- Home

- »

- Market Trend Reports

- »

-

Top 20 Blood Collection And DTC Company Market Analysis

![Top 20 Blood Collection And DTC Company Market Report]()

Top 20 Blood Collection And DTC Company Market Analysis: Company Market Size By Test Type, 2018 - 2030

- Published: Oct, 2024

- Report ID: GVR-MT-100280

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Report Overview

The blood collection market has witnessed significant growth in recent years. The increasing prevalence of chronic & infectious diseases is a major factor driving the use of blood collection devices. With the U.S. becoming more globalized, health risks transcend borders are expected to increase in coming years. Economic integration, industrialization, urbanization, and mass migration contribute to various public health challenges. The emergence of infectious diseases, such as COVID-19, has caused significant morbidity & mortality, highlighting the urgent need for effective disease management strategies.

Blood collection devices are crucial in diagnosing and monitoring chronic & infectious diseases. They provide a safe, hygienic, and efficient method for collecting blood samples, ensuring accurate test results & reducing the risk of contamination. In the context of the COVID-19 pandemic, these devices have been essential for collecting samples for diagnostic testing, tracking disease spread, and monitoring patient health.

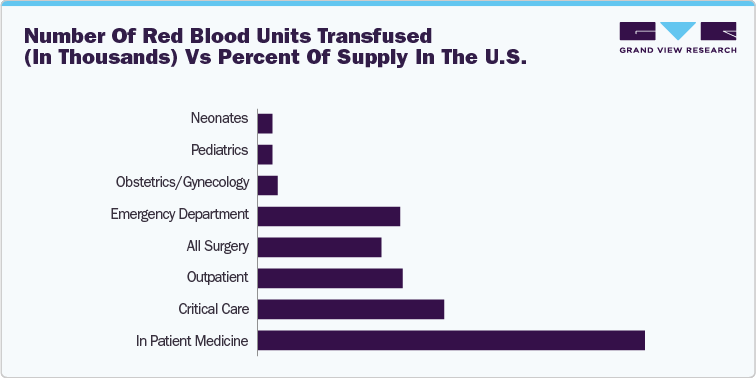

The rising number of blood transfusions is one of the key factors expected to drive the blood collection market. According to the WHO 2023 estimate, around 118.5 million donations were collected worldwide. Among these, around 40% is collected from high-income countries, home to 16% of the global population. In addition, around 13,300 blood centers across 169 countries collectively gather around 106 million blood donations annually across the globe. The volume of donations per center varies significantly based on the country’s income level.

Top 20 Blood Collection And DTC Company Market Analysis: Company Market Size By Test Type, 2018-2030, Report Scope

Attributes

Details

Area of Research

Blood Collection Market, by Product:

- Whatman 903

- Ahlstrom 226

- FTA

- ADx 100 (Advance Dx100 Serum Separator Collection Card)

- Cobas PSC (F. Hoffmann-La Roche Ltd)

- HemaSep (Ahlstrom)

- HemaSpot SE (Spot on)

- Telimmune Duo (Telimmune)

- Capitainer B (Capitainer)

- hemaPEN (Neoteryx)

- Mitra (Neoteryx)

- The TASSO

Top Blood Collection DTC Company Market Analysis, by test type as follows:

- Wellness

- HbA1c

- Sexual Wellness

- Women's Health

- Men's Health

- Drug Doping Testing

Report Representation

Excel format

Highlights of Report

- Top Blood Collection DTC Companies:

- Top Blood Collection Products, by Brands

- Market Estimates

- Volume Analysis

- Pricing Analysis

The rising incidence of hematological disorders is a significant factor expected to drive the use of blood collection devices. The prevalence of hematologic diseases, including anemia; sickle cell disease; bleeding disorders, such as clots & hemophilia; and cancer types, including myeloma, lymphoma, & leukemia, is growing. For instance, according to the Leukemia & Lymphoma Society (LLS) in the U.S., every 9 minutes, someone dies from blood cancer, representing about 157 people each day or over 6 people every hour. Leukemia, lymphoma, and myeloma caused the deaths of an estimated 57,380 people in the U.S. in 2023, accounting for 9.4% of cancer deaths that year.

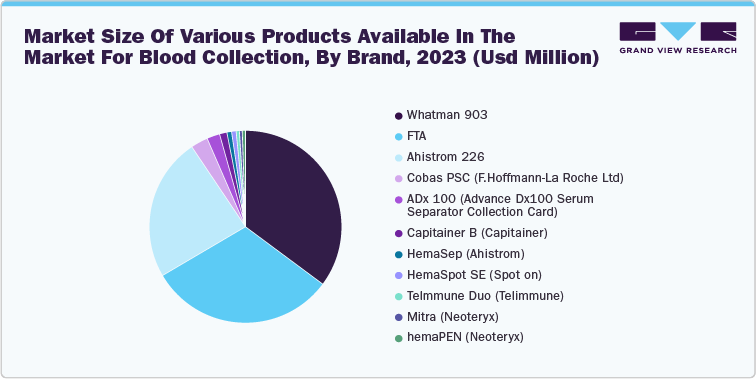

Blood Collection Market, by Product

The blood collection market is increasingly diverse, with products catering to various needs in sample collection and analysis. Whatman 903 and Ahlstrom 226 are well-regarded for their reliability in dried blood spot (DBS) sampling, essential for accurate laboratory testing. FTA cards offer an innovative solution for nucleic acid preservation, making them invaluable for molecular diagnostics. ADx 100 and Cobas PSC focus on serum collection, streamlining the process for point-of-care testing, while HemaSep and HemaSpot SE enhance the efficiency of sample processing. Telimmune Duo and Capitainer B are notable for their user-friendly designs, facilitating remote patient monitoring. The hemaPEN and Mitra devices are particularly interesting as they combine ease of use with advanced capillary sampling techniques, suitable for home collection. Finally, The TASSO represents a significant shift towards painless, self-collection options, appealing to patients and healthcare providers alike. Overall, the market reflects a trend towards convenience, patient-centered care, and the integration of innovative technologies in blood collection.

Revenue Estimates

Top Blood Collection DTC Companies

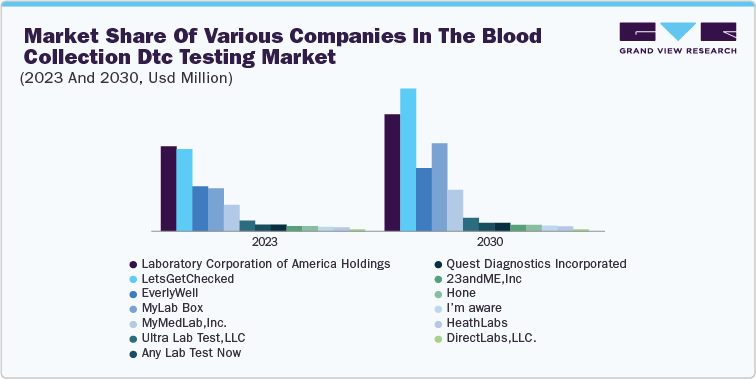

The direct-to-consumer (DTC) blood collection market is rapidly evolving, with companies like Quest Diagnostics and Laboratory Corporation of America leveraging their extensive laboratory networks to offer a range of tests. DirectLabs and ANY LAB TEST NOW cater to consumers seeking quick access to general wellness screenings, while MyMedLab and HealthLabs provide a broad selection of tests, including HbA1c and other chronic disease indicators. EverlyWell and LetsGetChecked focus on wellness and specialized testing, including sexual and women's health, appealing to health-conscious consumers. myLAB Box and I’m Aware emphasize at-home testing kits, which have gained popularity for convenience in sexual health and drug testing. Hone targets men's health with tailored screenings, whereas Ulta Lab Tests offers a wide array of tests for various health concerns. 23andME stands out by combining genetic testing with health insights, attracting consumers interested in personalized health data. Overall, the DTC blood collection market is thriving, driven by consumer demand for convenience, privacy, and proactive health management across various health domains.

Conclusion

Regulatory support and favorable reimbursement policies play a significant role in market growth. Governments and health organizations are continually updating guidelines & standards to ensure the safety and quality of blood collection practices, fostering a secure environment for donors & recipients. In conclusion, the blood collection market is expected to experience continued growth, driven by technological advancements, demographic shifts, increased public awareness, and strong regulatory support. As these factors converge, they will help enhance the efficiency & effectiveness of blood collection processes and ensure a stable & adequate blood supply to meet the growing healthcare demands.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified