.

Establishment Year: 2001

AGC Biologics is a CDMO which provides development and manufacturing services for advanced therapies and protein-based biologics. The company has more than 160 in-house analytical tests which is designed for commercial and clinical supply. Moreover, the company has three approved commercial cell therapies and more than 30 cell and gene therapy trials supplied in US and EU.

Some of the key development by the AGC Biologics are mentioned below:

-

In March 2024, AGC Biologics announced to manufacture the first FDA authorized gene therapy for metachromatic leukodystrophy.

-

In January 2024, AGC Biologics announced to expand its manufacturing facility in Japan. The new facility aims to create and develop high quality pharmaceutical development and manufacturing services in the Asia region. This will further help to meet the growing demand for advanced therapy medicinal products (ATMPs) and biologics.

-

In October 2023, AGC Biologics entered into a service agreement with the Medigene AG, which aims to support Medigene’s cell therapy product, focused on the treatment of solid cancers.

-

In August 2023, AGC Biologics announced of expanding its cell and gene manufacturing space in Milan. The expansion aims to meet the growing demand for upcoming GMP viral vector manufacturing projects.

SWOT:

AGC Biologics

STRENGTH

WEAKNESS

- AGC Biologics is an established in the CDMO market offering range of cell and gene therapy manufacturing services which has created the company’s strong brand recognition in the global market.

- The company has its presence across U.S., Europe, and Asia Pacific Market.

- The complex nature of cell and gene therapy manufacturing can lead to high operational costs, which may affect pricing competitiveness

OPPORTUNITY

THREAT

- There is significant potential for growth in emerging markets where healthcare infrastructure is improving, creating new opportunities for CDMOs.

- Increasing competition with both established players and new entrants may hamper the company’s market share

Database of few approved Cell and Gene Therapy

Sr. No.

Product name

Generic name

Year first approved

Disease(s)

Locations approved

Company

1

Lyfgenia

lovotibeglogene

autotemcel

2023

Sickle cell anemia

U.S.

bluebird bio

2

inaticabtagene

autoleucel

inaticabtagene autoleucel

2023

Acute lymphocytic leukemia

China

Juventas Cell Therapy

3

Casgevy

exagamglogene

autotemcel

2023

Sickle cell anemia; thalassemia

US, UK

CRISPR Therapeutics

4

Fucaso

equecabtagene autoleucel

2023

Multiple myeloma

China

Nanjing IASO Biotechnology

5

Vyjuvek

beremagene geperpavec

2023

Dystrophic epidermolysis bullosa

US

Krystal Biotech

An in-depth analysis shall be provided for below listed 30 cell & gene therapy CDMOs:

-

Resilience (National Resilience, Inc.)

-

ABL, Inc.

-

Advanced Medicine Partners

-

AGC Biologics

-

Akron Biotech

-

Alcami Corporation, Inc.

-

ALLCELLS

-

AmplifyBio

-

Asymchem

-

Batavia Biosciences

-

Boston Institute of Biotechnology, LLC (BIB)

-

BioCentriq

-

Biopharma Group

-

Catalent

-

Cellares

-

Center for Breakthrough Medicines

-

CHA Biotech

-

Charles River Laboratories

-

New York Blood Center Enterprises (Comprehensive Cell Solutions)

-

Creative Bioaaray

-

Cytiva

-

Dana Farber

-

Emergent BioSolutions

-

Forge Biologics

-

Fortis Life Sciences

-

FUJIFILM Diosynth Biotechnologies"

-

GBI Biomanufacturing

-

GeneFab

-

Genezen

-

GenScript

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified