- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape Of Catheters

Global Competitive Trends Catheters Market

The global catheter market size was estimated at USD 54.68 billion in 2023 and is projected to grow at a CAGR of 6.57% from 2024 to 2030. The increasing cases of chronic disorders such as neurological, cardiovascular, and urological disorders requiring hospitalization boosts the expansion of the market. For instance, as per the reports published by the National Library of Medicine in 2023, approximately 15% of the global population suffers from neurological disorders, which cause physical and cognitive disabilities.

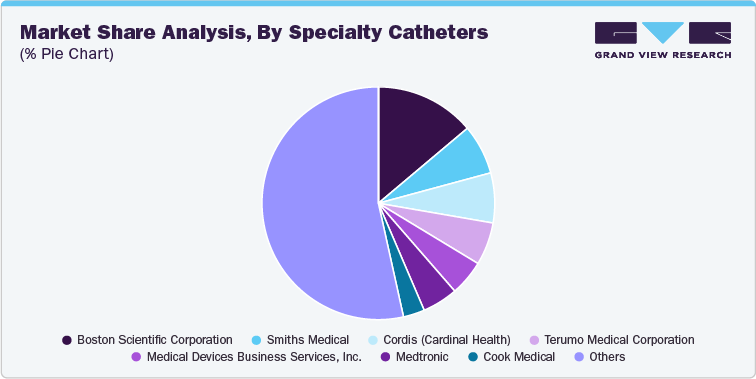

The global market for catheters is highly competitive, with diverse players focusing on innovation, product development, and strategic partnerships to strengthen their market presence. The key players in the market are investing in research and development to produce advanced, minimally invasive products to meet the increasing demand in hospitals, clinics, and ambulatory surgical centers.

The catheters market is witnessing rapid technological advancements, particularly in drug-eluting, antimicrobial, and sensor-integrated catheters offering real-time data monitoring. Companies are also focusing on developing catheters with biocompatible and antimicrobial materials to reduce infection risks, which is a major concern in catheterization procedures.

-

Boston Scientific focuses on innovation in cardiovascular catheters, including their HeartLogic diagnostic devices.

-

Medtronic focuses on developing minimally invasive catheter-based systems for cardiac and urological applications.

-

Teleflex is a major vascular access and urology manufacturer, continually launching products with enhanced safety features.

Leading players engage in mergers, acquisitions, and partnerships to enhance their market positioning and technological capabilities.

-

Boston Scientific made acquisitions to strengthen its position in the urology catheter segment. In January 2024, Boston Scientific has signed a definitive agreement to acquire Axonics, Inc., a publicly traded medical technology company that specializes in developing and commercializing innovative devices for treating urinary and bowel dysfunction. The acquisition is expected to strengthen Boston Scientific's ability to serve urologists and expand patient access to care.

-

Abbott has collaborated to extend its cardiovascular catheter product offerings. In May 2023, Abbott and Stereotaxis, Inc. announced a global collaboration to integrate Abbott's EnSite X EP System with SStereotaxis'Robotic Magnetic Navigation systems. Robotic technology provides precise and controlled catheter navigation, reducing the risk of human error and improving the accuracy of EP procedures. Integrating the EnSite X EP System allows for more accurate heart mapping, enabling physicians to identify and target abnormal electrical activity precisely. These strategic moves provide access to new technologies, intellectual property, and distribution networks across different regions. By offering a more advanced and comprehensive solution, Abbott can potentially increase its market share in the cardiovascular catheter market.

Regulatory Framework

Compliance with stringent regulatory standards, such as those from the U.S. FDA and European Medical Device Regulation (MDR), plays an important role in market competition. Companies such as Terumo, ConvaTec, Teleflex, Biotronik, and Medtronic are known for adhering to high regulatory standards, giving them a competitive advantage in markets with strict regulatory frameworks.

Regulatory Approvals

-

In September 2024, Biotronik has received U.S. FDA labeling approval for its Selectra 3D catheter, in combination with the Solia S lead, for use in left bundle branch area pacing (LBBAP).

-

In February 2024, Boston Scientific has announced that it has received approval from the U.S. FDA for its AGENT Paclitaxel-Coated Balloon Catheter. This device is indicated for treating coronary in-stent restenosis (ISR) in patients with coronary artery disease (CAD). ISR is a common complication following percutaneous coronary interventions (PCI), affecting patient outcomes and increasing the need for repeat procedures.

-

In October 2023, Linear Health Sciences announced that the U.S. FDA has approved the Orchid SRV safety release valve. This catheter, designed for use in all IV access procedures, aims to minimize the risk of IV catheter rupture and the need for hospital repairs.

-

In February 2023, Teleflex Incorporated declared that the U.S. FDA had granted its Triumph Catheter's 510(k) clearance. This innovative device features clear visualization and exact wire progression. Furthermore, the business reported that the UW Medicine Heart Institute in Seattle, Washington, witnessed the first clinical use of its GuideLiner Coast Catheter

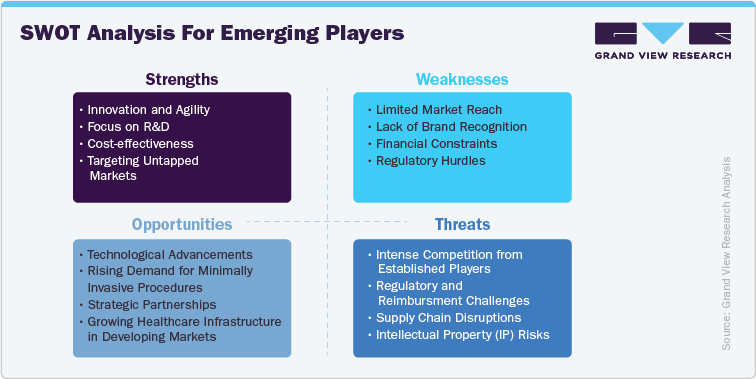

SWOT Analysis for Emerging Players

Strengths Overview for Emerging Players:

- Innovation and Agility:

Emerging players are more agile and can innovate rapidly in response to market needs. They focus on disruptive technologies such as smart catheters, which include sensors or drug delivery mechanisms. The ability to explore niche applications and provide customized catheter solutions, such as specialized neurovascular or urological catheters, gives these companies an advantage in underserved segments. For instance, in April 2024, CERENOVUS, Inc., a Johnson & Johnson MedTech, Inc. division, has launched the CEREGLIDE 71 Aspiration Catheter in the European region. This next-generation catheter, featuring TruCourse technology, is designed for revascularization in patients with acute ischemic stroke. It is the newest addition to the planned CEREGLIDE Family of Catheters, joining the CERENOVUS Stroke Solutions portfolio.

- Focus on R&D:

These companies invest heavily in R&D to develop next-generation catheters with enhanced functionality, such as antimicrobial coatings or biodegradable materials, addressing growing concerns over hospital-acquired infections and environmental sustainability. For instance, in July 2024, Bedal International, a Belgium-based medical device company that specializes in next-generation catheter securement solutions, has completed a USD 11 million funding round. This investment is expected to support the company’s continued global expansion and R&D departments.

- Cost-Effectiveness:

Many emerging players leverage lower production costs or specialized manufacturing techniques to offer competitive pricing, particularly in cost-sensitive markets such as developing countries.

In addition, they streamline operations and offer cost-effective alternatives to traditional catheter solutions. For instance, Vygon offers a line of cost-effective catheters designed for pediatric and neonatal care, produced through streamlined manufacturing processes.

- Targeting Untapped Markets:

Emerging players can easily penetrate underdeveloped or underserved regions, which larger companies overlook due to smaller revenue opportunities. They can focus on providing localized solutions that cater to specific regional health demands. For instance, AdvaCare Pharma targets underserved regions in Africa and Southeast Asia by providing affordable catheter solutions to the specific needs of healthcare systems in these regions.

Medtronic Extensive Product Benchmarking

Product Name

Application

RF Ablation Catheters

4 mm RF Conductr (Multi-Curve) Series

- It has bidirectional steering and provides variable sizes with one catheter

5 mm RF Conductr (Multi-Curve) Series

- It has bidirectional steering, 5 mm distal ablation tip electrode on a 7Fr catheter shaft and it provides variable sizes with one electrode

5F RF Marinr (Single-Curve) Series

- It has 5 Fr catheter shaft, which is designed for small anatomies

RF Contactr (Dual-Curve) Series

- It provides multiple ablation tip-electrode sizes and two distinct curves at one time

RF Enhancr II (Single-Curve) Series

- It has an ergonomic handle design and economical 4 mm shaft

RF Marinr (Multi-Curve) Series

- It provides variable sizes with one catheter

Cryoablation Catheters

Freezor Cardiac CryoAblation Catheter

- It has 7Fr shaft, 4 mm tip and 3 reaches: 47 mm, 53 mm and 58 mm

- It has cryoablation and cryomapping modes

Freezor Xtra Surgical Cardiac CryoAblation Device

- It has 7Fr shaft, 6 mm tip and 3 reaches: 49 mm, 55 mm and 60 mm

- It has cryoablation mode

Freezor MAX Surgical Cardiac CryoAblation Device

- It has 9Fr shaft, 8mm tip and 2 reaches: 55 mm and 66 mm

- It has cryoablation mode

Diagnostic Catheters

5F Torqr Coronary Sinus Series

- It has 5 Fr decapolar and braided shaft for stability

Marinr Coronary Sinus Series

- It provides marine steerability, decapolar design, and multiple electrode spacing options

Marinr (Multi-Curve) and MCXL Series

- It provides out-of-plane deflection, steering, and variable curve sizes with one catheter

Marinr (Single-Curve) Series

- It has a single curve design and provides steerability

Soloist Series

- It is 6 Fr quadripolar in design

Stablemapr SM Series

- It is steerable and duodeca polar and provides multiple curves with one catheter

Torqr Series

- It provides 5 Fr and 6 Fr options, several curve shapes, & electrode spacing options. It includes a braided shaft for stability

DXTERITY DIAGNOSTIC CATHETER

- Unique, ergonomic, winged hubs for easy manipulation

- Solid shaft construction for efficient torque and excellent overall catheter performance

- Double-braid wire for enhanced torque, strength, and kink resistance

- InSlide polymer additive for superior lubricity and enhanced deliverability

- Soft, atraumatic, radiopaque tip for excellent visibility

- Large lumen for high flow of contrast media to increase visualization

DXTERITY TRA DIAGNOSTIC CATHETER

- It has a collection of five universal curves featuring Full-Wall technology that are specifically adapted for transradial coronary cases

- Unique, ergonomic, winged hubs for easy manipulation

- Solid shaft construction for efficient torque and excellent overall catheter performance

- Double-braid wire for enhanced torque, strength, and kink resistance

- InSlide polymer additive for superior lubricity and enhanced deliverability

- Soft, atraumatic, radiopaque tip for visibility

- Large lumen for high flow of contrast media to increase visualization

Cardiac Cryoablation System

Arctic Front Advance

- It has an inflated balloon diameter of 23 mm to 28 mm and provides bidirectional steering of 45 degrees

Achieve (Mapping Catheter)

- It provides with catheter shaft size of 3.3 Fr, which is 1.1 mm; its loop size is 15 mm and 20 mm

Freezor MAX

- It has tip length of 8 mm, electrode spacin of 3-5-2, and catheter diameter of 9 Fr

CryoConsole

- It is compatible with Arctic Front and Freezor Max catheters

Balloon Dilatation Catheters

NC Sprinter RX

It is available in

- Multiple sizes, from 2 mm to 5 mm

- Various lengths: 6 mm, 9 mm, 12 mm, 15 mm, 21 mm, and 27 mm

- Catheter length: 142 cm

NC Stormer OTW

It is available in

- Multiple sizes, from 2 mm to 4 mm

- Various lengths: 6 mm, 11 mm, 14 mm, 16 mm, 18 mm, 21 mm, 26 mm, and 31 mm

- Catheter length: 138 cm

Sprinter Legend RX

It is available in

- Multiple sizes, from 1.5 mm to 4 mm

- Various lengths: 6 mm, 10 mm, 12 mm, 15 mm, 20 mm, 25 mm, and 30 mm

- Catheter length: 142 cm

Sprinter OTW

It is available in

- Multiple sizes, from 1.5 mm to 4 mm

- Various lengths: 6 mm, 10 mm, 12 mm, 15 mm, 20 mm, 25 mm, and 30 mm

- Catheter length: 142 cm

Guiding Catheters

Launcher

- It is available in French size (ID) 5F (0.058”), 6F (0.071”), 7F (0.081’) and 8F (0.090”)

Sherpa NX Active

- It is available in French size (ID) 5F (0.058”), 6F (0.071”) and its performance is consistent & durable

Sherpa NX Balanced

- It is available in French size (ID) 6F (0.071”), 7F (0.081’), & 8F (0.090”) and its performance is consistent and durable

- It is available in a variety of curve shapes

- It provides support for transradial and femoral approach

Guide Extension Catheter

TELESCOPE GEC

- It catheter features TruFlex soft polymer tip and SmoothPass technology to help channel interventional devices

Aspiration Catheters

EXPORT ADVANCE

- It includes preloaded stylet that facilitates dependable delivery to the target; short and soft forward facing tip design permits particle capture and is compatible with 6 F min guide

- It delivers consistent, high-performing aspiration power, thus, restoring flow and protecting patients

EXPORT AP

- It is enabled with Full-Wall technology, that provides dependable coronary aspiration power, along with:

- Variable braiding from hub to tip

- Enhanced strength, torque, and kink resistance

Medtronic Suppliers List for Major Companies

MEDTRONIC

Name of Distributor

Product

Location

Henry Schein Medical

Dialysis Catheters & Accessories

U.S.

Anika Therapeutics

Diabetes/ Dialysis Catheters & Accessories

U.S.

Medline Industries, Inc.

Diabetes/ Dialysis Catheters & Accessories

U.S.

Pfm medical

Diabetes/ Dialysis Catheters & Accessories

Germany

Vygon (UK) Ltd.

Diabetes/ Dialysis Catheters & Accessories

UK

Aptiva Medical s.r.l.

Diabetes/ Dialysis Catheters & Accessories

Italy

JK Medirise

Diabetes/ Dialysis Catheters & Accessories

India

Grobir Medical Suppliers

Diabetes/ Dialysis Catheters & Accessories

South Africa

Modern Pharmaceutical company

Diabetes/ Dialysis Catheters & Accessories

UAE

Salehiya Trading Est.

Diabetes/ Dialysis Catheters & Accessories

KSA

Jassim Alwazzan Sons

Diabetes/ Dialysis Catheters & Accessories

Kuwait

Bahwan Healthcare Centre LLC

Diabetes/ Dialysis Catheters & Accessories

Oman

Med Consult Egypt for Medical Services

Diabetes/ Dialysis Catheters & Accessories

Egypt

Eramedic

Diabetes/ Dialysis Catheters & Accessories

Morocco

CHP Distribution

Diabetes/ Dialysis Catheters & Accessories

Tunisia

Almithaliya Medical Co.

Diabetes/ Dialysis Catheters & Accessories

Libya

SAAR Medtec

Diabetes/ Dialysis Catheters & Accessories

Iraq

Getz Pharma (Pvt) Limited

Diabetes/ Dialysis Catheters & Accessories

Pakistan

Comprehensive Diabetes Centre

Diabetes/ Dialysis Catheters & Accessories

Kenya

Expert Insights (KOL)

“The catheter's ability to treat long lesions and its extended reach enable safe and effective treatment of some of our most difficult-to-treat patients, including those with CLTI, a complicated and severe disease state with a high mortality rate.” -MD, a vascular surgeon

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified